|

市场调查报告书

商品编码

1833620

电动工具市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Power Tools Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

2024 年全球电动工具市场价值为 698 亿美元,预计将以 4.3% 的复合年增长率成长,到 2034 年达到 1,081 亿美元。

在城镇化、人口成长以及政府加大基础建设投资的推动下,全球建筑业正稳步扩张。从大型公共交通系统和道路,到高层建筑和工业园区,建筑活动正在蓬勃发展,尤其是在亚太地区、拉丁美洲和中东地区的新兴经济体。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 698亿美元 |

| 预测值 | 1081亿美元 |

| 复合年增长率 | 4.3% |

电动有线工具的普及率不断上升

2024年,有线电动工具凭藉其可靠性、稳定的功率输出以及对重型任务的适应性,占据了显着的市场份额。儘管无线工具发展迅速,但有线工具仍然是在固定场所工作的专业人士的首选,因为在这些场所,不间断的表现至关重要。该领域的製造商正在提升产品的人体工学、安全性能和能源效率,以保持竞争力,同时满足不断变化的最终用户期望。

建筑业需求不断成长

受持续城镇化、大规模基础设施建设和住宅需求的推动,建筑业在2024年将占据显着份额。锯、钻、磨机和钉枪等电动工具对于商业和住宅项目的框架搭建、安装和装修工作至关重要。主要参与者瞄准这一领域,推出了坚固耐用、性能卓越、防尘性能更强、电池续航时间和工具连接性更强的工具,从而提高施工现场的生产力和工人安全。

钻孔和紧固以获得牵引力

2024年,钻孔和紧固工具市场占据了相当大的份额。其应用范围从基本的房屋维修到复杂的装配线和基础设施安装。精密工程、更轻巧的外形尺寸以及无刷马达整合推动了市场的成长。领先的公司专注于开发能够处理各种表面和材料的多功能工具,并添加扭矩控制和数位监控等智慧功能,以提高用户的准确性和控制力。

亚太地区将崛起成为推动力地区

2024年,亚太地区电动工具市场收入可观,这得益于快速的工业化进程、蓬勃发展的建筑业以及中国、印度和东南亚等国家不断增长的消费支出。本地和全球製造商正在该地区扩大生产设施,建立更强大的分销网络,并推出符合当地需求的经济实惠的产品线。积极的定价策略、在地化的品牌建立和售后支援也有助于品牌建立长期的市场影响力。

电动工具市场的主要参与者有 Chervon Trading、Ingersoll-Rand、Festool、Makita、Emerson Electric、Hilti、Apex Tool Group、Bosch、Hikoki(原 Hitachi Koki)、Snap-on、Enerpac Tool Group、Andreas Stihl、Atlas Copco、Techtronic Industries (Toki) 和 Stantronley 和 Stantronley (Toki) 和 Stantronic (Toki)。

为了巩固市场地位,电动工具领域的公司正在利用创新、策略合作伙伴关係和以客户为中心的产品开发。无线技术是一大重点,各大品牌大力投资电池效率、快速充电系统以及适用于多种工具的通用电池平台。许多品牌还采用了应用程式整合、使用情况追踪和物联网等智慧功能,以在竞争激烈的市场中脱颖而出。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 利润率

