|

市场调查报告书

商品编码

1833453

煞车摩擦产品市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Brake Friction Products Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

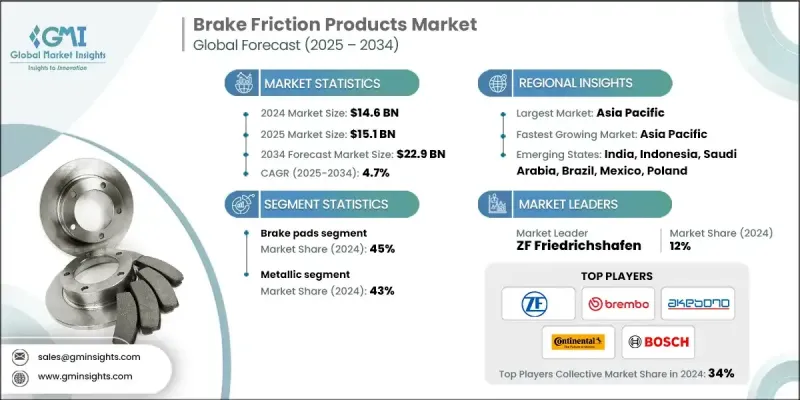

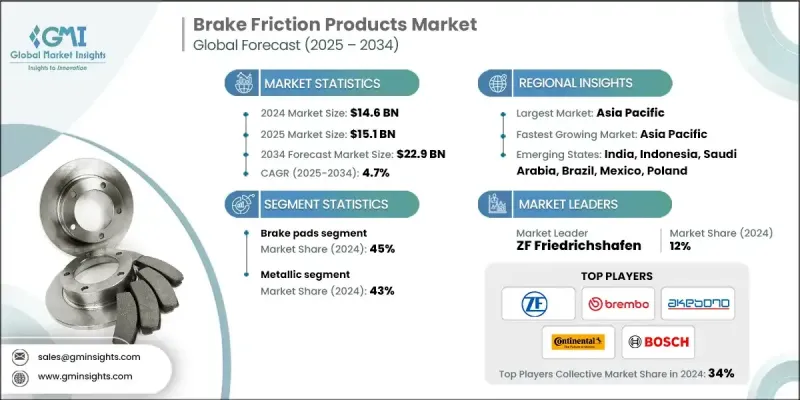

2024 年全球煞车摩擦产品市场价值为 146 亿美元,预计到 2034 年将以 4.7% 的复合年增长率成长至 229 亿美元。

全球汽车产量的稳定成长是煞车摩擦产品市场的主要驱动力。随着经济发展和都市化进程,越来越多的消费者购买乘用车、商用卡车和两轮车来满足其出行需求。这些车辆都高度依赖可靠的煞车系统来确保安全,因此,煞车片、衬片和蹄片等煞车摩擦部件成为每辆新车的必备部件。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 146亿美元 |

| 预测值 | 229亿美元 |

| 复合年增长率 | 4.7% |

煞车片需求不断成长

2024年,煞车片市场收入可观,这得益于车辆安全性和性能的提升,使其成为乘用车、商用车和两轮车不可或缺的部件。为了满足日益增长的消费者期望,製造商正致力于提升煞车片的耐用性和降噪能力。此外,陶瓷和半金属化合物等先进材料的日益普及也推动了该领域的成长。随着创新的不断推进和安全法规的严格实施,在汽车产量和更换需求不断增长的推动下,煞车片市场规模持续扩张。

金属材料的采用日益增多

金属摩擦材料凭藉其卓越的耐热性和耐用性,在2024年占据了相当大的份额。该领域尤其受到商用车和高性能汽车的青睐,这些汽车需要在严苛条件下实现强劲的煞车性能。然而,该行业也面临着许多挑战,例如环境法规要求降低金属含量,以及开发更环保的替代品的需求。各公司正在加大研发投入,以创新低金属或混合摩擦材料,从而兼顾性能与永续性,确保该领域保持竞争力并符合不断发展的标准。

