|

市场调查报告书

商品编码

1833665

血液透析导管市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Hemodialysis Catheters Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

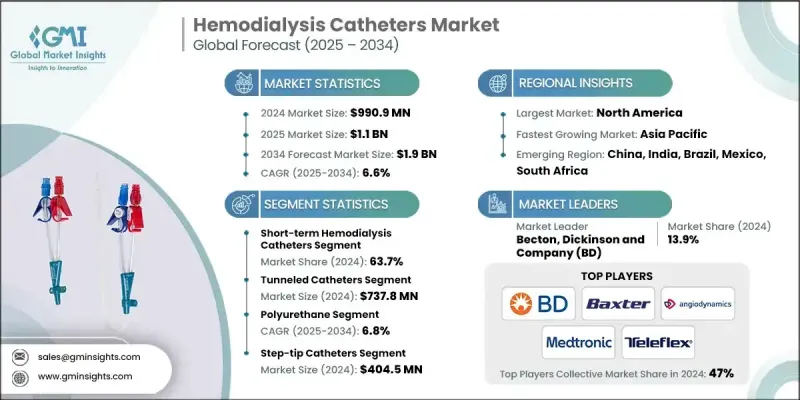

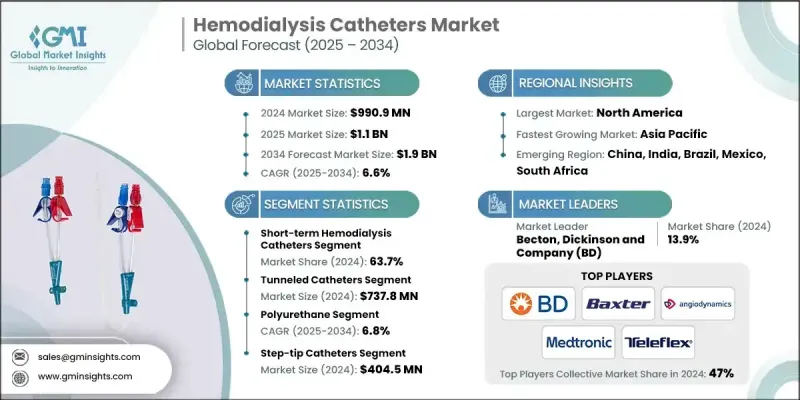

2024 年全球血液透析导管市场价值为 9.909 亿美元,预计将以 6.6% 的复合年增长率成长,到 2034 年达到 19 亿美元。

该市场的稳定成长很大程度上与慢性肾臟病 (CKD) 和末期肾病 (ESRD) 盛行率的上升有关,这带来了对透析治疗的巨大需求。人们对肾臟替代疗法的认识不断提高,进一步加速了各地区的应用。此外,导管设计的技术进步以及先进、生物相容性和抗感染材料的引入,正在推动产业扩张。全球人口快速老化,更容易受到肾臟相关併发症的影响,这也扩大了患者群体,并增加了对长期透析的需求。同时,医疗保健支出的增加、透析中心的不断建立以及政府支持的加强基础设施的倡议,使得人们能够更广泛地获得挽救生命的治疗。医疗保健机构正在优先投资透析服务,而製造商则不断创新,设计出更安全、更有效率的导管,从而支持预测期内的持续成长。这些因素,加上诊断方案的改进和肾臟健康宣传活动的发展,正在推动全球透析采用率的提高。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 9.909亿美元 |

| 预测值 | 19亿美元 |

| 复合年增长率 | 6.6% |

短期血液透析导管市场在2024年占据63.7%的市场份额,这得益于其在急性肾损伤和紧急情况下提供快速血管通路的重要作用。这类导管因其易于插入、成本效益高且可立即启动透析,广泛应用于医院和重症监护环境。急性肾损伤(通常与外科手术、败血症和心血管併发症相关)的发生率不断上升,并持续推高了对这些设备的需求。

隧道导管细分市场在2024年的收入为7.378亿美元,确立了其在市场上的主导地位。这些导管旨在为正在接受透析的患者提供可靠的长期血管通路。其皮下隧道设计可降低感染风险并提供卓越的稳定性,同时与非隧道产品相比,其更高的耐用性和更高的患者舒适度使其成为医疗保健提供者的首选。

2024年,美国血液透析导管市场规模达4.375亿美元,这主要得益于慢性肾臟病(CKD)和终末期肾病(ESRD)患者数量的不断增长。糖尿病、高血压和肥胖病例激增,以及鼓励早期诊断和治疗的认知度提升等因素共同推动了这一市场的成长。凭藉先进的医疗基础设施、数量众多的透析中心以及隧道式导管和生物相容性导管等创新导管的快速普及,美国仍然是全球血液透析导管市场成长的关键贡献者。

