|

市场调查报告书

商品编码

1833439

InGaAs 雪崩光电二极体 (InGaAs APD) 市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测InGaAs Avalanche Photodiode (InGaAs APD) Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

2024 年全球 InGaAs 雪崩光电二极体市场价值为 3.1217 亿美元,预计将以 8.7% 的复合年增长率成长,到 2034 年达到 7.0029 亿美元。

这一增长得益于对光纤通讯网路需求的激增,而这种需求的激增又源于人们对高速互联网、云端平台和数据密集型应用日益增长的依赖。 InGaAs 雪崩光电二极体 (APD) 对于确保在高效能电信环境(包括长距离传输、城域网路和先进的资料中心基础设施)中快速且准确地侦测光讯号至关重要。其高响应速度、快速讯号处理能力和低杂讯特性使其成为当今频宽驱动型世界中不可或缺的一部分。随着电信营运商不断增强其基础设施以支援下一代连接,以及各行各业数位转型的持续推进,InGaAs APD 的角色变得越来越重要。此外,随着基于雷射雷达 (LiDAR) 的应用在自动化、测绘和机器人等行业中日益普及,对能够在近红外线波长下高效工作的光电探测器的需求也持续攀升。这些趋势为 InGaAs APD 市场的创新和产品扩展创造了强劲动力。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 3.1217亿美元 |

| 预测值 | 7.0029亿美元 |

| 复合年增长率 | 8.7% |

中波长段(1.0 至 1.55 µm)在 2024 年创造了 1.481 亿美元的市场规模,预计复合年增长率为 10%。该领域受益于其在工业和环境应用(包括光纤、光谱学和精密感测技术)中日益增长的实用性。重点仍然是优化光电二极体,使其具有针对特定波长的反应能力、热稳定性和降低电子干扰。製造商正在不断提高其性能参数,以更好地满足电信和科学行业不断变化的需求,因为这些行业对精度和可靠性至关重要。

2024年,单光子雪崩二极体 (SPAD) 市场规模达1.1449亿美元。这些二极体能够以极高的精度探测单一光子,使其成为快节奏、光线受限环境的理想选择。量子应用、微光成像系统和时间分辨分析领域的需求不断增长,持续加速了SPAD技术的创新。製造商正在大力投资紧凑型、相容于CMOS且具有超低抖动的SPAD阵列,以便轻鬆整合到更小的光子系统中。 SPAD阵列在导航、3D成像和科学研究领域的应用预计将丰富其应用场景,并扩大其商业价值。

2024年,美国InGaAs雪崩光电二极体(InGaAs APD)市场规模达7,460万美元。美国市场的成长源自于光子技术在商业和国防领域的日益普及。先进光学感测和通讯工具在航太、电信和科研领域的广泛应用,正在为InGaAs APD创造长期需求。随着光纤网路的发展以及雷射雷达(LiDAR)在基础设施和安全系统中的应用不断扩大,对高精度光电探测器的需求将继续推动区域市场的发展。

InGaAs 雪崩光电二极体 (InGaAs APD) 市场的知名行业参与者包括 Hamamatsu Photonics、Albis Optoelectronics AG (Enablence)、Excelitas Technologies、OSI Optoelectronics、Laser Components DG, Inc.、First Sensor、Dexerials Corporation 和 Thors Inc. InGaAs 雪崩光电二极体市场的主要参与者正在实施多方面策略以增强其竞争优势。主要重点是技术创新,公司将投资投入研发以提高光谱灵敏度、降低噪音水平并增强在不同环境条件下的性能。许多公司也正在多样化产品组合,为量子运算、光达和先进电信系统等垂直领域推出紧凑型和专用光电二极体。与零件製造商和系统整合商的策略合作伙伴关係有助于简化产品采用。此外,该公司正在利用 CMOS 整合等半导体製造技术的进步来实现大规模生产和小型化。为了进一步提升市场占有率,全球参与者持续扩大其分销网络,并针对高成长产业的区域和特定应用需求客製化解决方案。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 利润率

