|

市场调查报告书

商品编码

1833650

自卸卡车市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Dump Truck Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

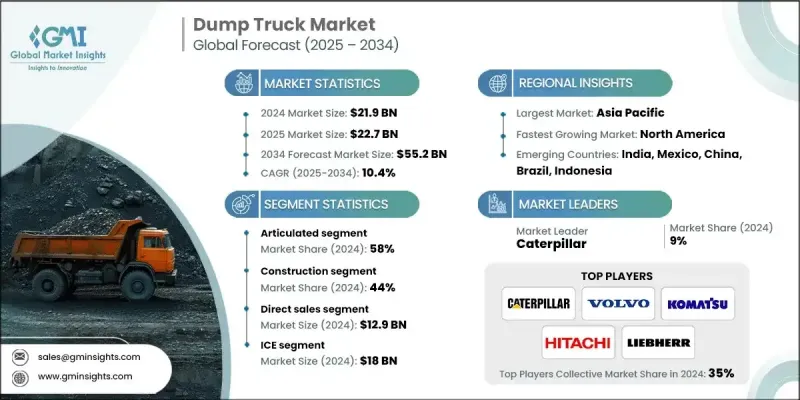

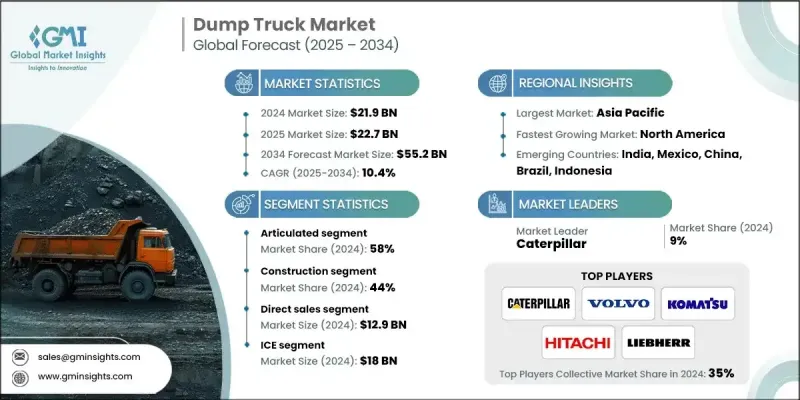

2024 年全球自卸卡车市场价值为 219 亿美元,预计将以 10.4% 的复合年增长率成长,到 2034 年达到 552 亿美元。

受人们对电气化和自动驾驶技术日益增长的兴趣推动,该行业正在经历一场变革性的转变。製造商面临的减排和提高能源效率的压力日益增大,这推动了电动自卸卡车的发展。同时,自动化技术也日益普及,其技术可减少操作失误、降低成本,并实现远端控製或完全自动驾驶车队营运。这些进步正在重塑传统的营运模式,为更清洁、更智慧、更经济高效的运输解决方案铺路。儘管该行业曾经在线性供应链和传统工作流程下运营,但在新冠疫情之后,情况发生了显着变化。此前,该行业以稳步成长和最小中断为特征,如今,市场正在应对卫生、物流和员工互动方面的挑战,推动数位转型、车辆功能创新和永续生产的需求。不断发展的生态系统需要更敏捷的方法,迫使製造商从传统的设计和生产模式转向以技术为驱动的整合式商业模式,以解决安全性、永续性和生产力问题。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 219亿美元 |

| 预测值 | 552亿美元 |

| 复合年增长率 | 10.4% |

2024年,铰接式自卸卡车市场占据58%的市场份额,预计2025年至2034年期间的复合年增长率将达到11%。铰接式卡车的有效载荷能力和越野性能正在不断提升。随着对能够承载更大载重量并能在崎岖不平路面上保持灵活性的卡车的需求不断增长,製造商正在大力投资设计创新。增强型传动系统、底盘改装和改进的悬吊系统正在实施,以满足在恶劣条件下对稳定性、适应性和更高燃油经济性的需求。随着基础设施项目日益复杂且环境日益严峻,铰接式卡车提供了高效运输物料的理想解决方案,同时最大限度地提高了安全性和耐用性。

