|

市场调查报告书

商品编码

1833642

资料中心服务市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Data Center Services Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

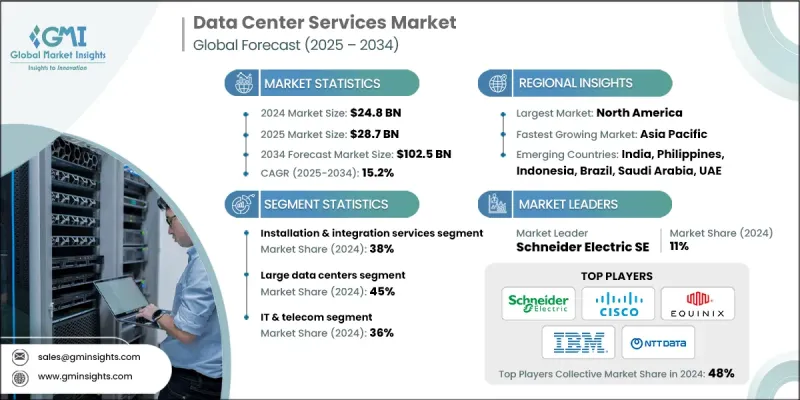

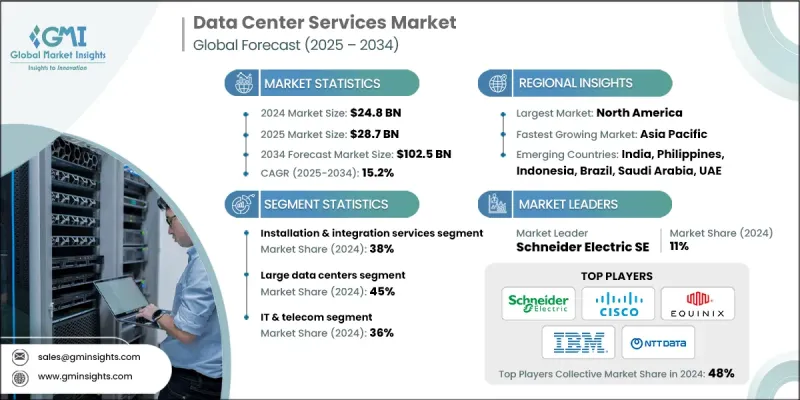

2024 年全球资料中心服务市场规模估计为 248 亿美元,预计年复合成长率为 15.2%,到 2034 年将达到 1,025 亿美元。

这一增长源于对云端运算和资料储存解决方案日益增长的需求。随着各行各业的公司越来越多地转向云端平台以获得可扩展性、敏捷性和成本节约,对可靠、高效能资料中心的需求也持续成长。这些设施构成了云端服务供应商的基础,使他们能够为客户提供可扩展且具弹性的数位解决方案。为了应对更严格的监管框架以及对网路威胁和资料外洩日益增强的认识,企业优先考虑采用具有强大安全协议、内建冗余且完全符合行业标准的资料中心。此外,对业务连续性、灾难復原和营运弹性的日益关注,也加速了对资料中心服务的需求,这些服务能够确保最长的正常运作时间、强大的故障转移功能以及安全的备份基础设施。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 248亿美元 |

| 预测值 | 1025亿美元 |

| 复合年增长率 | 15.2% |

安装和整合服务细分市场在2024年占据38%的份额,预计到2034年将以15%的复合年增长率成长。此细分市场对于部署超大规模基础架构、主机託管网站和企业级IT框架仍然至关重要。这些服务支援伺服器、电源系统、冷却机制和网路设备的无缝部署,同时确保与现有系统的兼容性。它们日益突出的原因是混合云端环境、人工智慧驱动的运算和高密度工作负载的日益普及,这些应用需要精确的配置和先进的整合技术。

2024年,大型资料中心市场占据45%的份额,预计2025年至2034年期间的复合年增长率将达到15.3%。这些设施是超大规模和主机託管部署的基石,提供无与伦比的容量、下一代冷却解决方案和高水准的互联互通。其基础设施旨在高效灵活地容纳人工智慧、企业工作负载和云端原生应用。对满足多租户需求的可扩展、高效能基础设施的需求不断增长,这进一步凸显了大型资料中心在全球数位转型策略中的重要性。

