|

市场调查报告书

商品编码

1833637

无管胰岛素帮浦市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Tubeless Insulin Pump Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

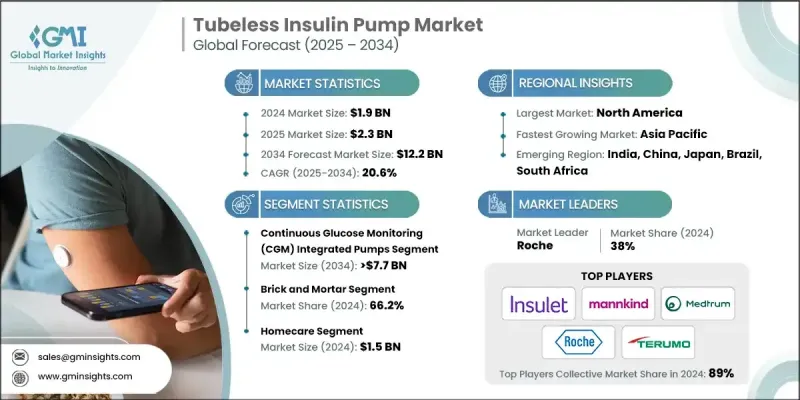

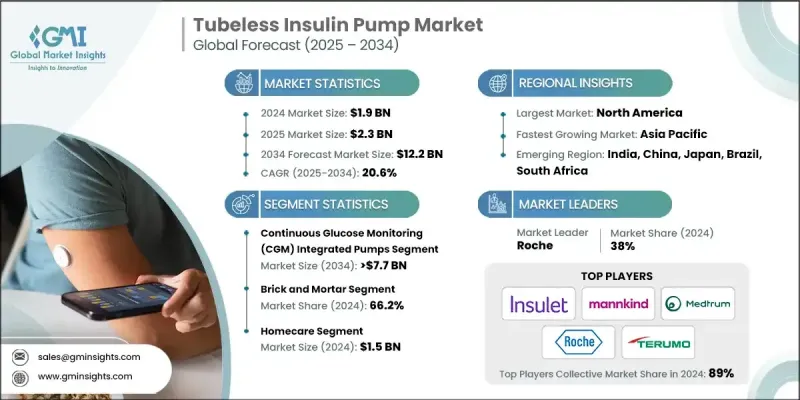

2024 年全球无管胰岛素帮浦市场价值为 19 亿美元,预计到 2034 年将以 20.6% 的复合年增长率成长至 122 亿美元。

根据世界卫生组织 (WHO) 统计,糖尿病是全球主要死亡原因之一,病例数的不断增长迫切需要更有效率、更易于管理的治疗方案。传统的胰岛素给药方法,例如每日註射,往往会导致治疗效果不一致、患者依从性降低以及不适。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 19亿美元 |

| 预测值 | 122亿美元 |

| 复合年增长率 | 20.6% |

持续血糖监测(CGM)一体帮浦的需求不断成长

2024年,持续血糖监测 (CGM) 一体式帮浦市场占据了相当大的份额,这得益于提供即时血糖水平资料的糖尿病管理。 CGM一体式帮浦可根据持续血糖监测无缝调整胰岛素输送,进而降低低血糖或高血糖的风险。将CGM和胰岛素输送功能整合在一个设备中,可确保使用者获得更好的控制、精准度和便利性,尤其对于需要持续监测的第1型糖尿病患者而言。

实体店面获得发展

2024年,实体店市场收入可观,这主要得益于医院、诊所和药店,这些场所通常销售、开立处方并提供无管胰岛素帮浦维修服务。该领域的重点在于胰岛素帮浦的分销和患者正确使用胰岛素帮浦的初步培训。该领域的公司正努力与医疗保健提供者建立牢固的关係,提供全面的培训和支援服务,以确保患者了解如何有效地使用胰岛素帮浦。

