|

市场调查报告书

商品编码

1833631

咖啡机市场机会、成长动力、产业趋势分析及2025-2034年预测Coffee Machines Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

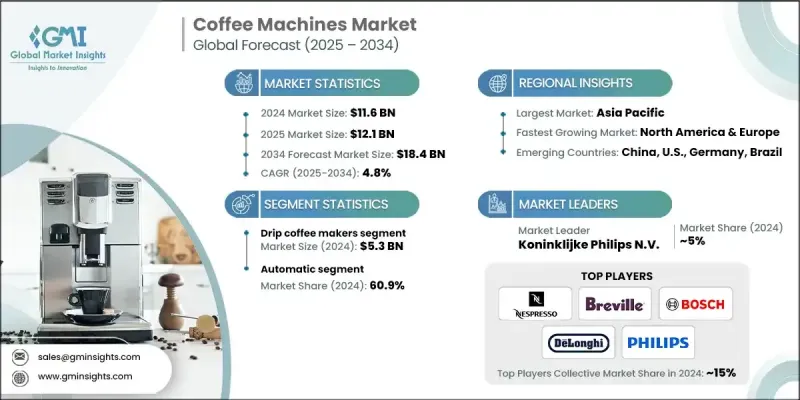

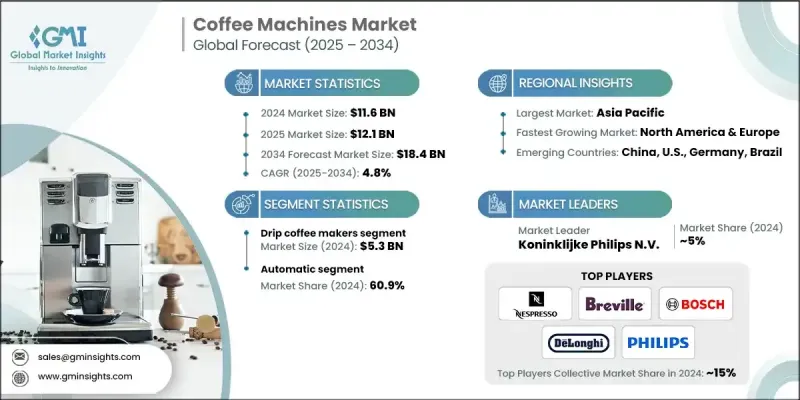

2024 年全球咖啡机市场价值为 116 亿美元,预计到 2034 年将以 4.8% 的复合年增长率增长至 184 亿美元。

这一增长与不断变化的生活方式偏好、咖啡文化的日益普及以及咖啡消费已成为许多消费者的日常习惯密切相关。都会生活和现代美学推动住宅领域占据市场主导地位,约占总销售额的70%。如今的消费者不仅追求高功能性,也注重设计,这使得咖啡机成为家居装饰的核心部分。同时,智慧厨房电器的普及正在彻底改变使用者与咖啡机的互动方式。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 116亿美元 |

| 预测值 | 184亿美元 |

| 复合年增长率 | 4.8% |

整合Wi-Fi、行动应用程式和语音助理的科技型咖啡机正日益受到青睐。这些机器配备了牛奶起泡、自动研磨和个人化冲泡设定等功能,以满足日益增长的便利性和客製化需求。随着消费者追求在家中就能享用咖啡馆级的咖啡,从咖啡豆到咖啡杯、浓缩咖啡和冷萃咖啡系统正变得越来越流行。使用胶囊或咖啡包的单杯式咖啡机也因其操作快速、清洁简单而表现良好,对忙碌的生活方式和现代厨房颇具吸引力。

2024年,滴滤咖啡机市场规模达53亿美元,预计2025年至2034年的复合年增长率为4.9%。滴滤咖啡机日益普及,源自于其价格实惠且操作简单。滴漏咖啡机一次冲泡即可冲泡多杯咖啡,非常适合家庭、共享办公空间,以及注重简约而非高端冲泡方式的个人。对于那些追求便利体验、又不想像浓缩咖啡或特色咖啡机那样复杂繁琐的消费者来说,滴滤咖啡机是一个可靠的选择。

自动咖啡机市场在2024年占据了60.9%的市场份额,预计复合年增长率为5%。这些机器,包括全自动浓缩咖啡机、胶囊式咖啡机和自动滴滤咖啡机,因其速度快、口感稳定和易用性而备受青睐。这个细分市场吸引了那些注重便利操作和可靠咖啡品质的消费者。随着家庭咖啡体验需求的成长,自动化解决方案在满足不断变化的偏好方面变得越来越重要。

