|

市场调查报告书

商品编码

1833648

成人失禁产品市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Adult Incontinence Products Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

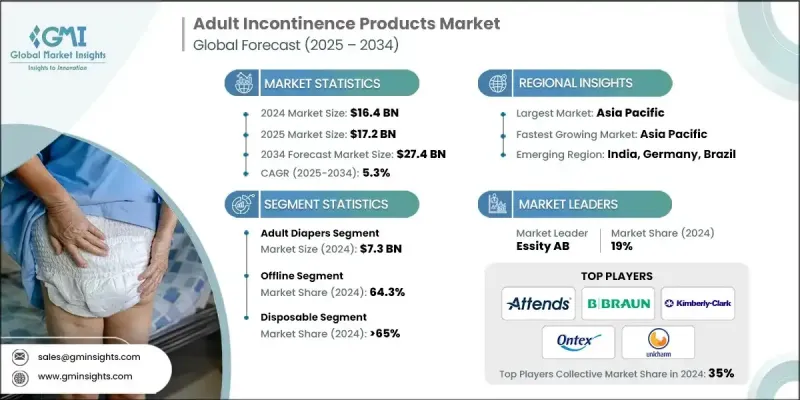

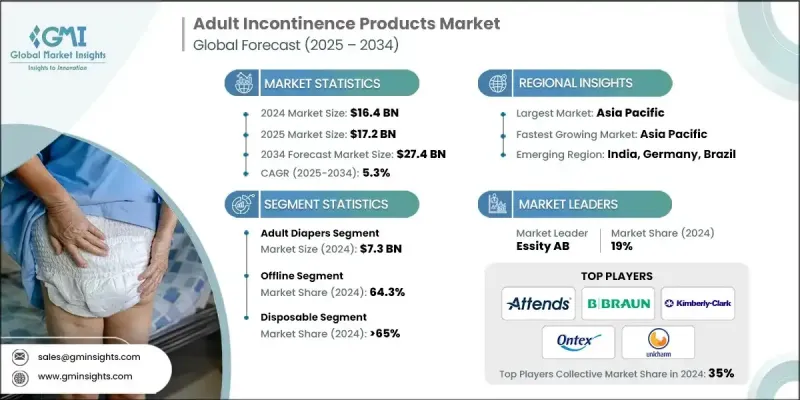

2024 年全球成人失禁产品市场价值为 164 亿美元,预计到 2034 年将以 5.3% 的复合年增长率增长至 274 亿美元。

老年人口的成长,尤其是在已开发国家,是主要驱动因素。随着年龄的增长,尿失禁和大便失禁等疾病的盛行率也会上升,导致成人纸尿裤、护垫和防护内衣的需求增加。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 164亿美元 |

| 预测值 | 274亿美元 |

| 复合年增长率 | 5.3% |

成人纸尿裤使用率上升

成人纸尿裤市场在2024年占据了相当大的份额,这得益于其在医疗机构和居家护理环境中的广泛应用。这些产品旨在缓解中度至重度失禁,并提供增强的吸收性、防漏性和舒适性。随着老龄化人口需求的增长,製造商正在创新,采用更薄的材料、气味控制技术和性别特定的设计,以提高用户的信心和判断力。

线下需求不断成长

2024年,在数位化程度较低或消费者更倾向于实体零售购买个人卫生用品的地区,线下市场实现了可持续的收入。药局、超市和专卖店让顾客可以直接购买产品、获得面对面咨询并即时比较品牌。为了获得优势,领先的公司专注于店内教育、产品试用和策略性货架摆放。许多公司也与零售商合作,提供忠诚度计画和捆绑优惠,从而提升品牌在线下零售生态系统中的知名度和復购率。

一次性用品将获得青睐

2024年,一次性用品凭藉其便利性、卫生性和日常适用性占据了相当大的市场份额。这类产品包括一次性设计的成人纸尿裤、护垫和拉拉裤,非常适合家庭护理和机构环境。一次性用品易于丢弃,吸收性更强,且采用亲肤材质,因此深受照护者和使用者的青睐。

亚太地区将成为利润丰厚的地区

受人口快速老化、预期寿命延长以及医疗保健覆盖范围扩大的推动,亚太地区成人失禁产品市场将在2025-2034年期间实现可观的复合年增长率。日本、中国和韩国等国家的需求正在激增,这不仅来自养老机构,也来自日益壮大的老年人群体,他们寻求谨慎可靠的解决方案。

