|

市场调查报告书

商品编码

1833680

迷你分离式空调系统市场机会、成长动力、产业趋势分析及2025-2034年预测Mini Split Air Conditioning System Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

2024 年全球迷你分离式空调系统市值为 74 亿美元,预计到 2034 年将以 5.5% 的复合年增长率成长至 125 亿美元。

随着人们越来越重视减少能源消耗和碳排放,迷你分离式系统因其较高的 SEER 等级和能够冷却特定区域而不会在未使用的空间上浪费能源的能力而越来越受欢迎。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 74亿美元 |

| 预测值 | 125亿美元 |

| 复合年增长率 | 5.5% |

单区迷你分离式空调需求不断成长

单区迷你分离式空调凭藉其经济实惠、操作简单和精准冷冻的优势,在2024年占据了相当大的市场份额。这类系统非常适合小型住宅、独立房间或家庭办公室,使用者无需彻底改造整个暖通空调系统即可为特定空间冷却。随着越来越多的房主寻求无需管道系统的节能解决方案,单区空调正逐渐成为首选,尤其是在空间和成本至关重要的城市环境中。

住宅领域采用率不断提高

到2034年,住宅市场将保持可观的复合年增长率,因为房主越来越重视舒适性、客製化和节能。这些系统提供了无管道中央空调的替代方案,特别适合老旧住宅或无法安装管道的扩建住宅。随着远距办公和居家时间的增加,对灵活控制各种居住空间温度的需求日益增长。各大品牌纷纷推出更安静的型号、更简洁的外观以及支援Wi-Fi的功能,以顺应智慧家庭的发展趋势。

线下领域将获得发展动力

2024年,线下市场占据了相当大的份额,这得益于产品的复杂性以及购买过程中对专家指导的需求。许多客户仍然倾向于透过实体零售商或授权经销商来评估系统性能、获得安装支援并确保售后服务的可用性。各公司正在加强零售合作伙伴关係,提供捆绑安装服务,并进行店内演示,以增强消费者信心并加速购买决策。

亚太地区将成为推动力地区

2024年,亚太地区迷你分离式空调系统市场占据了相当大的份额,这得益于密集的城市化进程、中产阶级收入的不断增长以及该地区炎热的气候。中国、日本、韩国和印度等国家在新建住宅和改造项目中,对紧凑型节能製冷解决方案的需求正在激增。国内外企业正致力于扩大生产设施,客製化设计以满足区域需求,并利用分销商网路来扩大覆盖范围和提高响应速度。

迷你分离式空调系统市场的主要参与者包括东芝公司、Senville、大金工业、LG电子、特灵科技、富士通将军、海尔集团公司、日立、三菱电机公司、开利公司、松下公司、三星电子、格力电器、江森自控国际和美的集团。

为了巩固市场地位,迷你分离式空调系统领域的公司正在大力投资研发、智慧功能和区域扩张。关键策略包括整合变频压缩机以提高能源效率、开发支援物联网的远端控制机型,以及使用环保冷媒以符合全球环保标准。领先品牌也与安装商建立策略联盟,培训服务网络,并进行宣传活动,向消费者宣传无管技术的优势。透过提供从入门级到高端的可扩展产品线,公司能够满足各种预算和应用的需求,确保市场可持续成长。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 利润率

- 每个阶段的增值

- 影响价值链的因素

- 产业衝击力

- 成长动力

- HVAC系统中能源效率的重要性

- 为特定区域客製化气候控制

- 易于安装和灵活设计

- 产业陷阱与挑战

- 来自替代技术的激烈竞争

- 市场饱和

- 机会

- 现有建筑改造需求不断成长

- 与智慧家庭和物联网技术的集成

- 成长动力

- 成长潜力分析

- 未来市场趋势

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 依产品类型

- 监理框架

- 标准和合规要求

- 区域监理框架

- 认证标准

- 贸易统计(HS编码:84158210)

- 主要进口国

- 主要出口国

- 波特五力分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:依产品类型,2021-2034

- 主要趋势

- 单区迷你分离式

- 多区域迷你分离式

第六章:市场估计与预测:按安装量,2021-2034

- 主要趋势

- 壁挂式

- 落地式

- 天花板式

- 其他(独立式)

第七章:市场估计与预测:依技术,2021-2034

- 主要趋势

- 逆变器迷你分离式机

- 非逆变器迷你分离式空调

第八章:市场估计与预测:按价格,2021-2034

- 主要趋势

- 低的

- 中等的

- 高的

第九章:市场估计与预测:依产能,2021-2034

- 主要趋势

- 高达 9,000 BTU/小时

- 9,000 至 12,000 BTU/小时

- 12,000 至 18,000 BTU/小时

- 18,000 BTU/小时以上

第 10 章:市场估计与预测:按最终用途,2021-2034 年

- 主要趋势

- 住宅

- 商业的

第 11 章:市场估计与预测:按配销通路,2021-2034 年

- 主要趋势

- 在线的

- 公司网站

- 电子商务网站

- 离线

- 专卖店

- 超市和大卖场

- 工厂直营店

- 其他零售店

第 12 章:市场估计与预测:按地区,2021-2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 多边环境协定

