|

市场调查报告书

商品编码

1833634

肝素市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Heparin Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

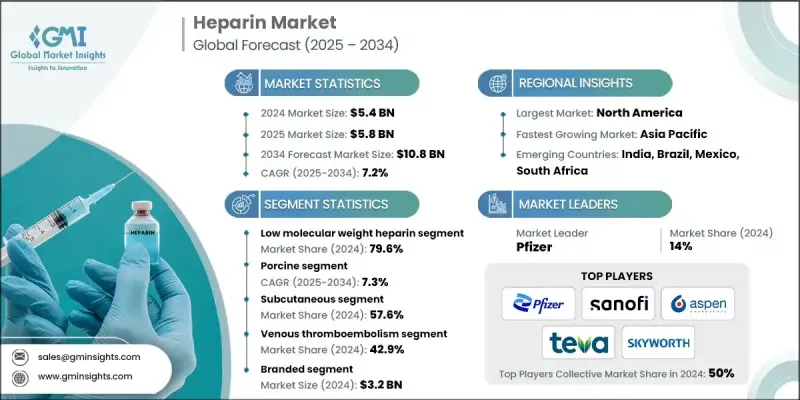

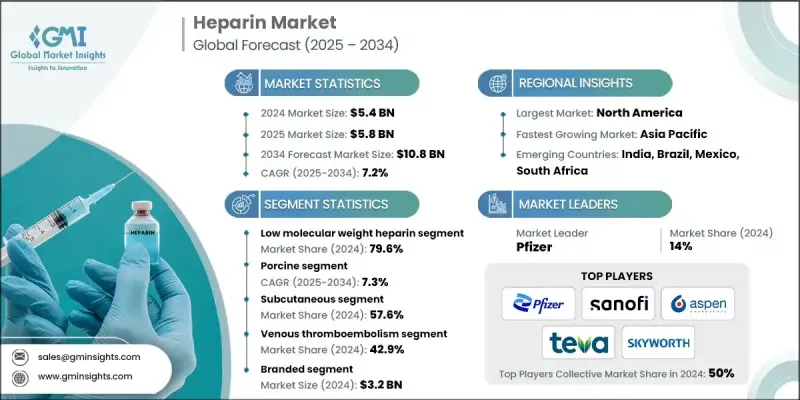

2024 年全球肝素市场价值为 54 亿美元,预计到 2034 年将以 7.2% 的复合年增长率增长至 108 亿美元。

需求成长主要归因于心血管和血栓性疾病的激增,以及全球外科手术数量的不断增加。肝素在透析、癌症治疗和各种医疗器材应用等领域的应用也越来越广泛。医疗基础设施的改善进一步促进了肝素治疗的扩展,尤其是在拉丁美洲和亚太地区的新兴经济体。持续专注于创新以及开发更有效、副作用更少的抗凝血疗法,正在推动市场发展。研究计画正在推动产品进步,使基于肝素的治疗方案更容易在医院、诊所和家庭护理机构中获得。随着心血管疾病持续给全球医疗保健系统带来沉重负担,抗凝血技术的不断发展预计将加速市场应用。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 54亿美元 |

| 预测值 | 108亿美元 |

| 复合年增长率 | 7.2% |

低分子量肝素 (LMWH) 市场在 2024 年占据 79.6% 的市场份额,这得益于其多项临床优势,包括良好的药物动力学、较低的出血风险、易于给药以及适合门诊治疗。 LMWH 的治疗效果可预测,且监测频率较低,因此成为医疗服务提供者和患者的首选。

猪源肝素市场在2024年的复合年增长率为7.3%,这得益于其稳定的供应、临床可靠性以及肝素诱导的血小板减少症(HIT)等併发症的发生率较低。这类肝素是生产最广泛使用的低分子肝素(LMWH)不可或缺的原料,而且仍是大规模生产的基石。

2024年,美国肝素市场产值达28亿美元。美国心血管疾病和慢性疾病的高发生率导致对抗凝血治疗的需求强劲。美国食品药物管理局(FDA)的监管支持以及优惠的报销框架,持续促进了品牌药和仿製药肝素製剂的广泛接受。医院和家庭护理环境中预充式註射器和自动注射器的使用日益增多,也促进了这些药物的安全便捷使用。

