|

市场调查报告书

商品编码

1833686

肺炎治疗市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Pneumonia Therapeutics Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

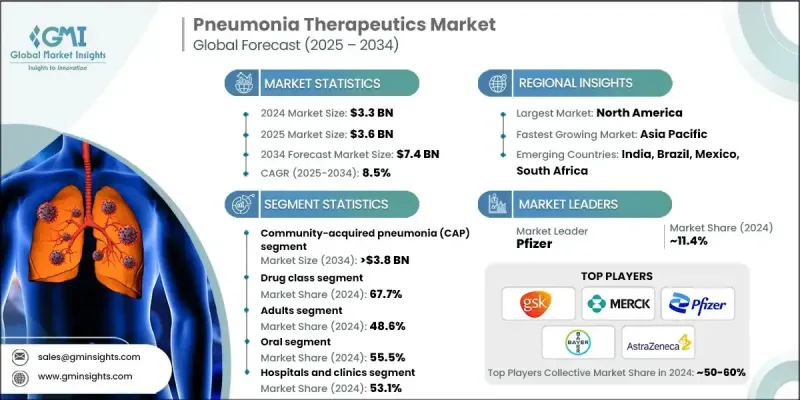

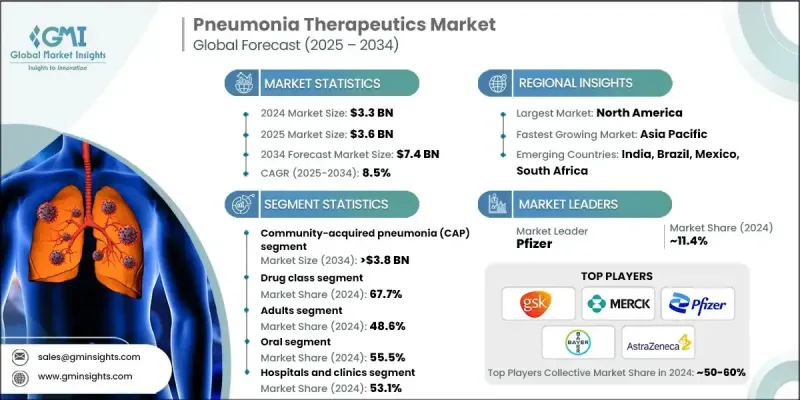

2024 年全球肺炎治疗市场价值为 33 亿美元,预计将以 8.5% 的复合年增长率成长,到 2034 年达到 74 亿美元。

在全球范围内,肺炎发生率呈上升趋势,尤其是在老年人、幼儿和免疫系统较弱的人群中。呼吸衰竭是一种严重的併发症,会损害氧气输送和二氧化碳的清除,并显着增加这些脆弱人群的死亡风险。随着住院时间延长和机械通气的普及,院内获得性肺炎和呼吸器相关性肺炎也日益受到关注。肺炎的治疗方案包括抗菌药物、抗病毒药物、抗霉菌药物、疫苗、氧气治疗等支持性治疗。这些药物与更广泛的呼吸系统药物不同,它们以诊断检测为指导,针对特定病原体。分子诊断和即时检测的创新使病原体识别更加精准,从而可以更好地制定个人化治疗方案,并减少抗生素的滥用。随着线上药局和直销管道的扩张,患者和照护者能够更轻鬆地获得处方药和非处方药。从地区来看,北美占据主导地位,这得益于高昂的医疗支出、强大的诊断基础设施以及先进疗法的早期采用。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 33亿美元 |

| 预测值 | 74亿美元 |

| 复合年增长率 | 8.5% |

2024年,社区型肺炎 (CAP) 占据了51.4%的市场份额,其驱动因素包括多种病原体、患者风险因素(例如年龄和基础健康状况)以及导致其高发生率的环境因素。 CAP仍然是全球肺炎治疗领域最突出的类别,影响着儿童和成人群体,而CAP住院率的上升刺激了对新型治疗方案的需求。

2024年,药物类药物因其在治疗轻度和重度肺炎方面的有效性,占据了67.7%的市场。该类药物细分为抗菌药物、抗病毒药物、抗真菌药物和其他药物类型,其中抗菌药物进一步细分为喹诺酮类、大环内酯类和其他抗菌药物。细菌性肺炎的流行,加上多重抗药性细菌的增多,推动了对新药製剂和联合疗法的需求。

2024年,美国肺炎治疗市场规模估计为12亿美元。美国肺炎盛行率的上升、住院人数的增加以及与肺炎相关的死亡率的上升,正在推动市场扩张。随着风险因素的日益普遍和诊断能力的不断提高,对疫苗和标靶治疗的需求正在急剧增长。

