|

市场调查报告书

商品编码

1833662

铁路号誌系统市场机会、成长动力、产业趋势分析及2025-2034年预测Railway Signaling System Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

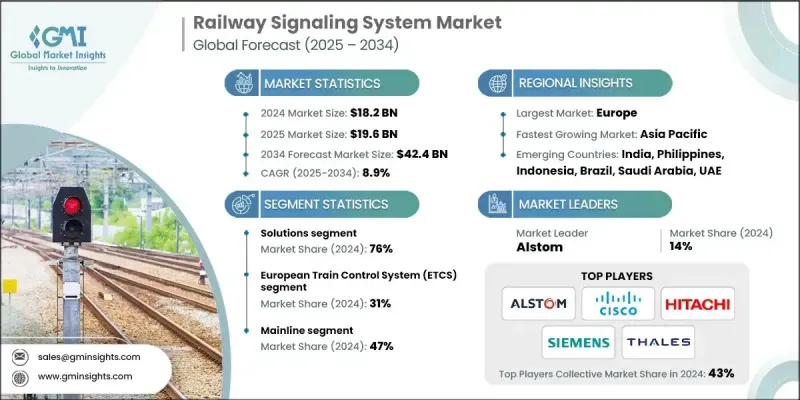

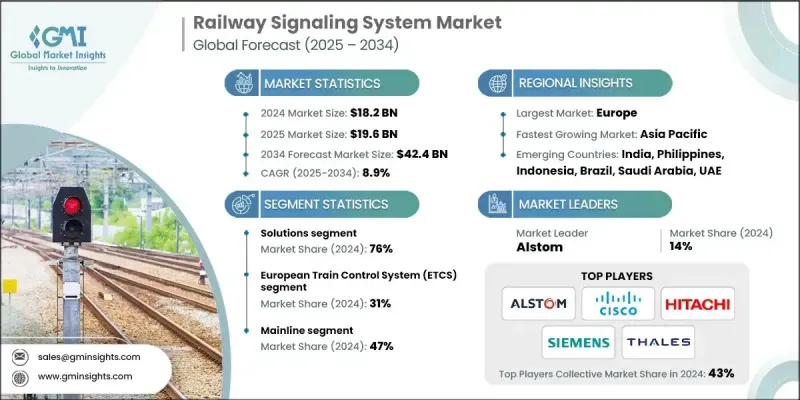

2024 年全球铁路号誌系统市场价值为 182 亿美元,预计到 2034 年将以 8.9% 的复合年增长率成长至 424 亿美元。

全球各国政府和私营营运商正在大力投资升级老化的铁路网络,包括部署现代化的号誌系统,以提高客运和货运线路的安全性、营运效率和运力。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 182亿美元 |

| 预测值 | 424亿美元 |

| 复合年增长率 | 8.9% |

解决方案领域需求不断成长

2024年,由于即时控制、自动化和全系统安全升级的需求日益增长,解决方案领域占据了相当大的份额。这些解决方案通常包括联锁系统、集中交通控制和基于通讯的列车控制 (CBTC) 软体,使营运商能够有效率且安全地管理交通流量。

欧洲列车控制系统(ETCS)将获得发展

2024年,欧洲列车控制系统 (ETCS) 领域占据了相当大的份额。作为更广泛的欧洲铁路交通管理系统 (ERTMS) 的一部分,ETCS 能够在成员国之间实现信号和控制系统的标准化,从而提高安全性、速度调节和营运效率。随着欧盟法规的广泛采用,尤其是在高速铁路和国际货运走廊领域,该领域正蓬勃发展。

主线采用率不断提升

2024年,在高速、长途和城际铁路营运的推动下,干线铁路市场将迎来显着成长。这些系统需要强大的号誌基础设施来应对巨大的交通流量、不断变化的列车速度和较长的轨道长度。随着欧洲各国升级其核心铁路网络,对集中交通控制和远端诊断等先进干线号誌解决方案的需求持续成长。

欧洲将崛起成为推手地区

欧洲铁路号誌系统市场预计在2025年至2034年期间实现显着的复合年增长率。在欧盟大力推动互通、永续铁路网建设的推动下,该地区对高速铁路、智慧出行和跨境货运走廊的投资正在加速成长。市场成长得益于政府拨款、数位化铁路计画以及强有力的公私合作。领先的公司正在推行在地化战略,与各国铁路部门合作,并开发符合欧盟法规的区域解决方案。

