|

市场调查报告书

商品编码

1833629

汽车驾驶舱域控制器市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Automotive Cockpit Domain Controller Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

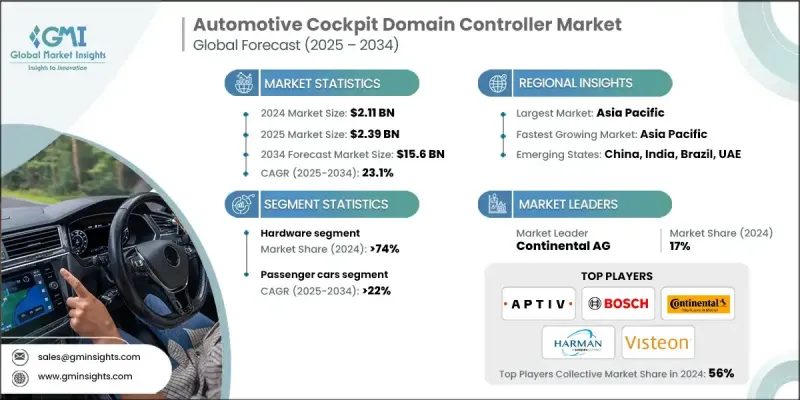

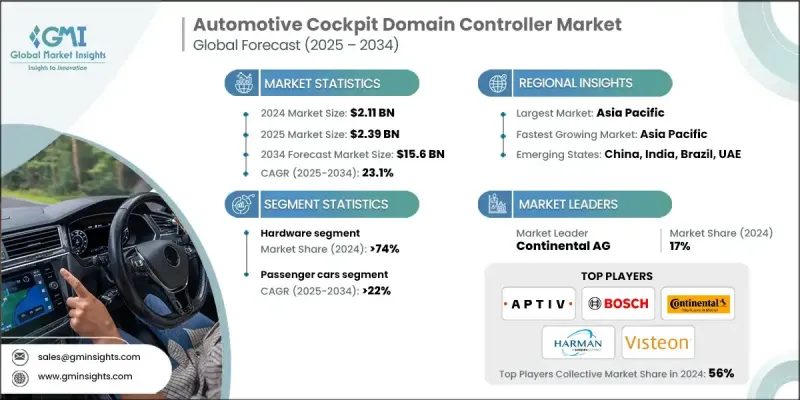

根据 Global Market Insights Inc. 发布的最新报告,2024 年全球汽车座舱控制器市场规模估计为 21.1 亿美元,预计将从 2025 年的 23.9 亿美元增长到 2034 年的 156 亿美元,复合年增长率为 23.1%。

汽车製造商正在从多个独立的ECU转向集中式驾驶舱域控制器,从而简化软体架构并降低复杂性。这种整合不仅减少了布线和重量,还简化了资讯娱乐、仪表板和空调系统的更新和诊断。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 21.1亿美元 |

| 预测值 | 156亿美元 |

| 复合年增长率 | 23.1% |

硬体采用率不断上升

2024年,汽车座舱域控制器市场的硬体部分占据了相当大的份额,这得益于专注于提供强大且节能的处理器的创新,这些处理器能够同时管理复杂的资讯娱乐、互联和安全功能。该部分透过将先进的SoC、GPU和高速通讯介面整合到紧凑、散热优化的模组中,以适应汽车级环境,从而推动成长。随着对即时处理和多任务处理能力的需求不断增长,硬体供应商优先考虑模组化设计和可扩展架构,以满足多样化的车辆需求,确保下一代智慧座舱的可靠性和性能。

乘用车将获得发展动力

2024年,乘用车市场收入可观,这得益于消费者对增强用户体验、互联互通和安全性的期望不断提升。原始设备製造商正大力投资整合式智慧座舱,透过语音识别、多萤幕显示设定和人工智慧助理提供无缝交互,所有这些都由强大的网域控制器进行协调。这反映出一个明显的趋势:更聪明、更互联的内装将重新定义驾驶体验。

