|

市场调查报告书

商品编码

1833633

船舶洗涤器系统市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Marine Scrubber Systems Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

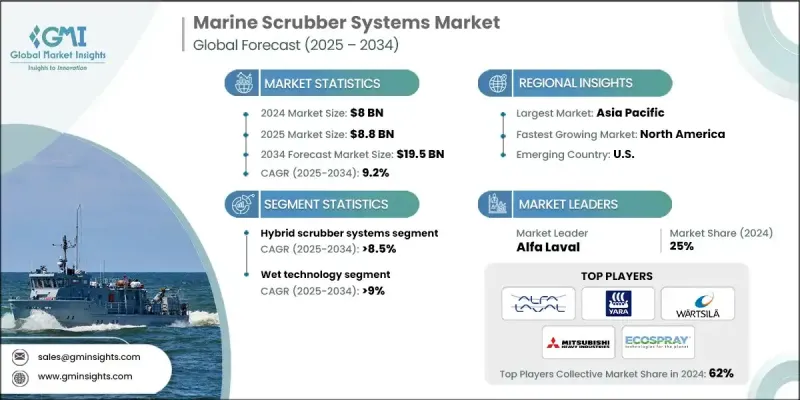

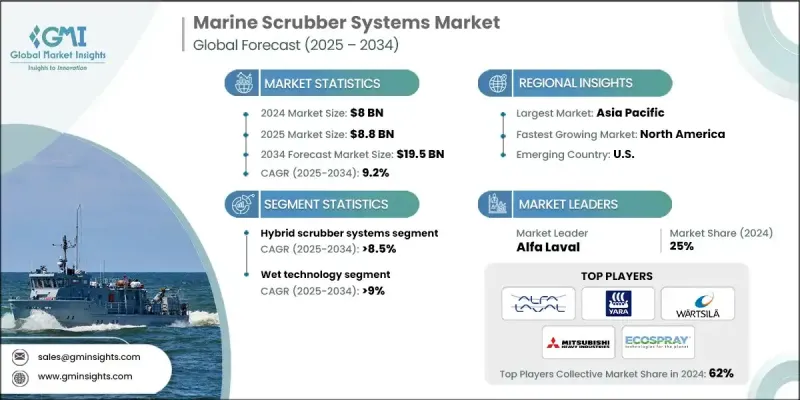

2024 年全球船舶洗涤器系统市值为 80 亿美元,预计到 2034 年将以 9.2% 的复合年增长率增长至 195 亿美元。

全球海洋环境法规日益严格,例如要求减少船舶硫排放的国际海事组织2020年版(IMO 2020),是推动船舶采用洗涤器系统的主要驱动力之一。这些系统通过去除废气中的硫氧化物,帮助船舶符合新的排放标准。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 80亿美元 |

| 预测值 | 195亿美元 |

| 复合年增长率 | 9.2% |

混合洗涤器系统的使用日益增多

混合洗涤器系统领域在2024年占据了相当大的份额,因为船东正在寻求更灵活的解决方案来满足不断变化的环境法规。混合洗涤器可以在开环和闭环模式下运行,允许船舶根据其航行区域的水质和监管要求在系统之间切换。该领域的公司专注于提高系统适应性和效率,同时降低营运成本。主要参与者也与造船厂合作,提供客製化解决方案,确保混合洗涤器针对新建船舶和改装船舶进行最佳化。

湿式洗涤器技术将获得发展

湿式洗涤器技术因其在去除废气中硫氧化物方面的有效性已得到证实,在2024年占据了可持续的份额。湿式洗涤器使用水或碱性溶液来中和硫排放,为船舶营运商提供了一种可靠的方法来遵守严格的硫排放法规,尤其是在排放限制严格的地区。此外,一些公司正在探索混合设计,将湿式和干式洗涤器系统的优势结合起来,以提供更丰富的功能。该领域参与者的策略方针包括提高洗涤器效率以降低营运成本,同时确保符合全球环境标准。

亚太地区将崛起成为推动力地区

由于航运活动的增加、排放法规的日益严格以及环保合规需求的不断增长,亚太地区船舶洗涤器系统市场将在2025年至2034年期间实现可观的复合年增长率。在该地区营运的公司正致力于提供经济实惠且可扩展的洗涤器解决方案,以满足亚洲船东的多样化需求。关键策略包括与当地造船厂和航运公司建立合作伙伴关係,投资研发以提高洗涤器在各种环境条件下的性能,并提供安装后支援服务。此外,亚太市场的参与者正在强调洗涤器改装的重要性,因为该地区许多老旧船舶需要升级系统以符合新的排放标准。

船舶洗涤器系统市场的主要参与者有 Clean Marine、富士电机、Langh Tech、MAN Energy Solutions、现代重工、光星、瓦锡兰、雅苒国际、PANASIA、杜邦、阿法拉伐、VDL AEC Maritime、CR Ocean Engineering、达门 Ecospray 和重工、三星重工、维美德、上海蓝魂环境科技、SAACK 和英国蓝魂环境科技。