铁路号誌系统市场的主要参与者有 GEAR International、泰雷兹、诺基亚、思科系统、日立、阿尔斯通、华为技术、通用电气、西门子和百通。

为了在铁路号誌系统市场保持竞争优势,领先企业将技术创新、策略合作伙伴关係和地理扩张放在首位。许多企业正在大力投资研发数位讯号平台,包括基于云端的控制系统、预测性维护工具和人工智慧自动化。与国家铁路营运商、交通部和基础设施开发商的合作,帮助企业获得大规模公共合同,尤其是高铁和地铁项目。透过专注于模组化设计以及数位孪生和自动讯号平台等下一代技术,这些企业正在巩固其在西欧和东欧的市场地位。

目录

第一章:方法论

- 市场范围和定义

- 研究设计

- 研究方法

- 资料收集方法

- 资料探勘来源

- 全球的

- 地区/国家

- 基础估算与计算

- 基准年计算

- 市场评估的主要趋势

- 初步研究和验证

- 主要来源

- 预测模型

- 研究假设和局限性

第 2 章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 利润率分析

- 成本结构

- 每个阶段的增值

- 影响价值链的因素

- 中断

- 产业衝击力

- 成长动力

- 透过先进的号誌系统提高安全性和营运效率。

- 政府对铁路基础设施现代化的投资。

- 采用ETCS和CBTC等尖端技术。

- 都市化进程加快,轨道运输需求增加

- 产业陷阱与挑战

- 前期投资和部署成本高。

- 缺乏实施和维护的熟练劳动力

- 市场机会

- 随着铁路网的不断扩大,向新兴市场扩张。

- 与智慧城市和城市交通计划相结合。

- 使用资料分析实施预测性维护。

- 政府、技术提供者和开发商之间的战略合作伙伴关係

- 成长动力

- 监管格局

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL分析

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 专利分析

- 商业案例和投资报酬率分析

- 按技术类型分類的总拥有成本 (TCO) 建模

- 实施成本基准与预算规划

- 营运节省和效率提升量化

- 安全投资报酬率与风险降低价值评估

- 按应用领域分析投资回收期

- 融资模式和公私部门合作策略

- 保险费影响及责任考虑

- 监理合规成本效益分析

- 技术迁移与实施策略

- 传统技术向数位化的迁移路径

- 分阶段实施和推广策略

- 系统整合方法和最佳实践

- 风险评估与缓解框架

- 供应商选择和采购指南

- 专案管理和时间表优化

- 绩效关键绩效指标 (KPI) 与成功指标

- 品质保证和测试协议

- 变革管理和利害关係人参与

- 网路安全与数位风险管理

- 铁路号誌网安全威胁情势

- 攻击向量分析和漏洞评估

- 网路安全框架与保护策略

- 事件响应和恢復协议

- 合规与监理要求

- 网路安全投资与预算规划

- 第三方风险管理

- 新出现的威胁与未来的准备

- 最佳情况

- 永续性和环境影响分析

- 生命週期评估与环境建模

- 永续设计与最佳化

- 环境合规与报告

- 绿色科技与创新

- 风险评估和缓解策略

- 技术风险分析与管理

- 网路安全风险框架

- 监理与合规风险评估

- 财务及市场风险评估

- 营运风险管理

- 供应链风险与弹性规划

- 专案实施风险缓解

- 保险与责任风险管理

第四章:竞争格局

- 介绍

- 公司市占率分析

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 多边环境协定

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 战略展望矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划和资金

第五章:市场估计与预测:依供应量,2021 - 2034

- 主要趋势

- 解决方案

- 服务

第六章:市场估计与预测:依技术分类,2021 - 2034 年

- 主要趋势

- 自动闭塞讯号(ABS)

- 欧洲列车控制系统(ETCS)

- 正向列车控制(PTC)

- 自动列车控制(ATC)

- 其他的

第七章:市场估计与预测:依部署模式,2021 - 2034 年

- 主要趋势

- 云

- 本地

第八章:市场估计与预测:火车,2021 - 2034

- 主要趋势

- 高速铁路

- 轻轨和地铁

- 货运列车

- 常规客运列车

第九章:市场估计与预测:依最终用途,2021 - 2034

- 主要趋势

- 主线

- 城市的

- 货运

第 10 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 菲律宾

- 印尼

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 多边环境协定

- 南非

- 沙乌地阿拉伯

- 阿联酋

第 11 章:公司简介

- 全球参与者

- Alstom

- Bombardier Transportation

- CAF

- Cisco Systems

- CRRC

- General Electric

- Hitachi

- IBM

- Mitsubishi Electric

- Nokia

- Siemens

- Stadler Rail

- Thales

- Wabtec

- 区域参与者

- Angelo

- Frequentis

- Indra Sistemas

- Kyosan Electric Manufacturing

- Straffic

- 新兴玩家

- ADLINK Technology

- Cylus

- Fidrox

- GEAR International

- Huawei Technologies

- Humatics

- Kontron Transportation

The Global Railway Signaling System Market was valued at USD 18.2 billion in 2024 and is estimated to grow at a CAGR of 8.9% to reach USD 42.4 billion by 2034.

