|

市场调查报告书

商品编码

1833447

陀螺仪市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Gyroscope Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

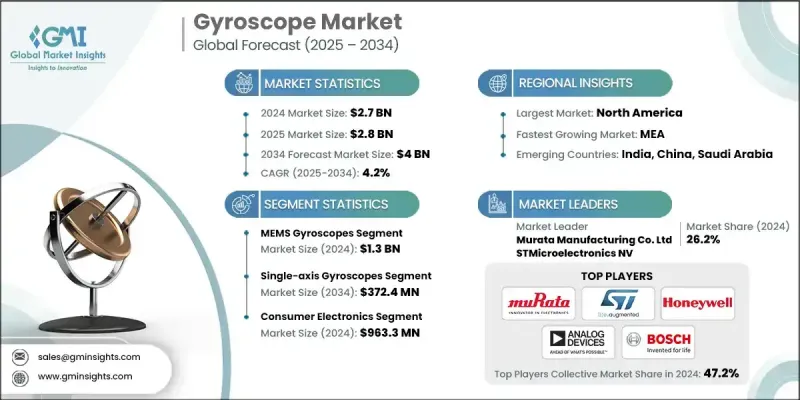

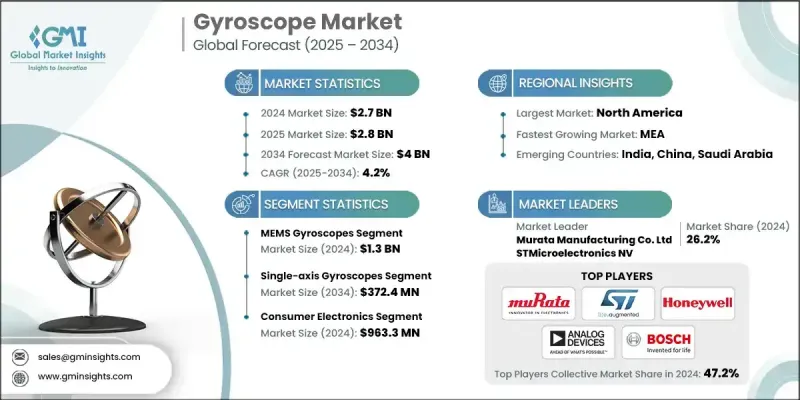

2024 年全球陀螺仪市场价值为 27 亿美元,预计将以 4.2% 的复合年增长率成长,到 2034 年达到 40 亿美元。

智慧型手机、平板电脑和穿戴式装置已变得高度复杂,使用者体验高度依赖运动感应功能。陀螺仪对于实现自动萤幕方向、步数追踪、手势控制和沈浸式扩增实境 (AR) 应用等功能至关重要。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 27亿美元 |

| 预测值 | 40亿美元 |

| 复合年增长率 | 4.2% |

MEMS陀螺仪的采用率不断上升

MEMS陀螺仪凭藉其紧凑的尺寸、低功耗以及大众市场应用的适用性,在2024年占据了相当大的市场份额。这些微机电系统广泛应用于行动装置、穿戴式装置、无人机和游戏控制器,使其成为全球成长最快的细分市场之一。各大公司正在大力投资微型化、大量生产流程和多轴感测器融合,以提高性能和成本效益。

单轴陀螺仪的使用率不断上升

单轴陀螺仪市场在2024年维持强劲成长。这类陀螺仪因其简单易用、经久耐用且成本低廉而备受青睐,其价格通常在5美元到100美元之间,具体取决于规格。儘管多轴解决方案的需求日益增长,但在只需极少量感测的场景下,单轴陀螺仪仍然是首选。为了维持市场竞争力,各公司正致力于提升单轴陀螺仪的灵敏度和稳定性,并将其整合到模组化感测器套件中,以吸引新兴市场和DIY技术平台。

消费性电子产品将获得青睐

2024年,消费性电子领域将占据相当大的份额,这主要得益于其在智慧型手机、AR/VR头戴装置、健身追踪器和游戏设备等领域的应用。随着使用者体验越来越沉浸式,并更加重视运动驱动,对紧凑、快速响应和低功耗陀螺仪的需求持续成长。为了保持竞争力,製造商优先考虑外形尺寸最佳化、大批量生产能力以及与OEM产品週期的紧密配合。