许多公司正专注于在航运活动活跃的地区(例如亚太、欧洲和北美)扩大市场份额。尤其值得一提的是,亚太市场由于拥有大量营运船舶,被视为高成长地区。各公司正在设立本地办事处、分销网络和服务中心,以确保快速提供安装和维护服务。这种地域扩张对于在快速发展的市场中保持竞争力至关重要。

目录

第一章:方法论与范围

第 2 章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 监管格局

- 2021-2034年价格趋势分析

- 按燃料

- 按地区

- 成本结构分析

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率(按地区划分)

- 北美洲

- 欧洲

- 亚太地区

- 战略仪表板

- 策略倡议

- 公司标竿分析

- 创新与技术格局

第五章:市场规模及预测:依技术分类,2021 - 2034 年

- 主要趋势

- 湿的

- 开环

- 闭环

- 杂交种

- 其他的

- 干燥

第六章:市场规模及预测:依燃料,2021 - 2034

- 主要趋势

- 多学科行动

- 氧化镁

- 杂交种

- 其他的

第七章:市场规模及预测:依应用,2021 - 2034

- 主要趋势

- 商业的

- 货柜船

- 油轮

- 散货船

- 滚装

- 其他的

- 海上

- AHTS

- 埃因霍温

- 卵泡囊病毒

- 多功能安全阀

- 其他的

- 休閒娱乐

- 游轮

- 渡轮

- 游艇

- 其他的

- 海军

- 其他的

第八章:市场规模及预测:按地区,2021 - 2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 希腊

- 挪威

- 德国

- 英国

- 法国

- 荷兰

- 义大利

- 克罗埃西亚

- 波兰

- 俄罗斯

- 丹麦

- 亚太地区

- 中国

- 日本

- 韩国

- 菲律宾

- 越南

- 台湾

- 印度

- 印尼

- 马来西亚

- 新加坡

- 澳洲

- 世界其他地区

第九章:公司简介

- ALFA LAVAL

- ANDRITZ

- CR Ocean Engineering

- Clean Marine

- Damen Shipyards Group

- DuPont

- Ecospray Technologies

- Hyundai Heavy Industries

- KwangSung

- Fuji Electric

- Langh Tech

- MAN Energy Solutions

- Mitsubishi Heavy Industries

- PANASIA

- SAACKE

- Samsung Heavy Industries

- Shanghai Bluesoul Environmental Technology

- Valmet

- VDL AEC Maritime

- Wartsila

- Yara International

The Global Marine Scrubber Systems Market was valued at USD 8 billion in 2024 and is estimated to grow at a CAGR of 9.2% to reach USD 19.5 billion by 2034.

The tightening of global maritime environmental regulations, such as IMO 2020, which mandates a reduction in sulfur emissions from ships, is one of the primary drivers for the adoption of marine scrubber systems. These systems help ships comply with new emission standards by removing sulfur oxides from exhaust gases.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $8 Billion |

| Forecast Value | $19.5 Billion |

| CAGR | 9.2% |

Rising Use of Hybrid Scrubber Systems

The hybrid scrubber systems segment held a significant share in 024 as ship owners seek more flexible solutions to meet evolving environmental regulations. Hybrid scrubbers can operate both in open and closed-loop modes, allowing vessels to switch between systems depending on the water quality and regulatory requirements of the area they are navigating. Companies in this segment are focusing on enhancing system adaptability and efficiency while reducing operational costs. Major players are also collaborating with shipbuilders to offer tailored solutions, ensuring hybrid scrubbers are optimized for both newbuilds and retrofits.

Wet Scrubber Technology to Gain Traction

The wet scrubber technology segment held a sustainable share in 2024 owing to its proven effectiveness in removing sulfur oxides from exhaust gases. Wet scrubbers use water or an alkaline solution to neutralize sulfur emissions, offering ship operators a reliable way to comply with stringent sulfur regulations, particularly in regions with strict discharge limits. Furthermore, some are exploring hybrid designs that combine the benefits of wet and dry scrubber systems to provide even more versatility. The strategic approach for players in this segment includes enhancing scrubber efficiency to lower operational costs while also ensuring compliance with global environmental standards.

Asia Pacific to Emerge as a Propelling Region

Asia Pacific marine scrubber systems market will grow at a decent CAGR during 2025-2034, owing to the increased shipping activity, stricter emissions regulations, and the growing demand for environmental compliance. Companies operating in the region are focusing on offering affordable and scalable scrubber solutions to meet the diverse needs of Asian ship owners. Key strategies include forming partnerships with local shipyards and shipping companies, investing in R&D to improve scrubber performance under various environmental conditions, and providing post-installation support services. Additionally, players in the Asia Pacific market are emphasizing the importance of scrubber retrofitting, as many older vessels in the region need to upgrade their systems to comply with new emissions standards.