- 每个阶段的增值

- 影响价值链的因素

- 产业衝击力

- 成长动力

- 建筑和基础设施活动不断增加

- 快速工业化

- DIY 和家居装修的成长

- 技术进步

- 产业陷阱与挑战

- 仿冒品

- 激烈的竞争和价格压力

- 成长动力

- 成长潜力分析

- 未来市场趋势

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 按工具类型

- 监管格局

- 标准和合规性要求

- 区域监理框架

- 认证标准

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:按模式,2021 - 2034

- 主要趋势

- 电动有线

- 电动无线

- 气动

第六章:市场估计与预测:按工具类型,2021 - 2034 年

- 主要趋势

- 钻孔和紧固

- 锯切和切割工具

- 拆除

- 材料去除

- 扳手

- 其他的

第七章:市场估计与预测:按应用,2021 - 2034

- 主要趋势

- 建造

- 汽车

- 航太

- 活力

- 电子产品

- DIY

- 其他的

第 8 章:市场估计与预测:按配销通路,2021 年至 2034 年

- 主要趋势

- 直接的

- 间接

第九章:市场估计与预测:按地区,2021 - 2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 印尼

- 马来西亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 多边环境协定

- 沙乌地阿拉伯

- 阿联酋

- 南非

第十章:公司简介

- Andreas Stihl

- Apex Tool Group

- Atlas Copco

- Chervon Trading

- Emerson Electric

- Enerpac Tool Group

- Hilti

- Hikoki (formerly Hitachi Koki)

- Ingersoll-Rand

- Makita

- Bosch

- Snap-on

- Stanley Black & Decker

- Techtronic Industries (TTI)

- Festool

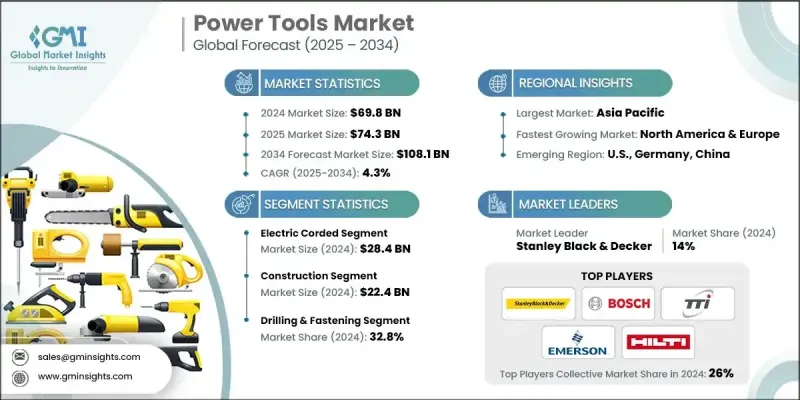

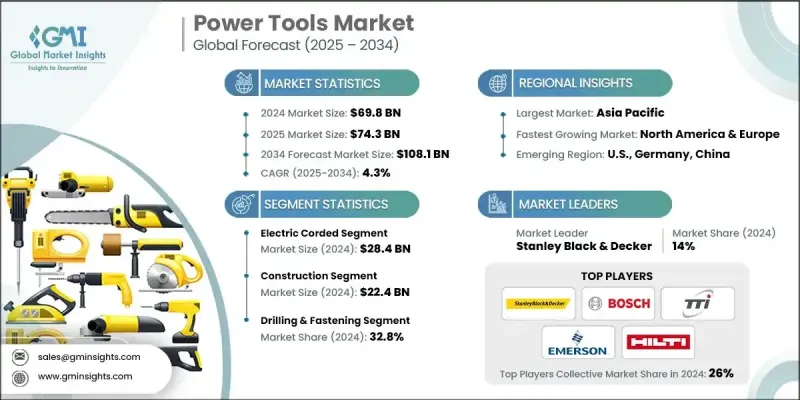

The Global Power Tools Market was valued at USD 69.8 billion in 2024 and is estimated to grow at a CAGR of 4.3% to reach USD 108.1 billion by 2034.

The global construction sector is witnessing steady expansion, fueled by urbanization, population growth, and increasing government investments in infrastructure development. From large-scale public transit systems and roadways to high-rise buildings and industrial zones, construction activity is surging, particularly in emerging economies across Asia Pacific, Latin America, and the Middle East.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $69.8 Billion |

| Forecast Value | $108.1 Billion |

| CAGR | 4.3% |

Rising Adoption of Electric Corded Tools

The electric corded segment held a notable share in 2024 owing to its reliability, consistent power output, and suitability for heavy-duty tasks. While cordless tools are growing rapidly, corded tools remain a preferred choice for professionals working in fixed locations where uninterrupted performance is critical. Manufacturers in this space are enhancing product ergonomics, safety features, and energy efficiency to remain competitive while addressing evolving end-user expectations.