Governments and private operators worldwide are investing heavily in upgrading aging rail networks. This includes the deployment of modern signaling systems to improve safety, operational efficiency, and capacity across both passenger and freight corridors.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $18.2 Billion |

| Forecast Value | $42.4 Billion |

| CAGR | 8.9% |

Rising Demand for Solutions Segment

The solutions segment held a significant share in 2024, driven by the growing need for real-time control, automation, and system-wide safety upgrades. These solutions typically include interlocking systems, centralized traffic control, and communication-based train control (CBTC) software, which enable operators to manage traffic flows efficiently and securely.

European Train Control System (ETCS) to Gain Traction

European train control system (ETCS) segment held a sizeable share in 2024. As part of the broader ERTMS (European Rail Traffic Management System), ETCS enables standardized signaling and control systems across member states, improving safety, speed regulation, and operational efficiency. The segment is gaining momentum with widespread adoption under EU mandates, especially in high-speed rail and international freight corridors.

Increasing Adoption in Mainline

The mainline segment witnessed noticeable growth in 2024, backed by high-speed, long-distance, and intercity rail operations. These systems require robust signaling infrastructure to handle large volumes of traffic, variable train speeds, and long track lengths. As countries across Europe upgrade their core rail networks, the demand for advanced mainline signaling solutions such as centralized traffic control and remote diagnostics continues to rise.

Europe to Emerge as a Propelling Region

Europe railway signaling system market is poised to grow at a notable CAGR during 2025-2034. Driven by the European Union's push for interoperable, sustainable rail networks, the region is witnessing accelerated investments in high-speed rail, smart mobility, and cross-border freight corridors. Market growth is supported by government grants, digital rail initiatives, and strong public-private collaboration. Leading companies are pursuing localization strategies, partnering with national rail authorities, and developing region-specific solutions that align with EU regulations.

Major players involved in the railway signaling system market are GEAR International, Thales, Nokia, Cisco Systems, Hitachi, Alstom, Huawei Technologies, General Electric, Siemens, and Belden.

To maintain a competitive edge in the railway signaling system market, leading companies are prioritizing technology innovation, strategic partnerships, and geographic expansion. Many are heavily investing in R&D to develop digital signaling platforms, including cloud-based control systems, predictive maintenance tools, and AI-enabled automation. Collaborations with national rail operators, transport ministries, and infrastructure developers are helping firms secure large-scale public contracts, especially for high-speed rail and metro projects. By focusing on modular designs and next-generation technologies like digital twins and automated signaling platforms, these players are reinforcing their foothold across both Western and Eastern Europe.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Offering

- 2.2.3 Technology

- 2.2.4 Train

- 2.2.5 Deployment mode

- 2.2.6 End Use

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Enhanced safety and operational efficiency through advanced signaling systems.

- 3.2.1.2 Government investments in railway infrastructure modernization.

- 3.2.1.3 Adoption of cutting-edge technologies like ETCS and CBTC.

- 3.2.1.4 Increasing urbanization and rail traffic demand

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High initial investment and deployment costs.

- 3.2.2.2 Shortage of skilled workforce for implementation and maintenance

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion into emerging markets with growing rail networks.

- 3.2.3.2 Integration with smart city and urban mobility initiatives.

- 3.2.3.3 Implementation of predictive maintenance using data analytics.

