|

市场调查报告书

商品编码

1833653

工业空气过滤市场机会、成长动力、产业趋势分析及2025-2034年预测Industrial Air Filtration Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

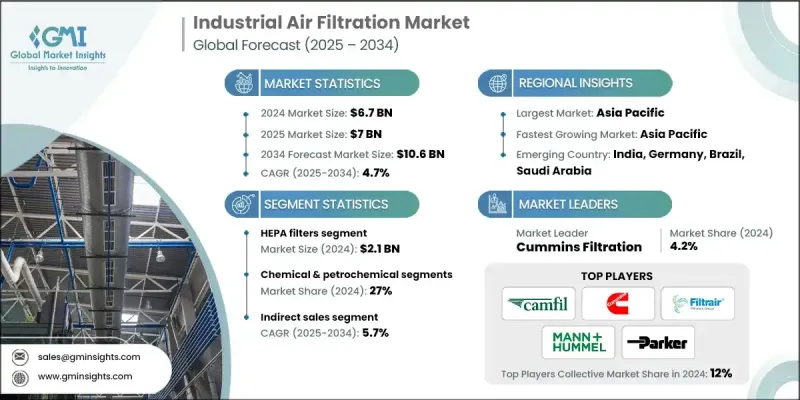

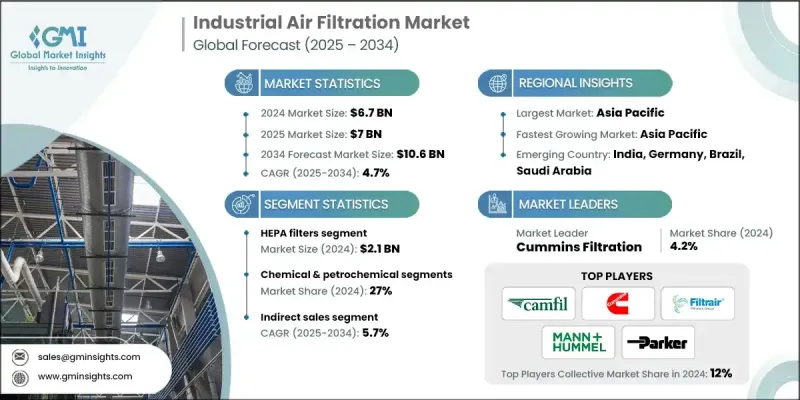

2024 年全球工业空气过滤市场价值为 67 亿美元,预计到 2034 年将以 4.7% 的复合年增长率增长至 106 亿美元。

美国职业安全与健康管理局 (OSHA)、美国环保署 (EPA) 等政府机构及其全球同行正在对工业环境实施更严格的空气品质标准。企业被迫安装先进的空气过滤系统,以保持合规并避免罚款,这极大地刺激了市场需求。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 67亿美元 |

| 预测值 | 106亿美元 |

| 复合年增长率 | 4.7% |

HEPA过滤器的采用率不断上升

HEPA过滤器由于其高效捕获细颗粒物(包括灰尘、气溶胶和微生物)的能力,在2024年占据了相当大的市场份额。这类过滤器在需要超洁净空气的环境中尤其重要,例如製药生产、电子製造和食品加工。

化学品和石化产品需求不断成长

2024年,化学和石化产业占据了相当大的份额,这主要得益于其高浓度的空气污染物和有害气体。维持这些设施的空气品质不仅对于合规性至关重要,也对工人安全和製程稳定性至关重要。该领域的过滤解决方案通常需要先进的化学吸收剂和耐腐蚀材料,这进一步推动了对专业高性能係统的需求。

间接销售获得牵引力

在加值经销商和系统整合商的支持下,间接销售领域将在2025年至2034年期间实现可观的复合年增长率。这些管道使製造商无需庞大的内部销售团队即可扩大市场覆盖范围。经销商还提供技术咨询、售后服务和客製化安装,在过滤供应商和工业客户之间建立起至关重要的纽带。

亚太地区将崛起成为推动力地区

受快速工业化、城市污染挑战和日益严格的环境法规的推动,亚太地区工业空气过滤市场在2024年占据了相当大的份额。中国、印度和韩国等国家在製造业、汽车业、水泥业和发电业等领域的需求领先。政府旨在减少空气污染和提高职业安全标准的措施推动了市场成长。随着基础设施支出的增加,对坚固耐用且可扩展的空气过滤系统的需求预计将稳定成长。

工业空气过滤市场的主要参与者有 Fives Group、Absolent、Mann+Hummel、Donaldson、BWF、Freudenberg、Universal Air Filter、AAF、Camfil、Cummins Filtration、Pall、Parker Hannifin、Nederman、Filtration Group Corporation 和 Lydall Gutsche Corporation。

为了巩固市场地位,工业空气过滤市场的领导者正在加大对产品创新、数位化整合和永续性的投资。许多公司正在推出配备物联网感测器的智慧过滤系统,用于即时空气品质监测和预测性维护。与原始设备製造商、分销商和工程公司建立策略合作伙伴关係有助于扩大分销网络,并根据行业特定需求量身定制解决方案。併购仍然是获取新技术或区域市场的热门途径。

目录

第一章:方法论与范围

第 2 章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 利润率

- 每个阶段的增值

- 影响价值链的因素

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 机会

- 成长潜力分析

- 未来市场趋势

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 依产品类型

- 监管格局

- 标准和合规性要求

- 区域监理框架

- 认证标准

- 贸易统计

- 主要进口国

- 主要出口国

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:依产品类型,2021 - 2034 年

- 主要趋势

- HEPA 过滤器

- 袋式除尘器/织物过滤器

- 静电集尘器(ESP)

- 旋风分离器

- 活性碳过滤器

- 其他(ULPA过滤器等)