美国资料中心服务业占据全球85%的市场份额,2024年创造了77亿美元的市场规模。这一领先地位得益于超大规模云端营运商的广泛存在、强大的数位基础设施以及企业广泛采用的混合IT系统。人工智慧、边缘运算和数位孪生技术的创新正在重塑企业的营运方式,为先进的资料中心创造新的用例。 5G网路的扩展、向云端平台的加速迁移以及日益增长的网路安全需求,都在推动企业投资于安全、可扩展且效能优化的资料中心环境。

资料中心服务产业的主要参与者包括施耐德电气、伊顿、NTT Data、Digital Realty、IBM、思科系统、戴尔公司、Equinix、西门子和ABB。资料中心服务市场的领导者正在拥抱永续发展、数位自动化和策略性全球扩张,以提升市场占有率。企业正在建造节能和模组化设施,以满足环境法规并降低营运成本。人工智慧监控、远端管理和预测性维护的整合正在提高效能和正常运行时间。

目录

第一章:方法论

- 市场范围和定义

- 研究设计

- 研究方法

- 资料收集方法

- 资料探勘来源

- 全球的

- 地区/国家

- 基础估算与计算

- 基准年计算

- 市场评估的主要趋势

- 初步研究和验证

- 主要来源

- 预测模型

- 研究假设和局限性

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 利润率分析

- 成本结构

- 每个阶段的增值

- 影响价值链的因素

- 中断

- 产业衝击力

- 成长动力

- 云端运算解决方案的采用日益增多

- 对资料储存和处理能力的需求不断增加

- 企业数位转型措施不断涌现

- 边缘资料中心的部署日益增多

- 产业陷阱与挑战

- 初始设定成本高

- 安全和合规性问题

- 市场机会

- 越来越关注绿色和永续资料中心

- 人工智慧和自动化在资料中心营运中的整合度不断提高

- 5G 和物联网驱动的基础设施的采用率不断提高

- 扩大新兴经济体的机会

- 成长动力

- 监管格局

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 成长潜力分析

- 成本分解分析

- 波特的分析

- PESTEL分析

- 专利分析

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 技术创新和基础设施发展

- 下一代冷却技术

- 电力基础设施与能源管理

- 模组化和预製解决方案

- 软体定义的基础设施和自动化

- 网路安全与零信任架构

- 资料中心安全威胁情势

- 资料中心的零信任实施

- 合规与审计框架

- 成本优化和财务智能

- 总拥有成本(TCO)分析

- 电力成本智慧与最佳化

- 房地产和选址经济学

- 财务模型和定价策略

- 供应链风险管理与弹性

- 全球供应链脆弱性评估

- 供应链多角化策略

- 供应商关係管理

- 劳动发展和技能差距分析

- 技能短缺危机及影响评估

- 劳动力发展策略

- 自动化和人机协作

- 永续性和环境方面

- 永续实践

- 减少废弃物的策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考虑

第四章:竞争格局

- 介绍

- 公司市占率分析

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 多边环境协定

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 战略展望矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划和资金

第五章:市场估计与预测:按服务 2021 - 2032

- 主要趋势

- 安装和整合服务

- 培训服务

- 咨询服务

- 维护和支援

- 其他的

第六章:市场估计与预测:依资料中心规模,2021 - 2032 年

- 主要趋势

- 小型资料中心

- 中型资料中心

- 大型资料中心

第七章:市场估计与预测:按应用,2021 - 2032

- 主要趋势

- 金融服务业协会

- 主机託管

- 活力

- 政府

- 卫生保健

- 製造业

- IT和电信

- 其他的

第八章:市场估计与预测:依部署模式,2021 - 2034 年

- 主要趋势

- 本地

- 云

- 杂交种

第九章:市场估计与预测:依层级,2021 - 2034

- 主要趋势

- 第 1 层

- 第 2 层

- 第 3 层

- 第 4 层

第 10 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 菲律宾

- 印尼

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 多边环境协定

- 南非

- 沙乌地阿拉伯

- 阿联酋

第 11 章:公司简介

- 全球参与者

- ABB

- Amazon Web Services

- Cisco Systems

- Dell

- DXC

- Equinix

- Eaton

- Fujitsu

- HCL

- Hewlett-Packard Enterprise (HPE)

- Hitachi

- Huawei Technologies

- IBM

- Microsoft

- NTT

- Schneider Electric

- Siemens

- Vertiv

- 区域参与者

- AirTrunk

- AtlasEdge

- CoreSite Realty

- Iron Mountain Data Centers

- Keppel Data Centre

- NEXTDC

- Switch

- 新兴玩家

- Applied Digital

- CoreWeave

- Crusoe Energy Systems

- Vapor IO

The Global Data Center Services Market was estimated at USD 24.8 billion in 2024 and is estimated to grow at a CAGR of 15.2% to reach USD 102.5 billion by 2034.