亚太地区将成为推动力地区

受中国、印度和日本等国汽车产量不断增长和城镇化进程加快的推动,亚太地区煞车摩擦产品市场将在2034年之前实现快速成长。消费者对车辆安全的意识不断增强,以及售后市场的蓬勃发展,将进一步推动市场扩张。主要参与者正在透过建立本地製造部门、与原始设备製造商建立战略合作伙伴关係,以及专注于根据地区偏好和监管要求定制经济高效的高品质摩擦材料,巩固其在该地区的地位。

煞车摩擦产品市场的主要参与者有德尔福科技、辉门、布雷博、曙光煞车工业株式会社、爱德克斯株式会社、罗伯特博世、大陆集团、采埃孚、日清纺控股、爱信精机株式会社。

煞车摩擦产品市场的公司正在部署创新、策略合作伙伴关係和区域扩张等多种策略,以巩固其市场地位。在研发方面的大量投入使製造商能够开发出符合严格环境和安全法规的先进摩擦材料,同时提升产品性能。与原始设备製造商 (OEM) 的合作有助于确保长期供应合同,从而确保稳定的收入来源。

目录

第一章:方法论

- 市场范围和定义

- 研究设计

- 研究方法

- 资料收集方法

- 资料探勘来源

- 全球的

- 地区/国家

- 基础估算与计算

- 基准年计算

- 市场评估的主要趋势

- 初步研究和验证

- 主要来源

- 预测模型

- 研究假设和局限性

第二章:行业洞察

- 产业生态系统分析

- 供应商格局

- 利润率

- 成本结构

- 每个阶段的增值

- 影响价值链的因素

- 中断

- 产业衝击力

- 成长动力

- 严格的安全规定

- 新兴市场汽车产量成长

- 转向无铜和环保材料

- 亚太地区两轮车和车队拥有量不断成长

- 产业陷阱与挑战

- 原物料价格波动

- 来自低成本非正规参与者的竞争

- 市场机会

- 车辆电气化

- 售后市场数位化与电子商务

- 已开发市场的高端化趋势

- 策略合作与併购

- 成长动力

- 成长潜力分析

- 监管格局

- 全球的

- ISO 26867:2009 测试标准实施

- 环境法规

- 效能测试和验证协议

- 品质保证和製造标准

- 区域

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 全球的

- 波特的分析

- PESTEL分析

- 技术和创新格局

- 当前的技术趋势

- 电动车革命影响评估

- 线控制动系统的开发与应用

- 自动驾驶汽车煞车要求

- 製造技术创新

- 新兴技术

- 智慧材料和自适应性能

- 人工智慧与预测性维护集成

- 永续材料创新与发展

- 当前的技术趋势

- 价格趋势

- 按地区

- 按产品

- 生产统计

- 生产中心

- 消费中心

- 汇出和汇入

- 成本分解分析

- 专利分析

- 永续性和环境方面

- 永续实践

- 减少废弃物的策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考虑

- 煞车粉尘排放分析及环境影响

- 环境法规合规框架

- 企业永续性与 ESG 绩效

- 制动性能分析和测试智能

- 真实世界停车距离资料库

- 热性能和衰减分析

- 摩擦係数一致性分析

- 噪音、振动和声振粗糙度 (NVH) 情报

- 煞车噪音分析与缓解

- 振动和抖动性能

- 严酷性和舒适度指标

- 健康与环境影响情报

- 煞车粉尘排放量化

- 职业健康与安全分析

- 环境生命週期评估

第三章:竞争格局

- 介绍

- 公司市占率分析

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 多边环境协定

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 战略展望矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划和资金

- 製造和供应链分析

- 全球製造足迹和产能分析

- 原物料供应链与风险评估

- 製造成本分析与最佳化

- 供应链弹性与风险管理

- 品质控制和性能验证框架

- 统计製程管制(SPC)分析

- 效能测试和验证协议

- 故障模式与影响分析(FMEA)