亚太地区将成为利润丰厚的地区

亚太地区是汽车座舱控制器市场的主要成长引擎,其驱动力来自快速的城市化进程、汽车产量的不断增长以及消费者对先进车载技术日益增长的需求。在政府推动电动车和数位转型的倡议的支持下,中国、日本、韩国和印度等国家正在大力投资智慧汽车技术。市场成长的动力源于本地製造能力以及全球供应商与区域汽车製造商之间的紧密合作,这些合作旨在满足日益增长的互联智慧座舱解决方案需求。

汽车座舱控制器市场的主要参与者有伟世通、NVIDIA、罗伯特·博世、高通技术、Aptiv、HARMAN、Denso、英特尔、佛吉亚和大陆集团。

为了巩固市场地位,汽车座舱域控制器领域的企业正专注于多项策略措施。这些措施包括投资研发,开发整合人工智慧、扩增实境和5G连接等新兴技术的可扩展高效能平台。许多企业正在与原始设备製造商(OEM)和软体开发商建立合作伙伴关係或合资企业,共同打造针对特定车型和地区的客製化解决方案。此外,扩大区域製造业务,尤其是在亚太地区,可以加快交货速度并提升成本优势。企业也强调网路安全功能和无线更新功能,以满足不断变化的安全标准和消费者期望,从而在这个竞争激烈、快速发展的市场中站稳脚跟。

目录

第一章:方法论

- 市场范围和定义

- 研究设计

- 研究方法

- 资料收集方法

- 资料探勘来源

- 全球的

- 地区/国家

- 基础估算与计算

- 基准年计算

- 市场评估的主要趋势

- 初步研究和验证

- 主要来源

- 预测模型

- 研究假设和局限性

第 2 章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 利润率分析

- 成本结构

- 每个阶段的增值

- 影响价值链的因素

- 中断

- 产业衝击力

- 成长动力

- 对连网和软体定义汽车的需求不断增长

- 向集中式电子电气车辆架构过渡

- 消费者对高级资讯娱乐和数位驾驶舱体验的需求不断增长

- 电动车和自动驾驶汽车的成长

- OEM一级厂商与半导体和软体厂商的合作

- 产业陷阱与挑战

- 高整合和软体验证成本

- 网路安全与资料隐私风险

- 市场机会

- 扩展云端与 OTA 更新生态系统

- 新兴市场(亚太地区、拉丁美洲地区、中东和非洲地区)渗透率不断提高

- 先进的 HMI 和多模式互动系统

- 与行动服务和车队应用程式集成

- 成长动力

- 成长潜力分析

- 监管和标准格局

- 全球监理框架分析

- 功能安全标准及实施

- 区域监管差异和合规性

- 合规成本分析及实施策略

- 波特的分析

- PESTEL分析

- 技术与创新格局

- 当前的技术趋势

- 硬体技术成熟度

- 软体平台准备就绪

- 整合复杂性评估

- 未来技术路线图

- 硬体发展时程和里程碑

- 软体平台发展路线图

- 新兴技术整合计划

- 标准演进和行业影响

- AUTOSAR自适应平台演进

- ISO 26262更新与安全影响

- 网路安全标准路线图

- 3.6.1 区域

- 当前的技术趋势

- 成本结构分析与商业案例框架

- 总拥有成本(TCO)分析

- ROI 模型与报酬分析

- 定价策略分析和基准测试

- 各细分市场的投资需求

- 专利分析

- 永续性和ESG影响评估

- 环境影响分析和指标

- 社会影响考量与指标

- 治理与合规框架

- ESG 投资影响与财务影响

- 用例和应用

- 最佳情况

- 供应链情报与风险评估

- 全球供应链映射与分析

- 半导体供应链深度探究

- 地缘政治风险评估

- 供应链弹性与优化策略

- 智慧财产权和专利状况

- 专利申请趋势与创新分析

- 主要专利持有者及智慧财产权策略分析

- IP货币化机会和策略

- 自由营运和知识产权风险管理

- 市场进入策略框架

- 市场进入策略分析

- 客户区隔与目标策略

- 通路策略与合作伙伴生态系统

- 行销和销售效率

第四章:竞争格局

- 介绍

- 公司市占率分析

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 多边环境协定

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 战略展望矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划和资金

