|

市场调查报告书

商品编码

1833664

牙科椅市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Dental Chair Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

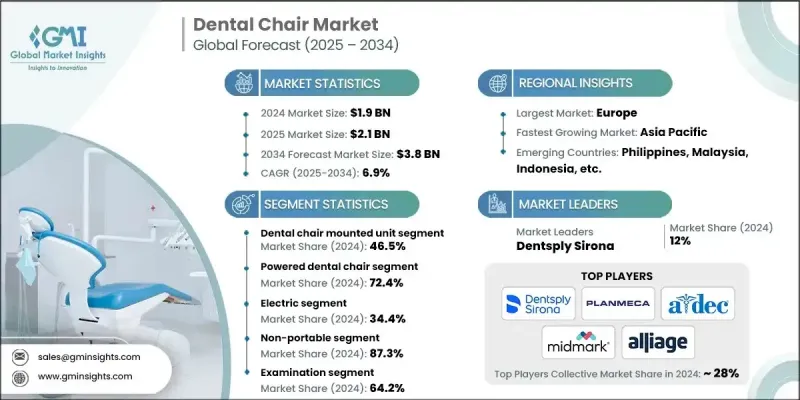

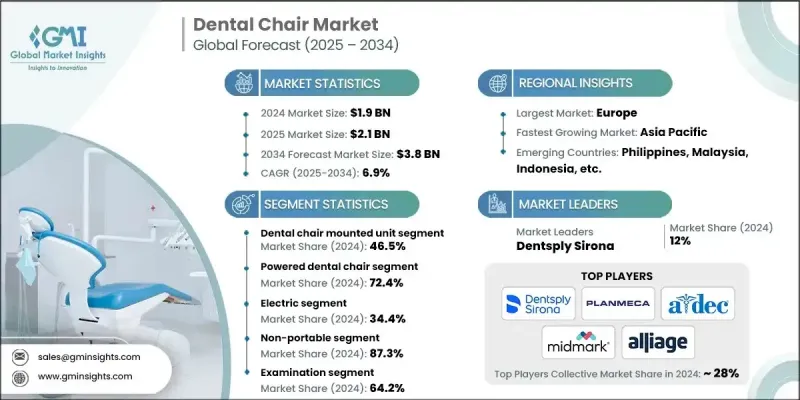

2024 年全球牙科椅市场价值为 19 亿美元,预计到 2034 年将以 6.9% 的复合年增长率增长至 38 亿美元。

这一增长主要得益于牙科手术数量的增长、口腔健康意识的增强以及对符合人体工学且技术先进的牙科椅的需求不断增长。牙科诊所的扩张、政府推广口腔卫生的项目以及对现代牙科基础设施的持续投资也推动了全球市场的成长,促进了成熟地区和新兴地区的牙科应用。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 19亿美元 |

| 预测值 | 38亿美元 |

| 复合年增长率 | 6.9% |

牙科治疗的激增和口腔健康意识的增强,加上先进牙科设备的使用,极大地推动了牙科椅市场的发展。如今,患者不仅注重有效的护理,也注重就诊时的舒适和便捷,这促使诊所投资于创新且符合人体工学的牙科椅。可调式座椅、数位控制和多功能单元等功能提高了营运效率,缩短了治疗时间,并改善了临床效果,使这些牙科椅成为当代牙科实践的重要组成部分。在已开发和发展中市场,牙科诊所和连锁店的兴起,以及基础设施投资的增加,扩大了牙科椅的客户群。自动定位、改进的照明以及影像和诊断工具的整合等技术进步,使牙科治疗过程更加顺畅,患者也更加舒适,从而进一步增加了牙科椅的需求。此外,在提供价格合理、高品质医疗服务的国家,牙科旅游业的成长也推动了先进牙科椅的采用,以满足全球标准。

2024年,牙科椅式一体机市场占据46.5%的市场份额,这得益于对整合牙科解决方案日益增长的需求以及营运效率的提升。该细分市场之所以受欢迎,是因为它能够将手机、吸痰系统、水管和控制器等基本牙科设备整合到一个符合人体工学的一体机中。这种整合简化了工作流程,缩短了治疗时间,并提高了患者的舒适度,使其成为现代牙科诊所的首选。

2024年,电动牙科椅市场占最大份额,达34.4%,这得益于人们对精准、节能、低维护牙科手术日益增长的偏好。电动牙科椅在治疗过程中提供平稳精准的移动,缩短了手术时间,并提高了患者的舒适度。其先进的自动化功能,包括可编程定位和整合控制系统,可提高繁忙牙科诊所的效率。数位化牙科和尖端牙科技术的日益普及,进一步加速了对电动牙科椅的需求。

