|

市场调查报告书

商品编码

1833638

睡眠呼吸中止设备市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Sleep Apnea Devices Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

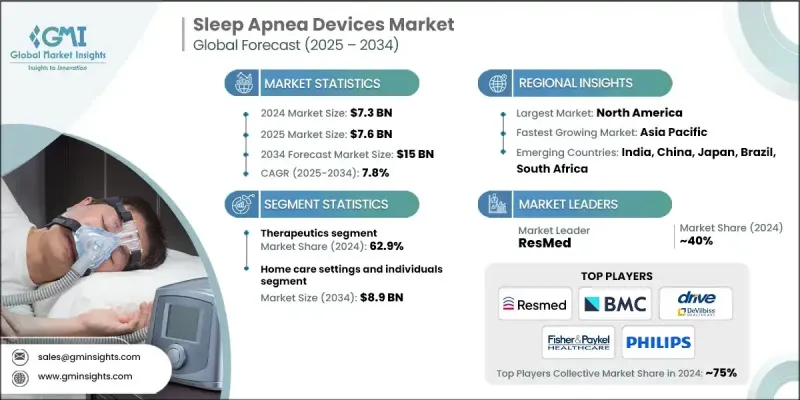

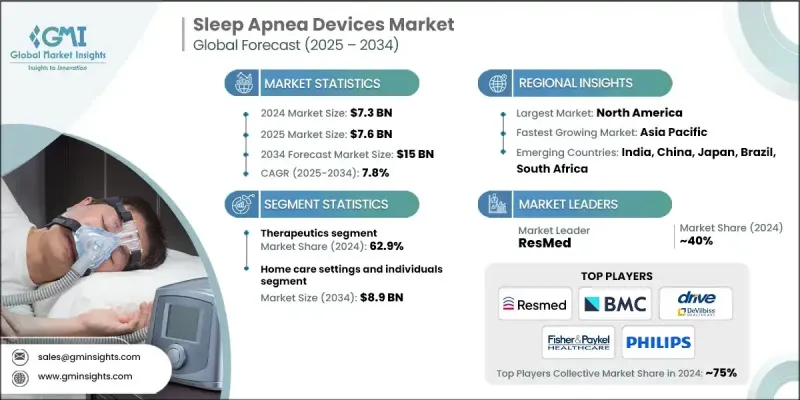

2024 年全球睡眠呼吸中止设备市场价值为 73 亿美元,预计到 2034 年将以 7.8% 的复合年增长率增长至 150 亿美元。

这一增长的驱动因素包括全球睡眠呼吸中止症病例数量的增加、人们对睡眠障碍认识的提高以及对先进便携式治疗解决方案日益增长的需求。睡眠呼吸中止症设备用于诊断和管理睡眠呼吸障碍,帮助维持呼吸道畅通并有效监测患者的睡眠健康。随着越来越多的人意识到持续打鼾、白天疲劳和注意力不集中等症状,医疗咨询和睡眠障碍诊断变得越来越普遍。睡眠测试方法的创新,包括实验室多导睡眠图和家用测试套件,进一步促进了诊断率的飙升。随着越来越多的患者获得正式诊断,对持续性正压呼吸器 (CPAP)、双水平气道正压通气 (BiPAP) 和其他睡眠呼吸中止症治疗技术等设备的需求持续增长。这些设备有助于降低未经治疗的睡眠呼吸中止症的健康风险,改善患者护理,并提高整体生活品质。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 73亿美元 |

| 预测值 | 150亿美元 |

| 复合年增长率 | 7.8% |

2024年,诊断细分市场占了37.1%的市占率。这一增长源于人们对早期睡眠障碍检测的日益关注,以及紧凑型人工智慧诊断工具的普及。随着这些技术日益成熟且价格合理,睡眠呼吸中止症筛检对患者和医疗服务提供者来说都变得更快、更方便。居家检测和即时资料分析的发展持续提升诊断能力,并促进市场扩张。

2024年,家庭护理机构和个人护理市场占据56.9%的市场份额,预计到2034年将达到89亿美元,这得益于临床环境之外对经济高效的长期治疗方案日益增长的需求。居家管理睡眠呼吸中止症有助于减少频繁就诊和住院费用。家庭护理保险覆盖范围的扩大以及经济实惠的治疗方案的出现,正在帮助更多人群更容易获得家庭睡眠治疗,鼓励更多人以独立且经济的方式管理自身疾病。

2024年,北美睡眠呼吸中止设备市场占37.6%的市场份额,这得益于其强大的医疗基础设施、完善的报销体係以及公众对睡眠相关健康问题的高度认知。该地区继续大力推广治疗性和诊断性睡眠呼吸中止症技术。远端监控平台与互联健康解决方案的整合正在进一步提升该地区的患者护理水准。 Drive DeVilbiss、BMC、ResMed、Teleflex、Fisher & Paykel和飞利浦等主要产业参与者透过提供包括持续正压通气(CPAP)、双水平正压通气(BiPAP)和远端睡眠测试解决方案在内的全面产品组合,巩固了其在北美市场的地位。