血液透析导管产业主要的活跃公司包括 Vygon、Amecath、Cook Medical、Polymed、Mozarc Medical、Delta Med、Teleflex、B. Braun、ST Stone Medical、Merit Medical、Medcomp、AngioDynamics、Becton、Dickinson and Company (BD)、Healthline Medical Products、Baxter 和 Bain Medical Equipment。为了巩固市场地位,血液透析导管产业的公司正优先考虑创新、地理扩张和策略合作。製造商正专注于先进的导管设计,以提高生物相容性、降低感染风险并改善流动性能,以满足日益增长的患者和临床医生需求。他们正在与医疗保健提供者和透析中心建立策略联盟,以确保长期供应协议并提高产品可及性。

目录

第一章:方法论与范围

第 2 章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 每个阶段的增值

- 影响价值链的因素

- 产业衝击力

- 成长动力

- 慢性肾臟疾病和末期肾臟病盛行率上升

- 促进慢性肾臟病意识的促进倡议

- 肾臟替代治疗数量不断增加

- 血液透析导管的技术进步

- 全球肾臟捐赠者短缺

- 产业陷阱与挑战

- 对肾臟相关疾病的认识不足

- 血液透析导管相关併发症

- 市场机会

- 扩展居家透析和远端患者监控解决方案

- 抗菌和生物相容性导管材料的采用日益增多

- 医疗保健基础设施不断完善的新兴市场具有成长潜力

- 成长动力

- 成长潜力分析

- 监管格局

- 技术格局

- 当前的技术趋势

- 转向长期使用隧道式带囊导管

- 抗菌涂层和肝素涂层导管的进展

- 微创导管置入技术的应用日益广泛

- 新兴技术

- 开发药物洗脱导管以最大限度地减少感染和血栓形成

- 嵌入感测器的智慧导管,可即时监测血流和凝血情况

- 针对患者特定解剖结构设计的 3D 列印客製化导管

- 当前的技术趋势

- 未来市场趋势

- 转向永久性血管通路以限制对导管的依赖

- 居家透析的使用日益增长,推动了先进导管的需求

- 远端导管监测的数位健康整合

- 市场进入策略

- 定价分析

- 差距分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 全球的

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲和中东地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

- 关键进展

- 併购

- 伙伴关係与协作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:按导管类型,2021 - 2034

- 主要趋势

- 短期血液透析导管

- 长期血液透析导管

第六章:市场估计与预测:按产品,2021 - 2034 年

- 主要趋势

- 隧道导管

- 带套囊隧道导管

- 无袖套隧道导管

- 非隧道导管

第七章:市场估计与预测:按材料,2021 - 2034 年

- 主要趋势

- 聚氨酯

- 硅酮

第八章:市场估计与预测:按提示配置,2021 - 2034 年

- 主要趋势

- 阶梯式导管

- 尖端分叉导管

- 对称导管

- 其他尖端配置

第九章:市场估计与预测:按流明,2021 - 2034 年

- 主要趋势

- 单腔

- 双腔

- 三腔

第 10 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第 11 章:公司简介

- Amecath

- AngioDynamics

- B. Braun

- Bain Medical Equipment

- Baxter

- Becton, Dickinson and Company (BD)

- Cook Medical

- Delta Med

- Healthline Medical Products

- Medcomp

- Merit Medical

- Mozarc Medical

- Polymed

- ST Stone Medical

- Teleflex

- Vygon

The Global Hemodialysis Catheters Market was valued at USD 990.9 million in 2024 and is estimated to grow at a CAGR of 6.6% to reach USD 1.9 billion by 2034.

The steady rise in this market is largely linked to the increasing prevalence of chronic kidney disease (CKD) and end-stage renal disease (ESRD), which creates significant demand for dialysis treatments. Growing awareness about renal replacement therapies has further accelerated adoption across regions. Additionally, technological progress in catheter design and the introduction of advanced, biocompatible, and infection-resistant materials are fueling industry expansion. The rapidly aging global population, which is more vulnerable to kidney-related complications, is also widening the patient base and boosting the need for long-term dialysis access. At the same time, greater healthcare spending, the rising establishment of dialysis centers, and government-backed initiatives to strengthen infrastructure are enabling broader access to life-saving therapies. Healthcare organizations are prioritizing investments in dialysis services while manufacturers continue to innovate with safer and more efficient catheter designs, supporting sustained growth over the forecast period. These factors, along with improved diagnosis programs and awareness campaigns on renal health, are driving higher adoption rates worldwide.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $990.9 Million |

| Forecast Value | $1.9 Billion |

| CAGR | 6.6% |

The short-term hemodialysis catheters segment held a 63.7% share in 2024, supported by their essential role in providing fast vascular access in acute kidney injury and emergency cases. These catheters are widely utilized in hospital and critical care environments because they can be inserted easily, offer cost efficiency, and allow immediate dialysis initiation. The rising incidence of acute kidney injury, often associated with surgical interventions, sepsis, and cardiovascular complications, continues to increase demand for these devices.