美国咖啡机市场在2024年创收27亿美元,预计到2034年将以5%的复合年增长率成长。美国市场的成长动力源自于消费者对高端和特色饮品的青睐,而消费者对能够在家中享用咖啡馆风味饮品的高性能咖啡机的兴趣日益浓厚。以便捷性为核心的产品,例如单杯式咖啡机,因其高效、快速和始终如一的口感而持续受到欢迎,成为生活节奏快、咖啡文化浓厚的美国消费者的理想选择。

全球咖啡机市场的知名企业包括 Melitta 集团、Rancilio 集团、Keurig Dr Pepper、博世、La Marzocco、AEG、Saeco、De'Longhi、Gaggia、Illycaffe、JURA Elektroapparate、Nespresso、Hamilton Beach Brands、Breville 集团和荷兰皇家飞利浦集团公司。咖啡机市场的领先公司专注于创新和以客户为中心的产品开发,以巩固其市场地位。许多公司正在投资智慧功能,例如物联网连接、触控萤幕介面和自动冲泡系统。与咖啡品牌和零售商的合作有助于扩大其消费者覆盖范围。对节能技术和永续材料的重视也引起了具有环保意识的买家的共鸣。

目录

第一章:方法论与范围

第 2 章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 利润率分析

- 每个阶段的增值

- 影响价值链的因素

- 中断

- 产业衝击力

- 成长动力

- 全球咖啡消费量上升

- 家庭咖啡文化的发展

- 技术进步

- 便利性和单份解决方案

- 产业陷阱与挑战

- 竞争激烈,市场饱和

- 价格敏感度和消费者预算限制

- 成长动力

- 成长潜力分析

- 未来市场趋势

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 依产品类型

- 监管格局

- 标准和合规性要求

- 区域监理框架

- 认证标准

- 差距分析

- 风险评估与缓解

- 交易分析

- 出口前10名国家

- 进口前10名国家

- 波特的分析

- PESTEL分析

- 消费者行为分析

- 购买模式

- 偏好分析

- 消费者行为的区域差异

- 电子商务对购买决策的影响

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:依产品类型,2021 - 2034 年

- 主要趋势

- 浓缩咖啡机

- 滴滤咖啡机

- 单杯咖啡机

- 其他(从豆到杯等)

第六章:市场估计与预测:依技术分类,2021 - 2034 年

- 主要趋势

- 手动的

- 自动的

- 其他(聪明等)

第七章:市场估计与预测:依价格区间,2021 - 2034

- 主要趋势

- 低的

- 中等的

- 高的

第八章:市场估计与预测:依最终用途,2021 - 2034

- 主要趋势

- 住宅

- 商业的

第九章:市场估计与预测:按配销通路,2021 - 2034

- 主要趋势

- 在线的

- 电子商务

- 公司网站

- 离线

- 专卖店

- 大型零售商店

- 其他(个体店等)

第 10 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 印尼

- 马来西亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 多边环境协定

- 沙乌地阿拉伯

- 阿联酋

- 南非

第 11 章:公司简介

- AEG

- Bosch

- Breville Group

- De'Longhi

- Gaggia

- Hamilton Beach Brands

- Illycaffe

- JURA Elektroapparate

- Keurig Dr Pepper

- Koninklijke Philips NV

- La Marzocco

- Melitta Group

- Nespresso

- Rancilio Group

- Saeco

The Global Coffee Machines Market was valued at USD 11.6 billion in 2024 and is estimated to grow at a CAGR of 4.8% to reach USD 18.4 billion by 2034.

This growth is closely tied to evolving lifestyle preferences, the increasing popularity of coffee culture, and the daily ritual that coffee consumption has become for many consumers. Urban living and modern aesthetics have pushed the housing segment to dominate the market, accounting for approximately 70% of total sales. Consumers today not only demand high functionality but also place value on design, making coffee machines a core part of home decor. In parallel, the expansion of smart kitchen appliances is revolutionizing how users interact with coffee makers.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $11.6 Billion |

| Forecast Value | $18.4 Billion |

| CAGR | 4.8% |

Tech-savvy models integrated with Wi-Fi, mobile apps, and voice assistants are gaining significant traction. These machines are equipped with features such as milk frothing, automatic grinding, and personalized brewing settings, catering to the rising demand for convenience and customization. Bean-to-cup, espresso, and cold brew systems are witnessing increased adoption as consumers seek cafe-quality results at home. Single-serve models that use pods or capsules are also performing well due to their quick operation and minimal cleanup, making them attractive for busy lifestyles and modern kitchens.

