|

市场调查报告书

商品编码

1833656

咳嗽辅助设备市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Cough Assist Devices Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

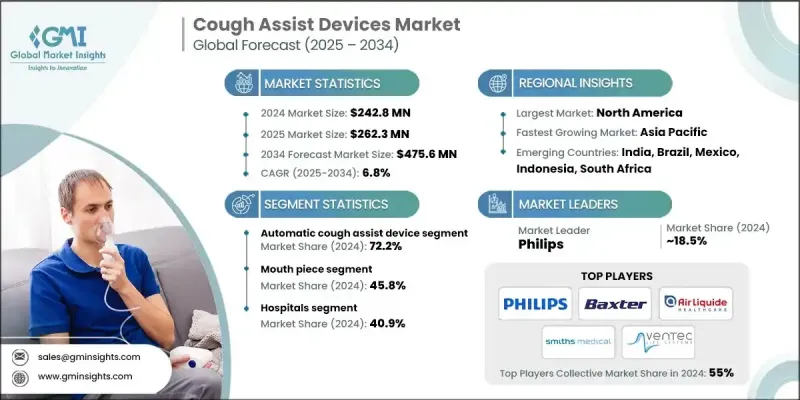

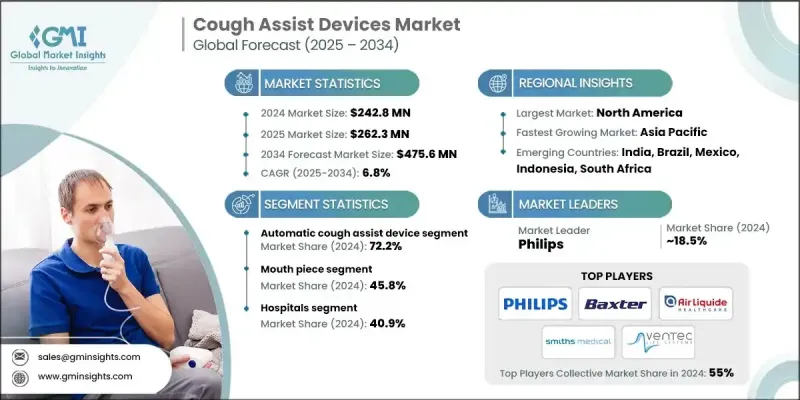

2024 年全球咳嗽辅助设备市场价值为 2.428 亿美元,预计将以 6.8% 的复合年增长率成长,到 2034 年达到 4.756 亿美元。

这一增长的动力源于慢性呼吸道疾病发病率的上升、人口老化加剧以及人们对非侵入性气道清除方案认知度的提高。随着呼吸健康成为公共卫生领域更重要的优先事项,对先进呼吸照护设备的需求持续成长。居家医疗的转变和医疗技术的进步进一步推动了咳嗽辅助解决方案的使用,因为这些设备有助于减少住院人数并改善患者预后。医疗保健提供者、患者和照护者都越来越认识到早期有效气道分泌物清除的临床价值。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 2.428亿美元 |

| 预测值 | 4.756亿美元 |

| 复合年增长率 | 6.8% |

咳嗽辅助装置旨在提供机械式的吸气和呼气,由于其能够改善呼吸功能并预防肺功能受损患者的呼吸併发症,其应用范围显着增长。这些装置的现代版本结构紧凑、用户友好,并针对家庭护理环境进行了优化,在这些环境中,便利性和独立性至关重要。随着医院、专科诊所和家庭等各种护理环境对这些工具的了解日益加深,它们在神经肌肉疾病和慢性肺部疾病患者中的应用也得到了扩展。

2024年,自动化设备市占率达到72.2%,因为这些设备能够增强分泌物清除,并且只需要极少的使用者操作。自动化系统的吸引力在于其高度客製化,允许医生根据患者的个别需求调整压力设定和计时週期。与手动设备相比,自动化系统具有更高的一致性、更好的舒适度和更有效率的治疗效果,使其成为现代呼吸护理的首选。

2024年,口罩市场占据了34.8%的市场份额,这得益于其适合那些难以使用口含器的患者。这些患者包括幼儿、老年人以及患有严重神经肌肉疾病的患者。口罩的主要优点在于其易于使用,无需患者进行精确配合,即可提供持续一致的治疗,从而提高弱势族群的整体治疗效果。