- 成本结构

- 每个阶段的增值

- 影响价值链的因素

- 中断

- 产业衝击力

- 成长动力

- 光纤通讯需求不断成长

- LiDAR应用的成长

- 医学影像技术的扩展

- 量子通讯和光子学的出现

- 军事和航太进步

- 产业陷阱与挑战

- 製造和材料成本高

- 高光功率下动态范围有限且饱和

- 市场机会

- 成长动力

- 成长潜力分析

- 监管格局

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL分析

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 按产品

- 定价策略

- 新兴商业模式

- 合规性要求

- 消费者情绪分析

- 专利和智慧财产权分析

- 地缘政治与贸易动态

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 市场集中度分析

- 关键参与者的竞争基准

- 财务绩效比较

- 收入

- 利润率

- 研发

- 产品组合比较

- 产品范围广度

- 科技

- 创新

- 地理位置比较

- 全球足迹分析

- 服务网路覆盖

- 各地区市场渗透率

- 竞争定位矩阵

- 领导者

- 挑战者

- 追踪者

- 利基市场参与者

- 战略展望矩阵

- 财务绩效比较

- 2021-2024 年关键发展

- 併购

- 伙伴关係与合作

- 技术进步

- 扩张和投资策略

- 数位转型计划

- 新兴/新创企业竞争对手格局

第五章:市场估计与预测:按类型,2021 - 2034

- 主要趋势

- 单光子雪崩二极体(SPAD)

- 多光子雪崩二极体(MPAD)

- 线性模式雪崩光电二极体

第六章:市场估计与预测:依波长范围,2021 - 2034

- 主要趋势

- 短波长(最长 1.0 µm)

- 中波长(1.0 至 1.55 µm)

- 长波长(1.55 µm 以上)

第七章:市场估计与预测:按应用,2021 - 2034

- 主要趋势

- 商业的

- 3D成像

- 手势识别

- 深度感应

- 汽车光达

- 其他的

- 资讯科技和电信

- 高速光互连

- 光收发器

- 长距离光纤通信

- 城域网路及接取网

- 无源光网路(PON)

- 其他的

- 航太与国防

- 通讯链路

- 光通讯

- 军用光达和测距仪

- 遥感

- 其他的

- 工业的

- 机器视觉

- 工业自动化

- 监控

- 计量与检验

- 其他的

- 卫生保健

- 光学相干断层扫描(OCT)

- 正子断层扫描(PET)

- 生物医学感

- 近红外光谱

- 其他的

- 其他的

第八章:市场估计与预测:按地区,2021-2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 多边环境协定

- 南非

- 沙乌地阿拉伯

- 阿联酋

第九章:公司简介

- 全球参与者:

- Hamamatsu Photonics

- Excelitas Technologies

- OSI Optoelectronics

- Thorlabs Inc.

- 区域参与者:

- Albis Optoelectronics (Enablence)

- Dexerials Corporation

- First Sensor

- GPD Optoelectronics Corp.

- Laser Components GmbH

- LONTEN

- Voxtel Inc.

- 新兴参与者:

- Advanced Photonix, Inc.

- GoFoton

- New England Photoconductor (NEP)

- NuPhotonics LLC

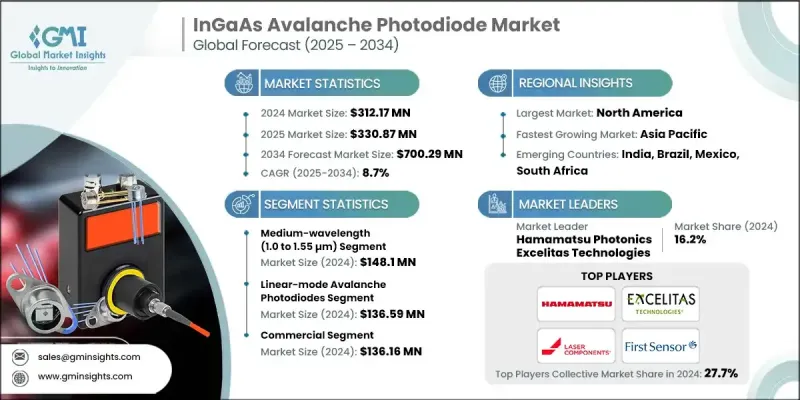

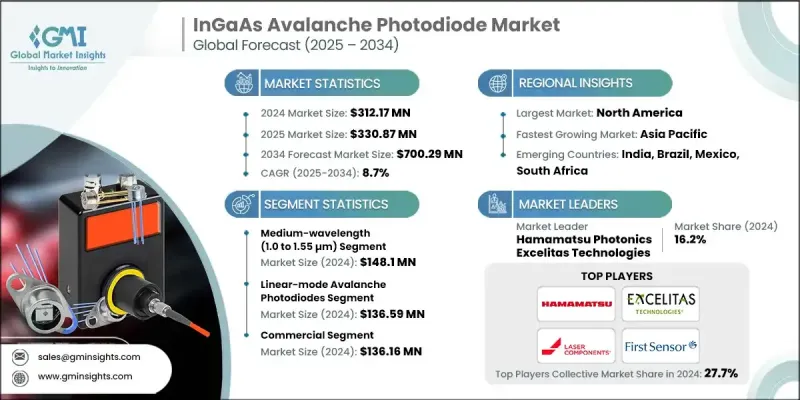

The Global InGaAs Avalanche Photodiode Market was valued at USD 312.17 million in 2024 and is estimated to grow at a CAGR of 8.7% to reach USD 700.29 million by 2034.