全球肝素产业的主要领导者包括利奥製药、辉瑞、Suanfarma、深圳海普瑞药业、Bioiberica、Amphastar、赛诺菲、雷迪博士实验室、常州千红生物製药、梯瓦製药工业、费森尤斯卡比、Aspen Pharmacare、南京健友生化製药、Rovi Laboratorios Farmaceacecosuti和烟台东生化。肝素市场的领导企业正在利用策略合作、垂直整合和产能扩张等组合来巩固其市场地位。一些公司正在投资研发,以开发疗效更好、副作用更少的下一代抗凝血剂。其他公司正在建立合作伙伴关係和许可协议,以拓宽分销管道并确保原材料供应。向高成长新兴市场的地域扩张也已成为关键的关注领域。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 每个阶段的增值

- 影响价值链的因素

- 产业衝击力

- 成长动力

- 全球心血管疾病盛行率上升

- 人口老化与外科手术

- 扩大医院基础设施和家庭护理

- 政府和机构健康计划

- 产业陷阱与挑战

- 品牌 LMWH 和生物相似药成本高昂

- 供应链中断和原材料依赖

- 市场机会

- 合成和重组肝素的开发

- 医疗保健投资不断增加的新兴市场

- 成长动力

- 成长潜力分析

- 监管格局

- 北美洲

- 我们

- 加拿大

- 欧洲

- 亚太地区

- 北美洲

- 未来市场趋势

- 技术格局

- 目前技术

- 新兴技术

- 专利格局

- 定价分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 全球的

- 北美洲

- 欧洲

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与协作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:按产品,2021 - 2034 年

- 主要趋势

- 低分子量肝素

- 普通肝素

- 超低分子量肝素/合成肝素

第六章:市场估计与预测:按来源,2021 - 2034 年

- 主要趋势

- 猪

- 牛

第七章:市场估计与预测:按管理路线,2021 - 2034 年

- 主要趋势

- 静脉

- 皮下

第 8 章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 静脉血栓栓塞症

- 心房颤动/扑动

- 冠状动脉疾病

- 其他应用

第九章:市场估计与预测:按类型,2021 - 2034

- 主要趋势

- 品牌

- 泛型

第 10 章:市场估计与预测:依最终用途,2021 年至 2034 年

- 主要趋势

- 医院

- 诊所

- 门诊手术中心(ASC)

- 其他最终用途

第 11 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第 12 章:公司简介

- Amphastar

- Aspen Pharmacare

- Bioiberica

- Changzhou Qianhong Biopharma

- Dr. Reddy's Laboratories

- Fresenius Kabi

- Laboratorios Farmaceuticos ROVI

- Leo Pharma

- Nanjing King-Friend Biochemical Pharmaceutical

- Pfizer

- Sanofi

- Shenzhen Hepalink Pharmaceuticals

- Suanfarma

- Teva Pharmaceutical Industries

The Global Heparin Market was valued at USD 5.4 billion in 2024 and is estimated to grow at a CAGR of 7.2% to reach USD 10.8 billion by 2034.

The increasing demand is largely attributed to a surge in cardiovascular and thrombotic conditions, coupled with a growing number of surgical interventions worldwide. Heparin is also seeing broader adoption in fields like dialysis, cancer treatment, and various medical device applications. These therapeutic expansions are further amplified by improvements in healthcare infrastructure, particularly in emerging economies across Latin America and the Asia-Pacific region. The continued focus on innovation and the development of more effective anticoagulant therapies with fewer adverse effects is pushing market dynamics forward. Research initiatives are fueling product advancements, making heparin-based treatment options more accessible across hospitals, clinics, and home care facilities. As cardiovascular disease continues to place a substantial burden on healthcare systems globally, the ongoing evolution of anticoagulation technology is expected to accelerate market adoption.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $5.4 Billion |

| Forecast Value | $10.8 Billion |

| CAGR | 7.2% |

The low molecular weight heparin (LMWH) segment held 79.6% share in 2024, driven by several clinical advantages, including its favorable pharmacokinetics, lower risk of bleeding, ease of administration, and suitability for outpatient settings. LMWH offers predictable therapeutic outcomes and requires less frequent monitoring, making it a preferred choice among healthcare providers and patients alike.