第五章:市场估计与预测:依组件划分,2021 - 2034 年

- 主要趋势

- 硬体

- 系统

- 模组

- 记忆

- 连接性

- 模组

- 显示介面

- 网路摄影机和感测器

- 其他(电源管理IC、HUD)

- 系统

- 软体

- 服务

第六章:市场估计与预测:依车型,2021 - 2034

- 主要趋势

- 搭乘用车

- 掀背车

- 轿车

- SUV

- 商用车

- 轻型商用车

- 中型商用车

- 重型商用车

第七章:市场估计与预测:依技术分类,2021 - 2034 年

- 主要趋势

- 集中式架构

- 分散式架构

- 区域架构

- 混合架构

第 8 章:市场估计与预测:按销售管道,2021 年至 2034 年

- 主要趋势

- 原始设备製造商(OEM)管道

- 售后频道

第九章:市场估计与预测:按应用,2021 - 2034

- 主要趋势

- 资讯娱乐系统

- 数位仪表板

- 人机介面(hmi)

- 平视显示器 (hud) 集成

- 驾驶员监控系统

- 气候控制与舒适系统

- 高级应用程式和新兴用例

第 10 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 北欧人

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 东南亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 多边环境协定

- 南非

- 沙乌地阿拉伯

- 阿联酋

第 11 章:公司简介

- 全球参与者

- Aptiv

- Continental

- Denso

- HARMAN International Industries

- Intel

- NVIDIA

- Qualcomm Technologies

- Robert Bosch

- STMicroelectronics

- Texas Instruments

- Visteon

- Valeo

- 区域参与者

- Alpine Electronics

- Faurecia

- Hyundai Mobis

- Infineon Technologies

- LG Electronics

- Magna International

- NXP Semiconductors

- Panasonic

- Sony

- 新兴参与者/颠覆者

- Analog Devices

- Black Sesame Technologies

- BYD Company

- ECARX Holdings

- Horizon Robotics

- Huawei Technologies

- MediaTek

- Renesas Electronics

- Tesla

The global automotive cockpit domain controller market was estimated at USD 2.11 billion in 2024 and is expected to grow from USD 2.39 billion in 2025 to USD 15.6 billion by 2034, at a CAGR of 23.1%, according to the latest report published by Global Market Insights Inc.

Automakers are shifting from multiple standalone ECUs to centralized cockpit domain controllers, streamlining software architecture and reducing complexity. This consolidation not only cuts down on wiring and weight but also simplifies updates and diagnostics across infotainment, instrument clusters, and climate systems.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.11 Billion |

| Forecast Value | $15.6 Billion |

| CAGR | 23.1% |

Rising Adoption in Hardware

The hardware segment from the automotive cockpit domain controller market held a significant share in 2024, driven by innovation focusing on delivering powerful and energy-efficient processors capable of managing complex infotainment, connectivity, and safety features simultaneously. This segment drives growth by integrating advanced SoCs, GPUs, and high-speed communication interfaces into compact, thermally optimized modules designed to withstand automotive-grade conditions. With increasing demand for real-time processing and multitasking capabilities, hardware suppliers are prioritizing modular designs and scalable architectures to meet diverse vehicle requirements, ensuring reliability and performance in next-generation smart cockpits.

Passenger Cars to Gain Traction

The passenger cars segment generated notable revenues in 2024, fueled by rising consumer expectations for enhanced user experiences, connectivity, and safety. OEMs are investing heavily in integrating smart cockpits that offer seamless interaction through voice recognition, multi-display setups, and AI-powered assistants, all orchestrated by robust domain controllers. This reflects a clear trend toward smarter, more connected interiors that redefine the driving experience.