2024年,美国咳嗽辅助设备市场规模达8,360万美元。该地区持续增长的动力源于慢性呼吸系统疾病的高发病率,以及患有呼吸道分泌物清除能力下降疾病的患者人数不断增加。老龄人口的成长以及对非侵入性疗法的强劲需求,正在加速整个医疗保健系统对咳嗽辅助技术的采用。

全球咳嗽辅助设备市场的主要活跃公司包括 Vitalograph、Smith's Medical(ICU Medical)、Dima Italia、ABM Respiratory Care、Seoil Pacific、Air Liquide Healthcare、West Care Medical、Breas Medical、Ventec Life Systems、PARI、Baxter、Physio Assist(Simeox)和飞利浦。咳嗽辅助设备领域的公司正在优先考虑技术升级,使其产品更加便携、可编程且用户友好,以顺应居家护理日益增长的趋势。主要参与者正在大力投资研发,以开发能够提供更个人化、高效治疗的下一代系统。他们正在寻求策略性併购和合作,以扩大全球影响力并加强分销网络。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 慢性呼吸系统疾病盛行率上升

- 神经肌肉疾病发生率不断上升

- 全球人口老化,呼吸肌无力

- 转向家庭医疗保健和长期照护环境

- 产业陷阱与挑战

- 对于许多医疗保健提供者和患者来说,设备购买价格高昂

- 各地区报销政策有限或不一致

- 市场机会

- 紧凑型、电池供电的便携式咳嗽辅助装置的开发

- 与远距医疗/远端监控和数位依从工具的集成

- 成长动力

- 成长潜力分析

- 监管格局

- 技术和创新格局

- 当前的技术趋势

- 便携式轻量级设备

- 可程式治疗週期

- 与数位监控集成

- 新兴技术

- 支援远距医疗的设备

- 人工智慧驱动的治疗优化

- 智慧型设备集成

- 当前的技术趋势

- 供应链分析

- 消费者行为趋势

- 市场进入策略分析

- 波特的分析

- PESTEL分析

- 未来市场趋势

- 扩大居家呼吸护理

- 新兴市场采用率不断上升

- 与基于价值的医疗保健模式的整合

- 差距分析

- 2024年定价分析

- 专利态势

第四章:竞争格局

- 介绍

- 公司市占率分析

- 全球的

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:依产品类型,2021 - 2034 年

- 主要趋势

- 自动咳嗽辅助装置

- 手动咳嗽辅助装置

第六章:市场估计与预测:以交付方式划分,2021 年至 2034 年

- 主要趋势

- 吹嘴

- 口罩

- 适配器

第七章:市场估计与预测:依最终用途,2021 - 2034

- 主要趋势

- 医院

- 居家照护环境

- 其他最终用途

第八章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第九章:公司简介

- ABM Respiratory Care

- Air Liquide Healthcare

- Baxter

- Breas Medical

- Dima Italia

- PARI

- Philips

- PhysioAssist (Simeox)

- Seoil Pacific

- Smiths Medical (ICU Medical)

- Ventec Life Systems

- Vitalograph

- West Care Medical

The Global Cough Assist Devices Market was valued at USD 242.8 million in 2024 and is estimated to grow at a CAGR of 6.8% to reach USD 475.6 million by 2034.

This growth is being fueled by rising incidences of chronic respiratory illnesses, increasing aging populations, and higher awareness around non-invasive airway clearance options. As respiratory health becomes a bigger public health priority, demand for advanced respiratory care devices continues to rise. The shift toward home-based healthcare and improvements in medical technology are further advancing the use of cough assist solutions, as these devices help reduce hospital admissions and improve patient outcomes. Healthcare providers, patients, and caregivers alike are increasingly recognizing the clinical value of early and effective airway secretion clearance.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $242.8 Million |

| Forecast Value | $475.6 Million |

| CAGR | 6.8% |

Cough assist devices, built to deliver mechanical insufflation-exsufflation, have seen significant growth in adoption due to their ability to improve breathing and prevent respiratory complications in patients with compromised lung function. Modern versions of these devices are compact, user-friendly, and optimized for use in home care settings, where convenience and independence are essential. Growing knowledge about these tools across various care settings, including hospitals, specialty clinics, and home environments, has expanded their usage among individuals with neuromuscular disorders and chronic pulmonary diseases.