居家照护采用率不断上升

随着患者寻求更便利的居家糖尿病管理解决方案,家庭护理领域在2024年占据了相当大的份额。该领域的无管胰岛素帮浦具有灵活性、自主性和易用性,使患者能够在家中管理胰岛素输送。随着医疗保健系统转向以患者为中心的护理,各公司正专注于提供远端监控、远距医疗咨询和患者教育等支援服务,以确保成功的结果并实现更好的健康管理。

区域洞察

北美将获得发展动力

2024年,北美无管胰岛素帮浦市场占据了显着份额,这得益于糖尿病盛行率的上升以及先进糖尿病管理工具的普及。该市场的一个关键驱动因素是,人们越来越倾向于使用更便利、侵入性更低的胰岛素输送系统,尤其是在第1型糖尿病患者中。随着保险覆盖范围的扩大以及对持续胰岛素输送益处的认识不断提高,北美患者开始选择便携性和功能性更强的无管胰岛素帮浦。

无管胰岛素帮浦市场的主要参与者有 Medtrum、MicroTech、Roche、TERUMO、Insulet、MannKind Corporation 和 Pharmasens。

为了巩固在无管胰岛素帮浦市场的地位和市场地位,各公司正专注于几个关键策略。首先,他们大力投资研发,将持续血糖监测 (CGM)、人工智慧 (AI) 和远端监控等尖端技术融入他们的胰岛素帮浦中,从而增强患者的控制能力和易用性。此外,各公司正在与医疗保健提供者和保险公司建立策略合作伙伴关係,以提高患者的设备可及性和覆盖范围。

目录

第一章:方法论与范围

第 2 章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 糖尿病盛行率上升

- 无管胰岛素帮浦的技术进步

- 糖尿病照护支出增加

- 传统和侵入式胰岛素帮浦造成的损伤

- 采取便利措施

- 产业陷阱与挑战

- 无管胰岛素帮浦的长期成本高昂

- 严格的政府法规

- 市场机会

- 转向可穿戴和用户友好型设备

- 居家护理领域采用率不断提高

- 成长动力

- 成长潜力分析

- 报销场景

- 监管格局

- 北美洲

- 欧洲

- 亚太地区

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 未来市场趋势

- 2021-2024 年各地区糖尿病发生率及盛行率

- 北美洲

- 欧洲

- 亚太地区

- 排

- 新产品开发格局

- 启动场景

- 2024年定价分析

- 投资前景

- 消费者行为分析

- 波特的分析

- PESTEL分析

- 差距分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 全球的

- 北美洲

- 欧洲

- 亚太地区

- 排

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:按技术分类,2021 - 2034 年

- 主要趋势

- 持续血糖监测(CGM)整合泵

- 标准无内胎泵

第六章:市场估计与预测:按配销通路,2021 - 2034 年

- 主要趋势

- 实体店面

- 电子商务

第七章:市场估计与预测:依最终用途,2021 - 2034

- 主要趋势

- 居家护理

- 医院和诊所

- 其他最终用途

第八章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 排

第九章:公司简介

- Insulet

- MannKind Corporation

- Medtrum

- MicroTech

- Pharmasens

- Roche

- TERUMO

The Global Tubeless Insulin Pump Market was valued at USD 1.9 billion in 2024 and is estimated to grow at a CAGR of 20.6% to reach USD 12.2 billion by 2034.

According to the World Health Organization (WHO), diabetes is one of the leading causes of death globally, and the rising number of cases is creating an urgent need for more efficient and manageable treatment options. The traditional methods of insulin administration, such as daily injections, often lead to inconsistent results, reduced patient adherence, and discomfort.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.9 Billion |

| Forecast Value | $12.2 Billion |

| CAGR | 20.6% |

Rising Demand for Continuous Glucose Monitoring (CGM) Integral Pumps

The continuous glucose monitoring (CGM) integral pumps segment held a significant share in 2024, driven by diabetes management that offers real-time data on glucose levels. CGM-integral pumps allow for seamless insulin delivery adjustments based on constant glucose monitoring, reducing the risk of hypo- or hyperglycemia. The combination of CGM and insulin delivery in one device ensures better control, precision, and convenience for users, especially for those with type 1 diabetes who require continuous monitoring.

