|

市场调查报告书

商品编码

1844263

高磷血症治疗市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Hyperphosphatemia Treatment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

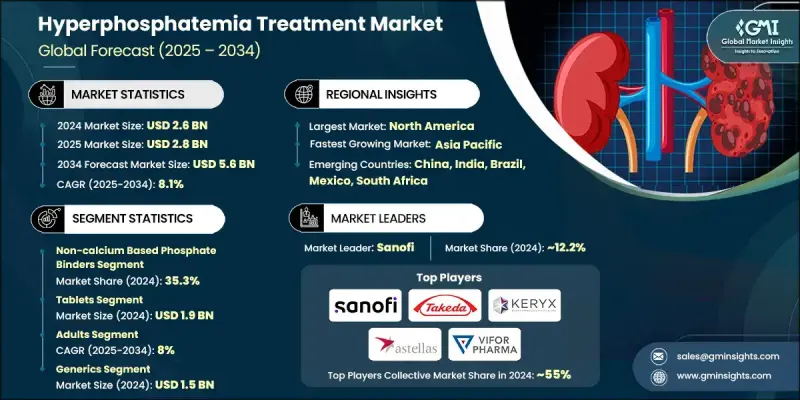

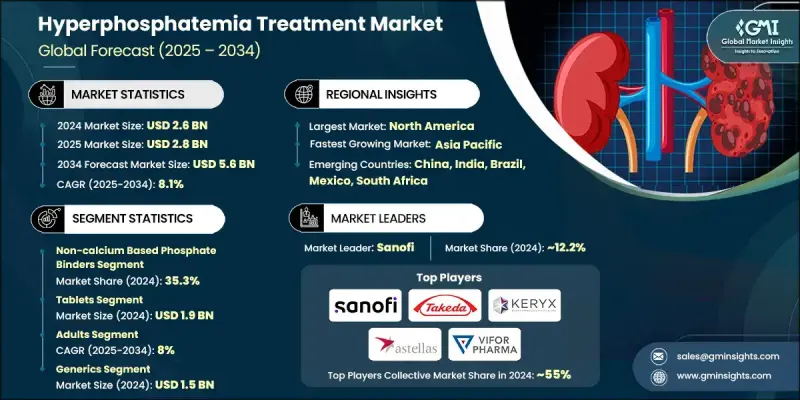

2024 年全球高血磷治疗市场价值为 26 亿美元,预计到 2034 年将以 8.1% 的复合年增长率增长至 56 亿美元。

这一增长的动力源于全球范围内慢性肾病 (CKD) 病例的增加、终末期肾病 (ESRD) 患者数量的增加以及透析应用的日益普及。人口老化,加上糖尿病和高血压的发生率上升,导致全球 CKD 盛行率持续上升,直接影响了高血磷症治疗的需求。加工食品和久坐不动的生活方式的转变也导致了磷酸盐失衡,迫使患者采取长期治疗方案。为此,治疗方案正在快速发展,已从传统的钙基黏合剂转向更具创新性的选择,例如铁基黏合剂和磷酸盐吸收抑制剂。这些新一代疗法耐受性更高、副作用更少,从而提高了依从性和疗效。随着监管部门的批准和临床试验的增加,非钙基黏合剂和新型药物正在各地区得到更广泛的应用,从而支持了长期的市场发展势头。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 26亿美元 |

| 预测值 | 56亿美元 |

| 复合年增长率 | 8.1% |

2024年,非钙基磷酸盐结合剂占35.3%的市场份额,预计到2034年将达到20亿美元,复合年增长率为8%。此类药物的药片尺寸较小,胃肠道不适更少,从而提高了患者的依从性。由于高血磷症需要终身治疗,患者对更便利、耐受性更好的治疗方案的需求正在稳定成长。医疗保健提供者和透析中心越来越青睐非钙基磷酸盐结合剂,因为它们符合现代价值导向型医疗目标,即註重改善心血管结局和增强磷酸盐调节,从而增强了该领域在市场扩张中的作用。

2034年,成人患者群体的复合年增长率将达到8%。 40岁以上的成年人是慢性肾臟病和末期肾病(ESRD)的高危险群,因此他们也是降磷治疗的最大消费者。随着全球成人慢性肾臟病(CKD)患者数量的增长,高磷血症治疗的需求持续增长,尤其是在肾臟科医师和透析中心资源丰富的市场。在已开发地区,结构化的护理方案和早期介入框架正在提高诊断和治疗依从性,有助于维持成人群体的市场主导地位。