In 2024, the drip coffee makers segment generated USD 5.3 billion and is expected to register a CAGR of 4.9% from 2025 through 2034. Their growing popularity stems from their affordability and user-friendly operation. Drip machines allow multiple servings in one brew cycle, making them ideal for family settings, shared office spaces, or individuals who value simplicity over high-end brewing. They are seen as a reliable option for consumers looking for convenience without the complexity of espresso or specialty coffee systems.

The automatic coffee machines segment held a 60.9% share in 2024 and is anticipated to grow at a CAGR of 5%. These machines, including fully automatic espresso systems, pod-based units, and automated drip brewers, are favored for their speed, consistency, and ease of use. This segment attracts consumers who prioritize hassle-free operation and reliable coffee quality. As demand for home-based coffee experiences grows, automatic solutions are becoming increasingly important in meeting evolving preferences.

U.S. Coffee Machines Market generated USD 2.7 billion in 2024 and is projected to grow at a CAGR of 5% through 2034. Growth in the U.S. is driven by a shift toward premium and specialty beverages, supported by rising interest in high-performance machines that can deliver cafe-style drinks at home. Convenience-focused products, including single-serve systems, continue to gain popularity due to their efficiency, speed, and consistent taste making them ideal for American consumers with fast-paced routines and a strong coffee culture.

Prominent players in the Global Coffee Machines Market include Melitta Group, Rancilio Group, Keurig Dr Pepper, Bosch, La Marzocco, AEG, Saeco, De'Longhi, Gaggia, Illycaffe, JURA Elektroapparate, Nespresso, Hamilton Beach Brands, Breville Group, and Koninklijke Philips N.V. Leading companies in the coffee machines market are focused on innovation and customer-centric product development to reinforce their market standing. Many are investing in smart features such as IoT connectivity, touch-screen interfaces, and automated brewing systems. Partnerships with coffee brands and retailers help expand their consumer reach. Emphasis on energy-efficient technology and sustainable materials also resonates with environmentally conscious buyers.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type trends

- 2.2.3 Technology trends

- 2.2.4 Price range trends

- 2.2.5 End use trends

- 2.2.6 Distribution channel trends

- 2.3 CXO perspectives: strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising global coffee consumption

- 3.2.1.2 Growth of at-home coffee culture

- 3.2.1.3 Technological advancements

- 3.2.1.4 Convenience & single-serve solutions

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High competition and market saturation

- 3.2.2.2 Price sensitivity and consumer budget constraints

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By product type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Gap analysis

- 3.9 Risk assessment and mitigation

- 3.10 Trade analysis

- 3.10.1 Top 10 export countries

- 3.10.2 Top 10 import countries

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

- 3.13 Consumer behavior analysis

- 3.13.1 Purchasing patterns

- 3.13.2 Preference analysis

- 3.13.3 Regional variations in consumer behavior

- 3.13.4 Impact of e-commerce on buying decisions

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By Region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.1 By Region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Product Type, 2021 - 2034, (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Espresso machines

- 5.3 Drip coffee makers

- 5.4 Single-serve coffee machines

- 5.5 Others (bean to cup, etc.)

Chapter 6 Market Estimates & Forecast, By Technology, 2021 - 2034, (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Manual

- 6.3 Automatic

- 6.4 Others (smart, etc.)

Chapter 7 Market Estimates & Forecast, By Price range, 2021 - 2034, (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Low

- 7.3 Medium

- 7.4 High

Chapter 8 Market Estimates & Forecast, By End use, 2021 - 2034, (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Residential

- 8.3 Commercial

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034, (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 Online

- 9.2.1 E-commerce

- 9.2.2 Company website

- 9.3 Offline

- 9.3.1 Specialty stores

- 9.3.2 Mega retail stores

- 9.3.3 Others (individual stores, etc.)

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034, (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.4.6 Indonesia

- 10.4.7 Malaysia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 Saudi Arabia

- 10.6.2 UAE

- 10.6.3 South Africa

Chapter 11 Company Profiles

- 11.1 AEG

- 11.2 Bosch

- 11.3 Breville Group

- 11.4 De'Longhi

- 11.5 Gaggia

- 11.6 Hamilton Beach Brands

- 11.7 Illycaffe

- 11.8 JURA Elektroapparate

- 11.9 Keurig Dr Pepper

- 11.10 Koninklijke Philips N.V.

- 11.11 La Marzocco

- 11.12 Melitta Group

- 11.13 Nespresso

- 11.14 Rancilio Group

- 11.15 Saeco