肺炎治疗产业的主要参与者包括诺华、雅培实验室、葛兰素史克、阿斯特捷利康、西普拉、梯瓦製药、拜耳、鲁宾製药、罗氏製药、百特国际、默克公司、迈兰、强生、第一三共、艾伯维、百时美施贵宝。肺炎治疗市场的领先公司正专注于精准医疗、转化研究和诊断整合,以巩固其竞争地位。许多公司正在大力投资分子诊断工具和即时检测,以区分病毒、细菌和真菌病例,从而实现更有效的治疗并减少浪费。该公司也正在开发新型抗生素和生物製剂以解决抗药性问题,以及缩短治疗时间的联合疗法。与疫苗开发商的策略联盟加强了产品组合,同时扩展到数位和远距医疗管道增加了可及性和知名度。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 每个阶段的增值

- 影响价值链的因素

- 产业衝击力

- 成长动力

- 全球肺炎病例上升

- 人口老化和免疫功能低下的患者

- 远距医疗和电子药房的扩展

- 政府疫苗接种计划

- 产业陷阱与挑战

- 品牌药物和疫苗成本高

- 发展中地区的认知有限

- 市场机会

- 联合疗法的开发

- 医疗保健投资不断增加的新兴市场

- 成长动力

- 成长潜力分析

- 监管格局

- 北美洲

- 我们

- 加拿大

- 欧洲

- 亚太地区

- 北美洲

- 未来市场趋势

- 技术格局

- 目前技术

- 新兴技术

- 定价分析

- 管道分析

- 差距分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 全球的

- 北美洲

- 欧洲

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与协作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:按感染类型,2021 - 2034 年

- 主要趋势

- 社区型肺炎(CAP)

- 院内获得性肺炎(HAP)

- 呼吸器相关性肺炎(VAP)

- 其他感染类型

第六章:市场估计与预测:依治疗类型,2021 - 2034

- 主要趋势

- 药品类别

- 抗菌药物

- 喹诺酮类药物

- 大环内酯类

- 其他抗菌药物

- 抗病毒药物

- 抗真菌药物

- 其他药物类别

- 抗菌药物

- 疫苗

- 氧气疗法

第七章:市场估计与预测:按年龄组,2021 - 2034 年

- 主要趋势

- 儿科

- 成年人

- 老年病学

第 8 章:市场估计与预测:按管理路线,2021 年至 2034 年

- 主要趋势

- 口服

- 肠外

- 其他给药途径

第九章:市场估计与预测:依最终用途,2021 - 2034

- 主要趋势

- 医院和诊所

- 居家照护环境

- 其他最终用途

第 10 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第 11 章:公司简介

- Abbott Laboratories

- AbbVie

- AstraZeneca

- Baxter International

- Bayer

- Bristol Myers Squibb

- Cipla

- Daiichi Sankyo

- F. Hoffmann-La Roche

- GlaxoSmithKline

- Johnson & Johnson

- Lupin Pharmaceuticals

- Merck & Co.

- Mylan

- Novartis

- Pfizer

- Teva Pharmaceuticals

The Global Pneumonia Therapeutics Market was valued at USD 3.3 billion in 2024 and is estimated to grow at a CAGR of 8.5% to reach USD 7.4 billion by 2034.

Pneumonia incidence is increasing globally, especially among older adults, young children, and people with weakened immune systems. Respiratory failure, a serious complication that impairs oxygen transfer and carbon dioxide removal, significantly increases mortality risk in these vulnerable populations. Hospital-acquired and ventilator-associated pneumonia are also growing concerns as stays lengthen, and mechanical ventilation becomes more common. Therapeutic options for pneumonia encompass antibacterial, antiviral, antifungal drugs, vaccines, and supportive treatments like oxygen therapy. These are distinguished from broader respiratory medications by targeting specific pathogens, guided by diagnostic testing. Innovations in molecular diagnostics and point-of-care testing are making pathogen identification more precise, allowing treatment to be better tailored and reducing misuse of antibiotics. With online pharmacies and direct-to-consumer channels expanding, patients and caregivers are gaining easier access to both prescription and over-the-counter treatments. Regionally, North America holds a dominant position, supported by high healthcare spending, strong diagnostic infrastructure, and early adoption of advanced therapies.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.3 Billion |

| Forecast Value | $7.4 Billion |

| CAGR | 8.5% |

In 2024, the community-acquired pneumonia (CAP) segment held 51.4% share, driven by a wide mix of pathogens, patient risk factors like age and underlying health conditions, and environmental influences contributing to its high incidence. CAP remains the most prominent category in pneumonia therapeutics globally, affecting both pediatric and adult populations, and rising hospitalization rates for CAP are spurring demand for novel therapeutic solutions.

