|

市场调查报告书

商品编码

1833669

电源优化器市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Power Optimizer Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

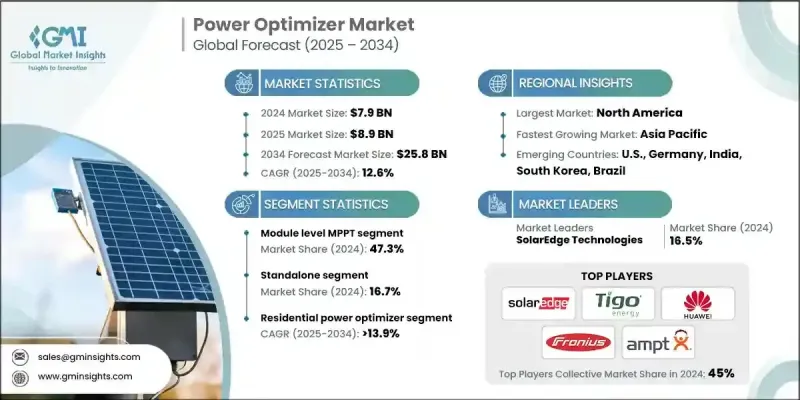

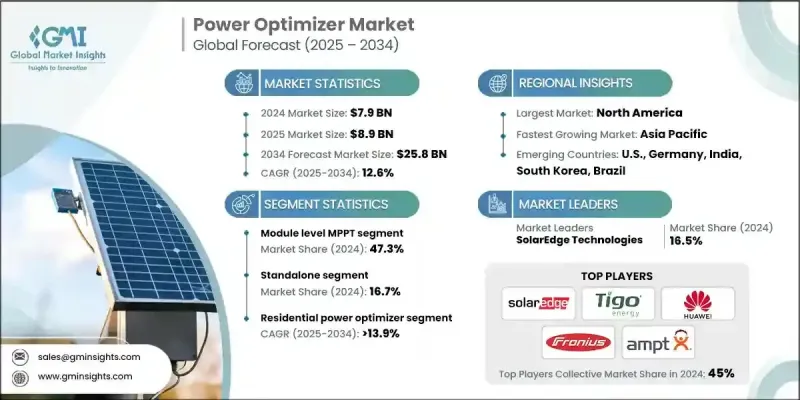

2024 年全球电源优化器市值为 79 亿美元,预计到 2034 年将以 12.6% 的复合年增长率增长至 258 亿美元。

随着住宅和商业领域对更高能量输出和更安全太阳能发电系统的需求持续增长,该行业正经历显着的发展势头。功率优化器如今已成为现代光伏基础设施的核心,它能够实现即时监控和系统诊断,从而帮助提高产量并降低营运成本。储能係统和智慧电网平台的日益融合正在强化这一增长,因为这些技术支援更强大的能源控制、稳定的电网互动和双向电力通讯。物联网、人工智慧和基于云端的分析领域的创新正在重塑功率优化器的运作方式,确保更智慧、更具预测性的维护和更高的系统效率。製造商也正在投资低碳设计和可回收组件,以符合永续发展目标。鼓励全球范围内采用太阳能的监管框架正在推动市场扩张,尤其是针对分散式能源发电的激励措施。此外,区块链与太阳能係统的整合为透明、安全的能源交易创造了机会,加强了去中心化的再生能源生态系统,并推动了全球对智慧能源解决方案的接受。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 79亿美元 |

| 预测值 | 258亿美元 |

| 复合年增长率 | 12.6% |

2024年,模组级MPPT市场占有47.3%的份额,预计到2034年将以3.1%的复合年增长率成长。这项技术对于提高单块太阳能板的发电量至关重要,尤其是在受阴影、倾斜角度变化或太阳能板配置不规则影响的光伏系统中。随着发展中经济体和已开发经济体加速普及屋顶太阳能,对更精细功率追踪和增强型太阳能板级控制的需求正在推动对模组级MPPT解决方案的需求。美国、印度和欧洲等地区的财政激励措施和政府优惠政策正在加强市场渗透,电子元件成本的降低也使该技术的价格越来越亲民。

2024年,併网光伏市场占有率达到83.3%,预计2034年将以11.9%的复合年增长率成长。由于大力支持将太阳能融入公用事业基础设施,尤其是净计量计划和智慧电网计划,併网系统将继续占据主导地位。这些政策不仅鼓励住宅和商业屋顶安装太阳能,而且还需要高性能功率优化器来维持不同生产水准下的能源稳定性。住宅、办公大楼和工业建筑的屋顶太阳能安装正变得越来越普遍,在这些应用中,优化器对于最大限度地减少部分遮蔽或复杂屋顶几何形状造成的能量损失至关重要。