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十三章:公司简介

- Carrier Corporation

- Daikin Industries

- Fujitsu General

- GREE Electric Appliances

- Haier Group Corporation

- Hitachi

- Johnson Controls International

- LG Electronics

- Midea Group

- Mitsubishi Electric Corporation

- Panasonic Corporation

- Samsung Electronics

- Senville

- Toshiba Corporation

- Trane Technologies

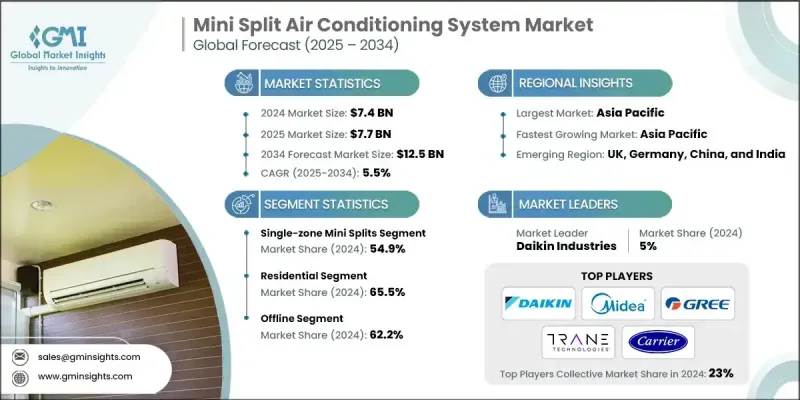

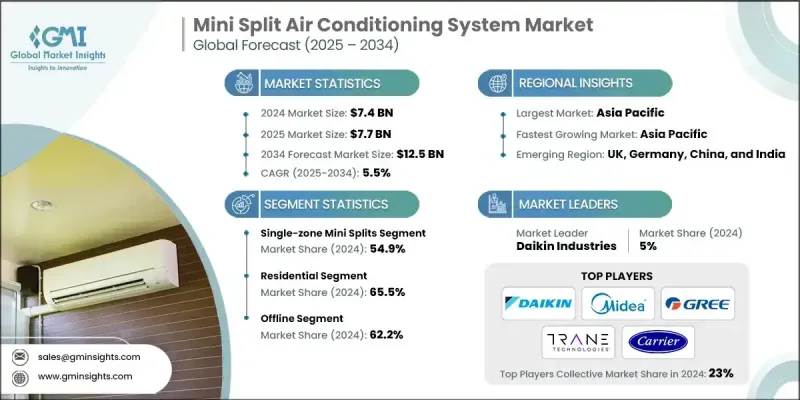

The Global Mini Split Air Conditioning System Market was valued at USD 7.4 billion in 2024 and is estimated to grow at a CAGR of 5.5% to reach USD 12.5 billion by 2034.

With growing emphasis on reducing energy consumption and carbon emissions, mini split systems are gaining popularity due to their high SEER ratings and ability to cool specific zones without wasting energy on unused spaces.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $7.4 billion |

| Forecast Value | $12.5 billion |

| CAGR | 5.5% |

Rising Demand for Single-Zone Mini Splits

The single-zone mini splits segment held a significant share in 2024, driven by its affordability, simplicity, and targeted cooling benefits. These systems are ideal for small homes, individual rooms, or home offices, allowing users to cool specific spaces without overhauling their entire HVAC setup. As more homeowners seek energy-efficient solutions without the need for ductwork, single zone units are emerging as the go-to option, particularly in urban environments where space and cost are critical.

Increasing Adoption in the Residential Sector

The residential segment will grow at a decent CAGR through 2034, as homeowners prioritize comfort, customization, and energy savings. These systems offer a ductless alternative to central AC, making them especially attractive for older homes or additions where duct installation is not feasible. With remote work and time spent at home increasing, there's a growing need for flexible climate control across living spaces. Brands are responding by introducing quieter models, cleaner aesthetics, and Wi-Fi enabled features that align with smart home movement.

Offline Sector to Gain Traction

The offline segment generated a sizeable share in 2024, backed by the complexity of the product and the need for expert guidance during purchase. Many customers still prefer brick-and-mortar retailers or authorized dealers to assess system performance, get installation support, and ensure after-sales service availability. Companies are strengthening retail partnerships, offering bundled installation services, and conducting in-store demos to drive consumer confidence and accelerate purchase decisions.

