|

市场调查报告书

商品编码

1833426

春季角结膜炎市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Vernal Keratoconjunctivitis Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

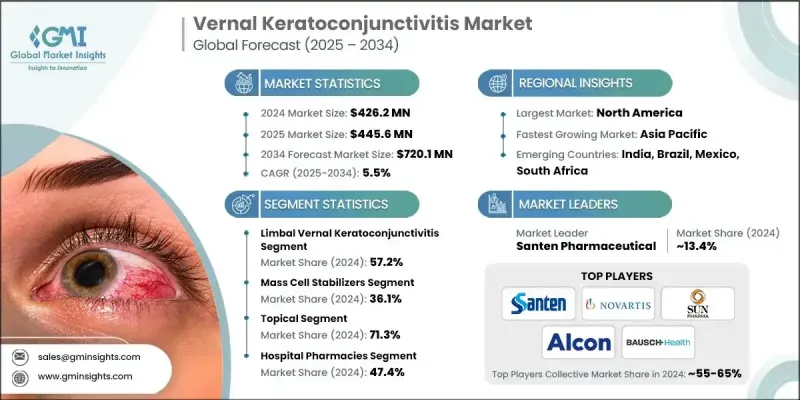

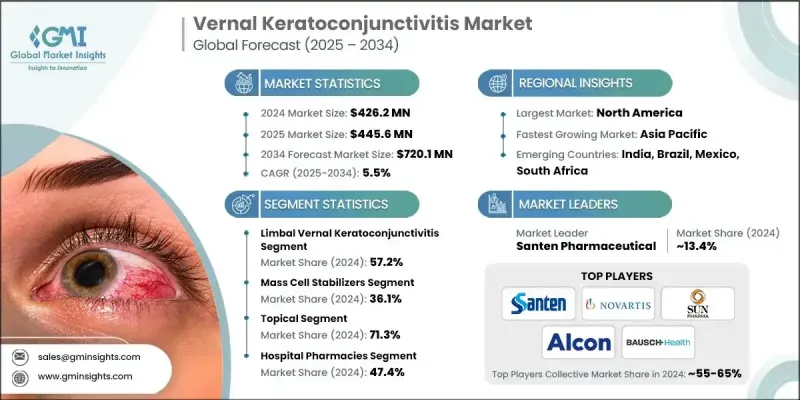

2024 年全球春季角结膜炎市值为 4.262 亿美元,预计到 2034 年将以 5.5% 的复合年增长率增长至 7.201 亿美元。

VKC 主要影响儿童和青少年,尤其是在温暖气候地区。随着该族群对过敏性眼部疾病的认识和诊断不断提高,全球对有效的 VKC 治疗的需求不断增长。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 4.262亿美元 |

| 预测值 | 7.201亿美元 |

| 复合年增长率 | 5.5% |

角膜缘春季角结膜炎盛行率不断上升

2024年,角膜缘春季角膜结膜炎占了相当大的份额,其特征是胶状角膜缘浸润和潜在的角膜上皮损伤。由于此病若不及时治疗,容易引发长期併发症,因此正受到临床关注。该病在温暖干燥气候条件下的儿童中尤其常见,这增加了流行地区对标靶治疗的需求。

肥大细胞稳定器获得牵引力

2024年,肥大细胞稳定剂领域为轻度至中度症状患者带来了强劲的收入。这些药物透过抑制组织胺和其他发炎介质的释放来发挥作用,有助于减轻搔痒、发红和肿胀。虽然它们通常需要数週时间才能完全起效,但其良好的安全性使其成为首选的第一线治疗方案。为了保持竞争力,製药公司正在改进配方以加快起效速度,将肥大细胞稳定剂与抗组织胺结合使用,并提高给药便利性,以支持患者依从性。

局部治疗的采用率不断上升

局部治疗领域在2024年占据了相当大的份额,这得益于其直接的作用方式和极低的全身暴露。含有皮质类固醇、环孢素、他克莫司和抗组织胺的眼药水被广泛用于治疗急性发作和慢性发炎。该领域受益于药物传输技术的持续创新,例如缓释製剂和无防腐剂製剂。