美国功率优化器市场占83.8%的市场份额,2024年市场规模达35亿美元。政策倡议、消费者意识提升以及住宅、商业和公用事业规模太阳能部署的强劲成长,持续推动美国市场的成长。财政激励和税收抵免政策提高了太阳能的成本效益,提高了安装率,并推动了对可提升性能和系统可靠性的优化技术的需求。随着数位电网系统的进步以及对再生能源独立的日益重视,功率优化器在确保无缝整合和高效电力传输方面发挥着至关重要的作用。

积极影响全球功率优化器产业的关键参与者包括 Tigo Energy、Fronius International、华为技术、HIITIO、Ferroamp、Altenergy Power System、英飞凌科技、SolarEdge Technologies、苏州康弗特半导体、Sun Sine Solution、Ampt、PCE Process Control Electronics、Alencon Systems 和 SUNGROW。领先的功率优化器公司正在利用产品创新和策略合作伙伴关係来增强其市场影响力。製造商正致力于将人工智慧、物联网和基于云端的分析技术整合到其係统中,以提供更智慧的监控、预测性维护和更高的能源产量。注重模组化和可扩展设计,可实现针对住宅、商业和公用事业规模部署的客製化。与太阳能电池板製造商和安装商的合作正在增强分销网路并拓宽市场准入。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 原料及零件供应商

- 技术与设计

- 製造业

- 配送和物流

- 安装和集成

- 售后服务

- 监管格局

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 成长潜力分析

- 波特的分析

- PESTEL分析

- 新兴机会和趋势

- 数位化和物联网集成

- 新兴市场渗透

- 投资分析及未来展望

第四章:竞争格局

- 介绍

- 按地区分析公司市场份额

- 北美洲

- 欧洲

- 亚太地区

- 中东和非洲

- 拉丁美洲

- 战略仪表板

- 策略倡议

- 重要伙伴关係与合作

- 重大併购活动

- 产品创新与发布

- 市场扩张策略

- 竞争基准测试

- 创新与永续发展格局

第五章:市场规模及预测:依最终用途,2021 - 2034

- 主要趋势

- 模组级 MPPT

- 先进的电力线通信

- 监控组件

- 安全停机组件

- 其他的

第六章:市场规模及预测:依连结性,2021 - 2034

- 主要趋势

- 独立

- 在电网上

第七章:市场规模及预测:依应用,2021 - 2034

- 主要趋势

- 住宅

- 商业和工业

- 公用事业

第八章:市场规模及预测:按地区,2021 - 2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 义大利

- 荷兰

- 英国

- 法国

- 亚太地区

- 中国

- 澳洲

- 日本

- 韩国

- 印度

- 中东和非洲

- 沙乌地阿拉伯

- 阿联酋

- 南非

- 拉丁美洲

- 巴西

- 智利

- 墨西哥

第九章:公司简介

- Alencon Systems

- Altenergy Power System

- Ampt

- Ferroamp

- Fronius International

- HIITIO

- Huawei Technologies

- Infineon Technologies

- PCE Process Control Electronic

- SolarEdge Technologies

- SUNGROW

- Sun Sine Solution

- Suzhou Convert Semiconductor

- Tigo Energy

The Global Power Optimizer Market was valued at USD 7.9 billion in 2024 and is estimated to grow at a CAGR of 12.6% to reach USD 25.8 billion by 2034.

The industry is experiencing notable momentum as the demand for higher energy output and safer solar power systems continues to grow across both residential and commercial sectors. Power optimizers are now central to modern photovoltaic infrastructure, allowing real-time monitoring and system diagnostics that help improve yield and cut down on operational costs. The increasing integration of energy storage systems and smart grid platforms is reinforcing this growth, as these technologies support greater energy control, stable grid interaction, and two-way power communication. Innovations in IoT, artificial intelligence, and cloud-based analytics are reshaping how power optimizers function-ensuring smarter, predictive maintenance and better system efficiency. Manufacturers are also investing in low-footprint designs and recyclable components to align with sustainability goals. Regulatory frameworks encouraging solar adoption across the globe are fueling market expansion, especially with incentives aimed at distributed energy generation. Furthermore, the convergence of blockchain with solar systems is opening opportunities for transparent, secure energy transactions, strengthening the decentralized renewable energy ecosystem, and propelling global acceptance of smart energy solutions.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $7.9 Billion |

| Forecast Value | $25.8 Billion |

| CAGR | 12.6% |

The module-level MPPT segment held 47.3% share in 2024 and is expected to grow at a CAGR 3.1% through 2034. This technology has become essential for improving energy production on a per-panel basis, especially in installations affected by shade, varying tilt angles, or irregular panel configurations. As adoption of rooftop solar accelerates across developing and developed economies, the push for more granular power tracking and enhanced panel-level control is boosting demand for module-level MPPT solutions. Financial incentives and favorable government policies across regions, including the U.S., India, and Europe are strengthening market penetration, with cost reductions in electronic components making the technology increasingly affordable.