Asia Pacific to Emerge as a Lucrative Region

Asia Pacific stands as a key growth engine in the automotive cockpit domain controller market, driven by rapid urbanization, increasing vehicle production, and expanding consumer demand for advanced in-car technologies. Countries like China, Japan, South Korea, and India are investing heavily in smart vehicle technologies, supported by government initiatives promoting electric mobility and digital transformation. The market growth is propelled by local manufacturing capabilities and strong collaborations between global suppliers and regional automakers seeking to capture the rising demand for connected, intelligent cockpit solutions.

Major players in the automotive cockpit domain controller market are Visteon, NVIDIA, Robert Bosch, Qualcomm Technologies, Aptiv, HARMAN, Denso, Intel, Faurecia, and Continental.

To strengthen their market position, companies in the automotive cockpit domain controller space are focusing on several strategic initiatives. These include investing in R&D to develop scalable, high-performance platforms integrate emerging technologies such as AI, AR, and 5G connectivity. Many firms are forging partnerships and joint ventures with OEMs and software developers to co-create customized solutions tailored to specific vehicle models and regions. Additionally, expanding regional manufacturing footprints, particularly in the Asia Pacific, enables faster delivery and cost advantages. Companies also emphasize cybersecurity features and over-the-air update capabilities to meet evolving safety standards and consumer expectations, securing their foothold in this competitive and rapidly evolving market.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Component

- 2.2.3 Vehicle

- 2.2.4 Technology

- 2.2.5 Sales channel

- 2.2.6 Application

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for connected and software-defined vehicles

- 3.2.1.2 Transition toward centralized e/e vehicle architecture

- 3.2.1.3 Increasing consumer demand for advanced infotainment & digital cockpit experiences

- 3.2.1.4 Growth of EVs and autonomous vehicles

- 3.2.1.5 OEM-tier 1 collaborations with semiconductor & software players

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High integration & software validation costs

- 3.2.2.2 Cybersecurity and data privacy risks

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion of cloud-enabled and OTA update ecosystems

- 3.2.3.2 Growing penetration in emerging markets (APAC, LATAM, MEA)

- 3.2.3.3 Advanced HMI & multimodal interaction systems

- 3.2.3.4 Integration with mobility services and fleet applications

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory and standards landscape

- 3.4.1 Global regulatory framework analysis

- 3.4.2 Functional safety standards and implementation

- 3.4.3 Regional regulatory variations and compliance

- 3.4.4 Compliance cost analysis and implementation strategy

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology & innovation landscape