北美将成为推动力地区

2024年,北美春季角结膜炎市场占据了强劲的份额,这得益于诊断率的提高、眼科护理专业人员意识的增强以及与气候变迁和过敏原相关的病例的增加。该地区还受益于成熟的眼科药物行业和支持儿科护理创新的监管途径。

春季角结膜炎市场的主要参与者有参天製药、梯瓦製药、Meda Pharmaceuticals、诺华、博士伦、千寿药、艾尔建、太阳製药、罗氏製药、Thea实验室、艾伯维、爱尔康和雅培实验室。

为了在春季角结膜炎市场占据强势地位,各公司正在部署以产品差异化、临床验证和精准推广为中心的多层次策略。关键措施包括投资儿科临床试验、确保罕见疾病适应症的监管专营权以及进行早期诊断的教育活动。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 每个阶段的增值

- 影响价值链的因素

- 产业衝击力

- 成长动力

- 全球春季角结膜炎盛行率上升

- 人口老化加剧,过敏敏感性上升

- 远距眼科和电子药局的扩展

- 政府和机构意识计划

- 产业陷阱与挑战

- 品牌免疫调节剂和生物製剂成本高

- 农村地区认识与诊断能力有限

- 市场机会

- 联合疗法和类固醇减量疗法的开发

- 医疗保健投资不断增加的新兴市场

- 成长动力

- 成长潜力分析

- 监管格局

- 北美洲

- 我们

- 加拿大

- 欧洲

- 亚太地区

- 北美洲

- 未来市场趋势

- 技术格局

- 定价分析

- 管道分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 全球的

- 北美洲

- 欧洲

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与协作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:按疾病类型,2021 - 2034 年

- 主要趋势

- 角膜缘春季角结膜炎

- 睑板春季角结膜炎

- 混合性春季角结膜炎

第六章:市场估计与预测:依治疗方式,2021 - 2034

- 主要趋势

- 肥大细胞稳定剂

- 抗组织胺药

- 皮质类固醇

- 非类固醇类抗发炎药

- 其他治疗

第七章:市场估计与预测:按管理路线,2021 - 2034 年

- 主要趋势

- 口服

- 外用

- 肠外

第八章:市场估计与预测:按性别,2021 - 2034 年

- 主要趋势

- 男性

- 女性

第九章:市场估计与预测:按配销通路,2021 - 2034 年

- 主要趋势

- 医院药房

- 零售药局

- 网路药局

第 10 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第 11 章:公司简介

- Abbott Laboratories

- AbbVie

- Alcon

- Allergan

- Bausch Health

- F Hoffmann La Roche

- Laboratoires Thea

- Meda Pharmaceuticals

- Novartis

- Santen Pharmaceutical

- Senju Pharmaceutical

- Sun Pharmaceutical

The Global Vernal Keratoconjunctivitis Market was valued at USD 426.2 million in 2024 and is estimated to grow at a CAGR of 5.5% to reach USD 720.1 million by 2034.

VKC primarily affects children and adolescents, particularly in warm climates. The growing awareness and diagnosis of allergic ocular conditions in this demographic are driving demand for effective VKC treatments globally.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $426.2 Million |

| Forecast Value | $720.1 Million |

| CAGR | 5.5% |

Increasing Prevalence of Limbal Vernal Keratoconjunctivitis

The limbal vernal keratoconjunctivitis segment held a sizeable share in2024, backed by gelatinous limbal infiltrates and potential damage to the corneal epithelium. This segment is gaining clinical attention due to its tendency to cause long-term complications if left untreated. It is particularly common in children living in warm, dry climates, which heightens the demand for targeted therapies in endemic regions.