活跃于全球睡眠呼吸中止设备市场的关键公司包括 Cadwell、DynaFlex、Asahi KASEI、Glidewell、Apnea Sciences、SomnoMed、NIHON KOHDEN、Natus、WEINMANN 等。为了巩固其在全球睡眠呼吸中止设备市场的地位,各公司正在部署多项核心策略。这些策略包括持续投资研发,以提高设备的准确性、便携性和患者舒适度。各公司正在引入支援即时资料监控和远距医疗相容性的互联技术。此外,与睡眠诊所、家庭护理提供者和保险网络的合作有助于扩大分销。行销计划着重于提高公众意识和鼓励早期诊断。此外,公司正在透过监管部门的批准进入新市场并建立可扩展的生产以满足日益增长的全球需求,特别是在家庭护理环境中。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 睡眠呼吸中止症及相关合併症的发生率不断上升

- 对便携式高效能睡眠呼吸中止解决方案的需求不断增长

- 人们对睡眠呼吸中止症和睡眠障碍的认识不断提高

- 人口老化加剧需求

- 技术进步

- 产业陷阱与挑战

- 缺乏对睡眠呼吸中止症治疗的依从性

- 产品召回与安全问题

- 市场机会

- 向新兴市场扩张

- 人工智慧与数位健康融合

- 成长动力

- 成长潜力分析

- 监管格局

- 技术格局

- 现有技术

- 新兴技术

- 未来市场趋势

- 报销场景

- 睡眠呼吸中止症植入物在睡眠呼吸中止症治疗设备中的作用不断演变

- 管道分析

- 投资前景

- 启动场景

- 2024年定价分析

- 波特的分析

- PESTEL分析

- 差距分析

第四章:竞争格局

- 介绍

- 公司矩阵分析

- 公司市占率分析

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲和中东地区

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:按产品,2021 - 2034 年

- 主要趋势

- 疗法

- 气道清除系统

- 气道正压通气 (PAP) 装置

- 持续性呼吸道正压通气 (CPAP) 设备

- 双水平气道正压通气 (BiPAP) 装置

- 自动气道正压通气 (APAP) 装置

- 自适应伺服通气 (ASV) 设备

- 口腔器具

- 下颚前移装置

- 舌固定装置

- 快速上颚扩弓

- 护齿套

- 其他疗法

- 诊断

- 多导睡眠图(PSG)设备

- 动态 PSG 设备

- 临床 PSG 设备

- 体动记录系统

- 脉搏血氧仪

- 居家睡眠测试 (HST) 设备

- 类型 2

- 类型 3

- 类型 4

- 呼吸描记器

- 多导睡眠图(PSG)设备

第六章:市场估计与预测:依最终用途,2021 - 2034 年

- 主要趋势

- 居家照护机构及个人

- 睡眠实验室和医院

第七章:市场估计与预测:按地区,2021 - 2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第八章:公司简介

- Asahi KASEI

- BMC

- Cadwell

- Drive DeVilbiss

- FISHER & PAYKEL

- natus

- NIHON KOHDEN

- Philips

- ResMed

- Teleflex

- WEINMANN

- Glidewell

- DynaFlex

- SomnoMed

- Apnea Sciences

The Global Sleep Apnea Devices Market was valued at USD 7.3 billion in 2024 and is estimated to grow at a CAGR of 7.8% to reach USD 15 billion by 2034.

This growth is being driven by the rising number of sleep apnea cases worldwide, increased awareness around sleep disorders, and growing demand for advanced, portable treatment solutions. Sleep apnea devices are used both for diagnosing and managing sleep-disordered breathing, helping to keep the airway open and monitor patients' sleep health effectively. With more individuals recognizing symptoms such as persistent snoring, fatigue during the day, and difficulty focusing, medical consultations and sleep disorder diagnoses are becoming more common. Innovations in sleep testing methods, including lab-based polysomnography and home testing kits, are further contributing to this surge in diagnosis rates. As more patients are formally diagnosed, demand for devices like CPAP, BiPAP, and other sleep apnea treatment technologies continues to rise. These devices are instrumental in reducing the health risks of untreated sleep apnea, offering improved patient care and boosting overall quality of life.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $7.3 Billion |

| Forecast Value | $15 Billion |

| CAGR | 7.8% |

In 2024, the diagnostics segment held a 37.1% share. This growth stems from heightened attention to early sleep disorder detection and greater access to compact and AI-powered diagnostic tools. As these technologies become more sophisticated and affordable, screening for sleep apnea is becoming quicker and more convenient for both patients and providers. The evolution of home-based testing and real-time data analysis continues to enhance diagnostic capabilities and market expansion.