第四章:市场估计与预测:依产品,2021 - 2034

- 主要趋势

- 煞车片

- 煞车蹄

- 煞车片

- 煞车鼓

- 煞车碟盘/煞车盘

- 其他的

第五章:市场估计与预测:依资料,2021 - 2034 年

- 主要趋势

- 金属

- 陶瓷製品

- 合成的

- 其他的

第六章:市场估计与预测:依车型,2021 - 2034

- 主要趋势

- 搭乘用车

- 轿车

- SUV

- 掀背车

- 商用车

- 轻型商用车(LCV)

- 重型商用车(HCV)

- 中型商用车(MCV)

- 两轮车

- 非公路车辆

第七章:市场估计与预测:依销售管道,2021 - 2034 年

- 主要趋势

- 原始设备製造商(OEM)

- 售后市场

第八章:市场估计与预测:按地区,2021 - 2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 北欧人

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳新银行

- 东南亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 多边环境协定

- 南非

- 沙乌地阿拉伯

- 阿联酋

第九章:公司简介

- Global companies

- Aisin Seiki Co.

- Akebono Brake Industry Co.

- Brembo

- Continental

- Federal-Mogul

- Miba Friction Group

- Robert Bosch

- Tenneco

- TMD Friction Holdings

- ZF Friedrichshafen

- Regional companies

- Advics Co.

- ATE

- Delphi Technologies

- EBC Brakes

- Ferodo

- Jurid

- MAT Holdings

- Nisshinbo Holdings

- NRS Brakes

- Sangsin Brake

- Wagner Brake

- 新兴企业

- AI-Powered Brake Analytics Startups

- Drivezy

- Brake Parts

- Fras-le

- Galfer Bike

- Hardron Friction Material

- SGL Carbon SE - Brake Disc Division

- Xinyi Brake Pad Co.

The Global Brake Friction Products Market was valued at USD 14.6 billion in 2024 and is estimated to grow at a CAGR of 4.7% to reach USD 22.9 billion by 2034.

The steady rise in global vehicle production is a primary driver in the brake friction products market. As economies develop and urbanize, more consumers are purchasing passenger cars, commercial trucks, and two-wheelers to meet their transportation needs. Each of these vehicles depends heavily on reliable braking systems to ensure safety, making brake friction components like pads, linings, and shoes essential parts in every new vehicle.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $14.6 Billion |

| Forecast Value | $22.9 Billion |

| CAGR | 4.7% |

Increasing Demand for Brake Pads

The brake pads segment generated substantial revenues in 2024, driven by vehicle safety and performance that makes them indispensable across passenger cars, commercial vehicles, and two-wheelers. Manufacturers are focusing on enhancing the durability and noise reduction capabilities of brake pads to meet rising consumer expectations. Furthermore, the increasing adoption of advanced materials such as ceramic and semi-metallic compounds is fueling growth within this segment. With ongoing innovations and stringent safety regulations, the brake pads segment continues to expand, driven by rising vehicle production and replacement demand.

Rising Adoption of Metallic Material

The metallic segment held a significant share in 2024 owing to its superior heat resistance and durability. This segment is particularly favored in commercial vehicles and high-performance automobiles that require robust braking under demanding conditions. However, industry faces challenges such as environmental regulations pushing for reduced metal content and the need to develop eco-friendlier alternatives. Companies are investing in R&D to innovate low-metallic or hybrid friction materials that balance performance with sustainability, ensuring this segment remains competitive and compliant with evolving standards.

Asia Pacific to Emerge as a Propelling Region

Asia Pacific brake friction products market will witness rapid growth through 2034, driven by escalating vehicle production and expanding urbanization across countries like China, India, and Japan. Increasing consumer awareness regarding vehicle safety and the growing aftermarket segment are further propelling market expansion. Key players are strengthening their foothold in this region by establishing local manufacturing units, forming strategic partnerships with OEMs, and focusing on cost-effective, high-quality friction materials tailored to regional preferences and regulatory requirements.

Major players in the brake friction products market are Delphi Technologies, Federal-Mogul, Brembo, Akebono Brake Industry Co., Advics Co., Robert Bosch, Continental, ZF Friedrichshafen, Nisshinbo Holdings, Aisin Seiki Co.