Mast Cell Stabilizers to Gain Traction

The mast cell stabilizers segment generated robust revenues in 2024 for patients with mild to moderate symptoms. These agents work by preventing the release of histamines and other inflammatory mediators, helping to reduce itching, redness, and swelling. Though they often require several weeks to reach full efficacy, their favorable safety profile makes them a preferred first-line option. To stay competitive, pharmaceutical companies are enhancing formulations for faster onset of action, combining mast cell stabilizers with antihistamines, and improving dosing convenience to support patient adherence.

Rising Adoption of Topical Treatments

The topical treatments segment held a significant share in 2024, owing to their direct mode of action and minimal systemic exposure. Eye drops containing corticosteroids, cyclosporine, tacrolimus, and antihistamines are widely prescribed to manage acute flare-ups and chronic inflammation. This segment benefits from continuous innovation in drug delivery technologies, such as sustained-release formulations and preservative-free options.

North America to Emerge as a Propelling Region

North America vernal keratoconjunctivitis market held a robust share in 2024 owing to improved diagnostic rates, heightened awareness among eye care professionals, and increasing cases linked to climate shifts and allergens. The region also benefits from a well-established ophthalmic drug industry and regulatory pathways that support innovation in pediatric care.

Major players in the vernal keratoconjunctivitis market are Santen Pharmaceutical, Teva Pharmaceuticals, Meda Pharmaceuticals, Novartis, Bausch Health, Senju Pharmaceutical, Allergan, Sun Pharma, F Hoffmann La Roche, Laboratoires Thea, AbbVie, Alcon, and Abbott Laboratories.

To build a strong presence in the vernal keratoconjunctivitis market, companies are deploying multi-layered strategies centered around product differentiation, clinical validation, and targeted outreach. Key initiatives include investing in pediatric clinical trials, securing regulatory exclusivity for rare disease indications, and launching educational campaigns for early diagnosis.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumption and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Disease type trends

- 2.2.3 Treatment trends

- 2.2.4 Route of administration trends

- 2.2.5 Gender trends

- 2.2.6 Distribution channel trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising global prevalence of vernal keratoconjunctivitis

- 3.2.1.2 Growing aging population and rising allergy sensitivity

- 3.2.1.3 Expansion of tele-ophthalmology and e-pharmacy

- 3.2.1.4 Government and institutional awareness programs

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of branded immunomodulators and biologics

- 3.2.2.2 Limited awareness and diagnostic capabilities in rural areas

- 3.2.3 Market opportunities

- 3.2.3.1 Development of combination and steroid-sparing therapies

- 3.2.3.2 Emerging markets with rising healthcare investment

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.1.1 U.S.

- 3.4.1.2 Canada

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.1 North America

- 3.5 Future market trends

- 3.6 Technology landscape

- 3.7 Pricing analysis

- 3.8 Pipeline analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 Global

- 4.2.2 North America

- 4.2.3 Europe

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Merger and acquisition

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Disease Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Limbal vernal keratoconjunctivitis

- 5.3 Tarsal vernal keratoconjunctivitis

- 5.4 Mixed vernal keratoconjunctivitis

Chapter 6 Market Estimates and Forecast, By Treatment, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Mast cell stabilizers

- 6.3 Antihistamines

- 6.4 Corticosteroids

- 6.5 Nonsteroidal anti-inflammatory drugs

- 6.6 Other treatments

Chapter 7 Market Estimates and Forecast, By Route of Administration, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Oral

- 7.3 Topical

- 7.4 Parenteral

Chapter 8 Market Estimates and Forecast, By Gender, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Male

- 8.3 Female

Chapter 9 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Hospital pharmacies

- 9.3 Retail pharmacies

- 9.4 Online pharmacies

Chapter 10 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Abbott Laboratories

- 11.2 AbbVie

- 11.3 Alcon

- 11.4 Allergan

- 11.5 Bausch Health

- 11.6 F Hoffmann La Roche

- 11.7 Laboratoires Thea

- 11.8 Meda Pharmaceuticals

- 11.9 Novartis

- 11.10 Santen Pharmaceutical

- 11.11 Senju Pharmaceutical

- 11.12 Sun Pharmaceutical