The automatic segment held a 72.2% share in 2024, as these devices provide enhanced secretion clearance and require minimal user input. The appeal of automatic systems lies in their high degree of customization, allowing physicians to adjust pressure settings and timing cycles based on individual patient needs. They offer improved consistency, better comfort, and more efficient therapy delivery compared to manual alternatives, making them the preferred choice in modern respiratory care.

The face masks segment held a 34.8% share in 2024, owing to their suitability for patients who may struggle to use mouthpieces. This includes young children, older adults, and individuals with significant neuromuscular impairments. The primary strength of face masks lies in their ease of use, as they eliminate the need for precise coordination from patients and deliver consistent treatment, improving overall therapeutic effectiveness in vulnerable groups.

United States Cough Assist Devices Market was valued at USD 83.6 million in 2024. The region's consistent growth is driven by the high prevalence of chronic respiratory conditions and the increasing number of patients affected by disorders that reduce the body's ability to clear airway secretions. The growing elderly population and strong demand for non-invasive therapies are accelerating the adoption of cough assist technologies throughout the healthcare system.

Key companies active in the Global Cough Assist Devices Market include Vitalograph, Smith's Medical (ICU Medical), Dima Italia, ABM Respiratory Care, Seoil Pacific, Air Liquide Healthcare, West Care Medical, Breas Medical, Ventec Life Systems, PARI, Baxter, Physio Assist (Simeox), and Philips. Companies in the cough assist devices space are prioritizing technological upgrades to make their products more portable, programmable, and user-friendly, aligning with the rising shift toward home-based care. Key players are heavily investing in R&D to develop next-generation systems that deliver more personalized, efficient therapies. Strategic mergers, acquisitions, and partnerships are being pursued to expand global reach and strengthen distribution networks.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Product type trends

- 2.2.3 Choice of delivery trends

- 2.2.4 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of chronic respiratory diseases

- 3.2.1.2 Growing incidence of neuromuscular disorders

- 3.2.1.3 Aging global population with weakened respiratory muscles

- 3.2.1.4 Shift toward home healthcare and long-term care settings

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High purchase price of devices for many healthcare providers and patients

- 3.2.2.2 Limited or inconsistent reimbursement policies across regions

- 3.2.3 Market opportunities

- 3.2.3.1 Development of compact, battery-powered portable cough assist devices

- 3.2.3.2 Integration with telehealth/remote monitoring and digital adherence tools

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East and Africa

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.1.1 Portable and lightweight devices

- 3.5.1.2 Programmable therapy cycles

- 3.5.1.3 Integration with digital monitoring

- 3.5.2 Emerging technologies

- 3.5.2.1 Telehealth-enabled devices

- 3.5.2.2 AI-driven therapy optimization

- 3.5.2.3 Smart device integration

- 3.5.1 Current technological trends

- 3.6 Supply chain analysis

- 3.7 Consumer behaviour trend

- 3.8 Go-to-market strategy analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

- 3.11 Future market trends

- 3.11.1 Expansion of home-based respiratory care

- 3.11.2 Rising adoption in emerging markets

- 3.11.3 Integration with value-based healthcare models

- 3.12 Gap analysis

- 3.13 Pricing analysis, 2024

- 3.14 Patent Landscape

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 Global

- 4.2.2 North America

- 4.2.3 Europe

- 4.2.4 Asia Pacific

- 4.2.5 Latin America

- 4.2.6 Middle East and Africa

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Automatic cough assist device

- 5.3 Manual cough assist device

Chapter 6 Market Estimates and Forecast, By Choice of Delivery, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Mouth piece

- 6.3 Face mask

- 6.4 Adapter

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals

- 7.3 Home care settings

- 7.4 Other end use

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 ABM Respiratory Care

- 9.2 Air Liquide Healthcare

- 9.3 Baxter

- 9.4 Breas Medical

- 9.5 Dima Italia

- 9.6 PARI

- 9.7 Philips

- 9.8 PhysioAssist (Simeox)

- 9.9 Seoil Pacific

- 9.10 Smiths Medical (ICU Medical)

- 9.11 Ventec Life Systems

- 9.12 Vitalograph

- 9.13 West Care Medical