2024年,北美牙科椅市场规模达4.496亿美元。该地区日益增长的老年人口正在推动牙科服务和先进诊疗方案的需求,并为这些方案创造了新的机会,而这些方案都依赖高科技牙科椅。随着现代牙科技术的兴起,对能够与数位化工作流程无缝整合的牙科椅的需求日益增长,这使得牙医能够提供更精准的诊断并改善治疗效果。牙科诊所正在寻求具有自动化和数位化功能的牙科椅,以提高员工的效率和生产力。

影响全球牙科椅市场的关键参与者包括 Dentsply Sirona、Alliage、Midmark、PLANMECA、A-dec、KAVO、MEGAGEN、Belmont、Boyd Industries、DIPLOMAT DENTAL SOLUTIONS、Flight Dental Systems、MORITA、OSSTEM IMPTLAN、VIC DENTAL SOLUTIONS、Flight Dental Systems、MORITA、OSSTEM IMPTLAN、VIC DENTAL SOevaD、牙科椅市场的公司高度重视创新以保持竞争优势,并不断提高产品的人体工学、舒适度和自动化程度。扩大分销网络并与牙科诊所和医疗保健提供者建立策略合作伙伴关係对于扩大市场范围至关重要。许多参与者投资研发以整合智慧控制和诊断工具等数位技术,以顺应数位化牙科日益增长的趋势。他们还透过根据当地需求和价格敏感度客製化产品来瞄准新兴市场。此外,该公司强调售后服务、培训和客户支援,以与牙科专业人士建立牢固的关係。

目录

第一章:方法论与范围

第 2 章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 口腔健康问题日益普遍

- 医疗旅游兴起

- 提高牙齿美学意识

- 发展中地区牙医数量和基础设施支出激增

- 产业陷阱与挑战

- 牙科椅价格高昂

- 对牙科手术漠不关心

- 机会

- 新兴经济体的扩张

- 私人牙科诊所数量增加

- 成长动力

- 成长潜力分析

- 监管格局

- 北美洲

- 欧洲

- 亚太地区

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 消费者行为趋势

- 2024 年各地区定价分析

- 永续性和环境影响

- 使用可回收材料

- 节能製造工艺

- 投资前景

- 波特的分析

- PESTEL分析

- 差距分析

- 未来市场趋势

第四章:竞争格局

- 介绍

- 公司矩阵分析

- 公司市占率分析

- 全球的

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲和中东地区

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:按产品,2021 - 2034 年

- 主要趋势

- 天花板安装的椅子

- 移动独立椅

- 牙科椅安装装置

第六章:市场估计与预测:按技术,2021 - 2034 年

- 主要趋势

- 电动牙科椅

- 非电动牙科椅

第七章:市场估计与预测:按运营,2021 - 2034

- 主要趋势

- 机电

- 油压

- 电的

- 手动的

- 气动

- 电动气动

第八章:市场估计与预测:按配置,2021 - 2034 年

- 主要趋势

- 便携的

- 不可携带

- 一般牙科椅

- 儿童牙科椅

- 拔牙牙科椅

第九章:市场估计与预测:按应用,2021 - 2034

- 主要趋势

- 考试

- 手术

第 10 章:市场估计与预测:按牙科专业,2021 - 2034 年

- 主要趋势

- 全科医学

- 口腔颚面外科

- 正畸和牙齿颚面矫正术

- 儿童牙科

- 牙科病理学

- 其他牙科专科

第 11 章:市场估计与预测:依最终用途,2021 年至 2034 年

- 主要趋势

- 牙医诊所

- 医院

- 门诊手术中心

- 其他最终用途

第 12 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 俄罗斯

- 奥地利

- 瑞典

- 丹麦

- 芬兰

- 挪威

- 瑞士

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 印尼

- 菲律宾

- 马来西亚

- 新加坡

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 哥伦比亚

- 秘鲁

- 智利

- 多边环境协定

- 南非

- 沙乌地阿拉伯

- 阿联酋

- 埃及

- 以色列

- 伊朗

第十三章:公司简介

- 全球参与者

- A-dec

- alliage

- Dentsply Sirona

- DIPLOMAT DENTAL SOLUTIONS

- FLiGHT DENTAL SYSTEMS

- MORITA

- KAVO

- MEGAGEN

- Midmark

- OSSTEM IMPLANT

- PLANMECA

- zevadent

- 区域参与者

- Belmont

- Boyd Industries

- Chirana

- FLiGHT DENTAL SYSTEMS

- VIC dental

- 新兴企业

- DIPLOMAT DENTAL SOLUTIONS

- HEKA

- neodent

- Paloma

- Summit Dental Systems (SDS)

The Global Dental Chair Market was valued at USD 1.9 billion in 2024 and is estimated to grow at a CAGR of 6.9% to reach USD 3.8 billion by 2034.