北美将成为推动力地区

受国防、航太和先进製造业强劲投资的推动,北美陀螺仪市场预计在2024年占据显着份额。该地区还拥有许多全球顶尖的科技和感测器公司,为创新与合作提供了肥沃的土壤。

陀螺仪市场的主要参与者有 Trimble Inc.、InvenSense Inc.、TE Connectivity Ltd.、EMCORE Corporation、Murata Manufacturing Co. Ltd、Systron Donner Inertial、Bosch Sensortec GmbH、InnaLabs、STMicroelectronics NV、Alog坦 Devices Inc.、Northnalogy. Inc. 和 NXP Semiconductors NV。

为了巩固在全球陀螺仪市场的立足点,各公司正专注于创新、垂直整合和终端市场多元化。研发投入仍然是核心,尤其是在MEMS微型化、感测器融合和下一代材料方面。与航太、汽车和消费电子公司建立策略合作伙伴关係有助于确保长期业务,并推动特定应用陀螺仪的共同开发。

目录

第一章:方法论

- 市场范围和定义

- 研究设计

- 研究方法

- 资料收集方法

- 资料探勘来源

- 全球的

- 地区/国家

- 基础估算与计算

- 基准年计算

- 市场评估的主要趋势

- 初步研究和验证

- 主要来源

- 预测模型

- 研究假设和局限性

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 利润率分析

- 成本结构

- 每个阶段的增值

- 影响价值链的因素

- 中断

- 产业衝击力

- 成长动力

- 消费性电子产品需求不断成长

- 自动驾驶汽车和ADAS的普及

- 航太和国防应用领域的扩展

- 工业自动化和机器人技术的扩展

- 微机电系统 (MEMS) 技术的进步

- 产业陷阱与挑战

- 製造成本上升

- 系统无缝整合困难

- 市场机会

- 增强物联网连接性和用例

- 自动驾驶汽车的进步

- 连网穿戴技术设备

- 成长动力

- 成长潜力分析

- 监管格局

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL分析

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 按产品

- 定价策略

- 新兴商业模式

- 合规性要求

- 永续性措施

- 消费者情绪分析

- 专利和智慧财产权分析

- 地缘政治与贸易动态

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 按地区

- 关键参与者的竞争基准

- 财务绩效比较

- 收入

- 利润率

- 研发

- 产品组合比较

- 产品范围广度

- 科技

- 创新

- 地理位置比较

- 全球足迹分析

- 服务网路覆盖

- 各地区市场渗透率

- 竞争定位矩阵

- 领导者

- 挑战者

- 追踪者

- 利基市场参与者

- 战略展望矩阵

- 财务绩效比较

- 2021-2024 年关键发展

- 併购

- 伙伴关係与合作

- 技术进步

- 扩张和投资策略

- 永续发展倡议

- 数位转型倡议

- 新兴/新创企业竞争对手格局

第五章:市场估计与预测:按技术类型,2021 - 2034 年

- 主要趋势

- MEMS陀螺仪

- 光纤陀螺仪(FOG)

- 环形雷射陀螺仪(RLG)

- 动态调谐陀螺仪(DTG)

- 半球谐振陀螺仪(HRG)

- 其他的

第六章:市场估计与预测:按轴配置,2021 - 2034 年

- 主要趋势

- 单轴陀螺仪

- 双轴陀螺仪

- 三轴陀螺仪

- 多轴陀螺仪

第七章:市场估计与预测:按应用,2021 - 2034

- 主要趋势

- 运动感应和手势控制

- 导航与惯性测量

- 稳定与控制系统

- 其他的

第 8 章:市场估计与预测:按最终用途产业,2021 年至 2034 年

- 主要趋势

- 消费性电子产品

- 智慧型手机和平板电脑

- 穿戴式装置

- 扩增实境/虚拟现实

- 摄影机稳定係统

- 其他的

- 汽车和运输

- 搭乘用车

- 商用车

- 轨道运输和地铁系统

- 其他的

- 航太和国防

- 飞机

- 无人机

- 太空船

- 船舶和潜水艇

- 其他的

- 工业和机器人

- 工业机器人

- 工业机械及设备

- 其他的

- 医疗保健和医疗器械

- 手术导航系统

- 医学影像设备

- 其他的

- 其他的

第九章:市场估计与预测:按地区,2021 - 2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 多边环境协定

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十章:公司简介

- 全球关键参与者

- Honeywell International Inc.

- Northrop Grumman Corporation

- STMicroelectronics NV

- Analog Devices Inc.

- NXP Semiconductors NV

- 区域关键参与者

- 北美洲

- InvenSense Inc.

- TE Connectivity Ltd.

- Trimble Inc.