建筑业在2024年占据了44%的市场份额,预计到2034年将以11.7%的复合年增长率成长。建筑业对高度专业化的自卸卡车的需求日益增长,这正在重塑产品开发。製造商正专注于打造能够满足各种建筑需求的车型,从适合城市发展的紧凑型车型到专为大型基础设施项目设计的大型越野车型。随着应用范围的不断扩大,企业越来越重视多功能性、燃油效率以及与远端资讯处理和负载监控系统的整合。随着建筑公司寻求针对特定任务和环境量身定制的设备,对客製化高性能自卸卡车的需求持续激增。

中国自卸卡车市场占45%的市场份额,2024年市场规模达42亿美元。中国积极推动扩大采矿业务,并扩大国内煤炭产量以减少对进口的依赖,这导致对大容量自卸卡车的需求持续成长。中国在全球钢铁製造业的主导地位以及在稀土金属生产中的主导地位(控制全球大部分产量)进一步加速了对强大自卸卡车车队的需求。为了支持这些产业,中国加大了对耐用重型车辆的投资,这些车辆能够长时间维持大容量作业,尤其是在具有挑战性的地形条件下。

引领全球自卸卡车市场的领导企业包括日立、别拉斯、沃尔沃、斯堪尼亚、康明斯、三一、派克汉尼汾、卡特彼勒、利勃海尔和小松。自卸卡车产业的顶尖企业正积极专注于创新、产品多元化和区域市场渗透,以增强其竞争地位。许多企业正透过开发电池驱动和混合动力车型,朝向电气化迈进,以满足全球排放标准。各公司也正在整合数位工具,包括GPS追踪、自动装载系统和车队管理软体,以提高营运效率。与当地经销商和基础设施公司的策略合作有助于提升品牌在新兴市场的知名度和客户忠诚度。

目录

第一章:方法论与范围

第 2 章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 原物料供应商

- 製造商

- 经销商

- 最终用途

- 成本结构

- 利润率

- 每个阶段的增值

- 影响供应链的因素

- 破坏者

- 供应商格局

- 对部队的影响

- 成长动力

- 基础设施扩张刺激自卸卡车需求

- 技术进步提高了自卸卡车的效率和安全性

- 政府对交通基础设施的投资刺激了需求

- 采矿业的成长推动了自卸卡车的销售

- 产业陷阱与挑战

- 经济衰退减少了建筑和采矿活动

- 严格的排放法规增加了製造成本

- 市场机会

- 电动和混合动力自卸卡车的普及率不断上升

- 智慧车队管理和远端资讯处理集成

- 成长动力

- 技术趋势与创新生态系统

- 现有技术

- 自主系统开发与实施路线图

- 电动和混合动力系统的演变和市场采用

- 远端资讯处理及物联网整合进展及资料分析

- 预测性维护和人工智慧应用开发

- 新兴技术

- 网路安全解决方案与连接设备保护

- 区块链整合和供应链透明度

- 扩增实境和虚拟培训系统开发

- 5G连线与即时资料处理应用

- 现有技术

- 监管格局

- 全球排放标准与环境法规

- 采矿安全法规和 MSHA 合规性

- 自动驾驶汽车法规和标准

- 国际贸易和关税影响

- 网路安全法规和资料保护

- 售后服务及支援生态系统

- 零件售后市场分析

- 维护和维修服务市场

- 培训和认证项目市场

- 数位服务和软体解决方案

- 融资租赁市场分析

- 设备融资市场动态

- 设备租赁市场分析

- 租赁市场和短期解决方案

- 替代融资解决方案

- 成长潜力分析

- 波特的分析

- PESTEL分析

- 永续性和环境方面

- 环境影响评估与生命週期分析

- 社会影响力和社区关係

- 治理与企业责任

- 永续技术发展

第四章:竞争格局

- 介绍

- 公司市占率分析

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 竞争定位矩阵

- 战略展望矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划和资金

第五章:市场估计与预测:依产品,2021 - 2034

- 主要趋势

- 铰接式

- 50公吨以下

- 50公吨及以上

- 死板的

- 50公吨以下

- 50至100公吨

- 101 - 150公吨

- 151 - 200公吨

- 201 - 250公吨

- 251 - 300公吨

- 300公吨以上

第六章:市场估计与预测:依驱动配置,2021 - 2034 年

- 主要趋势

- 前轮驱动(FWD)

