|

市场调查报告书

商品编码

1833437

水泵市场机会、成长动力、产业趋势分析及2025-2034年预测Water Pumps Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

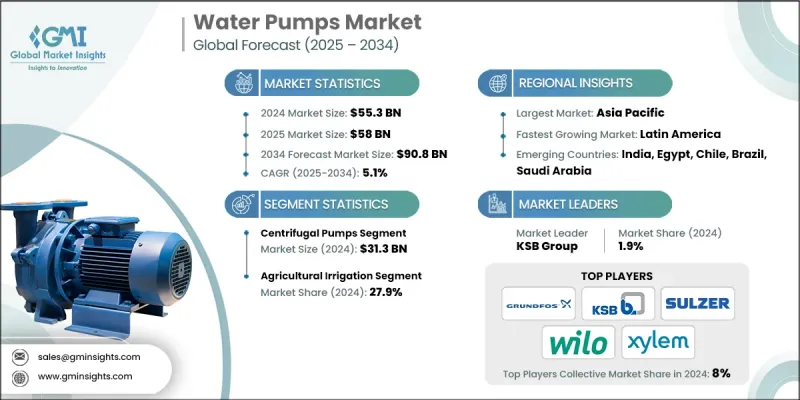

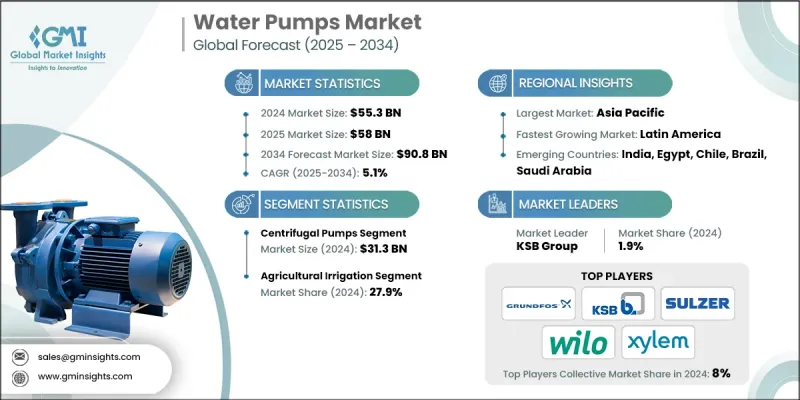

2024 年全球水泵市场价值为 553 亿美元,预计到 2034 年将以 5.1% 的复合年增长率增长至 908 亿美元。

城市化和人口增长给现有水基础设施带来巨大压力,导致对可靠且可扩展的供水和废水管理系统的需求日益增长。随着越来越多的人迁入城市,城市规模不断扩大,对清洁、安全、持续供水的需求也急剧上升。同时,人口成长也产生了更多的废水,需要高效率的处理和处置系统来满足环境和健康标准。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 553亿美元 |

| 预测值 | 908亿美元 |

| 复合年增长率 | 5.1% |

离心泵的采用率不断上升

离心泵凭藉其多功能设计、易于操作以及在各个行业的广泛适用性,在2024年占据了相当大的份额。离心泵以其处理高流量和低黏度流体的能力而闻名,广泛应用于市政供水系统、工业流程和建筑服务。其相对较低的维护成本以及与自动化系统的兼容性进一步推动了其应用。

农业灌溉需求不断增加

2024年,农业灌溉领域将占据相当大的份额,这得益于农业对高效配水系统日益增长的需求。随着全球水资源面临压力以及粮食需求不断增长,农民开始使用电动、太阳能和柴油驱动的水泵,以确保在不同地形和作物类型上实现持续灌溉。水泵有助于最大限度地减少体力劳动,同时最大限度地提高产量,使其成为现代农业实践中不可或缺的一部分。在许多发展中地区,政府补贴和农村电气化计画正在加速水泵的普及。

亚太地区将崛起成为推动力地区

2024年,亚太地区水泵市场占据了显着份额,这得益于中国、印度和东南亚等国家快速的城市发展、工业扩张以及日益增长的农业需求。基础设施现代化、智慧城市投资以及政府主导的水资源管理倡议,对从离心式到潜水式等各种类型的水泵产生了强劲的需求。此外,该地区製造业中心的崛起也推动了工业界对可靠流体处理解决方案的需求。

市场的主要参与者有 JEE Pumps Limited、Xylem、The Weir Group PLC、SPP Pumps、Dover Corporation、Flowserve、Pentair Corporation、Grundfos、Baker Hughes Corporation、ITT Gould Pumps、Sulzer Ltd、Crompton、WILO SE、KSB Group 和 Ebara Corporation。

