|

市场调查报告书

商品编码

1833663

餐具洗涤设备市场机会、成长动力、产业趋势分析及2025-2034年预测Warewashing Equipment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

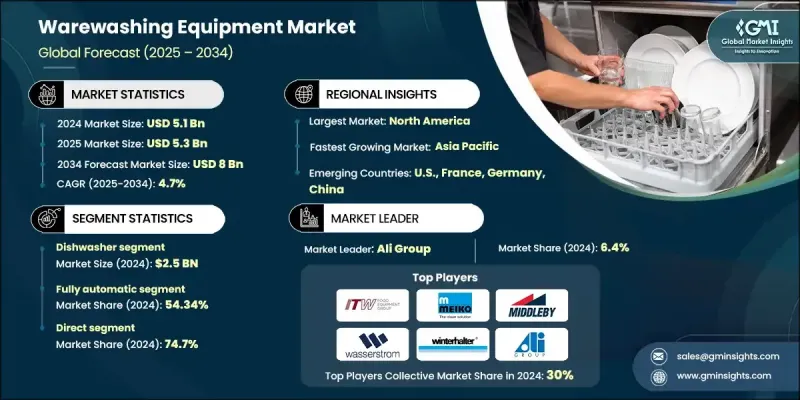

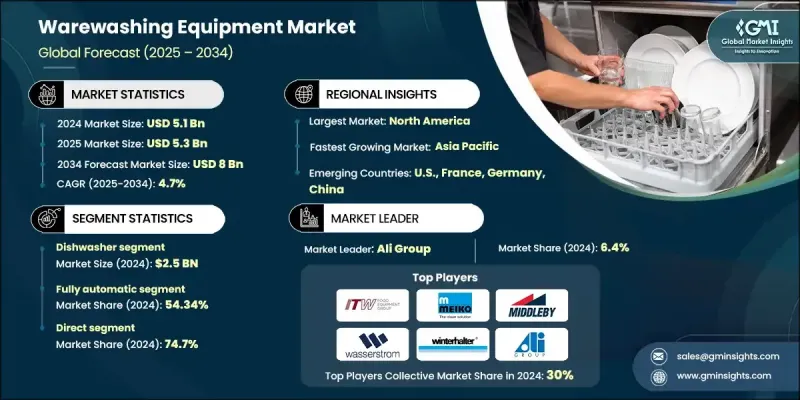

2024 年全球餐具洗涤设备市场价值为 51 亿美元,预计到 2034 年将以 4.7% 的复合年增长率增长至 80 亿美元。

市场扩张正受到食品服务业不断发展变化和清洁技术持续创新的共同影响。随着城市和半城市地区的餐厅、饭店和餐饮服务设施的不断增加,对大容量、节能的餐具清洗解决方案的需求也日益增长。随着这些行业更加重视客户满意度、卫生标准和运行速度,人们越来越倾向于选择能够精准可靠地处理更大容量餐具的技术先进的机器。自动化系统、物联网整合和感测器驱动的维护工具正在成为标准配置,使餐具清洗系统更加智慧和反应迅速。商业厨房和多地点连锁餐厅优先考虑在整个运营过程中保持一致的清洁度,这催生了对具有标准化、可编程设置的机器的需求。这些系统不仅可以改善卫生状况,还可以减少对劳动力的依赖,这在劳动成本高或劳动力短缺的地区尤其重要。不断提升的消费者期望、更严格的法规以及对更快速服务的需求,正推动餐具清洗设备产业进入智慧自动化和永续设计的新阶段。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 51亿美元 |

| 预测值 | 80亿美元 |

| 复合年增长率 | 4.7% |

洗碗机市场在2024年创造了25亿美元的市场规模,预计到2034年将以4.9%的复合年增长率成长。在所有餐具洗涤系统中,洗碗机因其多功能性、操作简单性和高效性,仍是最常用的洗涤方式。洗碗机能够清洗从餐具到托盘等各种物品,使其成为各种商业场所的首选,包括食品准备中心、饭店和机构厨房。与其他餐具洗涤解决方案相比,洗碗机功能多样,能够处理大量洗涤操作,同时又不影响卫生或效率。