This growth is supported by the surging demand for fiber-optic communication networks, driven by the increasing dependence on high-speed internet, cloud platforms, and data-heavy applications. InGaAs avalanche photodiodes (APDs) are critical to ensuring rapid and accurate optical signal detection in high-performance telecommunication environments, including long-distance transmission, metropolitan networks, and advanced data center infrastructure. Their high responsiveness, fast signal processing capabilities, and low-noise characteristics make them essential in today's bandwidth-driven world. As telecom providers ramp up their infrastructure to support next-gen connectivity and as digital transformation continues across sectors, the role of InGaAs APDs becomes increasingly vital. Furthermore, as LiDAR-based applications become more widespread across industries such as automation, mapping, and robotics, the demand for photo detectors that can operate efficiently in near-infrared wavelengths continues to climb. These trends are creating strong momentum for innovation and product expansion within the InGaAs APD market.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $312.17 Million |

| Forecast Value | $700.29 Million |

| CAGR | 8.7% |

The medium-wavelength segment (1.0 to 1.55 µm) generated USD 148.1 million in 2024 and is forecasted to grow at a 10% CAGR. This segment benefits from its increasing utility in industrial and environmental applications, including fiber optics, spectroscopy, and precision sensing technologies. The emphasis remains on optimizing photodiodes for wavelength-specific responsiveness, thermal stability, and reduced electronic interference. Manufacturers are continually enhancing their performance parameters to better serve evolving requirements from telecommunications and scientific industries, where accuracy and reliability are paramount.

In 2024, the single-photon avalanche diodes (SPADs) segment accounted for USD 114.49 million. These diodes can detect individual photons with exceptional precision, making them ideal for fast-paced, light-restricted environments. Increasing demand in quantum applications, low-light imaging systems, and time-resolved analytics continues to accelerate innovation in SPAD technology. Manufacturers are heavily investing in compact, CMOS-compatible SPAD arrays with ultra-low jitter to allow easy integration into smaller photonic systems. Their integration into navigation, 3D imaging, and scientific research fields is expected to diversify use cases and expand commercial interest.

U.S. InGaAs Avalanche Photodiode (InGaAs APD) Market generated USD 74.6 million in 2024. Growth in the U.S. stems from the rising implementation of photonic technologies in both commercial and defense sectors. The widespread use of advanced optical sensing and communication tools across aerospace, telecom, and scientific research is creating long-term demand for InGaAs APDs. As optical fiber networks grow and LiDAR use expands in infrastructure and security systems, the need for high-accuracy photodetectors continues to drive regional market performance.

Prominent industry participants in the InGaAs Avalanche Photodiode (InGaAs APD) Market include Hamamatsu Photonics, Albis Optoelectronics AG (Enablence), Excelitas Technologies, OSI Optoelectronics, Laser Components DG, Inc., First Sensor, Dexerials Corporation, and Thorlabs Inc. These companies play a critical role in shaping the technological evolution and commercial success of the industry. Key players in the InGaAs avalanche photodiode market are implementing multifaceted strategies to enhance their competitive edge. A primary focus is on technological innovation, with companies channeling investments into R&D to improve spectral sensitivity, reduce noise levels, and enhance performance across varying environmental conditions. Many are also diversifying product portfolios, introducing compact and application-specific photodiodes for verticals such as quantum computing, LiDAR, and advanced telecom systems. Strategic partnerships with component manufacturers and system integrators help streamline product adoption. Additionally, firms are leveraging semiconductor fabrication advancements like CMOS integration to enable mass production and miniaturization. To further boost market presence, global players continue to expand their distribution networks and tailor solutions for regional and application-specific demands across high-growth sectors.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Business trends

- 2.2.2 Type trends

- 2.2.3 Wavelength range trends

- 2.2.4 Application trends

- 2.2.5 Regional trends

- 2.3 TAM Analysis, 2025-2034 (USD Billion)

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand in fiber-optic communication

- 3.2.1.2 Growth of LiDAR applications

- 3.2.1.3 Expansion of medical imaging technologies

- 3.2.1.4 Emergence of quantum communication & photonics

- 3.2.1.5 Military & aerospace advancements

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High manufacturing and material costs