This growth is primarily fueled by the rising volume of dental procedures, heightened awareness around oral health, and an increasing demand for ergonomic and technologically advanced dental chairs. The expansion of dental clinics, government programs promoting oral hygiene, and growing investments in modern dental infrastructure are also propelling market growth worldwide, boosting adoption in both mature and emerging regions.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.9 Billion |

| Forecast Value | $3.8 Billion |

| CAGR | 6.9% |

The surge in dental treatments and oral health consciousness, coupled with the use of advanced dental equipment, is significantly driving the dental chair market. Patients today prioritize not only effective care but also comfort and convenience during dental visits, pushing clinics to invest in innovative and ergonomic chairs. Features like adjustable seating, digital controls, and multifunctional units enhance operational efficiency, reduce treatment time, and improve clinical outcomes, making these chairs a crucial part of contemporary dental practices. The rise of dental clinics and chains across developed and developing markets, backed by greater infrastructure investments, has expanded the customer base for dental chairs. Technological progress, such as automated positioning, improved lighting, and the integration of imaging and diagnostic tools, has further increased demand by making dental procedures smoother and more comfortable for patients. Additionally, the growth of dental tourism in countries offering affordable, high-quality care has driven the adoption of advanced dental chairs to meet global standards.

In 2024, the dental chair-mounted unit segment held a 46.5% share, driven by the increasing need for integrated dental solutions and improved operational efficiency. This segment's popularity stems from its ability to combine essential dental equipment such as handpieces, suction systems, waterlines, and controls into a single ergonomic unit. This integration streamlines workflow, reduces treatment durations, and enhances patient comfort, making it the preferred option for modern dental clinics.

The electric dental chair segment held the largest share of 34.4% in 2024, driven by the growing preference for precise, energy-efficient, and low-maintenance dental procedures. Electric chairs provide smooth and accurate movements during treatments, decreasing procedure times and increasing patient comfort. Their advanced automation features, including programmable positioning and integrated control systems, boost efficiency in busy dental practices. The rising adoption of digital dentistry and cutting-edge dental technologies worldwide has further accelerated demand for electric dental chairs.

North America Dental Chair Market was valued at USD 449.6 million in 2024. The region's increasing elderly population is driving demand and creating new opportunities for dental services and advanced procedures that rely on high-tech dental chairs. With the rise of modern dental technologies, there is a growing need for chairs that integrate seamlessly with digital workflows, enabling dentists to deliver more precise diagnoses and improved treatment results. Dental practices are seeking chairs with automated functions and digital capabilities to enhance staff efficiency and productivity.

Key players shaping the Global Dental Chair Market include Dentsply Sirona, Alliage, Midmark, PLANMECA, A-dec, KAVO, MEGAGEN, Belmont, Boyd Industries, DIPLOMAT DENTAL SOLUTIONS, Flight Dental Systems, MORITA, OSSTEM IMPLANT, VIC Dental, Zevadent, HEKA, Neodent, Paloma, and Summit Dental Systems (SDS). Companies in the dental chair market focus heavily on innovation to maintain their competitive edge, continuously enhancing ergonomics, comfort, and automation in their products. Expanding distribution networks and forming strategic partnerships with dental clinics and healthcare providers are critical to increasing market reach. Many players invest in R&D to integrate digital technologies such as smart controls and diagnostic tools, aligning with the growing trend of digital dentistry. They also target emerging markets by customizing products to local needs and price sensitivities. Additionally, companies emphasize after-sales service, training, and customer support to build strong relationships with dental professionals.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Product trends

- 2.2.3 Technology trends

- 2.2.4 Operation trends

- 2.2.5 Configuration trends

- 2.2.6 Application trends

- 2.2.7 Dental speciality trends

- 2.2.8 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of oral health disorders

- 3.2.1.2 Rise in medical tourism

- 3.2.1.3 Increasing awareness of dental aesthetics

- 3.2.1.4 Surge in number of dentists and infrastructural spending in developing regions

