|

市场调查报告书

商品编码

1844264

实木复合地板市场机会、成长动力、产业趋势分析及2025-2034年预测Parquet Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

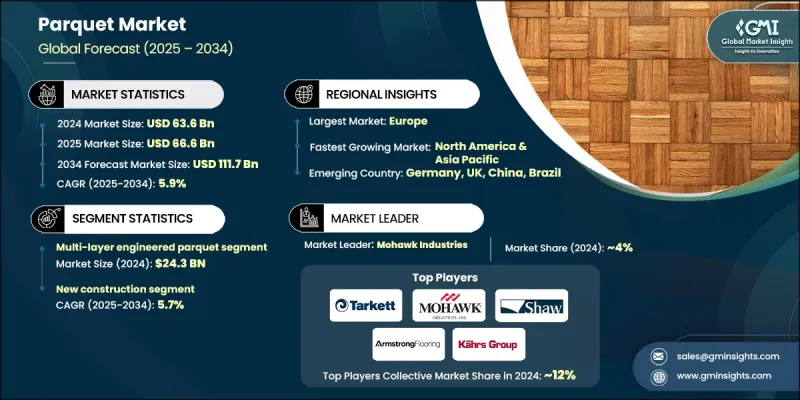

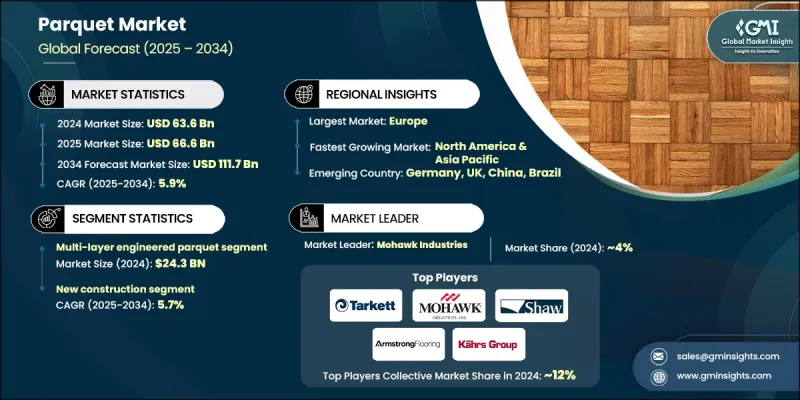

2024 年全球镶木地板市场价值为 636 亿美元,预计到 2034 年将以 5.9% 的复合年增长率增长至 1,117 亿美元。

人们对高端室内美学日益增长的兴趣,显着提升了对拼花地板的需求。消费者,尤其是年轻人和城市居民,越来越多地选择拼花地板,因为它拥有丰富的图案、永恆的优雅,以及将传统工艺与现代设计完美融合的能力。如今,这种地板风格被视为提升住宅和商业空间品质的高端室内装潢之选。日益丰富的饰面和可自订的设计也进一步提升了它的吸引力,让买家能够灵活地打造个性化的高端外观,同时又不牺牲耐用性和时尚感。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 636亿美元 |

| 预测值 | 1117亿美元 |

| 复合年增长率 | 5.9% |

政府和私营部门对住房和基础设施的大力投资,为实木复合地板产业创造了强劲的发展势头。随着开发商寻求兼具性能和风格的地板材料,实木复合地板凭藉其良好的韧性和视觉吸引力,已成为市场的主要竞争者。翻新工程也日益增多,屋主纷纷选择实木复合地板来提升房屋的特色和价值。市场的一个关键转变是消费者越来越注重环保,越来越多的消费者选择采用经过认证且以负责任的方式采伐的木材製成的实木复合地板,以符合永续发展目标和绿色建筑规范。

多层实木复合地板市场在2024年创收243亿美元,预计2025年至2034年的复合年增长率为6.4%。由于其在各种环境条件下的出色表现,该市场正经历强劲成长。这些产品由多层木材以交叉纹理排列而成,与传统实木地板相比,具有更高的耐用性和防潮性。其结构完整性使其适用于各种应用,包括潮湿区域或带有辐射供暖系统的空间,使其成为住宅和商业场所的首选。

2024年,新建建筑板块占据52.1%的市场份额,预计2025年至2034年期间的复合年增长率将达到5.7%,这得益于全球新建住宅、机构和商业开发项目的增加。随着城镇化进程的推进和住房需求的上升,建筑师和建筑商开始青睐拼花地板,因为它能够以耐用性、多功能性和高檔外观来提升室内空间。拼花地板在大型建筑中的应用日益广泛,进一步推动了已开发经济体和发展中经济体的成长。

2024年,美国拼花地板市场规模达123亿美元,预计2025年至2034年的复合年增长率将达到5.8%。美国市场扩张的动力源于房屋翻新改造活动的增加、高端饰面需求的激增以及实木复合地板的创新。随着人们对奢华美学的追求日益增长,拼花地板凭藉其独特的外观和持久耐用的性能,持续受到青睐。全球范围内的高端住宅项目和城市发展进一步提升了拼花地板作为高端地板解决方案的普及度。

