|

市场调查报告书

商品编码

1833616

心律调节器市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Pacemakers Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

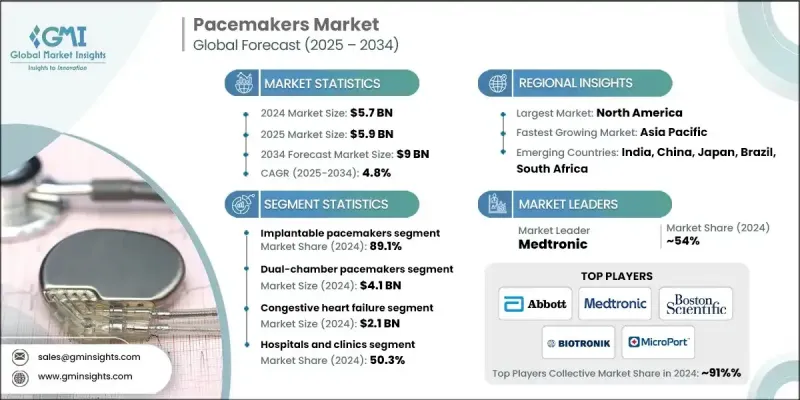

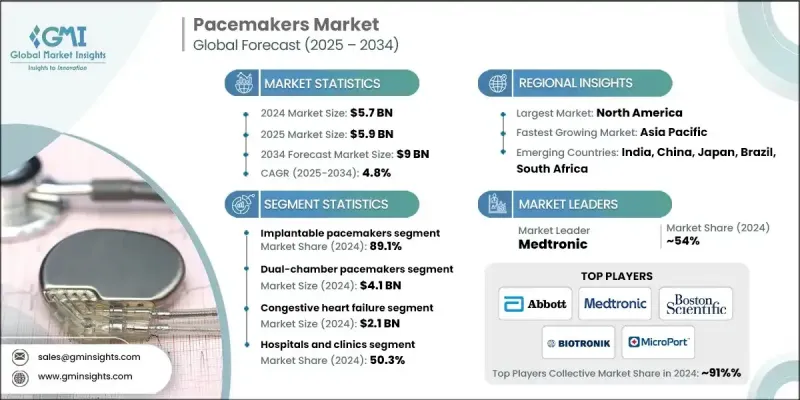

2024 年全球心律调节器市场价值为 57 亿美元,预计将以 4.8% 的复合年增长率成长,到 2034 年达到 90 亿美元。

这一强劲增长的动力源于心血管疾病发病率的上升、支持性报销政策以及人们对微创手术日益增长的偏好。心律调节器在管理心律不整方面发挥着至关重要的作用,它在心臟自然传导系统出现问题时发出电脉衝来调节心跳。美敦力、雅培和波士顿科学等行业领导者走在前列,凭藉先进的设计、更长的电池寿命和远端监控功能推动创新。相容于核磁共振成像(MRI)的起搏器越来越受欢迎,使患者能够在植入后安全地进行核磁共振成像——这对于诊断其他健康状况至关重要。此外,支援蓝牙和人工智慧的起搏器的推出正在改变心臟护理,它允许即时远端监控,将急诊就诊次数减少高达 30%,并允许临床医生根据患者活动和心律模式定制设备设定。电池技术的改进显着延长了起搏器的使用寿命,许多现代设备的使用寿命长达 20 年,最大限度地减少了频繁更换起搏器的需要。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 57亿美元 |

| 预测值 | 90亿美元 |

| 复合年增长率 | 4.8% |

2024年,植入式起搏器市场占据了89.1%的市场份额,因其在治疗心动过缓和心律不整等慢性心律不整方面已被证实的有效性而备受青睐。这些设备提供持续起搏,改善患者预后,并因其微创植入技术而被广泛采用。其可编程性使医疗保健提供者能够根据个别患者需求量身设置,确保最佳的心臟护理,尤其适用于老龄化人群和復发性心律不整患者。

双腔起搏器市场规模达41亿美元,预计2025-2034年期间的复合年增长率将达到5.2%,这得益于越来越多的房室传导阻滞患者受益于双腔起搏器。这些心律调节器在右心房和右心室分别放置两根导线,它们协同工作,模拟心房和心室收缩的自然时间。这种同步性可以改善血流和心输出量,从而更好地向身体组织和器官输送氧气。