The drug class segment held 67.7% share in 2024 owing to its effectiveness in treating both mild and severe pneumonia. This segment breaks down into antibacterial, antiviral, antifungal, and other drug types, with antibacterial treatments further divided into quinolones, macrolides, and other antibacterial agents. The prevalence of bacterial pneumonia, coupled with increasing multidrug-resistant organisms, has driven demand for new drug formulations and combination therapies.

U.S. Pneumonia Therapeutics Market was estimated at USD 1.2 billion in 2024. Rising prevalence, increasing hospitalizations, and mortality associated with pneumonia in the U.S. are fueling market expansion. The demand for vaccines and targeted therapies is growing sharply as risk factors become more prevalent and diagnostic capabilities become more advanced.

Major players operating in the pneumonia therapeutics industry include Novartis, Abbott Laboratories, GlaxoSmithKline, AstraZeneca, Cipla, Teva Pharmaceuticals, Bayer, Lupin Pharmaceuticals, F. Hoffmann-La Roche, Baxter International, Merck & Co., Mylan, Johnson & Johnson, Daiichi Sankyo, AbbVie, Bristol Myers Squibb. Leading firms in pneumonia therapeutics market are focusing on precision medicine, translational research, and diagnostic integration to solidify their competitive positions. Many are investing heavily in molecular diagnostic tools and point-of-care testing to distinguish between viral, bacterial, and fungal cases, enabling more effective therapy and reducing wastage. Companies are also developing novel antibiotics and biologics to address drug resistance, and combination treatments that shorten treatment duration. Strategic alliances with vaccine developers strengthen portfolios, while expanding into digital and telehealth channels increases access and awareness.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumption and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Infection type

- 2.2.3 Treatment type

- 2.2.4 Age group

- 2.2.5 Route of administration

- 2.2.6 End use

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising global pneumonia cases

- 3.2.1.2 Aging population and immunocompromised patients

- 3.2.1.3 Expansion of telehealth and e-pharmacy

- 3.2.1.4 Government vaccination programs

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of branded drugs and vaccines

- 3.2.2.2 Limited awareness in developing regions

- 3.2.3 Market opportunities

- 3.2.3.1 Development of combination therapies

- 3.2.3.2 Emerging markets with rising healthcare investment

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.1.1 U.S.

- 3.4.1.2 Canada

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.1 North America

- 3.5 Future market trends

- 3.6 Technology landscape

- 3.6.1 Current technology

- 3.6.2 Emerging technologies

- 3.7 Pricing analysis

- 3.8 Pipeline analysis

- 3.9 Gap analysis

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 Global

- 4.2.2 North America

- 4.2.3 Europe

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Merger and acquisition

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Infection Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Community-acquired pneumonia (CAP)

- 5.3 Hospital-acquired pneumonia (HAP)

- 5.4 Ventilator-associated pneumonia (VAP)

- 5.5 Other infection types

Chapter 6 Market Estimates and Forecast, By Treatment Type, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Drug class

- 6.2.1 Antibacterial drugs

- 6.2.1.1 Quinolones

- 6.2.1.2 Macrolide

- 6.2.1.3 Other antibacterial drugs

- 6.2.2 Antiviral drugs

- 6.2.3 Antifungal drugs

- 6.2.4 Other drug classes

- 6.2.1 Antibacterial drugs

- 6.3 Vaccines

- 6.4 Oxygen therapy

Chapter 7 Market Estimates and Forecast, By Age Group, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Pediatrics

- 7.3 Adults

- 7.4 Geriatrics

Chapter 8 Market Estimates and Forecast, By Route of Administration, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Oral

- 8.3 Parenteral

- 8.4 Other routes of administration

Chapter 9 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Hospitals and clinics

- 9.3 Homecare settings

- 9.4 Other end use

Chapter 10 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Abbott Laboratories

- 11.2 AbbVie

- 11.3 AstraZeneca

- 11.4 Baxter International

- 11.5 Bayer

- 11.6 Bristol Myers Squibb

- 11.7 Cipla

- 11.8 Daiichi Sankyo

- 11.9 F. Hoffmann-La Roche

- 11.10 GlaxoSmithKline

- 11.11 Johnson & Johnson

- 11.12 Lupin Pharmaceuticals

- 11.13 Merck & Co.

- 11.14 Mylan

- 11.15 Novartis

- 11.16 Pfizer

- 11.17 Teva Pharmaceuticals