- 后轮驱动(RWD)

- 全轮驱动(AWD)

第七章:市场估计与预测:按推进方式,2021 - 2034 年

- 主要趋势

- 冰

- 电的

- 杂交种

第 8 章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 矿业

- 建造

- 其他的

第九章:市场估计与预测:按分销管道,2021 - 2034 年

- 主要趋势

- 直销

- 分销商/经销商

第 10 章:市场估计与预测:按地区,2021 年至 2034 年

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 比利时

- 荷兰

- 瑞典

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 新加坡

- 韩国

- 越南

- 印尼

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 多边环境协定

- 南非

- 沙乌地阿拉伯

- 阿联酋

第 11 章:公司简介

- 全球参与者

- Caterpillar

- Komatsu

- Liebherr

- Hitachi

- Volvo

- Scania

- Cummins

- Parker Hannifin

- Regional Champions

- John Deere

- SANY

- BelAZ

- XCMG

- Doosan Infracore

- Hyundai Construction Equipment

- Bell Equipment

- MAN Truck & Bus

- Terex

- Tadano

- 新兴企业和科技颠覆者

- Autonomous Solutions (ASI)

- Modular Mining Systems

- Epiroc

- Sandvik Mining & Rock Solutions

- Kuhn Schweiz

- Allison Transmission

- Rio Tinto Technology & Innovation

The Global Dump Truck Market was valued at USD 21.9 billion in 2024 and is estimated to grow at a CAGR of 10.4% to reach USD 55.2 billion by 2034.

The industry is undergoing a transformative shift fueled by growing interest in electrification and autonomous technologies. Rising pressure on manufacturers to reduce emissions and improve energy efficiency is pushing the development of electric dump trucks. At the same time, automation is gaining ground, with technologies that reduce operational errors, lower costs, and enable remote-controlled or fully autonomous fleet operations. These advances are reshaping traditional operating models, making way for cleaner, more intelligent, and cost-efficient transport solutions. While the industry once operated under linear supply chains and conventional workflows, the landscape shifted significantly after the COVID-19 pandemic. Previously marked by steady, incremental growth and minimal disruption, the market now responds to challenges in health, logistics, and workforce interaction, driving the need for digital transformation, innovation in vehicle functionality, and sustainable production. The evolving ecosystem demands a more agile approach, compelling manufacturers to shift from traditional design and production toward integrated, technology-driven business models that address safety, sustainability, and productivity.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $21.9 Billion |

| Forecast Value | $55.2 billion |

| CAGR | 10.4% |

The articulated dump truck segment held a 58% share in 2024 and is expected to grow at a CAGR of 11% between 2025 and 2034. Articulated trucks are seeing continuous upgrades in payload capacity and off-road performance. With demand rising for trucks that can handle larger loads while maintaining flexibility across rugged and uneven surfaces, manufacturers are heavily investing in design innovation. Enhanced drivetrains, chassis modifications, and improved suspension systems are being implemented to accommodate the need for stability, adaptability, and better fuel economy under tough conditions. As infrastructure projects become more complex and are in challenging environments, articulated trucks offer the ideal solution for moving materials efficiently while maximizing safety and durability.

The construction segment held a 44% share in 2024 and is forecasted to grow at a CAGR of 11.7% through 2034. The construction industry's growing demand for highly specialized dump trucks is reshaping product development. Manufacturers are focusing on building models that address a wide range of construction needs, from compact units suited for urban developments to large-scale off-road models designed for expansive infrastructure projects. With the increasing variety of applications, companies are prioritizing versatility, fuel efficiency, and integration with telematics and load monitoring systems. As construction firms look for equipment tailored to specific tasks and environments, the demand for customized and high-performance dump trucks continues to surge.