Major players in the marine scrubber systems market are Clean Marine, Fuji Electric, Langh Tech, MAN Energy Solutions, Hyundai Heavy Industries, KwangSung, Wartsila, Yara International, PANASIA, DuPont, ALFA LAVAL, VDL AEC Maritime, CR Ocean Engineering, Damen Shipyards Group, Mitsubishi Heavy Industries, Samsung Heavy Industries, Valmet, Shanghai Bluesoul Environmental Technology, SAACKE, and Ecospray Technologies.

Many companies are focusing on expanding their market presence in regions with high shipping activity, such as Asia Pacific, Europe, and North America. In particular, the Asia Pacific market is seen as a high-growth area due to the large number of vessels operating in the region. Companies are setting up local offices, distribution networks, and service centers to ensure quick turnaround times for installation and maintenance services. This geographic expansion is key to staying competitive in a rapidly evolving market.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.1.3 Base estimates and calculations

- 1.1.4 Base year calculation

- 1.1.5 Key trends for market estimates

- 1.2 Forecast model

- 1.3 Primary research & validation

- 1.3.1 Primary sources

- 1.4 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

- 2.2 Business trends

- 2.3 Type trends

- 2.4 Fuel trends

- 2.5 Application trends

- 2.6 Regional trends

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Price trend analysis, 2021-2034

- 3.3.1 By fuel

- 3.3.2 By region

- 3.4 Cost structure analysis

- 3.5 Industry impact forces

- 3.5.1 Growth drivers

- 3.5.2 Industry pitfalls & challenges

- 3.6 Growth potential analysis

- 3.7 Porter's Analysis

- 3.7.1 Bargaining power of suppliers

- 3.7.2 Bargaining power of buyers

- 3.7.3 Threat of new entrants

- 3.7.4 Threat of substitutes

- 3.8 PESTEL Analysis

Chapter 4 Competitive landscape, 2025

- 4.1 Introduction

- 4.2 Company market share, by region, 2024

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.3 Strategic dashboard

- 4.4 Strategic initiatives

- 4.5 Company benchmarking

- 4.6 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Technology, 2021 - 2034 (USD Million, Units)

- 5.1 Key trends

- 5.2 Wet

- 5.2.1 Open loop

- 5.2.2 Closed loop

- 5.2.3 Hybrid

- 5.2.4 Others

- 5.3 Dry

Chapter 6 Market Size and Forecast, By Fuel, 2021 - 2034 (USD Million, Units)

- 6.1 Key trends

- 6.2 MDO

- 6.3 MGO

- 6.4 Hybrid

- 6.5 Others

Chapter 7 Market Size and Forecast, By Application, 2021 - 2034 (USD Million, Units)

- 7.1 Key trends

- 7.2 Commercial

- 7.2.1 Container vessels

- 7.2.2 Tankers

- 7.2.3 Bulk carriers

- 7.2.4 RO-RO

- 7.2.5 Others

- 7.3 Offshore

- 7.3.1 AHTS

- 7.3.2 PSV

- 7.3.3 FSV

- 7.3.4 MPSV

- 7.3.5 Others

- 7.4 Recreational

- 7.4.1 Cruise ships

- 7.4.2 Ferries

- 7.4.3 Yachts

- 7.4.4 Others

- 7.5 Navy

- 7.6 Others

Chapter 8 Market Size and Forecast, By Region, 2021 - 2034 (USD Million, Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Greece

- 8.3.2 Norway

- 8.3.3 Germany

- 8.3.4 UK

- 8.3.5 France

- 8.3.6 Netherlands

- 8.3.7 Italy

- 8.3.8 Croatia

- 8.3.9 Poland

- 8.3.10 Russia

- 8.3.11 Denmark

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 South Korea

- 8.4.4 Philippines

- 8.4.5 Vietnam

- 8.4.6 Taiwan

- 8.4.7 India

- 8.4.8 Indonesia

- 8.4.9 Malaysia

- 8.4.10 Singapore

- 8.4.11 Australia

- 8.5 Rest of World

Chapter 9 Company Profiles

- 9.1 ALFA LAVAL

- 9.2 ANDRITZ

- 9.3 CR Ocean Engineering

- 9.4 Clean Marine

- 9.5 Damen Shipyards Group

- 9.6 DuPont

- 9.7 Ecospray Technologies

- 9.8 Hyundai Heavy Industries

- 9.9 KwangSung

- 9.10 Fuji Electric

- 9.11 Langh Tech

- 9.12 MAN Energy Solutions

- 9.13 Mitsubishi Heavy Industries

- 9.14 PANASIA

- 9.15 SAACKE

- 9.16 Samsung Heavy Industries

- 9.17 Shanghai Bluesoul Environmental Technology

- 9.18 Valmet

- 9.19 VDL AEC Maritime

- 9.20 Wartsila

- 9.21 Yara International