The porcine-derived heparin segment held a CAGR of 7.3% in 2024 due to its consistent supply, clinical reliability, and reduced incidence of complications like heparin-induced thrombocytopenia (HIT). This variety of heparin is integral in the manufacturing of the most widely used LMWH types and remains the cornerstone of large-scale production.

United States Heparin Market generated USD 2.8 billion in 2024. The country's high incidence of cardiovascular diseases and chronic health conditions has led to strong demand for anticoagulant therapies. Regulatory support from the FDA, along with favorable reimbursement frameworks, continues to facilitate the widespread acceptance of both branded and generic heparin formulations. The growing use of prefilled syringes and autoinjectors in hospitals and home care environments is also contributing to the safe and convenient use of these medications.

Key companies leading the global heparin industry include Leo Pharma, Pfizer, Suanfarma, Shenzhen Hepalink Pharmaceuticals, Bioiberica, Amphastar, Sanofi, Dr. Reddy's Laboratories, Changzhou Qianhong Biopharma, Teva Pharmaceutical Industries, Fresenius Kabi, Aspen Pharmacare, Nanjing King-Friend Biochemical Pharmaceutical, Laboratorios Farmaceuticos ROVI, and Yantai Dongcheng Biochemicals. Leading players in the heparin market are leveraging a combination of strategic collaborations, vertical integration, and capacity expansion to strengthen their market position. Several companies are investing in R&D to develop next-generation anticoagulants with better efficacy and fewer side effects. Others are entering into partnerships and licensing agreements to broaden distribution channels and secure raw material supplies. Geographic expansion into high-growth emerging markets has also become a critical focus area.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumption and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 Source

- 2.2.4 Route of administration

- 2.2.5 Application

- 2.2.6 Type

- 2.2.7 End Use

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising global cardiovascular disease prevalence

- 3.2.1.2 Aging population and surgical procedures

- 3.2.1.3 Expansion of hospital infrastructure and homecare

- 3.2.1.4 Government and institutional health initiatives

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of branded LMWH and biosimilars

- 3.2.2.2 Supply chain disruptions and raw material dependency

- 3.2.3 Market opportunities

- 3.2.3.1 Development of synthetic and recombinant heparin

- 3.2.3.2 Emerging markets with rising healthcare investment

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.1.1 U.S.

- 3.4.1.2 Canada

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.1 North America

- 3.5 Future market trends

- 3.6 Technology landscape

- 3.6.1 Current technology

- 3.6.2 Emerging technologies

- 3.7 Patent landscape

- 3.8 Pricing analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 Global

- 4.2.2 North America

- 4.2.3 Europe

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Merger and acquisition

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Low molecular weight heparin

- 5.3 Unfractionated heparin

- 5.4 Ultra-low molecular weight heparin/synthetic heparin

Chapter 6 Market Estimates and Forecast, By Source, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Porcine

- 6.3 Bovine

Chapter 7 Market Estimates and Forecast, By Route of Administration, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Intravenous

- 7.3 Subcutaneous

Chapter 8 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Venous thromboembolism

- 8.3 Atrial fibrillation/flutter

- 8.4 Coronary artery disease

- 8.5 Other applications

Chapter 9 Market Estimates and Forecast, By Type, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Branded

- 9.3 Generics

Chapter 10 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 10.1 Key trends

- 10.2 Hospitals

- 10.3 Clinics

- 10.4 Ambulatory surgical centers (ASCs)

- 10.5 Other end use

Chapter 11 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Spain

- 11.3.5 Italy

- 11.3.6 Netherlands

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 Japan

- 11.4.3 India

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 Middle East and Africa

- 11.6.1 South Africa

- 11.6.2 Saudi Arabia

- 11.6.3 UAE

Chapter 12 Company Profiles

- 12.1 Amphastar

- 12.2 Aspen Pharmacare

- 12.3 Bioiberica

- 12.4 Changzhou Qianhong Biopharma

- 12.5 Dr. Reddy’s Laboratories

- 12.6 Fresenius Kabi

- 12.7 Laboratorios Farmaceuticos ROVI

- 12.8 Leo Pharma

- 12.9 Nanjing King-Friend Biochemical Pharmaceutical

- 12.10 Pfizer

- 12.11 Sanofi

- 12.12 Shenzhen Hepalink Pharmaceuticals

- 12.13 Suanfarma

- 12.14 Teva Pharmaceutical Industries