|

市场调查报告书

商品编码

1833670

兽医监测设备市场机会、成长动力、产业趋势分析及2025-2034年预测Veterinary Monitoring Equipment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

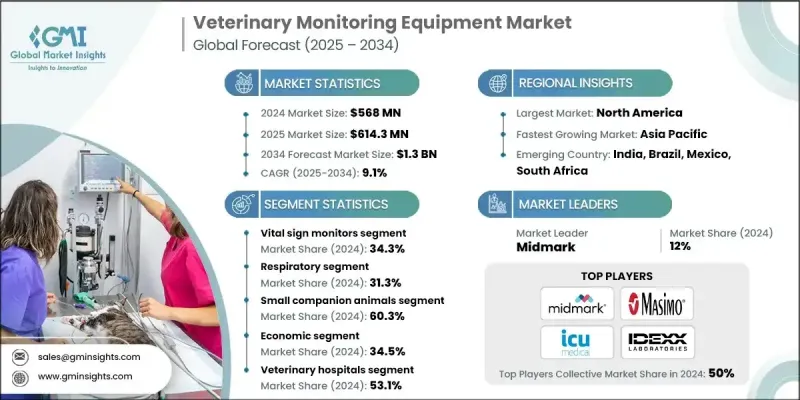

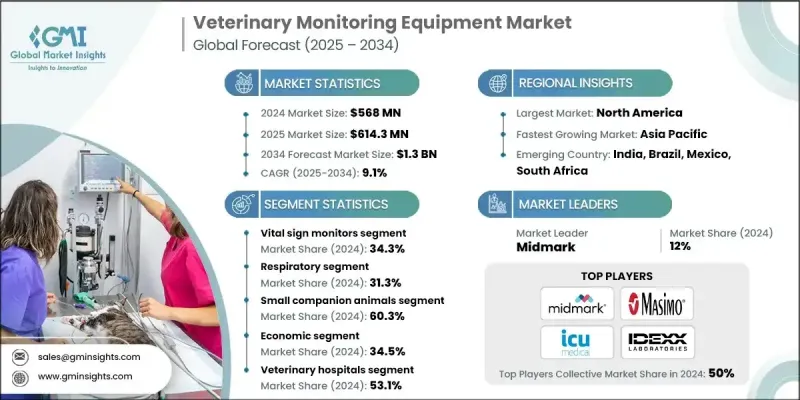

2024 年全球兽医监测设备市场价值为 5.68 亿美元,预计将以 9.1% 的复合年增长率成长,到 2034 年达到 13 亿美元。

宠物主人数量不断增长,尤其是在城市和已开发地区,这增加了对高品质兽医护理的需求。由于人们将宠物视为家庭成员,他们更愿意投资先进的监测工具,以确保更好的健康状况。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 5.68亿美元 |

| 预测值 | 13亿美元 |

| 复合年增长率 | 9.1% |

生命征象监测仪的使用日益增多

生命征象监测器在2024年占据了显着的市场份额,这得益于其在追踪动物核心健康指标(包括心率、血压、体温和血氧饱和度)方面发挥的重要作用。这些设备广泛应用于从常规体检到手术和重症监护病房等各种场合,是现代兽医实践中不可或缺的设备。随着对早期疾病检测和预防保健的需求日益增长,诊所正在采用能够提供即时资料和综合分析的多参数监测器。

呼吸监测器需求不断成长

随着兽医管理宠物和牲畜呼吸系统疾病病例的增多,呼吸监测领域将在2025-2034年期间实现可观的复合年增长率。二氧化碳分析仪和肺量计等设备用于评估通气、气体交换和整体肺功能,尤其是在麻醉和术后恢復期间。随着动物外科手术越来越复杂,准确的呼吸监测对于最大限度地减少併发症至关重要。

小型伴侣动物盛行率上升

小型伴侣动物市场在2024年占据了相当大的份额,这得益于宠物收养率的提高和宠物人性化的提升。宠物主人更愿意投资高品质的医疗服务,包括手术期间的进阶监测、慢性病管理和预防性检查。兽医诊所正在为其设施配备专门针对小型动物校准的监测仪,以确保读数准确并最大程度地减少不适感。

