|

市场调查报告书

商品编码

1833441

非小细胞肺癌市场机会、成长动力、产业趋势分析及2025-2034年预测Non-Small Cell Lung Cancer Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

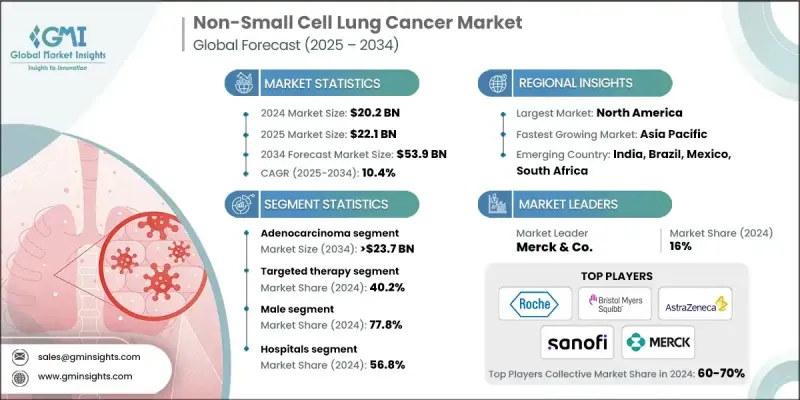

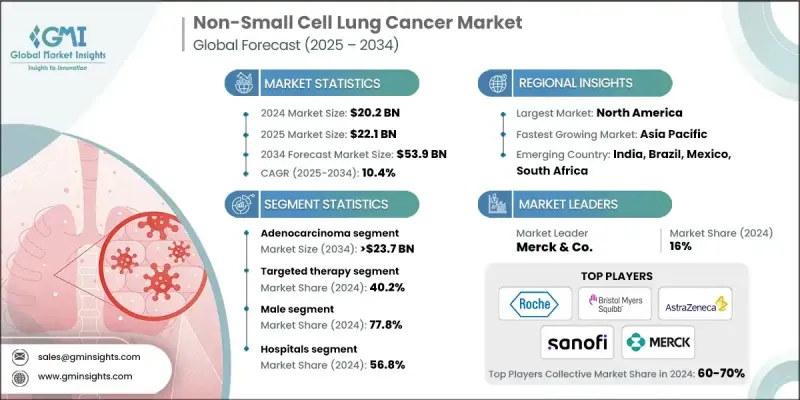

2024 年全球非小细胞肺癌市场价值为 202 亿美元,预计将以 10.4% 的复合年增长率成长,到 2034 年达到 539 亿美元。

针对特定基因突变(如 EGFR、ALK、ROS1 和 KRAS)的疗法的发展已经改变了治疗途径、扩展了个人化医疗并显着改善了特定患者群体的治疗效果。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 202亿美元 |

| 预测值 | 539亿美元 |

| 复合年增长率 | 10.4% |

腺癌盛行率上升

腺癌在2024年占据了相当大的份额,这得益于其高发病率,尤其是在非吸烟者和年轻患者中。腺癌是非小细胞肺癌(NSCLC)最常见的组织学亚型,通常与可操作的基因突变相关,使其成为分子标靶治疗的主要关注点。

标靶治疗的应用日益广泛

标靶治疗领域在2024年占据了相当大的份额,其优势在于提供个人化治疗方案,在提高生存率的同时最大限度地降低全身毒性。由于多种针对EGFR、ALK、BRAF、MET和KRAS等特定致癌驱动因素的药物获得批准,该领域发展势头强劲。标靶药物通常被推荐为符合条件患者的第一线治疗方案,与传统化疗相比,其无恶化存活期更长。

男性产业将获得发展

由于男性吸烟率和职业性肺癌致癌物暴露率历来较高,男性市场在2024年占据了相当大的份额。儘管基于性别的治疗方案并无显着差异,但男性患者发病率较高,导致诊断、治疗启动和后续护理方面的需求不成比例。

北美将成为推动力地区

2025-2034年期间,北美非小细胞肺癌市场将以可观的复合年增长率增长,这得益于强大的医疗基础设施、广泛的生物标誌物检测以及下一代疗法的早期应用。该地区也受惠于积极参与全球临床试验以及快速审批的监管途径,这些途径能够更快地将新型疗法推向市场。随着精准肿瘤学投资的不断增加以及政府的支持性倡议,北美预计将在非小细胞肺癌领域保持主导地位。

非小细胞肺癌产业的一些知名企业包括 Xcovery、默克公司、杨森生物技术公司、赛诺菲、艾伯维、诺华、安斯泰来製药、辉瑞、礼来、武田、罗氏公司、百时美施贵宝公司、阿斯特捷利康、太阳製药和 Merus。

为了巩固在非小细胞肺癌市场的地位,各大公司正在实施一系列策略,包括扩大精准肿瘤学产品组合,并透过监管快速通道加快上市时间。重点是开发下一代抑制剂,以克服现有疗法的抗药性,尤其是在标靶治疗领域。与诊断公司的合作也至关重要,因为它们可以透过伴随诊断简化患者识别。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 每个阶段的增值