Bricks and Mortar to Gain Traction

The bricks and mortar segment generated significant revenues in 2024, driven by hospitals, clinics, and pharmacies, where tubeless insulin pumps are often sold, prescribed, and serviced. The focus is on the distribution and initial training of patients in proper pump usage. Companies in this segment are working to establish strong relationships with healthcare providers, offering comprehensive training and support services to ensure patients understand how to use their pumps effectively.

Rising Adoption in Homecare

The homecare segment held a sizeable share in 2024, as patients seek more convenient, at-home diabetes management solutions. Tubeless insulin pumps in this sector offer flexibility, discretion, and ease of use, allowing patients to manage their insulin delivery at home. As healthcare systems move toward patient-centric care, companies are focusing on offering support services such as remote monitoring, telemedicine consultations, and patient education to ensure successful outcomes and better health management.

Regional Insights

North America to Gain Traction

North America tubeless insulin pump market held a notable share in 2024, driven by the increasing prevalence of diabetes and the rising adoption of advanced diabetes management tools. A key driver in this market is the increasing preference for more convenient, less invasive insulin delivery systems, particularly among type 1 diabetes patients. With the availability of insurance coverage and growing awareness of the benefits of continuous insulin delivery, patients in North America are opting for tubeless insulin pumps that offer enhanced portability and functionality.

Major players in the tubeless insulin pump market are Medtrum, MicroTech, Roche, TERUMO, Insulet, MannKind Corporation, and Pharmasens.

To strengthen their presence and market foothold in the tubeless insulin pump market, companies are focusing on several key strategies. First, they are heavily investing in research and development to integrate cutting-edge technologies such as continuous glucose monitoring (CGM), artificial intelligence (AI), and remote monitoring into their pumps, which provide enhanced control and ease of use for patients. Additionally, companies are forming strategic partnerships with healthcare providers and insurers to improve device accessibility and coverage for patients.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Technology trends

- 2.2.3 Distribution channel trends

- 2.2.4 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of diabetes

- 3.2.1.2 Technological advancements in tubeless insulin pumps

- 3.2.1.3 Increasing diabetes care expenditure

- 3.2.1.4 Injuries caused by conventional & invasive insulin pumps

- 3.2.1.5 Adoption of facilitative initiatives

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High long-term costs associated with the tubeless insulin pumps

- 3.2.2.2 Stringent government regulations

- 3.2.3 Market opportunities

- 3.2.3.1 Shift toward wearable & user-friendly devices

- 3.2.3.2 Growing adoption in homecare

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Reimbursement scenario

- 3.5 Regulatory landscape

- 3.5.1 North America

- 3.5.2 Europe

- 3.5.3 Asia Pacific

- 3.6 Technology and innovation landscape

- 3.6.1 Current technological trends

- 3.6.2 Emerging technologies

- 3.7 Future market trends

- 3.8 Incidence & prevalence of diabetes, by region, 2021-2024

- 3.8.1 North America

- 3.8.2 Europe

- 3.8.3 Asia Pacific

- 3.8.4 RoW

- 3.9 New product development landscape

- 3.10 Start-up scenario

- 3.11 Pricing analysis, 2024

- 3.12 Investment landscape

- 3.13 Consumer behaviour analysis

- 3.14 Porter's analysis

- 3.15 PESTEL analysis

- 3.16 Gap analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 Global

- 4.2.2 North America

- 4.2.3 Europe

- 4.2.4 Asia Pacific

- 4.2.5 RoW

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Technology, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Continuous glucose monitoring (CGM) integrated pumps

- 5.3 Standard tubeless pumps

Chapter 6 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Brick and mortar

- 6.3 E-commerce

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Homecare

- 7.3 Hospitals & clinics

- 7.4 Other end use

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 RoW

Chapter 9 Company Profiles

- 9.1 Insulet

- 9.2 MannKind Corporation

- 9.3 Medtrum

- 9.4 MicroTech

- 9.5 Pharmasens

- 9.6 Roche

- 9.7 TERUMO