Increasing Demand in Construction

The construction segment generated a significant share in 2024, driven by ongoing urbanization, large-scale infrastructure development, and residential housing demand. Power tools such as saws, drills, grinders, and nailers are essential for framing, installation, and finishing work across both commercial and residential projects. Key players are targeting this sector by introducing rugged, high-performance tools with improved dust protection, battery runtime, and tool connectivity-allowing for better job site productivity and worker safety.

Drilling and Fastening to Gain Traction

The drilling and fastening tools segment held a sizeable share in 2024. Applications range from basic home repairs to complex assembly lines and infrastructure installations. Market growth is driven by precision engineering, lighter form factors, and brushless motor integration. Leading companies are focusing on multi-functional tools that can handle diverse surfaces and materials, as well as adding smart features like torque control and digital monitoring to improve user accuracy and control.

Asia Pacific to Emerge as a Propelling Region

Asia Pacific power tools market generated substantial revenues in 2024, fueled by rapid industrialization, booming construction sectors, and increasing consumer spending in countries like China, India, and Southeast Asia. Local and global manufacturers are expanding production facilities in the region, establishing stronger distributor networks, and launching budget-friendly product lines tailored to local needs. Aggressive pricing strategies, localized branding, and after-sales support are also helping brands build long-term market presence.

Major players in the power tools market are Chervon Trading, Ingersoll-Rand, Festool, Makita, Emerson Electric, Hilti, Apex Tool Group, Bosch, Hikoki (formerly Hitachi Koki), Snap-on, Enerpac Tool Group, Andreas Stihl, Atlas Copco, Techtronic Industries (TTI), and Stanley Black & Decker.

To strengthen their market position, companies in the power tools space are leveraging innovation, strategic partnerships, and customer-centric product development. A major focus is on cordless technology, with brands investing heavily in battery efficiency, quick-charging systems, and universal battery platforms across multiple tools. Many are also adopting smart features such as app integration, usage tracking, and IoT capabilities to differentiate in a crowded marketplace.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Mode

- 2.2.3 Tool type

- 2.2.4 Application

- 2.2.5 Distribution Channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising construction and infrastructure activities

- 3.2.1.2 Rapid industrialization

- 3.2.1.3 Growth in DIY and home improvement

- 3.2.1.4 Technological advancements

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Counterfeit and low-quality products

- 3.2.2.2 Intense competition and price pressure

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By tool type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By Region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.1 By Region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Mode, 2021 - 2034, (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Electric corded

- 5.3 Electric cordless

- 5.4 Pneumatic

Chapter 6 Market Estimates & Forecast, By Tool type, 2021 - 2034, (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Drilling & fastening

- 6.3 Sawing & cutting tools

- 6.4 Demolition

- 6.5 Material removal

- 6.6 Wrenches

- 6.7 Others

Chapter 7 Market Estimates & Forecast, By Application, 2021 - 2034, (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Construction

- 7.3 Automotive

- 7.4 Aerospace

- 7.5 Energy

- 7.6 Electronics

- 7.7 DIY

- 7.8 Others

Chapter 8 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034, (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Direct

- 8.3 Indirect

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034, (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.4.6 Indonesia

- 9.4.7 Malaysia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 Saudi Arabia

- 9.6.2 UAE

- 9.6.3 South Africa

Chapter 10 Company Profiles

- 10.1 Andreas Stihl

- 10.2 Apex Tool Group

- 10.3 Atlas Copco

- 10.4 Chervon Trading

- 10.5 Emerson Electric

- 10.6 Enerpac Tool Group

- 10.7 Hilti

- 10.8 Hikoki (formerly Hitachi Koki)

- 10.9 Ingersoll-Rand

- 10.10 Makita

- 10.11 Bosch

- 10.12 Snap-on

- 10.13 Stanley Black & Decker

- 10.14 Techtronic Industries (TTI)

- 10.15 Festool