The tunneled catheters segment generated USD 737.8 million in 2024, establishing its dominance in the market. These catheters are designed to deliver dependable long-term vascular access for patients undergoing ongoing dialysis. Their subcutaneous tunneling reduces infection risks and provides superior stability, while enhanced durability and greater patient comfort compared to non-tunneled products make them the preferred option among healthcare providers.

U.S. Hemodialysis Catheters Market was valued at USD 437.5 million in 2024, driven by the rising number of patients diagnosed with CKD and ESRD. Contributing factors include a surge in diabetes, hypertension, and obesity cases, alongside improved awareness programs that encourage early diagnosis and treatment. With advanced healthcare infrastructure, a strong presence of dialysis centers, and rapid adoption of innovative catheters such as tunneled and biocompatible designs, the country remains a key contributor to global growth.

Key companies active in the Hemodialysis Catheters Industry include Vygon, Amecath, Cook Medical, Polymed, Mozarc Medical, Delta Med, Teleflex, B. Braun, ST Stone Medical, Merit Medical, Medcomp, AngioDynamics, Becton, Dickinson and Company (BD), Healthline Medical Products, Baxter, and Bain Medical Equipment. To strengthen their market position, companies in the hemodialysis catheters sector are prioritizing innovation, geographic expansion, and strategic collaborations. Manufacturers are focusing on advanced catheter designs with enhanced biocompatibility, lower infection risks, and better flow performance to address growing patient and clinician demands. Strategic alliances with healthcare providers and dialysis centers are being pursued to secure long-term supply agreements and improve product accessibility.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Catheter type trends

- 2.2.3 Product trends

- 2.2.4 Material trends

- 2.2.5 Tip configuration trends

- 2.2.6 Lumen trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factors affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of chronic kidney disorders and end-stage renal disease

- 3.2.1.2 Facilitative initiatives to promote chronic kidney disorder awareness

- 3.2.1.3 Rising number of renal replacement therapy

- 3.2.1.4 Technological advancements in hemodialysis catheters

- 3.2.1.5 Shortage of kidney donors globally

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Low awareness about kidney-related disorders

- 3.2.2.2 Complications associated with hemodialysis catheters

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion of home-based dialysis and remote patient monitoring solutions

- 3.2.3.2 Increasing adoption of antimicrobial and biocompatible catheter materials

- 3.2.3.3 Growth potential in emerging markets with rising healthcare infrastructure

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East and Africa

- 3.5 Technology landscape

- 3.5.1 Current technological trends

- 3.5.1.1 Shift toward tunneled cuffed catheters for long-term use

- 3.5.1.2 Advancements in antimicrobial-coated and heparin-coated catheters

- 3.5.1.3 Rising adoption of minimally invasive catheter placement techniques

- 3.5.2 Emerging technologies

- 3.5.2.1 Development of drug-eluting catheters to minimize infection and thrombosis

- 3.5.2.2 Smart catheters with embedded sensors for real-time monitoring of flow and clotting

- 3.5.2.3 3D-printed customized catheters designed for patient-specific anatomy

- 3.5.1 Current technological trends

- 3.6 Future market trends

- 3.6.1 Shift toward permanent vascular access to limit catheter reliance

- 3.6.2 Growing use of home dialysis driving advanced catheter demand

- 3.6.3 Integration of digital health for remote catheter monitoring

- 3.7 Go-to-market strategies

- 3.8 Pricing analysis

- 3.9 GAP analysis

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 Global

- 4.2.2 North America

- 4.2.3 Europe

- 4.2.4 Asia Pacific

- 4.2.5 LAMEA

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

- 4.7 Key developments

- 4.7.1 Merger and acquisition

- 4.7.2 Partnership and collaboration

- 4.7.3 New product launches

- 4.7.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Catheter Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Short-term hemodialysis catheters

- 5.3 Long-term hemodialysis catheters

Chapter 6 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Tunneled catheters

- 6.2.1 Cuffed tunneled catheters

- 6.2.2 Non-cuffed tunneled catheters

- 6.5 Non-tunneled catheters

Chapter 7 Market Estimates and Forecast, By Material, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Polyurethane

- 7.3 Silicone

Chapter 8 Market Estimates and Forecast, By Tip Configuration, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Step-tip catheters

- 8.3 Split-tip catheters

- 8.4 Symmetric catheters

- 8.5 Other tip configurations

Chapter 9 Market Estimates and Forecast, By Lumen, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Single-lumen

- 9.3 Double-lumen

- 9.4 Triple-lumen

Chapter 10 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Amecath

- 11.2 AngioDynamics

- 11.3 B. Braun

- 11.4 Bain Medical Equipment

- 11.5 Baxter

- 11.6 Becton, Dickinson and Company (BD)

- 11.7 Cook Medical

- 11.8 Delta Med

- 11.9 Healthline Medical Products

- 11.10 Medcomp

- 11.11 Merit Medical

- 11.12 Mozarc Medical

- 11.13 Polymed

- 11.14 ST Stone Medical

- 11.15 Teleflex

- 11.16 Vygon