- EMCORE Corporation

- SiTime Corporation

- PNI Sensor Technology

- 欧洲

- Murata Manufacturing Co. Ltd

- Bosch Sensortec GmbH

- Safran Electronics & Defense

- 亚太地区

- Epson America Inc.

- InnaLabs

- 北美洲

- 利基市场参与者/颠覆者

- Silicon Sensing Systems Ltd.

- Systron Donner Inertial

- KVH Industries

The Global Gyroscope Market was valued at USD 2.7 billion in 2024 and is estimated to grow at a CAGR of 4.2% to reach USD 4 billion by 2034.

Smartphones, tablets, and wearable devices have become highly sophisticated, with user experiences that depend heavily on motion-sensing capabilities. Gyroscopes are central to enabling features such as automatic screen orientation, step tracking, gesture control, and immersive augmented reality (AR) applications.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.7 Billion |

| Forecast Value | $4 billion |

| CAGR | 4.2% |

Rising Adoption of MEMS Gyroscopes

The MEMS gyroscopes segment held a sizeable share in 2024, owing to their compact size, low power consumption, and suitability for mass-market applications. These micro-electromechanical systems are widely used in mobile devices, wearables, drones, and game controllers, making them one of the fastest-growing segments globally. Companies are investing heavily in miniaturization, batch manufacturing processes, and multi-axis sensor fusion to improve performance and cost-efficiency.

Rising Usage of Single-Axis Gyroscopes

The single-axis gyroscopes segment held robust growth in 2024. These gyroscopes are valued for their simplicity, durability, and low-cost implementation, with pricing generally ranging from USD 5 to USD 100 depending on specifications. While the demand for multi-axis solutions is growing, single-axis units are still preferred in scenarios where minimal sensing is sufficient. To stay relevant, companies are focusing on enhancing the sensitivity and stability of single-axis models while integrating them into modular sensor kits to appeal to emerging markets and DIY technology platforms.

Consumer Electronics to Gain Traction

The consumer electronics segment held a sizeable share in 2024, driven by their use in smartphones, AR/VR headsets, fitness trackers, and gaming devices. As user experiences become more immersive and motion-driven, demand for compact, fast-responding, and low-power gyroscopes continues to rise. To stay competitive, manufacturers are prioritizing form factor optimization, high-volume production capabilities, and close alignment with OEM product cycles.

North America to Emerge as a Propelling Region

North America gyroscopes market is poised to witness a significant share in 2024, fueled by robust investments in defense, aerospace, and advanced manufacturing. The region also hosts many of the world's top tech and sensor companies, offering a fertile ground for innovation and collaboration.

Major players in the gyroscopes market are Trimble Inc., InvenSense Inc., TE Connectivity Ltd., EMCORE Corporation, Murata Manufacturing Co. Ltd, Systron Donner Inertial, Bosch Sensortec GmbH, InnaLabs, STMicroelectronics NV, Analog Devices Inc., Northrop Grumman Corporation, Silicon Sensing Systems Ltd., Epson America Inc., Honeywell International Inc., and NXP Semiconductors NV.

To strengthen their foothold in the global gyroscopes market, companies are focusing on a mix of innovation, vertical integration, and end-market diversification. R&D investment remains central, especially in MEMS miniaturization, sensor fusion, and next-generation materials. Strategic partnerships with aerospace, automotive, and consumer electronics firms help secure long-term business and drive co-development of application-specific gyros.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Technology type trends

- 2.2.2 Axis configuration trends

- 2.2.3 Application trends

- 2.2.4 End use industry trends

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand in consumer electronics

- 3.2.1.2 Proliferation of autonomous vehicles & ADAS

- 3.2.1.3 Expansion in aerospace & defense applications

- 3.2.1.4 Expansion of industrial automation and robotics

- 3.2.1.5 Advancements in micro-electro-mechanical systems (MEMS) technology

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Rising manufacturing costs

- 3.2.2.2 Difficulty in seamless system integration

- 3.2.3 Market opportunities

- 3.2.3.1 Increased IoT connectivity and use cases

- 3.2.3.2 Advances in autonomous vehicles

- 3.2.3.3 Connected wearable technology devices

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter’s analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Pricing strategies