2024年,全自动设备市场占据54.34%的市场份额,预计到2034年将以4.9%的复合年增长率成长。全自动洗碗机因其能够在有限的人工投入下处理大量厨具,在大规模营运中变得越来越重要。这些系统在严苛的环境下也能提供快速、可靠的运作和合规性。商业厨房、医院和机构餐厅尤其青睐这些机器,因为它们能够最大限度地减少人为错误,改善卫生条件,并在满足现代效率标准的同时,保持操作的一致性。

美国餐具洗涤设备市场占78.7%的市场份额,2024年市场规模达14亿美元。该地区的成长主要得益于成熟的酒店和餐饮服务业,这些行业的劳动力成本居高不下,且必须遵守严格的卫生法规。自动化餐具洗涤系统在应对营运成本压力和监管要求方面获得了强劲发展。此外,持续的永续发展趋势促使餐饮服务业者采用节能节水的机器,以符合成本节约和环保目标。企业越来越重视能够降低水力发电消耗、提升效能的设备,有助于简化工作流程并支持绿色环保计画。

影响全球餐具洗涤设备市场的关键参与者包括 Meiko、Washtech、Hobart、Fagor Industrial、Electrolux Professional、Classeq、Sammic、Ecolab、Winterhalter、Champion Industries、Insinger Machine Company、Smeg Foodservice Equipment、Comenda、Krupps 和 Jackson Warewashing Systems。为了确保长期市场定位,餐具洗涤设备产业的公司高度重视产品创新、能源效率和技术整合。领先的製造商正在开发配备智慧诊断、触控萤幕控制和远端监控功能的机器,以支援预测性维护并减少停机时间。自动化仍然是主要关注点,尤其对于希望以最少的劳动力投入简化操作的大批量运营商而言。永续性是另一个关键领域,各公司正在设计能够减少水和能源消耗同时最大限度地提高清洁效率的系统。

目录

第一章:方法论与范围

第 2 章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 利润率

- 每个阶段的增值

- 影响价值链的因素

- 产业衝击力

- 成长动力

- 餐饮和旅馆业需求不断成长

- 技术进步

- 严格的卫生规定

- 产业陷阱与挑战

- 初期投资成本高

- 维护和营运费用

- 机会

- 采用节能解决方案

- 新兴市场的扩张

- 成长动力

- 成长潜力分析

- 未来市场趋势

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 依产品类型

- 监管格局

- 标准和合规要求

- 区域监理框架

- 差距分析

- 风险评估与缓解

- 贸易分析(HS编码-845020)

- 出口前10名国家

- 进口前10名国家

- 波特的分析

- PESTEL分析

- 消费者行为分析

- 购买模式

- 偏好分析

- 消费者行为的区域差异

- 电子商务对购买决策的影响

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:依产品类型,2021 - 2034

- 主要趋势

- 洗碗机

- 洗杯机

- 齿条输送机

- 增压加热器

- 其他(碗碟架等)

第六章:市场估计与预测:按类型,2021 - 2034

- 主要趋势

- 手动的

- 半自动

- 全自动

第七章:市场估计与预测:依价格区间,2021 - 2034

- 主要趋势

- 低的

- 中等的

- 高的

第 8 章:市场估计与预测:按解决方案,2021 年至 2034 年

- 主要趋势

- 洗涤剂

- 漂洗助剂

- 消毒剂

第九章:市场估计与预测:依最终用途,2021 - 2034

- 主要趋势

- 商业的

- 饭店

- 餐厅

- 咖啡厅

- 餐饮服务

- 其他(医院、医疗机构等)