北美将成为利润丰厚的地区

由于先进的兽医基础设施、较高的宠物拥有率以及对动物健康的高度关注,北美兽医监测设备将在2025-2034年间实现可观的复合年增长率。美国城市诊所和农村畜牧设施对诊断技术的需求不断增长。该地区市场受益于早期采用的数位医疗工具、强大的分销网络以及兽医手术的良好报销趋势。领先的企业正在透过扩大其在学术型兽医院的业务、推出云端连接监测解决方案以及为连锁兽医机构提供客製化服务合约来提升其市场地位。

兽医监测设备市场的主要参与者有 Masimo、Vetland Medical、ICU Medical、Digicare Animal Health、Mindray Animal Health、Bionet America、Burtons Veterinary、Midmark、Medtronic、Avante Animal Health、Hallmarq Veterinary Imaging、Dextronix、Nonin 和 IDEXX Labories。

为了在兽医监测设备市场获得竞争优势,各公司正大力专注于产品创新、策略合作伙伴关係以及精准的客户互动。许多公司正在开发紧凑型多参数监测器,这些监测器具有无线连接和即时资料整合功能,以支援各种临床环境下的高效诊断。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 每个阶段的增值

- 影响价值链的因素

- 产业衝击力

- 成长动力

- 动物疾病盛行率不断上升

- 宠物保险的普及率不断上升

- 伴侣动物数量不断增加

- 增加宠物健康支出

- 产业陷阱与挑战

- 监控设备成本高

- 低收入地区和农村地区的交通受限

- 市场机会

- 宠物照护需求不断成长的新兴市场

- 采用穿戴式和远端监控设备

- 成长动力

- 成长潜力分析

- 监管格局

- 北美洲

- 我们

- 加拿大

- 欧洲

- 亚太地区

- 北美洲

- 未来市场趋势

- 定价分析

- 技术和创新格局

- 目前技术

- 新兴技术

- 差距分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与协作

- 新产品发布

第五章:市场估计与预测:按类型,2021 - 2034

- 主要趋势

- 生命征象监测仪

- 二氧化碳监测及血氧测定係统

- 麻醉监视器

- ECG 和 EKG 监视器

- 磁振造影(MRI)系统

- 其他兽医监测设备

第六章:市场估计与预测:按应用,2021 - 2034

- 主要趋势

- 体重和温度监测

- 心臟病学

- 呼吸系统

- 神经病学

- 多参数监测

- 其他应用

第七章:市场估计与预测:依动物类型,2021 - 2034

- 主要趋势

- 小型伴侣动物

- 狗

- 猫

- 其他小型伴侣动物

- 大型动物

- 马科动物

- 其他大型动物

- 珍稀动物

第八章:市场估计与预测:按价格层级,2021 - 2034 年

- 主要趋势

- 经济的

- 中檔

- 优质的

第九章:市场估计与预测:依最终用途,2021 - 2034

- 主要趋势

- 兽医诊所和诊断中心

- 兽医院

- 研究机构

- 其他最终用途

第 10 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第 11 章:公司简介

- Avante Animal Health

- Bionet America

- Burtons Veterinary

- Dextronix

- Digicare Animal Health

- Hallmarq Veterinary Imaging

- ICU Medical

- IDEXX Laboratories

- Masimo

- Medtronic

- Midmark

- Mindray Animal Health

- Nonin

- Vetland Medical

- Vetronic Services

The Global Veterinary Monitoring Equipment Market was valued at USD 568 million in 2024 and is estimated to grow at a CAGR of 9.1% to reach USD 1.3 billion by 2034.

The growing number of pet owners, especially in urban and developed regions, is increasing demand for high-quality veterinary care. As people view pets as family members, they are more willing to invest in advanced monitoring tools to ensure better health outcomes.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $568 Million |

| Forecast Value | $1.3 Billion |

| CAGR | 9.1% |

Rising use of Vital Sign Monitors

The vital sign monitors segment held a notable share in 2024, owing to its essential role in tracking an animal's core health indicators, including heart rate, blood pressure, temperature, and oxygen saturation. These devices are used across a range of settings from routine checkups to surgeries and intensive care units making them indispensable in modern veterinary practice. With increasing demand for early disease detection and preventive care, clinics are adopting multi-parameter monitors that deliver real-time data and integrated analytics.