2024年,北美高血磷治疗市场占44.3%的市场份额,其中美国贡献了该地区最大的收入份额。慢性肾臟病(CKD)的高负担和透析的广泛应用推动了该地区对降磷药物的强劲需求。由领先医疗机构管理的完善的透析诊所网络,能够实现可靠的磷酸盐监测和持续的治疗。这项基础设施支持传统疗法和新一代疗法的推广,使北美成为塑造全球市场动态和治疗创新的核心力量。

影响全球高磷血症治疗市场的关键参与者包括费森尤斯医疗、Vifor Pharma (CSL Limited)、Dr. Reddy's、武田製药、安斯泰来製药、赛诺菲、鲁宾、西普拉、Glenmark、梯瓦製药、Amneal、三菱田边製药、Aurobindo Pharma、Macleods 和 Keryx Biopaceuticals。在高磷血症治疗市场运作的公司正专注于透过药物创新和策略性许可交易来扩大其治疗组合。许多公司正在投资临床研究,以开发非钙和铁基黏合剂,以提供更好的安全性并改善患者的治疗效果。与透析网络和肾臟病诊所的合作有助于确保一致的分销和患者的可及性。赛诺菲和 Vifor Pharma 等公司正在透过区域合作加强全球影响力,而西普拉和梯瓦製药等仿製药公司则凭藉具有成本效益的配方进入新兴市场。

目录

第一章:方法论与范围

第 2 章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 每个阶段的增值

- 影响价值链的因素

- 产业衝击力

- 成长动力

- 慢性肾臟病(CKD)和透析患者盛行率上升

- 人口老化和生活方式相关疾病

- 药物开发和新疗法的进展

- 提高认识和预防性医疗保健倡议

- 产业陷阱与挑战

- 药物负担高,患者依从性差

- 治疗费用高

- 市场机会

- 低药物负担疗法的开发

- 个人化医疗和联合疗法

- 成长动力

- 成长潜力分析

- 监管格局

- 北美洲

- 我们

- 加拿大

- 欧洲

- 亚太地区

- 北美洲

- 技术格局

- 当前的技术趋势

- 新兴技术

- 未来市场趋势

- 定价分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 全球的

- 北美洲

- 欧洲

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与协作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:按产品,2021 - 2034 年

- 主要趋势

- 钙基磷酸盐结合剂

- 非钙基磷酸盐结合剂

- 铁基磷酸盐结合剂

- 碳酸镧

- 其他产品

第六章:市场估计与预测:按剂型,2021 - 2034

- 主要趋势

- 平板电脑

- 粉末

- 其他剂型

第七章:市场估计与预测:按年龄组,2021 - 2034 年

- 主要趋势

- 成年人

- 儿科

第八章:市场估计与预测:按类型,2021 - 2034

- 主要趋势

- 品牌

- 泛型

第九章:市场估计与预测:依最终用途,2021 - 2034

- 主要趋势

- 医院

- 居家照护环境

- 透析中心

- 其他最终用途

第 10 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第 11 章:公司简介

- Amneal

- Astellas Pharma

- Aurobindo Pharma

- Cipla

- Dr. Reddy's

- Glenmark

- Fresenius Medical Care

- Keryx Biopharmaceuticals

- Lupin

- Macleods

- Mitsubishi Tanabe Pharma

- Sanofi

- Takeda Pharmaceuticals

- Teva Pharmaceuticals

- Vifor Pharma (CSL Limited)

The Global Hyperphosphatemia Treatment Market was valued at USD 2.6 billion in 2024 and is estimated to grow at a CAGR of 8.1% to reach USD 5.6 billion by 2034.

The growth is fueled by rising cases of chronic kidney disease (CKD), the expanding number of end-stage renal disease (ESRD) patients, and the increasing adoption of dialysis worldwide. An aging population, together with higher rates of diabetes and hypertension, continues to drive up CKD prevalence globally, directly impacting the demand for hyperphosphatemia treatments. The shift toward processed food and sedentary lifestyles has also contributed to phosphate imbalances, pushing patients into long-term therapeutic regimens. In response, the treatment landscape is evolving rapidly, moving beyond traditional calcium-based binders toward more innovative options like iron-based binders and phosphate absorption inhibitors. These next-generation therapies offer improved tolerability and fewer side effects, boosting adherence and outcomes. As regulatory approvals and clinical trials increase, non-calcium binders and novel agents are being adopted more broadly across regions, supporting long-term market momentum.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.6 Billion |

| Forecast Value | $5.6 Billion |

| CAGR | 8.1% |

In 2024, the non-calcium-based phosphate binders held a 35.3% share and are anticipated to reach USD 2 billion by 2034, growing at a CAGR of 8%. These treatments offer smaller pill sizes and reduced gastrointestinal discomfort, leading to better patient adherence. As lifelong therapy is required for hyperphosphatemia, patient demand for more convenient and better-tolerated options is increasing steadily. Healthcare providers and dialysis centers increasingly prefer non-calcium binders due to their alignment with modern value-based care goals, which focus on improved cardiovascular outcomes and enhanced phosphate regulation, thereby reinforcing this segment's role in market expansion.