塑造实木复合地板市场竞争格局的关键公司包括莫霍克工业公司 (Mohawk Industries)、博略国际集团 (Beaulieu International Group)、得嘉 (Tarkett)、阿姆斯特朗地板 (Armstrong Flooring)、巴利内克集团 (Barlinek SA)、萧条Group)、艾格集团 (Egger Group)、克诺邦 (Kronospan)、瑞士柯诺集团 (Swiss Krono Group)、博罗 (Boral)、曼宁顿米尔斯 (Mannington Mills) 和鲍沃克集团 (Bauwerk Group)。为了巩固其在实木复合地板市场的地位,领先公司正专注于永续产品创新、扩大製造能力并提升供应链效率。许多公司正在投资研发,以开发采用 FSC 认证木材和低 VOC 黏合剂製成的环保产品。客製化是另一个策略重点,公司提供更广泛的图案、饰面和安装选项,以满足不同的设计偏好。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 利润率分析

- 每个阶段的增值

- 影响价值链的因素

- 中断

- 产业衝击力

- 成长动力

- 对美观和优质地板解决方案的需求不断增长

- 都市化和住宅建设不断增加

- 实木复合地板日益流行

- 产业陷阱与挑战

- 初始安装和材料成本高

- 易受湿气和湿度损害

- 成长动力

- 成长潜力分析

- 未来市场趋势

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 依产品类型

- 监管格局

- 标准和合规性要求

- 区域监理框架

- 认证标准

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:依产品类型,2021 - 2034 年

- 主要趋势

- 多层实木复合地板

- 三层实木复合地板

- 实木地板

- FSC认证的镶木地板

- 异国情调的木地板

- 竹木地板

第六章:市场估计与预测:依木材种类,2021 - 2034 年

- 主要趋势

- 橡木拼花地板

- 枫木地板

- 胡桃木拼花地板

- 樱桃木拼花地板

- 外来物种

- 工程物种组合

第七章:市场估计与预测:按应用,2021 - 2034

- 主要趋势

- 住宅

- 商业的

- 工业的

- 机构

第 8 章:市场估计与预测:按安装方式,2021 - 2034 年

- 主要趋势

- 胶合安装

- 浮动安装

- 钉入式安装

- 混合安装方法

第九章:市场估计与预测:依最终用途,2021 - 2034

- 主要趋势

- 新建筑

- 翻新和更换

- 维护和维修

第 10 章:市场估计与预测:按配销通路,2021 - 2034 年

- 主要趋势

- 直接的

- 间接

第 11 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 印尼

- 马来西亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 多边环境协定

- 沙乌地阿拉伯

- 阿联酋

- 南非

第 12 章:公司简介

- Armstrong Flooring

- Barlinek SA

- Bauwerk Group

- Beaulieu International Group

- Boral

- Egger Group

- Haro (Hamberger Flooring)

- Kahrs Group

- Kronospan

- Mannington Mills

- MeisterWerke

- Mohawk Industries

- Shaw Industries

- Swiss Krono Group

- Tarkett

The Global Parquet Market was valued at USD 63.6 billion in 2024 and is estimated to grow at a CAGR of 5.9% to reach USD 111.7 billion by 2034.

Rising interest in upscale interior aesthetics is significantly boosting demand for parquet flooring. Consumers, especially younger demographics and urban residents are increasingly choosing parquet for its rich patterns, timeless elegance, and ability to blend traditional craftsmanship with modern design. This flooring style is now viewed as a premium interior choice that elevates both residential and commercial spaces. The growing variety of finishes and customizable designs adds to its appeal, offering buyers the flexibility to achieve personalized, high-end looks without compromising durability or style.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $63.6 Billion |

| Forecast Value | $111.7 Billion |

| CAGR | 5.9% |

Major investments in housing and infrastructure from both government and private sectors are creating strong momentum for the parquet industry. As developers seek floor materials that offer both performance and style, parquet has become a top contender due to its resilience and visual appeal. Renovation projects are also on the rise, with homeowners turning to parquet to add character and value. A key shift in the market is the move toward eco-conscious choices, with more consumers opting for parquets made from certified and responsibly harvested wood to align with sustainability goals and green building codes.

The multi-layer engineered parquet segment generated USD 24.3 billion in 2024 and is projected to grow at a CAGR of 6.4% from 2025 through 2034. This segment is experiencing strong growth because of its excellent performance in various environmental conditions. These products consist of multiple wood layers arranged in cross-grain configurations, offering greater durability and moisture resistance compared to traditional solid wood flooring. Their structural integrity makes them suitable for a wide range of applications, including humid areas or spaces with radiant heating systems, making them a preferred option in both residential and commercial settings.