Growing Demand for Respiratory Monitors

The respiratory monitoring segment will grow at a decent CAGR during 2025-2034 as veterinarians manage rising cases of respiratory illnesses in pets and livestock. Devices like capnographs and spirometers are used to assess ventilation, gas exchange, and overall lung function, especially during anesthesia and post-operative recovery. With more complex surgical procedures being performed on animals, accurate respiratory monitoring is crucial for minimizing complications.

Rising Prevalence Among Small Companion Animals

The small companion animals segment held a significant share in 2024, driven by increasing pet adoption and the humanization of pets. Pet owners are more willing to invest in high-quality medical care, including advanced monitoring during surgeries, chronic disease management, and preventive exams. Veterinary clinics are equipping their facilities with monitors specifically calibrated for smaller species, ensuring accurate readings and minimal discomfort.

North America to Emerge as a Lucrative Region

North America veterinary monitoring equipment will grow at a decent CAGR during 2025-2034, backed by advanced veterinary infrastructure, high pet ownership rates, and a strong focus on animal wellness. The U.S. has seen rising demand for diagnostic technologies in both urban clinics and rural livestock facilities. This regional market benefits from early adoption of digital health tools, robust distribution networks, and favorable reimbursement trends for veterinary procedures. Leading players are enhancing their market position by expanding their presence in academic veterinary hospitals, rolling out cloud-connected monitoring solutions, and providing tailored service contracts to veterinary chains.

Major players in the veterinary monitoring equipment market are Masimo, Vetland Medical, ICU Medical, Digicare Animal Health, Mindray Animal Health, Bionet America, Burtons Veterinary, Midmark, Medtronic, Avante Animal Health, Hallmarq Veterinary Imaging, Dextronix, Nonin, and IDEXX Laboratories.

To gain a competitive edge in the veterinary monitoring equipment market, companies are focusing heavily on product innovation, strategic partnerships, and targeted customer engagement. Many are developing compact, multi-parameter monitors with wireless connectivity and real-time data integration to support efficient diagnostics across a variety of clinical settings.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumption and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Type

- 2.2.3 Application

- 2.2.4 Animal Type

- 2.2.5 Price Tier

- 2.2.6 End use

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of animal disorders

- 3.2.1.2 Rising adoption of pet insurance

- 3.2.1.3 Growing companion animal population

- 3.2.1.4 Increasing spending on pet health

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of monitoring equipment

- 3.2.2.2 Limited access in low-income and rural areas

- 3.2.3 Market opportunities

- 3.2.3.1 Emerging markets with growing pet care demand

- 3.2.3.2 Adoption of wearable and remote monitoring devices

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.1.1 U.S.

- 3.4.1.2 Canada

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.1 North America

- 3.5 Future market trends

- 3.6 Pricing analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technology

- 3.7.2 Emerging technologies

- 3.8 Gap analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Merger and acquisition

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

Chapter 5 Market Estimates and Forecast, By Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Vital sign monitors

- 5.3 Capnography and oximetry systems

- 5.4 Anesthesia monitors

- 5.5 ECG and EKG monitors

- 5.6 Magnetic resonance imaging (MRI) systems

- 5.7 Other veterinary monitoring equipment

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Weight and temperature monitoring

- 6.3 Cardiology

- 6.4 Respiratory

- 6.5 Neurology

- 6.6 Multi-parameter monitoring

- 6.7 Other applications

Chapter 7 Market Estimates and Forecast, By Animal Type, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Small companion animals

- 7.2.1 Dogs

- 7.2.2 Cats

- 7.2.3 Others small companion animals

- 7.3 Large animals

- 7.3.1 Equines

- 7.3.2 Other large animals

- 7.4 Exotic animals

Chapter 8 Market Estimates and Forecast, By Price Tier, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Economic

- 8.3 Mid-range

- 8.4 Premium

Chapter 9 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Veterinary clinics and diagnostic centers

- 9.3 Veterinary hospitals

- 9.4 Research institutes

- 9.5 Other end use

Chapter 10 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Avante Animal Health

- 11.2 Bionet America

- 11.3 Burtons Veterinary

- 11.4 Dextronix

- 11.5 Digicare Animal Health

- 11.6 Hallmarq Veterinary Imaging

- 11.7 ICU Medical

- 11.8 IDEXX Laboratories

- 11.9 Masimo

- 11.10 Medtronic

- 11.11 Midmark

- 11.12 Mindray Animal Health

- 11.13 Nonin

- 11.14 Vetland Medical

- 11.15 Vetronic Services