为了巩固自身地位,领先的水泵製造商正在采取创新、在地化和策略性扩张相结合的策略。许多公司正在加大研发投入,设计出效率更高、能耗更低的水泵,瞄准对永续性要求严格的产业。此外,各公司也正在针对特定应用客製化产品,例如为农村农场设计太阳能水泵,或为工业化学品设计耐腐蚀水泵,以满足独特的市场需求。将生产设施扩展到更靠近需求中心的地方,尤其是在亚洲和拉丁美洲,有助于降低成本并缩短交货时间。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商概况

- 利润率

- 每个阶段的增值

- 影响价值链的因素

- 中断

- 产业影响力量

- 成长动力

- 产业陷阱与挑战

- 机会

- 成长潜力分析

- 未来市场趋势

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 价格趋势

- 按地区和产品类型

- 监理框架

- 标准和认证

- 环境法规

- 进出口法规

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:按泵类型,2021 - 2034

- 主要趋势

- 离心泵

- 单级离心泵

- 多级离心泵

- 潜水泵

- 深井潜水泵

- 钻孔潜水泵

- 污水和废水潜水泵

- 直立式涡轮泵

- 渣浆泵

- 橡胶衬里渣浆泵

- 金属内衬渣浆泵

- 其他的

第六章:市场估计与预测:依资料,2021 - 2034 年

- 主要趋势

- 铸铁泵

- 不銹钢帮浦

- 青铜和黄铜泵

- 复合材料和塑胶泵

- 其他的

第七章:市场估计与预测:依水容量范围,2021 - 2034

- 主要趋势

- 低容量泵浦(最高 100 m³/h)

- 中等容量泵浦(100-1,000 m³/h)

- 大容量泵浦(1,000-5,000 m³/h)

第八章:市场估计与预测:依电源分类,2021 - 2034 年

- 主要趋势

- 电动帮浦

- 柴油引擎驱动泵

- 太阳能泵

- 风力帮浦

- 液压泵浦

- 其他的

第九章:市场估计与预测:按应用,2021 - 2034

- 主要趋势

- 农业灌溉

- 海水淡化厂

- 工业製程

- 采矿作业

- 市政供水

- 其他的

第 10 章:市场估计与预测:按配销通路,2021 年至 2034 年

- 主要趋势

- 直销

- 间接销售

第 11 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 多边环境协定

- 阿联酋

- 沙乌地阿拉伯

- 南非

第十二章:公司简介

- Baker Hughes Corporation

- Crompton

- Dover Corporation

- Ebara Corporation

- Flowserve

- Grundfos

- ITT Gould Pumps

- JEE Pumps Limited

- KSB Group

- Pentair Corporation

- SPP Pumps

- Sulzer Ltd

- The Weir Group PLC

- WILO SE

- Xylem

The Global Water Pumps Market was valued at USD 55.3 billion in 2024 and is estimated to grow at a CAGR of 5.1% to reach USD 90.8 billion by 2034.

Urbanization and population growth are putting significant pressure on existing water infrastructure, leading to a growing need for reliable and scalable water supply and wastewater management systems. As more people migrate to urban areas and cities expand, the demand for clean, safe, and continuous water access is rising sharply. At the same time, larger populations generate more wastewater, requiring efficient treatment and disposal systems to meet environmental and health standards.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $55.3 Billion |

| Forecast Value | $90.8 Billion |

| CAGR | 5.1% |

Rising Adoption of Centrifugal Pumps

The centrifugal pumps segment held a significant share in 2024 owing to its versatile design, ease of operation, and wide-ranging applicability across sectors. Known for their ability to handle high flow rates and low-viscosity fluids, centrifugal pumps are extensively used in municipal water supply systems, industrial processes, and building services. Their relatively low maintenance costs and compatibility with automated systems further boost adoption.

Increasing Demand in Agriculture Irrigation

The agriculture irrigation segment witnessed a substantial share in 2024, supported by the increasing need for efficient water distribution systems in farming. With global water resources under pressure and food demand on the rise, farmers are turning to electric, solar, and diesel-powered pumps to ensure consistent irrigation across varying terrains and crop types. Water pumps help minimize manual labor while maximizing yield, making them indispensable in modern agricultural practices. In many developing regions, government subsidies and rural electrification programs are helping to accelerate pump adoption.