The on-grid segment held 83.3% share in 2024 and is expected to grow at a CAGR of 11.9% through 2034. On-grid systems continue to dominate due to the strong policy support for solar integration into utility infrastructure, especially with net metering programs and smart grid initiatives. These policies not only encourage residential and commercial rooftop solar installations but also necessitate high-performing power optimizers to maintain energy stability across varying production levels. Rooftop solar installations on homes, office buildings, and industrial structures are becoming more common, and in such applications, optimizers are crucial in minimizing energy losses from partial shading or complex roof geometries.

United States Power Optimizer Market held an 83.8% share and generated USD 3.5 billion in 2024. Growth in the U.S. market continues to be driven by a combination of policy initiatives, consumer awareness, and a robust increase in solar deployments across residential, commercial, and utility-scale applications. Financial incentives and tax credits have made solar more cost-effective, boosting installation rates and driving higher demand for optimization technologies that enhance performance and system reliability. With advancements in digital grid systems and increased emphasis on renewable energy independence, power optimizers are playing a vital role in ensuring seamless integration and efficient power delivery.

Key players actively shaping the Global Power Optimizer Industry include Tigo Energy, Fronius International, Huawei Technologies, HIITIO, Ferroamp, Altenergy Power System, Infineon Technologies, SolarEdge Technologies, Suzhou Convert Semiconductor, Sun Sine Solution, Ampt, PCE Process Control Electronics, Alencon Systems, and SUNGROW. Leading power optimizer companies are leveraging product innovation and strategic partnerships to strengthen their market presence. Manufacturers are focusing on integrating AI, IoT, and cloud-based analytics into their systems to offer smarter monitoring, predictive maintenance, and improved energy yields. Emphasis on modular and scalable designs enables customization for residential, commercial, and utility-scale deployments. Collaborations with solar panel manufacturers and installers are enhancing distribution networks and widening market access.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1.1 Raw material & component suppliers

- 3.1.1.2 Technology & design

- 3.1.1.3 Manufacturing

- 3.1.1.4 Distribution & logistics

- 3.1.1.5 Installation & integration

- 3.1.1.6 Aftermarket services

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

- 3.6.1 Political factors

- 3.6.2 Economic factors

- 3.6.3 Social factors

- 3.6.4 Technological factors

- 3.6.5 Legal factors

- 3.6.6 Environmental factors

- 3.7 Emerging opportunities & trends

- 3.7.1 Digitalization & IoT integration

- 3.7.2 Emerging market penetration

- 3.8 Investment analysis & future outlook

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, by region, 2024

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Middle East & Africa

- 4.2.5 Latin America

- 4.3 Strategic dashboard

- 4.4 Strategic initiatives

- 4.4.1 Key partnerships & collaborations

- 4.4.2 Major M&A activities

- 4.4.3 Product innovations & launches

- 4.4.4 Market expansion strategies

- 4.5 Competitive benchmarking

- 4.6 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By End Use , 2021 - 2034 (USD Million & MW)

- 5.1 Key trends

- 5.2 Module level MPPT

- 5.3 Advanced power line communication

- 5.4 Monitoring components

- 5.5 Safety shutdown components

- 5.6 Others

Chapter 6 Market Size and Forecast, By Connectivity, 2021 - 2034 (USD Million & MW)

- 6.1 Key trends

- 6.2 Standalone

- 6.3 On grid

Chapter 7 Market Size and Forecast, By Application, 2021 - 2034 (USD Million & MW)

- 7.1 Key trends

- 7.2 Residential

- 7.3 Commercial & industrial

- 7.4 Utility

Chapter 8 Market Size and Forecast, By Region, 2021 - 2034 (USD Million & MW)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 Italy

- 8.3.3 Netherlands

- 8.3.4 UK

- 8.3.5 France

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Australia

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 India

- 8.5 Middle East & Africa

- 8.5.1 Saudi Arabia

- 8.5.2 UAE

- 8.5.3 South Africa

- 8.6 Latin America

- 8.6.1 Brazil

- 8.6.2 Chile

- 8.6.3 Mexico

Chapter 9 Company Profiles

- 9.1 Alencon Systems

- 9.2 Altenergy Power System

- 9.3 Ampt

- 9.4 Ferroamp

- 9.5 Fronius International

- 9.6 HIITIO

- 9.7 Huawei Technologies

- 9.8 Infineon Technologies

- 9.9 PCE Process Control Electronic

- 9.10 SolarEdge Technologies

- 9.11 SUNGROW

- 9.12 Sun Sine Solution

- 9.13 Suzhou Convert Semiconductor

- 9.14 Tigo Energy