第六章:市场估计与预测:按应用,2021 - 2034

- 主要趋势

- 洁净室空气过滤

- 工业製程空气净化

- HVAC系统过滤

- 除尘系统

- 排放控制

第七章:市场估计与预测:按最终用途产业,2021 - 2034 年

- 主要趋势

- 製药和生物技术

- 半导体和电子产品

- 食品和饮料

- 汽车

- 化工和石化

- 其他(医疗保健和医院等)

第 8 章:市场估计与预测:按配销通路,2021 年至 2034 年

- 主要趋势

- 直销

- 间接销售

第九章:市场估计与预测:按地区,2021 - 2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 多边环境协定

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十章:公司简介

- AAF

- Absolent

- BWF

- Camfil

- Cummins Filtration

- Donaldson

- Filtration Group Corporation

- Fives Group

- Freudenberg

- Lydall Gutsche

- Mann+Hummel

- Nederman

- Pall

- Parker Hannifin

- Universal Air Filter

The Global Industrial Air Filtration Market was valued at USD 6.7 billion in 2024 and is estimated to grow at a CAGR of 4.7% to reach USD 10.6 billion by 2034.

Government agencies such as OSHA, EPA, and their global counterparts are enforcing stricter air quality standards in industrial environments. Companies are compelled to install advanced air filtration systems to remain compliant and avoid fines, which significantly boosts market demand.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $6.7 Billion |

| Forecast Value | $10.6 Billion |

| CAGR | 4.7% |

Rising Adoption of HEPA Filters

The HEPA filters segment held a significant share in 2024, owing to its high efficiency in capturing fine particulate matter, including dust, aerosols, and microorganisms. These filters are especially critical in environments requiring ultra-clean air, such as pharmaceutical production, electronics manufacturing, and food processing.

Increasing Demand in Chemicals and Petrochemicals

The chemical and petrochemical segment generated a substantial share in 2024, driven by high levels of airborne pollutants and hazardous gases involved. Maintaining air quality in these facilities is essential not only for regulatory compliance but also for worker safety and process stability. Filtration solutions in this space often require advanced chemical absorbents and corrosion-resistant materials, further pushing the demand for specialized high-performance systems.

Indirect Sales to Gain Traction

The indirect sales segment will grow at a decent CAGR during 2025-2034, backed by value-added resellers and system integrators. These channels enable manufacturers to extend their market reach without the need for an extensive in-house sales force. Distributors also offer technical consulting, after-sales service, and customized installation, making a critical link between filtration providers and industrial clients.

Asia Pacific to Emerge as a Propelling Region

Asia Pacific industrial air filtration market held a sizeable share in 2024, driven by rapid industrialization, urban pollution challenges, and growing environmental regulations. Countries like China, India, and South Korea are leading demand across sectors such as manufacturing, automotive, cement, and power generation. Market growth is fueled by government initiatives aimed at reducing air pollution and enhancing occupational safety standards. As infrastructure spending increases, the need for robust and scalable air filtration systems is expected to rise steadily.

Major players in the industrial air filtration market are Fives Group, Absolent, Mann+Hummel, Donaldson, BWF, Freudenberg, Universal Air Filter, AAF, Camfil, Cummins Filtration, Pall, Parker Hannifin, Nederman, Filtration Group Corporation, Lydall Gutsche.

To strengthen their foothold, leading players in the industrial air filtration market are investing in product innovation, digital integration, and sustainability. Many companies are launching smart filtration systems equipped with IoT sensors for real-time air quality monitoring and predictive maintenance. Strategic partnerships with OEMs, distributors, and engineering firms help expand distribution networks and tailor solutions to industry-specific needs. Mergers and acquisitions remain a popular route to gain access to new technologies or regional markets.

Table of Contents

Chapter 1 Methodology and scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 Application

- 2.2.4 End use industry

- 2.2.5 Distribution channel

- 2.3 CXO perspectives: strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls & challenges

- 3.2.3 Opportunities

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By product type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Trade statistics

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Product Type, 2021 - 2034 ($Billion, Thousand Units)

- 5.1 Key trends

- 5.2 HEPA filters

- 5.3 Baghouse/fabric filters

- 5.4 Electrostatic precipitators (ESP)

- 5.5 Cyclone separators

- 5.6 Activated carbon filters

- 5.7 Others (ULPA filters etc.)

Chapter 6 Market Estimates & Forecast, By Application, 2021 - 2034 ($Billion, Thousand Units)

- 6.1 Key trends

- 6.2 Cleanroom air filtration

- 6.3 Industrial process air cleaning

- 6.4 HVAC system filtration

- 6.5 Dust collection systems

- 6.6 Emission control

Chapter 7 Market Estimates & Forecast, By End Use Industry, 2021 - 2034 ($Billion, Thousand Units)

- 7.1 Key trends

- 7.2 Pharmaceuticals & biotechnology

- 7.3 Semiconductor & electronics

- 7.4 Food & beverages

- 7.5 Automotive

- 7.6 Chemical & petrochemical

- 7.7 Others (healthcare & hospitals etc.)

Chapter 8 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 ($Billion, Thousand Units)

- 8.1 Key trends

- 8.2 Direct sales

- 8.3 Indirect sales

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Billion, Thousand Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 AAF

- 10.2 Absolent

- 10.3 BWF

- 10.4 Camfil

- 10.5 Cummins Filtration

- 10.6 Donaldson

- 10.7 Filtration Group Corporation

- 10.8 Fives Group

- 10.9 Freudenberg

- 10.10 Lydall Gutsche

- 10.11 Mann+Hummel

- 10.12 Nederman

- 10.13 Pall

- 10.14 Parker Hannifin

- 10.15 Universal Air Filter