China Dump Truck Market held a 45% share and generated USD 4.2 billion in 2024. China's aggressive push to expand its mining operations and scale domestic coal production to reduce import dependence has led to consistent demand for high-capacity dump trucks. The country's dominance in global steel manufacturing and its commanding role in rare earth metals production, where it controls most global output, have further accelerated the requirement for robust dump truck fleets. To support these industries, there has been increased investment in durable and heavy-duty vehicles capable of sustaining high-volume operations over prolonged periods, especially in challenging terrain.

Leading companies shaping the Global Dump Truck Market include Hitachi, BelAZ, Volvo, Scania, Cummins, SANY, Parker Hannifin, Caterpillar, Liebherr, and Komatsu. Top players in the dump truck industry are actively focusing on innovation, product diversification, and regional market penetration to strengthen their competitive position. Many are advancing toward electrification by developing battery-powered and hybrid models to meet global emission standards. Companies are also integrating digital tools, including GPS tracking, automated loading systems, and fleet management software, to enhance operational efficiency. Strategic collaborations with local distributors and infrastructure firms help increase brand presence and customer loyalty in emerging markets.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.1.3 Base estimates and calculations

- 1.1.4 Base year calculation

- 1.1.5 Key trends for market estimates

- 1.2 Forecast model

- 1.3 Primary research and validation

- 1.4 Some of the primary sources (but not limited to)

- 1.5 Data mining sources

- 1.5.1 Secondary

- 1.5.1.1 Paid Sources

- 1.5.1.2 Public Sources

- 1.5.1.3 Sources, by region

- 1.5.1 Secondary

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 Drive Configuration

- 2.2.4 Propulsion

- 2.2.5 Application

- 2.2.6 Distribution Channels

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Key decision points for industry executives

- 2.4.2 Critical success factors for market players

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.1.1 Raw material providers

- 3.1.1.2 Manufacturer

- 3.1.1.3 Distributor

- 3.1.1.4 End use

- 3.1.2 Cost structure

- 3.1.3 Profit margin

- 3.1.4 Value addition at each stage

- 3.1.5 Factors impacting the supply chain

- 3.1.6 Disruptors

- 3.1.1 Supplier landscape

- 3.2 Impact on forces

- 3.2.1 Growth drivers

- 3.2.1.1 Infrastructure expansion fuels demand for dump trucks

- 3.2.1.2 Technological advancements enhance dump truck efficiency and safety

- 3.2.1.3 Government investments in transportation infrastructure spur demand

- 3.2.1.4 Mining sector growth boosts dump truck sales

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Economic downturns reduce construction and mining activities

- 3.2.2.2 Stringent emissions regulations increase manufacturing costs

- 3.2.3 Market opportunities

- 3.2.3.1 Rising adoption of electric and hybrid dump trucks

- 3.2.3.2 Smart fleet management and telematics integration

- 3.2.1 Growth drivers

- 3.3 Technology Trends & Innovation Ecosystem

- 3.3.1 Current technologies

- 3.3.1.1 Autonomous systems development & implementation roadmap

- 3.3.1.2 Electric & hybrid powertrain evolution & market adoption

- 3.3.1.3 Telematics & IoT integration advances & data analytics

- 3.3.1.4 Predictive maintenance & AI applications development

- 3.3.2 Emerging technologies

- 3.3.2.1 Cybersecurity solutions & connected equipment protection

- 3.3.2.2 Blockchain integration & supply chain transparency

- 3.3.2.3 Augmented reality & virtual training system development

- 3.3.2.4 5G connectivity & real-time data processing applications

- 3.3.1 Current technologies

- 3.4 Regulatory landscape

- 3.4.1 Global emissions standards & environmental regulations

- 3.4.2 Mining safety regulations & MSHA compliance

- 3.4.3 Autonomous vehicle regulations & standards

- 3.4.4 International trade & tariff implications

- 3.4.5 Cybersecurity regulations & data protection

- 3.5 Aftermarket services & support ecosystem

- 3.5.1 Parts & components aftermarket analysis

- 3.5.2 Maintenance & repair services market

- 3.5.3 Training & certification programs market

- 3.5.4 Digital services & software solutions

- 3.6 Financing & leasing market analysis

- 3.6.1 Equipment financing market dynamics

- 3.6.2 Equipment leasing market analysis

- 3.6.3 Rental market & short-term solutions

- 3.6.4 Alternative financing solutions

- 3.7 Growth potential analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

- 3.10 Sustainability and environmental aspects

- 3.10.1 Environmental impact assessment & lifecycle analysis

- 3.10.2 Social impact & community relations

- 3.10.3 Governance & corporate responsibility

- 3.10.4 Sustainable technological development

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Latin America

- 4.2.5 Middle East & Africa

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

- 4.5 Key developments

- 4.5.1 Mergers & acquisitions

- 4.5.2 Partnerships & collaborations

- 4.5.3 New product launches

- 4.5.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Product, 2021 - 2034 ($ Bn & Units)