2024年,北美起搏器市场占据50.9%的市场份额,这得益于主要市场参与者的加入、心血管设备需求的不断增长以及心臟病患病率的不断上升。心血管疾病导致的住院人数增加进一步刺激了对起搏器及相关监测设备的需求。该地区也受益于专注于提升起搏器技术的强劲研发活动,推动了市场的持续扩张。预计新公司的进入将在整个预测期内加速市场成长。

全球起搏器产业的知名公司包括波士顿科学、百多力、乐普医疗、MEDICO、美敦力、雅培、微创医疗、Oscor、Osypka Medical、Pacetronix 和 Vitatron。为了巩固市场地位,心律调节器产业的领先公司高度重视创新,开发电池寿命更长、成像技术相容性更强、远端监控功能更强大的设备。许多公司正在投资人工智慧和蓝牙技术,以提供即时资料传输和个人化患者护理。扩大地域覆盖,尤其是新兴市场,是另一个关键策略,并辅以与医疗服务提供者的合作和政府专案的支持。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 心血管疾病盛行率不断上升

- 优惠的报销政策

- 技术进步

- 微创手术的采用率不断上升

- 产业陷阱与挑战

- 心律调节器装置和植入费用高昂

- 严格的监管审批

- 市场机会

- MRI相容起搏器的需求不断增长

- 远端监控和远端心臟病学解决方案的集成

- 成长动力

- 成长潜力分析

- 监管格局

- 技术格局

- 现有技术

- 新兴技术

- 未来市场趋势

- 报销场景

- 品牌分析

- 管道分析

- 投资前景

- 启动场景

- 2021-2024 年各地区起搏器数量

- 2024年定价分析

- 波特的分析

- PESTEL分析

- 差距分析

第四章:竞争格局

- 介绍

- 公司矩阵分析

- 公司市占率分析

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲和中东地区

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:按产品,2021 - 2034 年

- 主要趋势

- 植入式心律调节器

- 体外心律调节器

第六章:市场估计与预测:按技术,2021 - 2034 年

- 主要趋势

- 单腔起搏器

- 单腔心室

- 单腔心房

- 双腔起搏器

- 双心室/CRT起搏器

第七章:市场估计与预测:按应用,2021 - 2034

- 主要趋势

- 充血性心臟衰竭

- 心搏过缓

- 心律不整

- 心跳过速

- 其他应用

第八章:市场估计与预测:依最终用途,2021 - 2034 年

- 主要趋势

- 医院和诊所

- 心臟护理中心

- 门诊手术中心

- 其他最终用途

第九章:市场估计与预测:按地区,2021 - 2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十章:公司简介

- Abbott

- BIOTRONIK

- Boston Scientific

- Lepu Medical

- MEDICO

- Medtronic

- MicroPort

- Oscor

- Osypka Medical

- Pacetronix

- Vitatron

The Global Pacemakers Market was valued at USD 5.7 billion in 2024 and is estimated to grow at a CAGR of 4.8% to reach USD 9 billion by 2034.

This robust growth is driven by the rising incidence of cardiovascular diseases, supportive reimbursement policies, and the increasing preference for minimally invasive procedures. Pacemakers play a vital role in managing heart rhythm disorders by delivering electrical impulses that regulate the heartbeat when the heart's natural conduction system falters. Industry leaders such as Medtronic, Abbott, and Boston Scientific are at the forefront, pushing innovation with advanced designs, extended battery life, and remote monitoring capabilities. MRI-compatible pacemakers have become increasingly popular, enabling patients to safely undergo magnetic resonance imaging after implantation-a crucial development for diagnosing other health conditions. Moreover, the introduction of Bluetooth-enabled and AI-powered pacemakers is transforming cardiac care by allowing real-time remote monitoring, reducing emergency hospital visits by up to 30%, and letting clinicians customize device settings based on patient activity and heart rhythm patterns. The battery technology improvements have significantly extended pacemaker longevity, with many modern devices lasting up to 20 years, minimizing the need for frequent replacements.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $5.7 Billion |

| Forecast Value | $9 Billion |

| CAGR | 4.8% |

The implantable pacemakers segment held 89.1% share in 2024, favored for their proven effectiveness in treating chronic heart rhythm conditions such as bradycardia and arrhythmias. These devices offer continuous pacing, enhanced patient outcomes, and are widely adopted due to minimally invasive implantation techniques. Their programmability allows healthcare providers to tailor settings to individual patient needs, ensuring optimal cardiac care, especially for aging populations and those with recurrent rhythm issues.