- 机构

- 工业的

第 10 章:市场估计与预测:按配销通路,2021 年至 2034 年

- 主要趋势

- 直接的

- 间接

第 11 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 多边环境协定

- 阿联酋

- 南非

- 沙乌地阿拉伯

第 12 章:公司简介

- Champion Industries

- Classeq

- Comenda

- Electrolux Professional

- Ecolab

- Fagor Industrial

- Hobart

- Insinger Machine Company

- Jackson Warewashing Systems

- Krupps

- Meiko

- Sammic

- Smeg Foodservice Equipment

- Winterhalter

- Washtech

The Global Warewashing Equipment Market was valued at USD 5.1 billion in 2024 and is estimated to grow at a CAGR of 4.7% to reach USD 8 billion by 2034.

Market expansion is being shaped by a mix of evolving food service dynamics and consistent innovation in cleaning technologies. With restaurants, hotels, and food service facilities increasing in both urban and semi-urban areas, demand for high-capacity, energy-efficient warewashing solutions is on the rise. As these industries focus more on customer satisfaction, hygiene standards, and operational speed, there's a greater shift toward technologically advanced machines that can handle larger volumes with precision and reliability. Automated systems, IoT integration, and sensor-driven maintenance tools are becoming standard, making warewashing systems more intelligent and responsive. Commercial kitchens and multi-location restaurant chains are prioritizing consistent cleanliness across operations, creating demand for machines with standardized, programmable settings. These systems not only improve hygiene but also reduce labor dependency, particularly vital in regions with high labor costs or workforce shortages. The combination of rising consumer expectations, stricter regulations, and the need for faster service is driving the warewashing equipment industry into a new phase of intelligent automation and sustainable design.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $5.1 Billion |

| Forecast Value | $8 Billion |

| CAGR | 4.7% |

The dishwasher segment generated USD 2.5 billion in 2024 and is forecasted to grow at a CAGR of 4.9% through 2034. Among all warewashing systems, dishwashers continue to be the most used due to their versatility, ease of operation, and efficiency. Their ability to wash a broad range of items, from utensils to trays, makes them a preferred option in various commercial settings, including food prep centers, hospitality, and institutional kitchens. Compared to other warewashing solutions, dishwashers serve as multi-functional workhorses that handle bulk operations without compromising hygiene or efficiency.

In 2024, the fully automatic equipment segment held a 54.34% share and is expected to grow at a CAGR of 4.9% through 2034. Fully automated warewashing machines have become increasingly essential in large-scale operations due to their ability to handle substantial volumes of kitchenware with limited manual input. These systems deliver speed, reliability, and regulatory compliance in demanding environments. Commercial kitchens, hospitals, and institutional cafeterias especially favor these machines because they minimize human error, improve sanitation, and support operational consistency while meeting modern efficiency standards.

United States Warewashing Equipment Market held a 78.7% share and generated USD 1.4 billion in 2024. The growth in this region is largely driven by a mature hospitality and foodservice sector, where labor costs remain high and compliance with stringent hygiene regulations is mandatory. Automated warewashing systems have gained strong traction in response to operational cost pressures and regulatory mandates. Additionally, the ongoing shift toward sustainability has prompted foodservice operators to adopt energy- and water-efficient machines that align with cost-saving and environmental goals. Businesses increasingly prioritize equipment that reduces utility consumption while enhancing performance, helping to streamline workflow and support green initiatives.

Key players shaping the Global Warewashing Equipment Market include Meiko, Washtech, Hobart, Fagor Industrial, Electrolux Professional, Classeq, Sammic, Ecolab, Winterhalter, Champion Industries, Insinger Machine Company, Smeg Foodservice Equipment, Comenda, Krupps, and Jackson Warewashing Systems. To secure long-term market positioning, companies in the warewashing equipment industry are heavily focused on product innovation, energy efficiency, and technological integration. Leading manufacturers are developing machines equipped with smart diagnostics, touch-screen controls, and remote monitoring capabilities to support predictive maintenance and reduce downtime. Automation remains a primary focus, especially for high-volume operators looking to streamline operations with minimal labor input. Sustainability is another critical area, with firms designing systems that reduce water and energy use while maximizing cleaning efficiency.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.3 Data collection methods