- 影响价值链的因素

- 产业衝击力

- 成长动力

- 非小细胞肺癌盛行率不断上升

- 免疫疗法和标靶治疗的突破

- 诊断技术的进步

- 个人化医疗的普及率不断提高

- 产业陷阱与挑战

- 先进疗法成本高昂

- 监管和诊断基础设施差距

- 市场机会

- 新兴市场需求不断成长

- 转向个人化和联合治疗

- 成长动力

- 成长潜力分析

- 监管格局

- 未来市场趋势

- 管道分析

- 技术和创新格局

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与协作

- 新产品发布

第五章:市场估计与预测:按类型,2021 - 2034

- 主要趋势

- 腺癌

- 鳞状细胞癌

- 大细胞癌

- 其他类型

第六章:市场估计与预测:依治疗方式,2021 - 2034

- 主要趋势

- 化疗

- 免疫疗法

- 标靶治疗

- 其他治疗类型

第七章:市场估计与预测:依性别,2021 - 2034 年

- 主要趋势

- 男性

- 女性

第八章:市场估计与预测:依最终用途,2021 - 2034 年

- 主要趋势

- 医院

- 专科诊所

- 其他最终用途

第九章:市场估计与预测:按地区,2021 - 2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十章:公司简介

- AbbVie

- Astellas Pharma

- AstraZeneca

- Bristol-Myers Squibb Company

- Eli Lilly

- F. Hoffmann La Roche

- Janssen Biotech

- Merck & Co.

- Merus

- Novartis

- Pfizer

- Sanofi

- Sun Pharmaceutical

- Takeda

- Xcovery

The Global Non-Small Cell Lung Cancer Market was valued at USD 20.2 billion in 2024 and is estimated to grow at a CAGR of 10.4% to reach USD 53.9 billion by 2034.

The development of therapies targeting specific genetic mutations (like EGFR, ALK, ROS1, and KRAS) has transformed treatment pathways, expanded personalized medicine and significantly improved outcomes in select patient groups.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $20.2 Billion |

| Forecast Value | $53.9 Billion |

| CAGR | 10.4% |

Rising Prevalence of Adenocarcinoma

The adenocarcinoma segment held a significant share in 2024, driven by its high prevalence, particularly among non-smokers and younger patients. As the most common histological subtype of NSCLC, adenocarcinoma is often associated with actionable genetic mutations, making it a prime focus for molecularly targeted therapies.

Increasing Adoption of Targeted Therapy

The targeted therapy segment held a sizeable share in 2024, backed by offering a personalized approach that improves survival while minimizing systemic toxicity. This segment has gained strong momentum due to the approval of multiple agents addressing specific oncogenic drivers like EGFR, ALK, BRAF, MET, and KRAS mutations. Targeted drugs are often preferred as first-line treatments for eligible patients, resulting in longer progression-free survival compared to traditional chemotherapy.

Male Sector to Gain Traction

The male segment generated a substantial share in 2024, owing to historically higher rates of smoking and occupational exposure to lung carcinogens among men. Although gender-based treatment protocols do not significantly differ, the higher incidence among male patients drives disproportionate demand in terms of diagnostics, therapy initiation, and follow-up care.

North America to Emerge as a Propelling Region

North America non-small cell lung cancer market will grow at a decent CAGR during 2025-2034, fueled by robust healthcare infrastructure, widespread biomarker testing, and early adoption of next-generation therapies. The region also benefits from active participation in global clinical trials and fast-track regulatory pathways that bring novel treatments to market faster. With rising investment in precision oncology and supportive government initiatives, North America is expected to maintain its dominant position in the NSCLC landscape.

Some prominent players operating in the non-small cell lung cancer industry include Xcovery, Merck & Co., Janssen Biotech, Sanofi, AbbVie, Novartis, Astellas Pharma, Pfizer, Eli Lilly, Takeda, F. Hoffmann La Roche, Bristol-Myers Squibb Company, AstraZeneca, Sun Pharmaceutical, and Merus.

To strengthen their presence in the non-small cell lung cancer market, companies are implementing a range of strategies, including expanding their precision oncology portfolios and accelerating time-to-market through regulatory fast-tracks. A major focus lies in developing next-generation inhibitors to overcome resistance to existing therapies, particularly in the targeted therapy segment. Collaborations with diagnostic firms are also key, as they enable streamlined patient identification through companion diagnostics.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumption and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Type

- 2.2.3 Treatment

- 2.2.4 Gender

- 2.2.5 End use

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of non-small cell lung cancer

- 3.2.1.2 Breakthroughs in immunotherapy and targeted treatments

- 3.2.1.3 Advancements in diagnostic technologies

- 3.2.1.4 Growing adoption of personalized medicine

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of advanced therapies

- 3.2.2.2 Regulatory and diagnostic infrastructure gaps

- 3.2.3 Market opportunities

- 3.2.3.1 Rising demand in emerging markets

- 3.2.3.2 Shift toward personalized and combination therapies

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East and Africa

- 3.5 Future market trends

- 3.6 Pipeline analysis

- 3.7 Technology and innovation landscape

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Merger and acquisition

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

Chapter 5 Market Estimates and Forecast, By Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Adenocarcinoma

- 5.3 Squamous cell carcinoma

- 5.4 Large cell carcinoma

- 5.5 Other types

Chapter 6 Market Estimates and Forecast, By Treatment, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Chemotherapy

- 6.3 Immunotherapy

- 6.4 Targeted therapy

- 6.5 Other treatment types

Chapter 7 Market Estimates and Forecast, By Gender, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Male

- 7.3 Female

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospitals

- 8.3 Specialty clinics

- 8.4 Other end use

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 AbbVie

- 10.2 Astellas Pharma

- 10.3 AstraZeneca

- 10.4 Bristol-Myers Squibb Company

- 10.5 Eli Lilly

- 10.6 F. Hoffmann La Roche

- 10.7 Janssen Biotech

- 10.8 Merck & Co.

- 10.9 Merus

- 10.10 Novartis

- 10.11 Pfizer

- 10.12 Sanofi

- 10.13 Sun Pharmaceutical

- 10.14 Takeda

- 10.15 Xcovery