|

市场调查报告书

商品编码

1833690

马达起动器市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Motor Starter Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

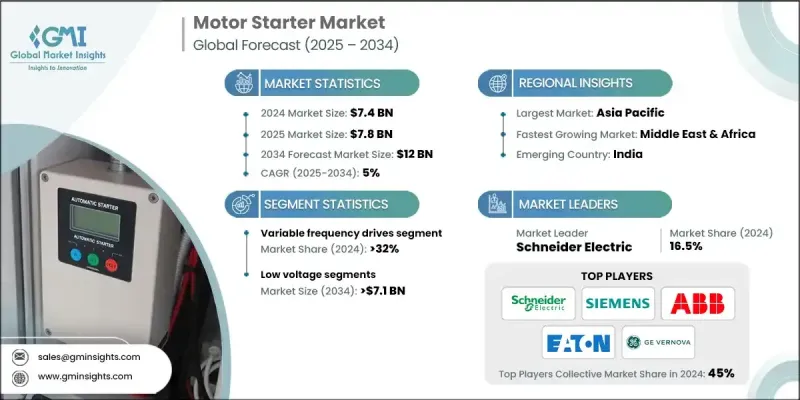

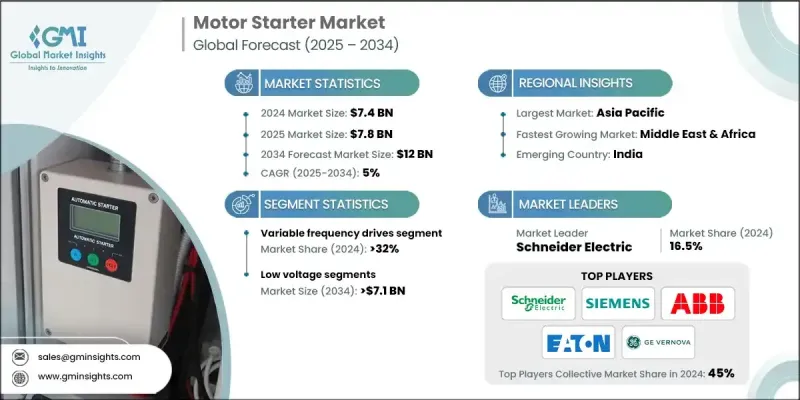

根据 Global Market Insights Inc. 发布的最新报告,全球电动马达起动器市场规模预计在 2024 年为 74 亿美元,预计将从 2025 年的 78 亿美元增长到 2034 年的 120 亿美元,复合年增长率为 5%。

由于高度重视节能和降低营运成本,各行各业都在投资先进的马达启动器,尤其是软启动器和智慧启动器,以帮助减少电涌、管理负载并提高马达效率。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 74亿美元 |

| 预测值 | 120亿美元 |

| 复合年增长率 | 5% |

变频驱动器获得牵引力

变频驱动器 (VFD) 凭藉其卓越的能源效率、精确的电机控制以及对设备机械应力的降低,在 2024 年占据了相当大的份额。 VFD 不仅可以调节马达转速,还可以延长马达寿命并降低能耗,使其成为暖通空调、石油天然气和水处理等行业的首选。

低压应用日益普及

2024年,低压起动器占据了相当大的份额,这得益于其在商业建筑、小规模製造和基础设施应用中的广泛应用。这些起动器非常适合控制额定电压通常低于1,000V的系统中的电机,包括泵、压缩机和传送带。

亚太地区将崛起成为推动力地区

2024年,亚太地区电机起动器市场维持了可持续的份额,这得益于中国、印度和东南亚等国家工业化的蓬勃发展、基础设施投资的增加以及能源需求的不断增长。该地区在全球电机安装量中占有相当大的份额,尤其是在製造业、建筑业和公用事业领域。

电机起动器市场的主要参与者有正泰集团、艾默生电气、洛瓦托电气、Kalp Controls、GE Vernova、罗克韦尔自动化、三菱电机、C&S 电气、西门子、菲尼克斯电气、富士电机、LS 电气、WEG、c3controls、Havells India、ABB、CORDYsen、Lauritz Solutions、伊顿、欧姆龙公司、SKN-BENTEX。

为了扩大市场份额,电机起动器市场的领导者正专注于产品创新、数位化整合和策略合作伙伴关係。许多企业正在开发内建连接功能的智慧起动器,以实现远端监控、诊断以及与工业控制系统的无缝整合。其他企业则透过在亚太和拉丁美洲等高成长地区建立製造中心和研发中心,扩大其全球影响力。此外,企业正在加强其服务网络,提供包括调试、维护和培训在内的端到端支持,以提高客户忠诚度。此外,企业还部署了客製化定价策略、垂直细分产品线以及在新兴市场的积极行销,以抓住尚未开发的需求。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 监管格局

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 成长潜力分析

- 波特的分析

- PESTEL分析

- 电动马达起动器成本结构分析

- 价格趋势分析,(美元/单位)