Companies operating in the brake friction products market are deploying a combination of innovation, strategic partnerships, and regional expansion to bolster their market position. Heavy investments in R&D allow manufacturers to develop advanced friction materials that meet stringent environmental and safety regulations while enhancing product performance. Collaborations with original equipment manufacturers (OEMs) help secure long-term supply contracts, ensuring steady revenue streams.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Industry Insights

- 2.1 Industry ecosystem analysis

- 2.1.1 Supplier landscape

- 2.1.2 Profit margin

- 2.1.3 Cost structure

- 2.1.4 Value addition at each stage

- 2.1.5 Factor affecting the value chain

- 2.1.6 Disruptions

- 2.2 Industry impact forces

- 2.2.1 Growth drivers

- 2.2.1.1 Stringent safety regulations

- 2.2.1.2 Vehicle production growth in emerging markets

- 2.2.1.3 Shift toward copper-free & eco-friendly materials

- 2.2.1.4 Rising two-wheeler and fleet ownership in APAC

- 2.2.2 Industry pitfalls and challenges

- 2.2.2.1 Raw material price volatility

- 2.2.2.2 Competition from low-cost unorganized players

- 2.2.3 Market opportunities

- 2.2.3.1 Electrification of vehicles

- 2.2.3.2 Aftermarket digitization & e-commerce

- 2.2.3.3 Premiumization trend in developed markets

- 2.2.3.4 Strategic collaborations & M&A

- 2.2.1 Growth drivers

- 2.3 Growth potential analysis

- 2.4 Regulatory landscape

- 2.4.1 Global

- 2.4.1.1 ISO 26867:2009 Testing Standards Implementation

- 2.4.1.2 Environmental Regulations

- 2.4.1.3 Performance Testing and Validation Protocols

- 2.4.1.4 Quality Assurance and Manufacturing Standards

- 2.4.2 Regional

- 2.4.2.1 North America

- 2.4.2.2 Europe

- 2.4.2.3 Asia Pacific

- 2.4.2.4 Latin America

- 2.4.2.5 Middle East & Africa

- 2.4.1 Global

- 2.5 Porter’s analysis

- 2.6 PESTEL analysis

- 2.7 Technology and innovation landscape

- 2.7.1 Current technological trends

- 2.7.1.1 Electric vehicle revolution impact assessment

- 2.7.1.2 Brake-by-wire systems development and adoption

- 2.7.1.3 Autonomous vehicle braking requirements

- 2.7.1.4 Manufacturing technology innovation

- 2.7.2 Emerging technologies

- 2.7.2.1 Smart materials and adaptive performance

- 2.7.2.2 AI and predictive maintenance integration

- 2.7.2.3 Sustainable material innovation and development

- 2.7.1 Current technological trends

- 2.8 Price trends

- 2.8.1 By region

- 2.8.2 By product

- 2.9 Production statistics

- 2.9.1 Production hubs

- 2.9.2 Consumption hubs

- 2.9.3 Export and import

- 2.10 Cost breakdown analysis

- 2.11 Patent analysis

- 2.12 Sustainability and environmental aspects

- 2.12.1 Sustainable practices

- 2.12.2 Waste reduction strategies

- 2.12.3 Energy efficiency in production

- 2.12.4 Eco-friendly initiatives

- 2.12.5 Carbon footprint considerations

- 2.12.6 Brake dust emission analysis and environmental impact

- 2.12.7 Environmental regulation compliance framework

- 2.12.8 Corporate sustainability and ESG performance

- 2.13 Brake performance analytics and testing intelligence

- 2.13.1 Real-world stopping distance database

- 2.13.2 Thermal performance and fade analysis

- 2.13.3 Friction coefficient consistency analytics

- 2.14 Noise, vibration, and harshness (NVH) intelligence