成人失禁产品市场的主要参与者有康维特、金佰利、NorthShore Care Supply、Abena、Attends Healthcare、宝洁、B. Braun Melsungen、Hollister、Hayat Kimya、尤妮佳、Ontex、First Quality Enterprises、Nobel Hygiene、Cardinal Health 和 Essity。

为了巩固其在成人失禁产品市场的地位,各公司正在采取一系列产品创新、精准行销和扩大分销管道的策略。许多公司专注于超薄、高吸收性材料,以提供隐藏的保护,同时开发环保的一次性产品,以吸引註重永续发展的消费者。数位转型是另一个核心策略,各品牌正在提升电商影响力,提供订阅服务,并利用资料分析来个人化产品推荐。

目录

第一章:方法论与范围

第 2 章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 利润率

- 每个阶段的增值

- 影响价值链的因素

- 产业衝击力

- 成长动力

- 人口老化

- 慢性健康状况增加

- 改善医疗保健服务

- 产业陷阱与挑战

- 监理合规性

- 环境影响

- 机会

- 电子商务扩张

- 环保产品开发创新

- 成长动力

- 成长潜力分析

- 未来市场趋势

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 依产品类型

- 监管格局

- 标准和合规性要求

- 区域监理框架

- 认证标准

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:依产品类型,2021 - 2034 年

- 主要趋势

- 成人纸尿裤

- 防护内衣

- 护垫和衬垫

- 其他的

第六章:市场估计与预测:依消费者群体划分,2021 年至 2034 年

- 主要趋势

- 男性

- 女性

- 男女通用的

第七章:市场估计与预测:按年龄组,2021 - 2034 年

- 主要趋势

- 年轻人(20-39岁)

- 中年人(40-64岁)

- 老年人(65岁以上)

第八章:市场估计与预测:按类别,2021 - 2034

- 主要趋势

- 可重复使用的

- 一次性的

第九章:市场估计与预测:按规模,2021 - 2034

- 主要趋势

- 小的

- 中等的

- 大的

- 特大号

第十章:市场估计与预测:按价格,2021 - 2034 年

- 主要趋势

- 低的

- 中等的

- 高的

第 11 章:市场估计与预测:按配销通路,2021 年至 2034 年

- 主要趋势

- 离线

- 超市和大卖场

- 药局

- 其他的

- 在线的

- 电子商务

- 品牌网站

第 12 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十三章:公司简介

- Abena

- Attends Healthcare

- B. Braun Melsungen

- Cardinal Health

- ConvaTec

- Essity

- First Quality Enterprises

- Hayat Kimya

- Hollister

- Kimberly Clark

- Nobel Hygiene

- NorthShore Care Supply

- Ontex

- Procter & Gamble

- Unicharm

The Global Adult Incontinence Products Market was valued at USD 16.4 billion in 2024 and is estimated to grow at a CAGR of 5.3% to reach USD 27.4 billion by 2034.

The rise in the elderly population, particularly in developed countries, is a primary driver. As people age, the prevalence of conditions like urinary and fecal incontinence increases, leading to higher demand for adult diapers, pads, and protective underwear.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $16.4 Billion |

| Forecast Value | $27.4 Billion |

| CAGR | 5.3% |

Rising Adoption of Adult Diapers

The adult diaper segment held a significant share in 2024, driven by its wide usage across both healthcare facilities and at-home care environments. These products are designed to manage moderate to severe incontinence and offer enhanced absorbency, leak protection, and comfort for users. With growing demand from the aging population, manufacturers are innovating with thinner materials, odor control technology, and gender-specific designs to improve user confidence and discretion.

Increasing Demand in Offline

The offline segment generated sustainable revenues in 2024, in regions with limited digital adoption or where consumers prefer physical retail for personal hygiene purchases. Pharmacies, supermarkets, and specialty stores allow customers to access products directly, receive in-person advice, and compare brands in real time. To gain an edge, leading companies are focusing on in-store education, product sampling, and strategic shelf placements. Many also work with retailers to offer loyalty programs and bundle deals, boosting both brand visibility and repeat purchases within the offline retail ecosystem.

Disposables to Gain Traction

The disposable segment held a sizeable share in 2024 owing to its convenience, hygiene benefits, and suitability for daily use. Products in this category include adult diapers, pads, and pull-ups designed for one-time use, making them ideal for both home care and institutional environments. The ease of disposal, along with improved absorbency and skin-friendly materials, makes disposable options highly favored among caregivers and users alike.