- 1.4 Data mining sources

- 1.4.1 Global

- 1.4.2 Regional/Country

- 1.5 Base estimates and calculations

- 1.5.1 Base year calculation

- 1.5.2 Key trends for market estimation

- 1.6 Primary research and validation

- 1.6.1 Primary sources

- 1.7 Forecast model

- 1.8 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 Type

- 2.2.4 Price range

- 2.2.5 Solution

- 2.2.6 End use

- 2.2.7 Distribution channel

- 2.3 CXO perspectives: strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factors affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand in food service & hospitality

- 3.2.1.2 Technological advancements

- 3.2.1.3 Stringent hygiene regulations

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High initial investment costs

- 3.2.2.2 Maintenance and operational expenses

- 3.2.3 Opportunities

- 3.2.3.1 Adoption of energy-efficient solutions

- 3.2.3.2 Expansion in emerging markets

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By Product type

- 3.7 Regulatory landscape

- 3.7.1 standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.8 Gap analysis

- 3.9 Risk assessment and mitigation

- 3.10 Trade analysis (HS Code-845020)

- 3.10.1 Top 10 export countries

- 3.10.2 Top 10 import countries

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

- 3.13 Consumer behavior analysis

- 3.13.1 Purchasing patterns

- 3.13.2 Preference analysis

- 3.13.3 Regional variations in consumer behavior

- 3.13.4 Impact of e-commerce on buying decisions

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates & Forecast, By Product Type, 2021 - 2034 ($Bn, Thousand Units)

- 5.1 Key trends

- 5.2 Dishwasher

- 5.3 Glasswasher

- 5.4 Rack conveyors

- 5.5 Booster heater

- 5.6 Others (dish drainers, etc.)

Chapter 6 Market Estimates & Forecast, By Type, 2021 - 2034 ($Bn, Thousand Units)

- 6.1 Key trends

- 6.2 Manual

- 6.3 Semi-automatic

- 6.4 Fully automatic

Chapter 7 Market Estimates & Forecast, By Price Range, 2021 - 2034 ($Bn, Thousand Units)

- 7.1 Key trends

- 7.2 Low

- 7.3 Medium

- 7.4 High

Chapter 8 Market Estimates & Forecast, By Solution, 2021 - 2034 ($Bn, Thousand Units)

- 8.1 Key trends

- 8.2 Detergent

- 8.3 Rinse aids

- 8.4 Sanitizer

Chapter 9 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn, Thousand Units)

- 9.1 Key trends

- 9.2 Commercial

- 9.2.1 Hotels

- 9.2.2 Restaurants

- 9.2.3 Cafes

- 9.2.4 Catering services

- 9.2.5 Others (hospitals and healthcare facilities, etc.)

- 9.3 Institutional

- 9.4 Industrial

Chapter 10 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 ($Bn, Thousand Units)

- 10.1 Key trends

- 10.2 Direct

- 10.3 Indirect

Chapter 11 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Thousand Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 UK

- 11.3.2 Germany

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.3.6 Russia

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 MEA

- 11.6.1 UAE

- 11.6.2 South Africa

- 11.6.3 Saudi Arabia

Chapter 12 Company Profiles

- 12.1 Champion Industries

- 12.2 Classeq

- 12.3 Comenda

- 12.4 Electrolux Professional

- 12.5 Ecolab

- 12.6 Fagor Industrial

- 12.7 Hobart

- 12.8 Insinger Machine Company

- 12.9 Jackson Warewashing Systems

- 12.10 Krupps

- 12.11 Meiko

- 12.12 Sammic

- 12.13 Smeg Foodservice Equipment

- 12.14 Winterhalter

- 12.15 Washtech