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of dental chairs

- 3.2.2.2 Apathy towards dental procedure

- 3.2.3 Opportunities

- 3.2.3.1 Expansion in emerging economies

- 3.2.3.2 Rise in number of private dental clinics

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Consumer behavior trends

- 3.7 Pricing analysis, by region, 2024

- 3.8 Sustainability and environmental impact

- 3.8.1 Use of recyclable materials

- 3.8.2 Energy-efficient manufacturing processes

- 3.9 Investment landscape

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

- 3.12 Gap analysis

- 3.13 Future market trends

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.3.1 Global

- 4.3.2 North America

- 4.3.3 Europe

- 4.3.4 Asia Pacific

- 4.3.5 LAMEA

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

- 4.7 Key developments

- 4.7.1 Mergers and acquisitions

- 4.7.2 Partnerships and collaborations

- 4.7.3 New product launches

- 4.7.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn and Units)

- 5.1 Key trends

- 5.2 Ceiling mounted chair

- 5.3 Mobile independent chair

- 5.4 Dental chair mounted unit

Chapter 6 Market Estimates and Forecast, By Technology, 2021 - 2034 ($ Mn and Units)

- 6.1 Key trends

- 6.2 Powered dental chair

- 6.3 Non-powered dental chair

Chapter 7 Market Estimates and Forecast, By Operation, 2021 - 2034 ($ Mn and Units)

- 7.1 Key trends

- 7.2 Electromechanical

- 7.3 Hydraulic

- 7.4 Electric

- 7.5 Manual

- 7.6 Pneumatic

- 7.7 Electropneumatic

Chapter 8 Market Estimates and Forecast, By Configuration, 2021 - 2034 ($ Mn and Units)

- 8.1 Key trends

- 8.2 Portable

- 8.3 Non-portable

- 8.3.1 General dental chair

- 8.3.2 Pediatric dental chair

- 8.3.3 Exodontics dental chair

Chapter 9 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn and Units)

- 9.1 Key trends

- 9.2 Examination

- 9.3 Surgery

Chapter 10 Market Estimates and Forecast, By Dental Speciality, 2021 - 2034 ($ Mn and Units)

- 10.1 Key trends

- 10.2 General practice

- 10.3 Oral and maxillofacial surgery

- 10.4 Orthodontics and dentofacial orthopedics

- 10.5 Pediatric dentistry

- 10.6 Dental pathology

- 10.7 Other dental speciality

Chapter 11 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn and Units)

- 11.1 Key trends

- 11.2 Dental clinics

- 11.3 Hospitals

- 11.4 Ambulatory surgery centers

- 11.5 Other end use

Chapter 12 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn and Units)

- 12.1 Key trends

- 12.2 North America

- 12.2.1 U.S.

- 12.2.2 Canada

- 12.3 Europe

- 12.3.1 Germany

- 12.3.2 UK

- 12.3.3 France

- 12.3.4 Spain

- 12.3.5 Italy

- 12.3.6 Russia

- 12.3.7 Austria

- 12.3.8 Sweden

- 12.3.9 Denmark

- 12.3.10 Finland

- 12.3.11 Norway

- 12.3.12 Switzerland

- 12.3.13 Netherlands

- 12.4 Asia Pacific

- 12.4.1 China

- 12.4.2 Japan

- 12.4.3 India

- 12.4.4 Australia

- 12.4.5 South Korea

- 12.4.6 Indonesia

- 12.4.7 Philippines

- 12.4.8 Malaysia

- 12.4.9 Singapore

- 12.5 Latin America

- 12.5.1 Brazil

- 12.5.2 Mexico

- 12.5.3 Argentina

- 12.5.4 Colombia

- 12.5.5 Peru

- 12.5.6 Chile

- 12.6 MEA

- 12.6.1 South Africa

- 12.6.2 Saudi Arabia

- 12.6.3 UAE

- 12.6.4 Egypt

- 12.6.5 Israel

- 12.6.6 Iran

Chapter 13 Company Profiles

- 13.1 Global players

- 13.1.1 A-dec

- 13.1.2 alliage

- 13.1.3 Dentsply Sirona

- 13.1.4 DIPLOMAT DENTAL SOLUTIONS

- 13.1.5 FLiGHT DENTAL SYSTEMS

- 13.1.6 MORITA

- 13.1.7 KAVO

- 13.1.8 MEGAGEN

- 13.1.9 Midmark

- 13.1.10 OSSTEM IMPLANT

- 13.1.11 PLANMECA

- 13.1.12 zevadent

- 13.2 Regional players

- 13.2.1 Belmont

- 13.2.2 Boyd Industries

- 13.2.3 Chirana

- 13.2.4 FLiGHT DENTAL SYSTEMS

- 13.2.5 VIC dental

- 13.3 Emerging players

- 13.3.1 DIPLOMAT DENTAL SOLUTIONS

- 13.3.2 HEKA

- 13.3.3 neodent

- 13.3.4 Paloma

- 13.3.5 Summit Dental Systems (SDS)