- 2.14.1 Brake noise analysis and mitigation

- 2.14.2 Vibration and judder performance

- 2.14.3 Harshness and comfort metrics

- 2.15 Health and environmental impact intelligence

- 2.15.1 Brake dust emission quantification

- 2.15.2 Occupational health and safety analysis

- 2.15.3 Environmental lifecycle assessment

Chapter 3 Competitive Landscape, 2024

- 3.1 Introduction

- 3.2 Company market share analysis

- 3.2.1 North America

- 3.2.2 Europe

- 3.2.3 Asia Pacific

- 3.2.4 LATAM

- 3.2.5 MEA

- 3.3 Competitive analysis of major market players

- 3.4 Competitive positioning matrix

- 3.5 Strategic outlook matrix

- 3.6 Key developments

- 3.6.1 Mergers & acquisitions

- 3.6.2 Partnerships & collaborations

- 3.6.3 New product launches

- 3.6.4 Expansion plans and funding

- 3.7 Manufacturing and supply chain analysis

- 3.7.1 Global manufacturing footprint and capacity analysis

- 3.7.2 Raw material supply chain and risk assessment

- 3.7.3 Manufacturing cost analysis and optimization

- 3.7.4 Supply chain resilience and risk management

- 3.8 Quality control and performance validation framework

- 3.8.1 Statistical process control (SPC) analytics

- 3.8.2 Performance testing and validation protocols

- 3.8.3 Failure mode and effects analysis (FMEA)

Chapter 4 Market Estimates & Forecast, By Product, 2021 - 2034 ($Mn, Units)

- 4.1 Key trends

- 4.2 Brake pads

- 4.3 Brake shoes

- 4.4 Brake linings

- 4.5 Brake drums

- 4.6 Brake rotors/discs

- 4.7 Others

Chapter 5 Market Estimates & Forecast, By Material, 2021 - 2034 ($Mn, Units)

- 5.1 Key trends

- 5.2 Metallic

- 5.3 Ceramic

- 5.4 Composite

- 5.5 Others

Chapter 6 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Mn, Units)

- 6.1 Key trends

- 6.2 Passenger cars

- 6.2.1 Sedan

- 6.2.2 SUVs

- 6.2.3 Hatchback

- 6.3 Commercial vehicles

- 6.3.1 Light commercial vehicles (LCVs)

- 6.3.2 Heavy commercial vehicles (HCVs)

- 6.3.3 Medium commercial vehicles (MCVs)

- 6.4 Two-wheelers

- 6.5 Off-highway vehicles

Chapter 7 Market Estimates & Forecast, By Sales Channel, 2021 - 2034 ($Mn, Units)

- 7.1 Key trends

- 7.2 Original equipment manufacturer (OEM)

- 7.3 Aftermarket

Chapter 8 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn, Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 US

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Nordics

- 8.3.7 Russia

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 ANZ

- 8.4.6 Southeast Asia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 MEA

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Global companies

- 9.1.1 Aisin Seiki Co.

- 9.1.2 Akebono Brake Industry Co.

- 9.1.3 Brembo

- 9.1.4 Continental

- 9.1.5 Federal-Mogul

- 9.1.6 Miba Friction Group

- 9.1.7 Robert Bosch

- 9.1.8 Tenneco

- 9.1.9 TMD Friction Holdings

- 9.1.10 ZF Friedrichshafen

- 9.2 Regional companies

- 9.2.1 Advics Co.

- 9.2.2 ATE

- 9.2.3 Delphi Technologies

- 9.2.4 EBC Brakes

- 9.2.5 Ferodo

- 9.2.6 Jurid

- 9.2.7 MAT Holdings

- 9.2.8 Nisshinbo Holdings

- 9.2.9 NRS Brakes

- 9.2.10 Sangsin Brake

- 9.2.11 Wagner Brake

- 9.3 Emerging players

- 9.3.1 AI-Powered Brake Analytics Startups

- 9.3.2 Drivezy

- 9.3.3 Brake Parts

- 9.3.4 Fras-le

- 9.3.5 Galfer Bike

- 9.3.6 Hardron Friction Material

- 9.3.7 SGL Carbon SE - Brake Disc Division

- 9.3.8 Xinyi Brake Pad Co.