The growth is driven by the increasing demand for cloud computing and data storage solutions. As companies in diverse sectors increasingly shift to cloud-based platforms to gain scalability, agility, and cost savings, the demand for dependable, high-performing data centers continues to rise. These facilities form the foundation for cloud service providers, allowing them to deliver scalable and resilient digital solutions to their customers. In response to stricter regulatory frameworks and heightened awareness around cyber threats and data breaches, organizations are prioritizing data centers that incorporate robust security protocols, built-in redundancy, and full compliance with industry standards. Additionally, the growing focus on business continuity, disaster recovery, and operational resilience is accelerating the need for data center services that ensure maximum uptime, strong failover capabilities, and secure backup infrastructure.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $24.8 Billion |

| Forecast Value | $102.5 Billion |

| CAGR | 15.2% |

The installation and integration services segment held a 38% share in 2024 and is projected to grow at a CAGR of 15% through 2034. This segment remains critical for deploying hyperscale infrastructures, colocation sites, and enterprise-grade IT frameworks. These services enable seamless deployment of servers, power systems, cooling mechanisms, and networking equipment while ensuring compatibility with existing systems. Their growing prominence is attributed to the rising adoption of hybrid cloud environments, AI-driven computing, and high-density workloads, which demand precise configuration and advanced integration techniques.

In 2024, the large data centers segment held a 45% share and is anticipated to grow at a CAGR of 15.3% between 2025 and 2034. These facilities act as the cornerstone for hyperscale and colocation deployments, providing unparalleled capacity, next-gen cooling solutions, and high-level interconnectivity. Their infrastructure is designed to accommodate AI, enterprise workloads, and cloud-native applications with efficiency and flexibility. Rising demand for scalable, high-performance infrastructure that meets multi-tenant requirements is reinforcing the importance of large data centers in global digital transformation strategies.

United States Data Center Services Industry held an 85% share and generated USD 7.7 billion in 2024. This leadership is driven by the widespread presence of hyperscale cloud operators, robust digital infrastructure, and widespread adoption of hybrid IT systems across enterprises. Innovation in artificial intelligence, edge computing, and digital twin technologies is reshaping the way businesses operate, creating new use cases for advanced data centers. The expansion of 5G networks, accelerated migration to cloud platforms, and rising cybersecurity demands are all pushing organizations to invest in secure, scalable, and performance-optimized data center environments.

Major players operating in the data center services industry include Schneider Electric, Eaton, NTT Data, Digital Realty, IBM, Cisco Systems, Dell Inc., Equinix, Siemens, and ABB. Leading players in the data center services market are embracing sustainability, digital automation, and strategic global expansion to boost market presence. Companies are building energy-efficient and modular facilities to meet environmental regulations and reduce operating costs. Integration of AI-powered monitoring, remote management, and predictive maintenance is enhancing performance and uptime.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Service

- 2.2.3 Data center size

- 2.2.4 Application

- 2.2.5 Deployment mode

- 2.2.6 Tier

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing adoption of cloud computing solutions

- 3.2.1.2 Increasing demand for data storage and processing capacity

- 3.2.1.3 Rising digital transformation initiatives across enterprises

- 3.2.1.4 Growing deployment of edge data centers

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High initial setup costs

- 3.2.2.2 Security and compliance concerns

- 3.2.3 Market opportunities

- 3.2.3.1 Growing focus on green and sustainable data centers

- 3.2.3.2 Increasing integration of AI and automation in data center operations

- 3.2.3.3 Rising adoption of 5G and IoT-driven infrastructure

- 3.2.3.4 Expanding opportunities in emerging economies

- 3.2.1 Growth drivers

- 3.3 Regulatory landscape

- 3.3.1 North America

- 3.3.2 Europe

- 3.3.3 Asia Pacific

- 3.3.4 Latin America

- 3.3.5 Middle East & Africa

- 3.4 Growth potential analysis

- 3.5 Cost breakdown analysis

- 3.6 Porter's analysis

- 3.7 PESTEL analysis

- 3.8 Patent analysis

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.9.3 Technology innovation and infrastructure evolution