Asia Pacific to Emerge as a Propelling Region

Asia Pacific mini split air conditioning system market held a significant share in 2024, driven by dense urbanization, rising middle-class income, and the region's hot climate. Countries like China, Japan, South Korea, and India are witnessing surging demand for compact, energy-efficient cooling solutions in both new residential developments and retrofit projects. Local and international players are focusing on expanding production facilities, customizing designs to meet regional preferences, and leveraging distributor networks to increase reach and responsiveness.

Major players in the mini split air conditioning system market are Toshiba Corporation, Senville, Daikin Industries, LG Electronics, Trane Technologies, Fujitsu General, Haier Group Corporation, Hitachi, Mitsubishi Electric Corporation, Carrier Corporation, Panasonic Corporation, Samsung Electronics, GREE Electric Appliances, Johnson Controls International, and Midea Group.

To strengthen their market presence, companies in the mini split air conditioning system space are investing heavily in R&D, smart features, and regional expansion. Key strategies include the integration of inverter compressors for enhanced energy efficiency, the development of IoT-enabled models for remote control, and the use of eco-friendly refrigerants to comply with global environmental standards. Leading brands are also forming strategic alliances with installers, training service networks, and launching awareness campaigns to educate consumers on the benefits of ductless technology. By offering scalable product lines-from entry-level to premium-companies are catering to a wide range of budgets and applications, ensuring sustainable market growth.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 Installation

- 2.2.4 Technology

- 2.2.5 Price

- 2.2.6 Capacity

- 2.2.7 End use

- 2.2.8 Distribution channel

- 2.3 CXO perspectives: strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 The significance of energy efficiency in HVAC systems

- 3.2.1.2 Tailoring climate control for specific zone

- 3.2.1.3 Ease of installation and flexibility design

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High competition from alternative technologies

- 3.2.2.2 Market saturation

- 3.2.3 Opportunities

- 3.2.3.1 Rising demand for retrofit installations in existing buildings

- 3.2.3.2 Integration with smart home & IoT technologies

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By product type

- 3.7 Regulatory framework

- 3.7.1 standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Trade statistics (HS code: 84158210)

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Porter's five forces analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Product Type, 2021-2034 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Single-zone mini splits

- 5.3 Multi-zone mini splits

Chapter 6 Market Estimates & Forecast, By Installation, 2021-2034 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Wall mounted

- 6.3 Floor-mounted

- 6.4 Ceiling-mounted

- 6.5 Other (Free standing)

Chapter 7 Market Estimates & Forecast, By Technology, 2021-2034 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Inverter mini splits

- 7.3 Non-inverter mini splits

Chapter 8 Market Estimates & Forecast, By Price, 2021-2034 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Low

- 8.3 Medium

- 8.4 High

Chapter 9 Market Estimates & Forecast, By Capacity, 2021-2034 (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 Up to 9,000 BTU/hr

- 9.3 9,000 to 12,000 BTU/hr

- 9.4 12,000 to 18,000 BTU/hr

- 9.5 18,000 BTU/hr and above

Chapter 10 Market Estimates & Forecast, By End Use, 2021-2034 (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 Residential

- 10.3 Commercial

Chapter 11 Market Estimates & Forecast, By Distribution Channel, 2021-2034 (USD Billion) (Thousand Units)

- 11.1 Key trends

- 11.2 Online

- 11.2.1 Company websites

- 11.2.2 E-commerce website

- 11.3 Offline

- 11.3.1 Specialty stores

- 11.3.2 Supermarket & hypermarkets

- 11.3.3 Factory outlets

- 11.3.4 Other retail stores

Chapter 12 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Thousand Units)

- 12.1 Key trends

- 12.2 North America

- 12.2.1 U.S.

- 12.2.2 Canada

- 12.3 Europe

- 12.3.1 Germany

- 12.3.2 UK

- 12.3.3 France

- 12.3.4 Italy

- 12.3.5 Spain

- 12.4 Asia Pacific

- 12.4.1 China

- 12.4.2 India

- 12.4.3 Japan

- 12.4.4 South Korea

- 12.4.5 Australia

- 12.5 Latin America

- 12.5.1 Brazil

- 12.5.2 Mexico

- 12.5.3 Argentina

- 12.6 MEA

- 12.6.1 South Africa

- 12.6.2 Saudi Arabia

- 12.6.3 UAE

Chapter 13 Company Profiles

- 13.1 Carrier Corporation

- 13.2 Daikin Industries

- 13.3 Fujitsu General

- 13.4 GREE Electric Appliances

- 13.5 Haier Group Corporation

- 13.6 Hitachi

- 13.7 Johnson Controls International

- 13.8 LG Electronics

- 13.9 Midea Group

- 13.10 Mitsubishi Electric Corporation

- 13.11 Panasonic Corporation

- 13.12 Samsung Electronics

- 13.13 Senville

- 13.14 Toshiba Corporation

- 13.15 Trane Technologies