- 3.2.2.2 Limited dynamic range and saturation at high optical powers

- 3.2.3 Market opportunities

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter’s analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Pricing strategies

- 3.10 Emerging business models

- 3.11 Compliance requirements

- 3.12 Consumer sentiment analysis

- 3.13 Patent and IP analysis

- 3.14 Geopolitical and trade dynamics

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 MEA

- 4.2.2 Market concentration analysis

- 4.2.1 By region

- 4.3 Competitive benchmarking of key players

- 4.3.1 Financial performance comparison

- 4.3.1.1 Revenue

- 4.3.1.2 Profit margin

- 4.3.1.3 R&D

- 4.3.2 Product portfolio comparison

- 4.3.2.1 Product range breadth

- 4.3.2.2 Technology

- 4.3.2.3 Innovation

- 4.3.3 Geographic presence comparison

- 4.3.3.1 Global footprint analysis

- 4.3.3.2 Service network coverage

- 4.3.3.3 Market penetration by region

- 4.3.4 Competitive positioning matrix

- 4.3.4.1 Leaders

- 4.3.4.2 Challengers

- 4.3.4.3 Followers

- 4.3.4.4 Niche players

- 4.3.5 Strategic outlook matrix

- 4.3.1 Financial performance comparison

- 4.4 Key developments, 2021-2024

- 4.4.1 Mergers and acquisitions

- 4.4.2 Partnerships and collaborations

- 4.4.3 Technological advancements

- 4.4.4 Expansion and investment strategies

- 4.4.5 Digital Transformation Initiatives

- 4.5 Emerging/ Startup Competitors Landscape

Chapter 5 Market Estimates and Forecast, By Type, 2021 - 2034 (USD Million)

- 5.1 Key trends

- 5.2 Single-photon Avalanche Diodes (SPADs)

- 5.3 Multi-photon Avalanche Diodes (MPADs)

- 5.4 Linear-mode Avalanche Photodiodes

Chapter 6 Market Estimates and Forecast, By Wavelength Range, 2021 - 2034 (USD Million)

- 6.1 Key trends

- 6.2 Short-wavelength (up to 1.0 µm)

- 6.3 Medium-wavelength (1.0 to 1.55 µm)

- 6.4 Long-wavelength (1.55 µm and above)

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Million)

- 7.1 Key trends

- 7.2 Commercial

- 7.2.1 3D imaging

- 7.2.2 Gesture recognition

- 7.2.3 Depth sensing

- 7.2.4 Automotive LiDAR

- 7.2.5 Others

- 7.3 IT & Telecommunication

- 7.3.1 High-speed optical interconnects

- 7.3.2 Optical transceivers

- 7.3.3 Long-haul optical fiber communication

- 7.3.4 Metro and access networks

- 7.3.5 Passive optical networks (PONs)

- 7.3.6 Others

- 7.4 Aerospace & Defense

- 7.4.1 Communication links

- 7.4.2 Optical communication

- 7.4.3 Military LiDAR and rangefinding

- 7.4.4 Remote sensing

- 7.4.5 Others

- 7.5 Industrial

- 7.5.1 Machine vision

- 7.5.2 Industrial automation

- 7.5.3 Monitoring

- 7.5.4 Metrology & inspection

- 7.5.5 Others

- 7.6 Healthcare

- 7.6.1 Optical Coherence Tomography (OCT)

- 7.6.2 Positron Emission Tomography (PET)

- 7.6.3 Biomedical sensing

- 7.6.4 Near-infrared spectroscopy

- 7.6.5 Others

- 7.7 Others

Chapter 8 Market Estimates & Forecast, By Region, 2021-2034 (USD Million)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 MEA

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Global Players:

- 9.1.1 Hamamatsu Photonics

- 9.1.2 Excelitas Technologies

- 9.1.3 OSI Optoelectronics

- 9.1.4 Thorlabs Inc.

- 9.2 Regional Players:

- 9.2.1 Albis Optoelectronics (Enablence)

- 9.2.2 Dexerials Corporation

- 9.2.3 First Sensor

- 9.2.4 GPD Optoelectronics Corp.

- 9.2.5 Laser Components GmbH

- 9.2.6 LONTEN

- 9.2.7 Voxtel Inc.

- 9.3 Emerging Players:

- 9.3.1 Advanced Photonix, Inc.

- 9.3.2 GoFoton

- 9.3.3 New England Photoconductor (NEP)

- 9.3.4 NuPhotonics LLC