- 3.2.3.4 Strategic partnerships between governments, tech providers, and developers

- 3.2.1 Growth drivers

- 3.3 Regulatory landscape

- 3.3.1 North America

- 3.3.2 Europe

- 3.3.3 Asia Pacific

- 3.3.4 Latin America

- 3.3.5 Middle East & Africa

- 3.4 Porter's analysis

- 3.5 PESTEL analysis

- 3.6 Technology and Innovation landscape

- 3.6.1 Current technological trends

- 3.6.2 Emerging technologies

- 3.7 Patent analysis

- 3.8 Business Case & ROI Analysis

- 3.8.1 Total cost of ownership (TCO) modeling by technology type

- 3.8.2 Implementation cost benchmarking & budget planning

- 3.8.3 Operational savings & efficiency gains quantification

- 3.8.4 Safety ROI & risk reduction value assessment

- 3.8.5 Payback period analysis by application segment

- 3.8.6 Financing models & public-private partnership strategies

- 3.8.7 Insurance premium impact & liability considerations

- 3.8.8 Regulatory compliance cost-benefit analysis

- 3.9 Technology migration & implementation strategy

- 3.9.1 Legacy-to-digital migration pathways

- 3.9.2 Phased implementation & rollout strategies

- 3.9.3 System integration methodologies & best practices

- 3.9.4 Risk assessment & mitigation framework

- 3.9.5 Vendor selection & procurement guidelines

- 3.9.6 Project management & timeline optimization

- 3.9.7 Performance KPIs & success metrics

- 3.9.8 Quality assurance & testing protocols

- 3.9.9 Change management & stakeholder engagement

- 3.10 Cybersecurity & digital risk management

- 3.10.1 Railway signaling cybersecurity threat landscape

- 3.10.2 Attack vector analysis & vulnerability assessment

- 3.10.3 Cybersecurity framework & protection strategies

- 3.10.4 Incident response & recovery protocols

- 3.10.5 Compliance & regulatory requirements

- 3.10.6 Cybersecurity investment & budget planning

- 3.10.7 Third-party risk management

- 3.10.8 Emerging threats & future preparedness

- 3.11 Best-case scenario

- 3.12 Sustainability and environmental impact analysis

- 3.12.1 Lifecycle assessment and environmental modeling

- 3.12.2 Sustainable design and optimization

- 3.12.3 Environmental compliance and reporting

- 3.12.4 Green technology and innovation

- 3.13 Risk assessment & mitigation strategies

- 3.13.1 Technology risk analysis & management

- 3.13.2 Cybersecurity risk framework

- 3.13.3 Regulatory & compliance risk assessment

- 3.13.4 Financial & market risk evaluation

- 3.13.5 Operational risk management

- 3.13.6 Supply chain risk & resilience planning

- 3.13.7 Project implementation risk mitigation

- 3.13.8 Insurance & liability risk management

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Offering, 2021 - 2034 ($Bn)

- 5.1 Key trends

- 5.1.1 Solutions

- 5.1.2 Services

Chapter 6 Market Estimates & Forecast, By Technology, 2021 - 2034 ($Bn)

- 6.1 Key trends

- 6.2 Automatic Block Signaling (ABS)

- 6.3 European Train Control System (ETCS)

- 6.4 Positive Train Control (PTC)

- 6.5 Automatic Train Control (ATC)

- 6.6 Others

Chapter 7 Market Estimates & Forecast, By Deployment Mode, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 Cloud

- 7.3 On-premises

Chapter 8 Market Estimates & Forecast, By Train, 2021 - 2034 ($Bn)

- 8.1 Key trends

- 8.2 High-speed rail

- 8.3 Light rail & metros

- 8.4 Freight trains

- 8.5 Conventional passenger trains

Chapter 9 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn)

- 9.1 Key trends

- 9.2 Mainline

- 9.3 Urban

- 9.4 Freight

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 US

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Philippines

- 10.4.7 Indonesia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Global Players

- 11.1.1 Alstom

- 11.1.2 Bombardier Transportation

- 11.1.3 CAF

- 11.1.4 Cisco Systems

- 11.1.5 CRRC

- 11.1.6 General Electric

- 11.1.7 Hitachi

- 11.1.8 IBM

- 11.1.9 Mitsubishi Electric

- 11.1.10 Nokia

- 11.1.11 Siemens

- 11.1.12 Stadler Rail

- 11.1.13 Thales

- 11.1.14 Wabtec

- 11.2 Regional Players

- 11.2.1 Angelo

- 11.2.2 Frequentis

- 11.2.3 Indra Sistemas

- 11.2.4 Kyosan Electric Manufacturing

- 11.2.5 Straffic

- 11.3 Emerging Players

- 11.3.1 ADLINK Technology

- 11.3.2 Cylus

- 11.3.3 Fidrox

- 11.3.4 GEAR International

- 11.3.5 Huawei Technologies

- 11.3.6 Humatics

- 11.3.7 Kontron Transportation