The dual-chamber pacemakers segment generated USD 4.1 billion and is expected to grow at a CAGR of 5.2% during 2025-2034, attributed to the increasing number of patients suffering from atrioventricular block who benefit from dual-chamber devices. These pacemakers have two leads positioned in the right atrium and right ventricle, which work together to replicate the natural timing of atrial and ventricular contractions. This synchronization improves blood flow and cardiac output, leading to better oxygen delivery to the body's tissues and organs.

North America Pacemakers Market held 50.9% share in 2024, driven by the presence of key market players, rising demand for cardiovascular devices, and a growing prevalence of heart conditions. Increased hospital admissions due to cardiovascular issues further boost the demand for pacemakers and related monitoring devices. The region also benefits from strong R&D activities focused on enhancing pacemaker technologies, fueling continued market expansion. The entry of new companies into the market is expected to accelerate growth throughout the forecast period.

Prominent companies in the Global Pacemakers Industry include Boston Scientific, BIOTRONIK, Lepu Medical, MEDICO, Medtronic, Abbott, MicroPort, Oscor, Osypka Medical, Pacetronix, and Vitatron. To strengthen their market position, leading companies in the pacemakers sector focus heavily on innovation, developing devices with longer battery lives, improved compatibility with imaging technologies, and enhanced remote monitoring capabilities. Many firms are investing in AI and Bluetooth technologies to offer real-time data transmission and personalized patient care. Expanding geographic presence, especially into emerging markets, is another key strategy, supported by partnerships with healthcare providers and government programs.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Product trends

- 2.2.3 Technology trends

- 2.2.4 Application trends

- 2.2.5 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of cardiovascular diseases

- 3.2.1.2 Favorable reimbursement policies

- 3.2.1.3 Technological advancements

- 3.2.1.4 Rising adoption of minimally invasive procedures

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of pacemaker devices and implantation

- 3.2.2.2 Stringent regulatory approvals

- 3.2.3 Market opportunities

- 3.2.3.1 Rising demand for MRI-compatible pacemakers

- 3.2.3.2 Integration of remote monitoring and telecardiology solutions

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technological landscape

- 3.5.1 Current technologies

- 3.5.2 Emerging technologies

- 3.6 Future market trends

- 3.7 Reimbursement scenario

- 3.8 Brand analysis

- 3.9 Pipeline analysis

- 3.10 Investment landscape

- 3.11 Start-up scenario

- 3.12 Number of pacemaker units, by region, 2021-2024

- 3.12.1 North America

- 3.12.2 Europe

- 3.12.3 Asia Pacific

- 3.12.4 Latin America

- 3.12.5 MEA

- 3.13 Pricing analysis, 2024

- 3.14 Porter's analysis

- 3.15 PESTEL analysis

- 3.16 Gap analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.3.1 North America

- 4.3.2 Europe

- 4.3.3 Asia Pacific

- 4.3.4 LAMEA

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Implantable pacemakers

- 5.3 External pacemakers

Chapter 6 Market Estimates and Forecast, By Technology, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Single-chamber pacemakers

- 6.2.1 Single-chamber ventricular

- 6.2.2 Single-chamber atrial

- 6.3 Dual-chamber pacemakers

- 6.4 Biventricular/CRT pacemakers

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Congestive heart failure

- 7.3 Bradycardia

- 7.4 Arrhythmias

- 7.5 Tachycardia

- 7.6 Other applications

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospitals and clinics

- 8.3 Cardiac care centers

- 8.4 Ambulatory surgical centers

- 8.5 Other end use

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Abbott

- 10.2 BIOTRONIK

- 10.3 Boston Scientific

- 10.4 Lepu Medical

- 10.5 MEDICO

- 10.6 Medtronic

- 10.7 MicroPort

- 10.8 Oscor

- 10.9 Osypka Medical

- 10.10 Pacetronix

- 10.11 Vitatron