- 按地区

- 按产品

- 新兴机会和趋势

- 马达起动器的投资分析及未来展望

第四章:竞争格局

- 介绍

- 按地区分析公司市场份额

- 北美洲

- 欧洲

- 亚太地区

- 中东和非洲

- 拉丁美洲

- 策略倡议

- 战略仪表板

- 竞争基准测试

- 创新与技术格局

- 竞争性定价策略基准测试

- 配销通路策略比较

第五章:市场规模及预测:依产品,2021 - 2034

- 主要趋势

- 软启动器

- 变频驱动器(VFD)

- 跨线启动器

- 可逆启动器

- 混合马达起动器

- 其他的

第六章:市场规模及预测:依保护系统,2021 - 2034

- 主要趋势

- 电子过载继电器

- 固态过载保护

- 热磁性保护

第七章:市场规模及预测:按控制系统,2021 - 2034

- 主要趋势

- PLC

- 现场总线

第 8 章:市场规模与预测:按电压,2021 - 2034 年

- 主要趋势

- 低的

- 中等的

- 高的

第九章:市场规模及预测:依当前,2021 - 2034 年

- 主要趋势

- > 9 安 - 27 安

- > 27 安 - 90 安

- > 90 安 - 270 安

- > 270 安 - 810 安

- > 810 安

第 10 章:市场规模与预测:按应用,2021 - 2034 年

- 主要趋势

- 分散式架构

- 控制柜

- 混合配置

第 11 章:市场规模与预测:依最终用途,2021 - 2034 年

- 主要趋势

- 住宅

- 商业的

- 工业的

第 12 章:市场规模与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 法国

- 俄罗斯

- 英国

- 义大利

- 西班牙

- 荷兰

- 奥地利

- 亚太地区

- 中国

- 日本

- 韩国

- 印度

- 澳洲

- 纽西兰

- 印尼

- 中东和非洲

- 沙乌地阿拉伯

- 阿联酋

- 卡达

- 埃及

- 南非

- 奈及利亚

- 拉丁美洲

- 巴西

- 阿根廷

第十三章:公司简介

- ABB

- C&S Electric

- c3controls

- CG Power & Industrial Solutions

- CHINT Group

- CORDYNE

- Danfoss

- Eaton

- Emerson Electric

- Fuji Electric

- GE Vernova

- Havells India

- Kalp Controls

- Lauritz Knudsen Electrical & Automation

- LOVATO ELECTRIC

- LS ELECTRIC

- Mitsubishi Electric

- Omron Corporation

- Phoenix Contact

- Rockwell Automation

- Schneider Electric

- Siemens

- SKN-BENTEX

- WEG

The global motor starter market was estimated at USD 7.4 billion in 2024 and is expected to grow from USD 7.8 billion in 2025 to USD 12 billion by 2034, at a CAGR of 5%, as per the latest report published by Global Market Insights Inc.

With a strong focus on energy savings and reducing operational costs, industries are investing in advanced motor starters, especially soft starters and intelligent starters that help reduce power surges, manage load, and enhance motor efficiency.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $7.4 Billion |

| Forecast Value | $12 Billion |

| CAGR | 5% |

Variable Frequency Drives to Gain Traction

The variable frequency drives (VFD) segment held a significant share in 2024, owing to its superior energy efficiency, precise motor control, and reduced mechanical stress on equipment. VFDs not only regulate motor speed but also help extend motor life and lower energy consumption, making them a preferred choice across industries such as HVAC, oil & gas, and water treatment.

Rising Adoption of Low Voltage

The low voltage held a sizeable share in 2024, driven by its widespread use in commercial buildings, small-scale manufacturing, and infrastructure applications. These starters are ideal for controlling motors in systems with voltage ratings typically below 1,000V, including pumps, compressors, and conveyors.

Asia Pacific to Emerge as a Propelling Region

Asia Pacific motor starter market held a sustainable share in 2024, fueled by booming industrialization, rising investments in infrastructure, and growing energy demand across countries like China, India, and Southeast Asia. This region accounts for a significant share of global motor installations, particularly in manufacturing, construction, and utilities.

Major players in the motor starter market are CHINT Group, Emerson Electric, LOVATO ELECTRIC, Kalp Controls, GE Vernova, Rockwell Automation, Mitsubishi Electric, C&S Electric, Siemens, Phoenix Contact, Fuji Electric, LS ELECTRIC, WEG, c3controls, Havells India, ABB, CORDYNE, Lauritz Knudsen Electrical & Automation, Danfoss, Schneider Electric, CG Power & Industrial Solutions, Eaton, Omron Corporation, SKN-BENTEX.