- 3.10 Emerging business models

- 3.11 Compliance requirements

- 3.12 Sustainability Measures

- 3.13 Consumer sentiment analysis

- 3.14 Patent and IP analysis

- 3.15 Geopolitical and trade dynamics

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.1 By region

- 4.3 Competitive benchmarking of key players

- 4.3.1 Financial performance comparison

- 4.3.1.1 Revenue

- 4.3.1.2 Profit margin

- 4.3.1.3 R&D

- 4.3.2 Product portfolio comparison

- 4.3.2.1 Product range breadth

- 4.3.2.2 Technology

- 4.3.2.3 Innovation

- 4.3.3 Geographic presence comparison

- 4.3.3.1 Global footprint analysis

- 4.3.3.2 Service network coverage

- 4.3.3.3 Market penetration by region

- 4.3.4 Competitive positioning matrix

- 4.3.4.1 Leaders

- 4.3.4.2 Challengers

- 4.3.4.3 Followers

- 4.3.4.4 Niche players

- 4.3.5 Strategic outlook matrix

- 4.3.1 Financial performance comparison

- 4.4 Key developments, 2021-2024

- 4.4.1 Mergers and acquisitions

- 4.4.2 Partnerships and collaborations

- 4.4.3 Technological advancements

- 4.4.4 Expansion and investment strategies

- 4.4.5 Sustainability initiatives

- 4.4.6 Digital transformation initiatives

- 4.5 Emerging/ startup competitors landscape

Chapter 5 Market Estimates and Forecast, By Technology Type, 2021 - 2034 (USD Million)

- 5.1 Key trends

- 5.2 MEMS gyroscopes

- 5.3 Fiber optic gyroscopes (FOG)

- 5.4 Ring laser gyroscopes (RLG)

- 5.5 Dynamically tuned gyroscopes (DTG)

- 5.6 Hemispherical resonator gyroscopes (HRG)

- 5.7 Others

Chapter 6 Market Estimates and Forecast, By Axis Configuration, 2021 - 2034 (USD Million)

- 6.1 Key trends

- 6.2 Single-axis gyroscopes

- 6.3 Dual-axis gyroscopes

- 6.4 Three-axis gyroscopes

- 6.5 Multi-axis gyroscopes

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Million)

- 7.1 Key trends

- 7.2 Motion sensing & gesture control

- 7.3 Navigation & inertial measurement

- 7.4 Stabilization & control systems

- 7.5 Others

Chapter 8 Market Estimates and Forecast, By End use Industry, 2021 - 2034 (USD Billion)

- 8.1 Key trends

- 8.2 Consumer electronics

- 8.2.1 Smartphones and tablets

- 8.2.2 Wearable devices

- 8.2.3 AR/VR

- 8.2.4 Camera stabilization systems

- 8.2.5 Others

- 8.3 Automotive and transportation

- 8.3.1 Passenger vehicles

- 8.3.2 Commercial vehicles

- 8.3.3 Rail transport and metro systems

- 8.3.4 Others

- 8.4 Aerospace and defense

- 8.4.1 Aircrafts

- 8.4.2 UAVs

- 8.4.3 Spacecrafts

- 8.4.4 Ships & submarines

- 8.4.5 Others

- 8.5 Industrial and robotics

- 8.5.1 Industrial robots

- 8.5.2 Industrial machines & equipments

- 8.5.3 Others

- 8.6 Healthcare and medical devices

- 8.6.1 Surgical navigation systems

- 8.6.2 Medical imaging equipment

- 8.6.3 Others

- 8.7 Others

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 (USD Billion)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Global Key Players

- 10.1.1 Honeywell International Inc.

- 10.1.2 Northrop Grumman Corporation

- 10.1.3 STMicroelectronics NV

- 10.1.4 Analog Devices Inc.

- 10.1.5 NXP Semiconductors NV

- 10.2 Regional Key Players

- 10.2.1 North America

- 10.2.1.1 InvenSense Inc.

- 10.2.1.2 TE Connectivity Ltd.

- 10.2.1.3 Trimble Inc.

- 10.2.1.4 EMCORE Corporation

- 10.2.1.5 SiTime Corporation

- 10.2.1.6 PNI Sensor Technology

- 10.2.2 Europe

- 10.2.2.1 Murata Manufacturing Co. Ltd

- 10.2.2.2 Bosch Sensortec GmbH

- 10.2.2.3 Safran Electronics & Defense

- 10.2.3 Asia Pacific

- 10.2.3.1 Epson America Inc.

- 10.2.3.2 InnaLabs

- 10.2.1 North America

- 10.3 Niche Players / Disruptors

- 10.3.1 Silicon Sensing Systems Ltd.

- 10.3.2 Systron Donner Inertial

- 10.3.3 KVH Industries