Asia Pacific to Emerge as a Lucrative Region

Asia Pacific adult incontinence products market will grow at a decent CAGR during 2025-2034, fueled by a rapidly aging population, increasing life expectancy, and expanding access to healthcare. Countries like Japan, China, and South Korea are seeing a surge in demand, not only from elder care facilities but also from a growing base of active seniors seeking discreet and reliable solutions.

Major players in the adult incontinence products market are ConvaTec, Kimberly-Clark, NorthShore Care Supply, Abena, Attends Healthcare, Procter & Gamble, B. Braun Melsungen, Hollister, Hayat Kimya, Unicharm, Ontex, First Quality Enterprises, Nobel Hygiene, Cardinal Health, and Essity.

To strengthen their position in the adult incontinence products market, companies are embracing a mix of product innovation, targeted marketing, and expanded distribution. Many are focusing on ultra-thin, high-absorbency materials that offer discreet protection, while also developing eco-conscious disposable options to appeal to sustainability-minded consumers. Digital transformation is another core strategy, with brands enhancing their e-commerce presence, offering subscription services, and using data analytics to personalize product recommendations.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 Consumer group

- 2.2.4 Age group

- 2.2.5 Category

- 2.2.6 Size

- 2.2.7 Price

- 2.2.8 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Aging population

- 3.2.1.2 Increase in chronic health conditions

- 3.2.1.3 Improved healthcare access

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Regulatory compliance

- 3.2.2.2 Environmental impact

- 3.2.3 Opportunities

- 3.2.3.1 E-commerce expansion

- 3.2.3.2 Innovations in development of eco-friendly products

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By product type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Adult diapers

- 5.3 Protective underwear

- 5.4 Pads & liners

- 5.5 Others

Chapter 6 Market Estimates and Forecast, By Consumer Group, 2021 - 2034 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Male

- 6.3 Female

- 6.4 Unisex

Chapter 7 Market Estimates and Forecast, By Age Group, 2021 - 2034 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Young adults (20-39)

- 7.3 Middle-aged adults (40-64)

- 7.4 Senior (65 & above)

Chapter 8 Market Estimates and Forecast, By Category, 2021 - 2034 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Reusable

- 8.3 Disposable

Chapter 9 Market Estimates and Forecast, By Size, 2021 - 2034 (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 Small

- 9.3 Medium

- 9.4 Large

- 9.5 Extra large

Chapter 10 Market Estimates and Forecast, By Price, 2021 - 2034 (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 Low

- 10.3 Medium

- 10.4 High

Chapter 11 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 (USD Billion) (Thousand Units)

- 11.1 Key trends

- 11.2 Offline

- 11.2.1 Supermarkets & hypermarkets

- 11.2.2 Pharmacies

- 11.2.3 Others

- 11.3 Online

- 11.3.1 E-commerce

- 11.3.2 Brand websites

Chapter 12 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion) (Thousand Units)

- 12.1 Key trends

- 12.2 North America

- 12.2.1 U.S.

- 12.2.2 Canada

- 12.3 Europe

- 12.3.1 Germany

- 12.3.2 UK

- 12.3.3 France

- 12.3.4 Italy

- 12.3.5 Spain

- 12.4 Asia Pacific

- 12.4.1 China

- 12.4.2 Japan

- 12.4.3 India

- 12.4.4 Australia

- 12.4.5 South Korea

- 12.5 Latin America

- 12.5.1 Brazil

- 12.5.2 Mexico

- 12.5.3 Argentina

- 12.6 Middle East and Africa

- 12.6.1 South Africa

- 12.6.2 Saudi Arabia

- 12.6.3 UAE

Chapter 13 Company Profiles

- 13.1 Abena

- 13.2 Attends Healthcare

- 13.3 B. Braun Melsungen

- 13.4 Cardinal Health

- 13.5 ConvaTec

- 13.6 Essity

- 13.7 First Quality Enterprises

- 13.8 Hayat Kimya

- 13.9 Hollister

- 13.10 Kimberly Clark

- 13.11 Nobel Hygiene

- 13.12 NorthShore Care Supply

- 13.13 Ontex

- 13.14 Procter & Gamble

- 13.15 Unicharm