Asia Pacific to Emerge as a Propelling Region

Asia Pacific water pumps market held a notable share in 2024, fueled by rapid urban development, industrial expansion, and growing agricultural needs across countries like China, India, and Southeast Asia. Infrastructure modernization, investments in smart cities, and government-led water management initiatives are creating strong demand for a variety of water pump types, from centrifugal to submersible systems. Additionally, the rise of manufacturing hubs in the region is driving industrial demand for reliable fluid handling solutions.

Major Players in the market are JEE Pumps Limited, Xylem, The Weir Group PLC, SPP Pumps, Dover Corporation, Flowserve, Pentair Corporation, Grundfos, Baker Hughes Corporation, ITT Gould Pumps, Sulzer Ltd, Crompton, WILO SE, KSB Group, and Ebara Corporation.

To reinforce their position, leading water pump manufacturers are adopting a mix of innovation, localization, and strategic expansion. Many are investing in R&D to design pumps that deliver higher efficiency with lower energy consumption, targeting sectors with strict sustainability requirements. Companies are also tailoring products for specific applications such as solar pumps for rural farms or corrosion-resistant pumps for industrial chemicals to meet unique market needs. Expanding manufacturing facilities closer to demand centers, particularly in Asia and Latin America, helps reduce costs and improve delivery timelines.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Pump Type

- 2.2.2 Material

- 2.2.3 Water Capacity Range

- 2.2.4 Power Source

- 2.2.5 Application

- 2.2.6 Distribution Channel

- 2.2.7 Regional

- 2.3 CXO perspective: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry Impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls & challenges

- 3.2.3 Opportunities

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region and product type

- 3.7 Regulatory framework

- 3.7.1 Standards and certifications

- 3.7.2 Environmental regulations

- 3.7.3 Import export regulations

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates & Forecast, By Pump Type, 2021 - 2034 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Centrifugal Pumps

- 5.2.1 Single-stage Centrifugal Pumps

- 5.2.2 Multi-stage Centrifugal Pumps

- 5.3 Submersible Pumps

- 5.3.1 Deep Well Submersible Pumps

- 5.3.2 Borehole Submersible Pumps

- 5.3.3 Sewage & Wastewater Submersible Pumps

- 5.4 Vertical Turbine Pumps

- 5.5 Slurry Pumps

- 5.5.1 Rubber-Lined Slurry Pumps

- 5.5.2 Metal-Lined Slurry Pumps

- 5.6 Others

Chapter 6 Market Estimates & Forecast, By Material, 2021 - 2034 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Cast Iron Pumps

- 6.3 Stainless Steel Pumps

- 6.4 Bronze & Brass Pumps

- 6.5 Composite & Plastic Pumps

- 6.6 Others

Chapter 7 Market Estimates & Forecast, By Water Capacity Range, 2021 - 2034 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Low Capacity Pumps (Up to 100 m³/h)

- 7.3 Medium Capacity Pumps (100-1,000 m³/h)

- 7.4 High Capacity Pumps (1,000-5,000 m³/h)

Chapter 8 Market Estimates & Forecast, By Power Source, 2021 - 2034 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Electric-Powered Pumps

- 8.3 Diesel Engine-Driven Pumps

- 8.4 Solar-Powered Pumps

- 8.5 Wind-Powered Pumps

- 8.6 Hydraulic-Powered Pumps

- 8.7 Others

Chapter 9 Market Estimates & Forecast, By Application, 2021 - 2034 (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 Agricultural Irrigation

- 9.3 Desalination Plants

- 9.4 Industrial Process

- 9.5 Mining Operations

- 9.6 Municipal Water Supply

- 9.7 Others

Chapter 10 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034, (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 Direct Sales

- 10.3 Indirect Sales

Chapter 11 Market Estimates & Forecast, By Region, 2021 - 2034, (USD Billion) (Thousand Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 U.K.

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.3.6 Netherlands

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 South Korea

- 11.4.5 Australia

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 MEA

- 11.6.1 UAE

- 11.6.2 Saudi Arabia

- 11.6.3 South Africa

Chapter 12 Company Profiles (Business Overview, Financial Data, Product Landscape, Strategic Outlook, SWOT Analysis)

- 12.1 Baker Hughes Corporation

- 12.2 Crompton

- 12.3 Dover Corporation

- 12.4 Ebara Corporation

- 12.5 Flowserve

- 12.6 Grundfos

- 12.7 ITT Gould Pumps

- 12.8 JEE Pumps Limited

- 12.9 KSB Group

- 12.10 Pentair Corporation

- 12.11 SPP Pumps

- 12.12 Sulzer Ltd

- 12.13 The Weir Group PLC

- 12.14 WILO SE

- 12.15 Xylem