The home care settings and individuals segment held a share of 56.9% in 2024 and is expected to generate USD 8.9 billion by 2034, fueled by the rising demand for cost-effective, long-term treatment solutions outside of clinical settings. Managing sleep apnea at home helps cut down on frequent clinic visits and hospitalization expenses. Expanded insurance coverage for home-based care and the availability of budget-friendly treatment options are helping make home sleep therapy more accessible to a wide population base, encouraging more people to manage their condition independently and affordably.

North America Sleep Apnea Devices Market held a 37.6% share in 2024, supported by robust healthcare infrastructure, a well-established reimbursement ecosystem, and high public awareness around sleep-related health issues. The region continues to see strong early adoption of both therapeutic and diagnostic sleep apnea technologies. Integration of remote monitoring platforms and connected health solutions is further advancing patient care in the region. Major industry players such as Drive DeVilbiss, BMC, ResMed, Teleflex, Fisher & Paykel, and Philips have cemented their position in North America by offering comprehensive portfolios that include CPAP, BiPAP, and remote sleep testing solutions.

Key companies active in the Global Sleep Apnea Devices Market Include Cadwell, DynaFlex, Asahi KASEI, Glidewell, Apnea Sciences, SomnoMed, NIHON KOHDEN, Natus, WEINMANN, and others. To strengthen their position in the global sleep apnea devices market, companies are deploying several core strategies. These include consistent investment in research and development to enhance device accuracy, portability, and patient comfort. Firms are introducing connected technologies that support real-time data monitoring and telehealth compatibility. In addition, partnerships with sleep clinics, home care providers, and insurance networks are helping expand distribution. Marketing initiatives focus on increasing public awareness and encouraging early diagnosis. Moreover, companies are entering new markets through regulatory approvals and building scalable production to meet rising global demand, particularly in home care settings.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Product trends

- 2.2.3 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing incidence of sleep apnea and related comorbidities

- 3.2.1.2 Growing demand for portable, high-performance sleep apnea solutions

- 3.2.1.3 Surging awareness of sleep apnea and sleep disorders

- 3.2.1.4 Rising aging population amplifying demand

- 3.2.1.5 Technological advancements

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Lack of adherence to sleep apnea treatment

- 3.2.2.2 Product recalls and safety concerns

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion into emerging markets

- 3.2.3.2 AI and digital health integration

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technological landscape

- 3.5.1 Current technologies

- 3.5.2 Emerging technologies

- 3.6 Future market trends

- 3.7 Reimbursement scenario

- 3.8 Evolving role of sleep apnea implants within sleep apnea treatment devices

- 3.9 Pipeline analysis

- 3.10 Investment landscape

- 3.11 Start-up scenario

- 3.12 Pricing analysis, 2024

- 3.13 Porter's analysis

- 3.14 PESTEL analysis

- 3.15 Gap analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.3.1 North America

- 4.3.2 Europe

- 4.3.3 Asia Pacific

- 4.3.4 LAMEA

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Therapeutics

- 5.2.1 Airway clearance systems

- 5.2.2 Positive airway pressure (PAP) devices

- 5.2.2.1 Continuous positive airway pressure (CPAP) devices

- 5.2.2.2 Bilevel positive airway pressure (BiPAP) devices

- 5.2.2.3 Automatic positive airway pressure (APAP) devices

- 5.2.3 Adaptive servo-ventilation (ASV) devices

- 5.2.4 Oral appliances

- 5.2.4.1 Mandibular advancement devices

- 5.2.4.2 Tongue-retaining devices

- 5.2.4.3 Rapid maxillary expansion

- 5.2.4.4 Mouth guards

- 5.2.5 Other therapeutics

- 5.3 Diagnostics

- 5.3.1 Polysomnography (PSG) device

- 5.3.1.1 Ambulatory PSG devices

- 5.3.1.2 Clinical PSG devices

- 5.3.2 Actigraphy systems

- 5.3.3 Pulse oximeters

- 5.3.4 Home sleep testing (HST) devices

- 5.3.4.1 Type 2

- 5.3.4.2 Type 3

- 5.3.4.3 Type 4

- 5.3.5 Respiratory polygraph

- 5.3.1 Polysomnography (PSG) device

Chapter 6 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Home care settings and individuals

- 6.3 Sleep laboratories and hospitals

Chapter 7 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Spain

- 7.3.5 Italy

- 7.3.6 Netherlands

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Japan

- 7.4.3 India

- 7.4.4 Australia

- 7.4.5 South Korea

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.5.3 Argentina

- 7.6 Middle East and Africa

- 7.6.1 South Africa

- 7.6.2 Saudi Arabia

- 7.6.3 UAE

Chapter 8 Company Profiles

- 8.1 Asahi KASEI

- 8.2 BMC

- 8.3 Cadwell

- 8.4 Drive DeVilbiss

- 8.5 FISHER & PAYKEL

- 8.6 natus

- 8.7 NIHON KOHDEN

- 8.8 Philips

- 8.9 ResMed

- 8.10 Teleflex

- 8.11 WEINMANN

- 8.12 Glidewell

- 8.13 DynaFlex

- 8.14 SomnoMed

- 8.15 Apnea Sciences