The new construction segment held 52.1% share in 2024 and is forecasted to grow at a CAGR of 5.7% from 2025 to 2034, driven by the global uptick in new residential, institutional, and commercial developments. As urbanization progresses and housing demands rise, architects and builders are turning to parquet flooring for its ability to enhance interior spaces with durability, versatility, and an upscale appearance. Its increasing use in large-scale construction is further pushing growth across developed and developing economies.

United States Parquet Flooring Market generated USD 12.3 billion in 2024 and will grow at a CAGR of 5.8% from 2025 to 2034. The market expansion in the U.S. is being driven by increased remodeling activity, a surge in demand for high-end finishes, and innovations in engineered wood flooring. With growing interest in luxury aesthetics, parquet flooring continues to gain favor for its distinctive appearance and long-lasting performance. High-end housing projects and urban developments worldwide are further boosting the popularity of parquet as a premium flooring solution.

Key companies shaping the competitive landscape in the Parquet Flooring Market include Mohawk Industries, Beaulieu International Group, Tarkett, Armstrong Flooring, Barlinek SA, Shaw Industries, MeisterWerke, Haro (Hamberger Flooring), Kahrs Group, Egger Group, Kronospan, Swiss Krono Group, Boral, Mannington Mills, and Bauwerk Group. To strengthen their position in the Parquet Flooring Market, leading companies are focusing on sustainable product innovation, expanding manufacturing capabilities, and enhancing supply chain efficiency. Many are investing in R&D to develop eco-friendly products made from FSC-certified wood and low-VOC adhesives. Customization is another strategic priority, with firms offering a broader range of patterns, finishes, and installation options to meet diverse design preferences.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 Wood species

- 2.2.4 Application

- 2.2.5 Installation method

- 2.2.6 End use

- 2.2.7 Distribution channel

- 2.3 CXO perspectives: strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for aesthetic and premium flooring solutions

- 3.2.1.2 Increasing urbanization and residential construction

- 3.2.1.3 Growing popularity of engineered wood flooring

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High initial installation and material costs

- 3.2.2.2 Susceptibility to moisture and humidity damage

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By product type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By Region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.1 By Region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Product Type, 2021 - 2034, (USD Billion) (Million sq ft)

- 5.1 Key trends

- 5.2 Multi-layer engineered parquet

- 5.3 Three-layer engineered parquet

- 5.4 Solid wood parquet

- 5.5 FSC-certified parquet

- 5.6 Exotic wood parquet

- 5.7 Bamboo parquet

Chapter 6 Market Estimates & Forecast, By Wood Species, 2021 - 2034, (USD Billion) (Million sq ft)

- 6.1 Key trends

- 6.2 Oak parquet

- 6.3 Maple parquet

- 6.4 Walnut parquet

- 6.5 Cherry parquet

- 6.6 Exotic species

- 6.7 Engineered species combinations

Chapter 7 Market Estimates & Forecast, By Application, 2021 - 2034, (USD Billion) (Million sq ft)

- 7.1 Key trends

- 7.2 Residential

- 7.3 Commercial

- 7.4 Industrial

- 7.5 Institutional

Chapter 8 Market Estimates & Forecast, By Installation Method, 2021 - 2034, (USD Billion) (Million sq ft)

- 8.1 Key trends

- 8.2 Glue-down installation

- 8.3 Floating installation

- 8.4 Nail-down installation

- 8.5 Hybrid installation methods

Chapter 9 Market Estimates & Forecast, By End use, 2021 - 2034, (USD Billion) (Million sq ft)

- 9.1 Key trends

- 9.2 New construction

- 9.3 Renovation and replacement

- 9.4 Maintenance and repair

Chapter 10 Market Estimates & Forecast, By Distribution channel, 2021 - 2034, (USD Billion) (Million sq ft)

- 10.1 Key trends

- 10.2 Direct

- 10.3 Indirect

Chapter 11 Market Estimates & Forecast, By Region, 2021 - 2034, (USD Billion) (Million sq ft)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 South Korea

- 11.4.5 Australia

- 11.4.6 Indonesia

- 11.4.7 Malaysia

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 MEA

- 11.6.1 Saudi Arabia

- 11.6.2 UAE

- 11.6.3 South Africa

Chapter 12 Company Profiles

- 12.1 Armstrong Flooring

- 12.2 Barlinek SA

- 12.3 Bauwerk Group

- 12.4 Beaulieu International Group

- 12.5 Boral

- 12.6 Egger Group

- 12.7 Haro (Hamberger Flooring)

- 12.8 Kahrs Group

- 12.9 Kronospan

- 12.10 Mannington Mills

- 12.11 MeisterWerke

- 12.12 Mohawk Industries

- 12.13 Shaw Industries

- 12.14 Swiss Krono Group

- 12.15 Tarkett