- 3.9.3.1 Next-generation cooling technologies

- 3.9.3.2 Power infrastructure and energy management

- 3.9.3.3 Modular and prefabricated solutions

- 3.9.3.4 Software-defined infrastructure and automation

- 3.10 Cybersecurity and zero trust architecture

- 3.10.1 Data center security threat landscape

- 3.10.2 Zero trust implementation in data centers

- 3.10.3 Compliance and audit framework

- 3.11 Cost optimization and financial intelligence

- 3.11.1 Total cost of ownership (TCO) analysis

- 3.11.2 Power cost intelligence and optimization

- 3.11.3 Real estate and site selection economics

- 3.11.4 Financial models and pricing strategies

- 3.12 Supply chain risk management and resilience

- 3.12.1 Global supply chain vulnerability assessment

- 3.12.2 Supply chain diversification strategies

- 3.12.3 Vendor relationship management

- 3.13 Workforce development and skills gap analysis

- 3.13.1 Skills shortage crisis and impact assessment

- 3.13.2 Workforce development strategies

- 3.13.3 Automation and human-AI collaboration

- 3.14 Sustainability and environmental aspects

- 3.14.1 Sustainable practices

- 3.14.2 Waste reduction strategies

- 3.14.3 Energy efficiency in production

- 3.14.4 Eco-friendly initiatives

- 3.14.5 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Service 2021 - 2032 (USD Billion)

- 5.1 Key trends

- 5.2 Installation & integration services

- 5.3 Training services

- 5.4 Consulting services

- 5.5 Maintenance and support

- 5.6 Others

Chapter 6 Market Estimates & Forecast, By Data Center Size, 2021 - 2032 (USD Billion)

- 6.1 Key trends

- 6.2 Small data centers

- 6.3 Medium data centers

- 6.4 Large data centers

Chapter 7 Market Estimates & Forecast, By Application, 2021 - 2032 (USD Billion)

- 7.1 Key trends

- 7.2 BFSI

- 7.3 Colocation

- 7.4 Energy

- 7.5 Government

- 7.6 Healthcare

- 7.7 Manufacturing

- 7.8 IT & telecom

- 7.9 Others

Chapter 8 Market Estimates & Forecast, By Deployment Mode, 2021 - 2034 ($Bn)

- 8.1 Key trends

- 8.2 On-premises

- 8.3 Cloud

- 8.4 Hybrid

Chapter 9 Market Estimates & Forecast, By Tier, 2021 - 2034 ($Bn)

- 9.1 Key trends

- 9.2 Tier 1

- 9.3 Tier 2

- 9.4 Tier 3

- 9.5 Tier 4

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 US

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Philippines

- 10.4.7 Indonesia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Global Players

- 11.1.1 ABB

- 11.1.2 Amazon Web Services

- 11.1.3 Cisco Systems

- 11.1.4 Dell

- 11.1.5 DXC

- 11.1.6 Equinix

- 11.1.7 Eaton

- 11.1.8 Fujitsu

- 11.1.9 Google

- 11.1.10 HCL

- 11.1.11 Hewlett-Packard Enterprise (HPE)

- 11.1.12 Hitachi

- 11.1.13 Huawei Technologies

- 11.1.14 IBM

- 11.1.15 Microsoft

- 11.1.16 NTT

- 11.1.17 Schneider Electric

- 11.1.18 Siemens

- 11.1.19 Vertiv

- 11.2 Regional Players

- 11.2.1 AirTrunk

- 11.2.2 AtlasEdge

- 11.2.3 CoreSite Realty

- 11.2.4 Iron Mountain Data Centers

- 11.2.5 Keppel Data Centre

- 11.2.6 NEXTDC

- 11.2.7 Switch

- 11.3 Emerging Players

- 11.3.1 Applied Digital

- 11.3.2 CoreWeave

- 11.3.3 Crusoe Energy Systems

- 11.3.4 Vapor IO