- 3.7.1 Current technological trends

- 3.7.1.1 Hardware technology maturity

- 3.7.1.2 Software platform readiness

- 3.7.1.3 Integration complexity assessment

- 3.7.2 Future technology roadmap

- 3.7.2.1 Hardware evolution timeline and milestones

- 3.7.2.2 Software platform development roadmap

- 3.7.2.3 Emerging technology integration schedule

- 3.7.3 Standards evolution and industry impact

- 3.7.3.1 Autosar adaptive platform evolution

- 3.7.3.2 Iso 26262 updates and safety implications

- 3.7.3.3 Cybersecurity standards roadmap

- 3.7.1 Current technological trends

- 3.8 Cost structure analysis and business case framework

- 3.8.1 Total cost of ownership (TCO) analysis

- 3.8.2 ROI models and payback analysis

- 3.8.3 Pricing strategy analysis and benchmarking

- 3.8.4 Investment requirements by market segment

- 3.9 Patent analysis

- 3.10 Sustainability and esg impact assessment

- 3.10.1 Environmental impact analysis and metrics

- 3.10.2 Social impact considerations and metrics

- 3.10.3 Governance and compliance framework

- 3.10.4 Esg investment implications and financial impact

- 3.11 Use cases and applications

- 3.12 Best-case scenario

- 3.13 Supply chain intelligence and risk assessment

- 3.13.1 Global supply chain mapping and analysis

- 3.13.2 Semiconductor supply chain deep dive

- 3.13.3 Geopolitical risk assessment

- 3.13.4 Supply chain resilience and optimization strategies

- 3.14 Intellectual property and patent landscape

- 3.14.1 Patent filing trends and innovation analysis

- 3.14.2 Key patent holders and ip strategy analysis

- 3.14.3 Ip monetization opportunities and strategies

- 3.14.4 Freedom to operate and ip risk management

- 3.15 Go-to-market strategy framework

- 3.15.1 Market entry strategy analysis

- 3.15.2 Customer segmentation and targeting strategy

- 3.15.3 Channel strategy and partner ecosystem

- 3.15.4 Marketing and sales effectiveness

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 ($Mn)

- 5.1 Key trends

- 5.2 Hardware

- 5.2.1 System on chip

- 5.2.1.1 Modules

- 5.2.1.1.1 Memory

- 5.2.1.1.2 Connectivity

- 5.2.1.1 Modules

- 5.2.2 Display interfaces

- 5.2.3 Camera & sensors

- 5.2.4 Others (power management IC, HUD)

- 5.2.1 System on chip

- 5.3 Software

- 5.4 Services

Chapter 6 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Mn)

- 6.1 Key trends

- 6.2 Passenger cars

- 6.2.1 Hatchback

- 6.2.2 Sedan

- 6.2.3 SUV

- 6.3 Commercial vehicles

- 6.3.1 Light commercial vehicles

- 6.3.2 Medium commercial vehicles

- 6.3.3 Heavy commercial vehicles

Chapter 7 Market Estimates & Forecast, By Technology, 2021 - 2034 ($Mn)

- 7.1 Key trends

- 7.2 Centralized architecture

- 7.3 Distributed architecture

- 7.4 Zonal architecture

- 7.5 Hybrid architecture

Chapter 8 Market Estimates & Forecast, By Sales Channel, 2021 - 2034 ($Mn)

- 8.1 Key trends

- 8.2 Original equipment manufacturer (oem) channel

- 8.3 Aftermarket channel

Chapter 9 Market Estimates & Forecast, By Application, 2021 - 2034 ($Mn)

- 9.1 Key trends

- 9.2 Infotainment systems

- 9.3 Digital instrument cluster

- 9.4 Human machine interface (hmi)

- 9.5 Head-up display (hud) integration

- 9.6 Driver monitoring systems

- 9.7 Climate control and comfort systems

- 9.8 Advanced applications and emerging use cases

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 US

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Nordics

- 10.3.7 Russia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Southeast Asia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Global Players

- 11.1.1 Aptiv

- 11.1.2 Continental

- 11.1.3 Denso

- 11.1.4 HARMAN International Industries

- 11.1.5 Intel

- 11.1.6 NVIDIA

- 11.1.7 Qualcomm Technologies

- 11.1.8 Robert Bosch

- 11.1.9 STMicroelectronics

- 11.1.10 Texas Instruments

- 11.1.11 Visteon

- 11.1.12 Valeo

- 11.2 Regional Players

- 11.2.1 Alpine Electronics

- 11.2.2 Faurecia

- 11.2.3 Hyundai Mobis

- 11.2.4 Infineon Technologies

- 11.2.5 LG Electronics

- 11.2.6 Magna International

- 11.2.7 NXP Semiconductors

- 11.2.8 Panasonic

- 11.2.9 Sony

- 11.3 Emerging Players/Disruptors

- 11.3.1 Analog Devices

- 11.3.2 Black Sesame Technologies

- 11.3.3 BYD Company

- 11.3.4 ECARX Holdings

- 11.3.5 Horizon Robotics

- 11.3.6 Huawei Technologies

- 11.3.7 MediaTek

- 11.3.8 Renesas Electronics

- 11.3.9 Tesla