To expand their presence, leading players in the motor starter market are focusing on product innovation, digital integration, and strategic partnerships. Many are developing smart starters with built-in connectivity, allowing remote monitoring, diagnostics, and seamless integration with industrial control systems. Others are expanding their global footprint by establishing manufacturing hubs and R&D centers in high-growth regions like the Asia Pacific and Latin America. In addition, companies are strengthening their service networks, offering end-to-end support that includes commissioning, maintenance, and training to enhance customer loyalty. Tailored pricing strategies, vertical-specific product lines, and aggressive marketing in emerging markets are also being deployed to capture untapped demand.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data Collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculations

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

- 2.1.1 Business trends

- 2.1.2 Product trends

- 2.1.3 Protection system trends

- 2.1.4 Control system trends

- 2.1.5 Voltage trends

- 2.1.6 Current trends

- 2.1.7 Application trends

- 2.1.8 End use trends

- 2.1.9 Regional trends

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

- 3.7 Cost structure analysis of motor starters

- 3.8 Price trend analysis, (USD/Unit)

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Emerging opportunities & trends

- 3.10 Investment analysis & future outlook for the motor starter

Chapter 4 Competitive landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, by region, 2024

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Middle East & Africa

- 4.2.5 Latin America

- 4.3 Strategic initiatives

- 4.4 Strategic dashboard

- 4.5 Competitive benchmarking

- 4.6 Innovation & technology landscape

- 4.7 Competitive pricing strategy benchmarking

- 4.8 Distribution channel strategy comparison

Chapter 5 Market Size and Forecast, By Product, 2021 - 2034 (Units & USD Million)

- 5.1 Key trends

- 5.2 Soft starters

- 5.3 Variable frequency drives (VFDs)

- 5.4 Across-the-line starters

- 5.5 Reversing starters

- 5.6 Hybrid motor starters

- 5.7 Others

Chapter 6 Market Size and Forecast, By Protection System, 2021 - 2034 (Units & USD Million)

- 6.1 Key trends

- 6.2 Electronic overload relays

- 6.3 Solid-state overload protection

- 6.4 Thermal-magnetic protection

Chapter 7 Market Size and Forecast, By Control System, 2021 - 2034 (Units & USD Million)

- 7.1 Key trends

- 7.2 PLC

- 7.3 Fieldbus

Chapter 8 Market Size and Forecast, By Voltage, 2021 - 2034 (Units & USD Million)

- 8.1 Key trends

- 8.2 Low

- 8.3 Medium

- 8.4 High

Chapter 9 Market Size and Forecast, By Current, 2021 - 2034 (Units & USD Million)

- 9.1 Key trends

- 9.2 > 9 A - 27 A

- 9.3 > 27 A - 90 A

- 9.4 > 90 A - 270 A

- 9.5 > 270 A - 810 A

- 9.6 > 810 A

Chapter 10 Market Size and Forecast, By Application, 2021 - 2034 (Units & USD Million)

- 10.1 Key trends

- 10.2 Distributed architecture

- 10.3 Control cabinet

- 10.4 Hybrid configuration

Chapter 11 Market Size and Forecast, By End Use, 2021 - 2034 (Units & USD Million)

- 11.1 Key trends

- 11.2 Residential

- 11.3 Commercial

- 11.4 Industrial

Chapter 12 Market Size and Forecast, By Region, 2021 - 2034 (Units & USD Million)

- 12.1 Key trends

- 12.2 North America

- 12.2.1 U.S.

- 12.2.2 Canada

- 12.2.3 Mexico

- 12.3 Europe

- 12.3.1 Germany

- 12.3.2 France

- 12.3.3 Russia

- 12.3.4 UK

- 12.3.5 Italy

- 12.3.6 Spain

- 12.3.7 Netherlands

- 12.3.8 Austria

- 12.4 Asia Pacific

- 12.4.1 China

- 12.4.2 Japan

- 12.4.3 South Korea

- 12.4.4 India

- 12.4.5 Australia

- 12.4.6 New Zealand

- 12.4.7 Indonesia

- 12.5 Middle East & Africa

- 12.5.1 Saudi Arabia

- 12.5.2 UAE

- 12.5.3 Qatar

- 12.5.4 Egypt

- 12.5.5 South Africa

- 12.5.6 Nigeria

- 12.6 Latin America

- 12.6.1 Brazil

- 12.6.2 Argentina

Chapter 13 Company Profiles

- 13.1 ABB

- 13.2 C&S Electric

- 13.3 c3controls

- 13.4 CG Power & Industrial Solutions

- 13.5 CHINT Group

- 13.6 CORDYNE

- 13.7 Danfoss

- 13.8 Eaton

- 13.9 Emerson Electric

- 13.10 Fuji Electric

- 13.11 GE Vernova

- 13.12 Havells India

- 13.13 Kalp Controls

- 13.14 Lauritz Knudsen Electrical & Automation

- 13.15 LOVATO ELECTRIC

- 13.16 LS ELECTRIC

- 13.17 Mitsubishi Electric

- 13.18 Omron Corporation

- 13.19 Phoenix Contact

- 13.20 Rockwell Automation

- 13.21 Schneider Electric

- 13.22 Siemens

- 13.23 SKN-BENTEX

- 13.24 WEG