- 5.1 Key trends

- 5.2 Articulated

- 5.2.1 Below 50 Metric Tons

- 5.2.2 50 Metric Tons and above

- 5.3 Rigid

- 5.3.1 Below 50 metric tons

- 5.3.2 50 to 100 metric tons

- 5.3.3 101 - 150 metric tons

- 5.3.4 151 - 200 metric tons

- 5.3.5 201 - 250 metric tons

- 5.3.6 251 - 300 metric tons

- 5.3.7 Above 300 metric tons

Chapter 6 Market Estimates & Forecast, By Drive Configuration, 2021 - 2034 ($ Bn & Units)

- 6.1 Key trends

- 6.2 Front-wheel drive (FWD)

- 6.3 Rear-wheel drive (RWD)

- 6.4 All-wheel drive (AWD)

Chapter 7 Market Estimates & Forecast, By Propulsion, 2021 - 2034 ($ Bn & Units)

- 7.1 Key trends

- 7.2 ICE

- 7.3 Electric

- 7.4 Hybrid

Chapter 8 Market Estimates & Forecast, By Application, 2021 - 2034 ($ Bn & Units)

- 8.1 Key trends

- 8.2 Mining

- 8.3 Construction

- 8.4 Others

Chapter 9 Market Estimates & Forecast, By Distribution Channels, 2021 - 2034 ($ Bn & Units)

- 9.1 Key trends

- 9.2 Direct Sales

- 9.3 Distributors/Dealers

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($ Bn & Units)

- 10.1 North America

- 10.1.1 US

- 10.1.2 Canada

- 10.2 Europe

- 10.2.1 UK

- 10.2.2 Germany

- 10.2.3 France

- 10.2.4 Italy

- 10.2.5 Spain

- 10.2.6 Belgium

- 10.2.7 Netherlands

- 10.2.8 Sweden

- 10.3 Asia Pacific

- 10.3.1 China

- 10.3.2 India

- 10.3.3 Japan

- 10.3.4 Australia

- 10.3.5 Singapore

- 10.3.6 South Korea

- 10.3.7 Vietnam

- 10.3.8 Indonesia

- 10.4 Latin America

- 10.4.1 Brazil

- 10.4.2 Mexico

- 10.4.3 Argentina

- 10.5 MEA

- 10.5.1 South Africa

- 10.5.2 Saudi Arabia

- 10.5.3 UAE

Chapter 11 Company Profiles

- 11.1 Global Players

- 11.1.1 Caterpillar

- 11.1.2 Komatsu

- 11.1.3 Liebherr

- 11.1.4 Hitachi

- 11.1.5 Volvo

- 11.1.6 Scania

- 11.1.7 Cummins

- 11.1.8 Parker Hannifin

- 11.2 Regional Champions

- 11.2.1 John Deere

- 11.2.2 SANY

- 11.2.3 BelAZ

- 11.2.4 XCMG

- 11.2.5 Doosan Infracore

- 11.2.6 Hyundai Construction Equipment

- 11.2.7 Bell Equipment

- 11.2.8 MAN Truck & Bus

- 11.2.9 Terex

- 11.2.10 Tadano

- 11.3 Emerging Players & Technology Disruptors

- 11.3.1 Autonomous Solutions (ASI)

- 11.3.2 Modular Mining Systems

- 11.3.3 Epiroc

- 11.3.4 Sandvik Mining & Rock Solutions

- 11.3.5 Kuhn Schweiz

- 11.3.6 Allison Transmission

- 11.3.7 Rio Tinto Technology & Innovation