The adult patient group segment is growing at a CAGR of 8% throughout 2034. Adults over the age of 40 represent the highest-risk demographic for both chronic kidney disease and ESRD, making them the largest consumers of phosphate-lowering treatments. As the global adult CKD population grows, demand for hyperphosphatemia therapies continues to scale, especially in markets where access to nephrology specialists and dialysis centers is widespread. In developed regions, structured care protocols and early intervention frameworks are improving diagnosis and treatment compliance, helping maintain the adult segment's market dominance.

North America Hyperphosphatemia Treatment Market held 44.3% share in 2024, with the United States contributing the largest portion of regional revenue. The high burden of CKD and the widespread adoption of dialysis drive strong demand for phosphate-lowering drugs across the region. A well-established network of dialysis clinics, managed by leading providers, enables reliable phosphate monitoring and consistent therapy delivery. This infrastructure supports the expansion of both traditional and next-generation treatments, making North America a central force in shaping global market dynamics and therapeutic innovation.

Key players shaping the Global Hyperphosphatemia Treatment Market include Fresenius Medical Care, Vifor Pharma (CSL Limited), Dr. Reddy's, Takeda Pharmaceuticals, Astellas Pharma, Sanofi, Lupin, Cipla, Glenmark, Teva Pharmaceuticals, Amneal, Mitsubishi Tanabe Pharma, Aurobindo Pharma, Macleods, and Keryx Biopharmaceuticals. Companies operating in the hyperphosphatemia treatment market are focusing on expanding their therapeutic portfolios through drug innovation and strategic licensing deals. Many are investing in clinical research to develop non-calcium and iron-based binders that provide better safety profiles and improved patient outcomes. Partnerships with dialysis networks and nephrology clinics help ensure consistent distribution and patient access. Firms like Sanofi and Vifor Pharma are strengthening global reach through regional collaborations, while generics players such as Cipla and Teva Pharmaceuticals are entering emerging markets with cost-effective formulations.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Product trends

- 2.2.3 Dosage form trends

- 2.2.4 Age group trends

- 2.2.5 Type trends

- 2.2.6 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factors affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of chronic kidney disease (CKD) and dialysis patients

- 3.2.1.2 Aging population and lifestyle-related disorders

- 3.2.1.3 Advancements in drug development and novel therapies

- 3.2.1.4 Increasing awareness and preventive healthcare initiatives

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High pill burden and poor patient compliance

- 3.2.2.2 High treatment costs

- 3.2.3 Market opportunities

- 3.2.3.1 Development of low-pill-burden therapies

- 3.2.3.2 Personalized medicine and combination therapies

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.1.1 U.S.

- 3.4.1.2 Canada

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.1 North America

- 3.5 Technology landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Future market trends

- 3.7 Pricing analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 Global

- 4.2.2 North America

- 4.2.3 Europe

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Merger and acquisition

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Calcium-based phosphate binders

- 5.3 Non-calcium based phosphate binders

- 5.4 Iron-based phosphate binders

- 5.5 Lanthanum carbonate

- 5.6 Other products

Chapter 6 Market Estimates and Forecast, By Dosage Form, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Tablets

- 6.3 Powder

- 6.4 Other dosage forms

Chapter 7 Market Estimates and Forecast, By Age Group, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Adults

- 7.3 Pediatrics

Chapter 8 Market Estimates and Forecast, By Type, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Branded

- 8.3 Generics

Chapter 9 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Hospitals

- 9.3 Homecare settings

- 9.4 Dialysis centers

- 9.5 Other end use

Chapter 10 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Amneal

- 11.2 Astellas Pharma

- 11.3 Aurobindo Pharma

- 11.4 Cipla

- 11.5 Dr. Reddy's

- 11.6 Glenmark

- 11.7 Fresenius Medical Care

- 11.8 Keryx Biopharmaceuticals

- 11.9 Lupin

- 11.10 Macleods

- 11.11 Mitsubishi Tanabe Pharma

- 11.12 Sanofi

- 11.13 Takeda Pharmaceuticals

- 11.14 Teva Pharmaceuticals

- 11.15 Vifor Pharma (CSL Limited)