|

市场调查报告书

商品编码

1844270

红外线 (IR) 感测器市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Infrared (IR) Sensors Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

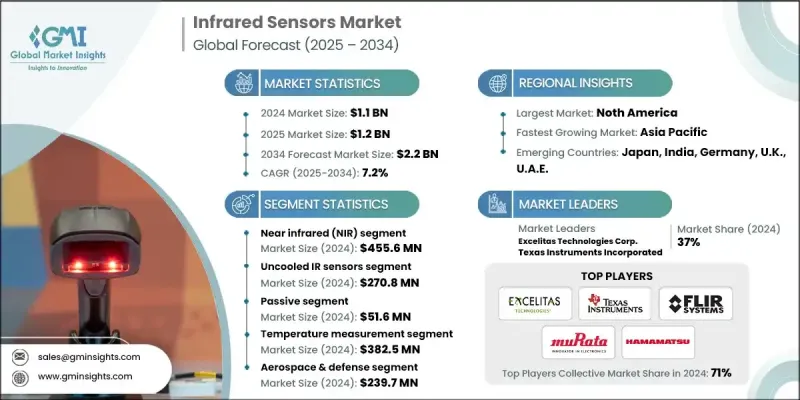

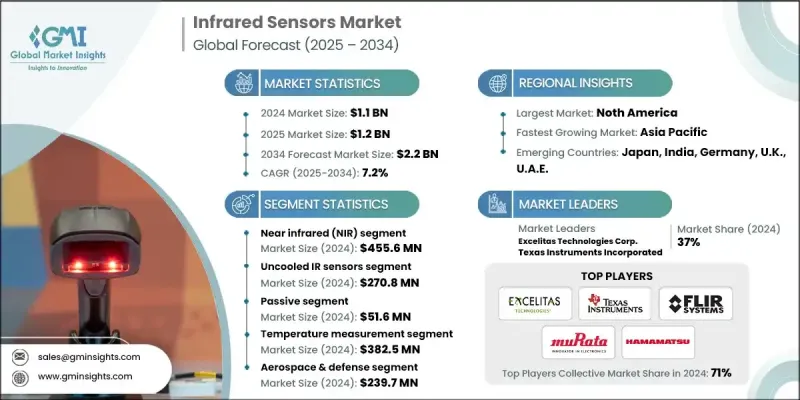

2024 年全球红外线感测器市场价值为 11 亿美元,预计到 2034 年将以 7.2% 的复合年增长率增长至 22 亿美元。

红外线感测技术在气候监测、环境观测、工业和消费性电子产品领域的应用日益广泛,推动了这一成长。红外线感测器能够提供对温度梯度、大气现象和热讯号资料的关键洞察,这些数据对于天气预报、环境保护和灾害復原至关重要。高解析度热成像、紧凑型探测器和智慧演算法等创新正在推动各行各业的应用。政府和私营机构正在将红外线技术融入遥感基础设施、预警系统和城市规划框架,以增强气候復原力。随着全球对永续性、污染控制和生态系统管理的关注日益加深,对精确热资料的需求也日益增长,从而拓宽了红外线感测器的潜在市场。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 11亿美元 |

| 预测值 | 22亿美元 |

| 复合年增长率 | 7.2% |

2024年,近红外线 (NIR) 市场规模达4.556亿美元。 NIR感测器因其在消费性电子设备、脸部辨识、手势感应、生物辨识应用以及工业品质控制和医疗诊断领域的广泛应用而占据主导地位。其成本效益、紧凑性和易于整合的特性使其广受欢迎。

2024 年非製冷红外线感测器市场价值为 2.708 亿美元。非製冷红外线探测器在经济性、紧凑性和坚固性之间实现了有效平衡,使其非常适合消费性电子产品、手持式热像仪、医学热成像和工业安全系统。

2024年,美国红外线感测器市场规模达2.475亿美元,预计到2034年将以7.7%的复合年增长率成长。美国市场主要由国防、遥感、自动驾驶汽车和医学成像等领域的投资所驱动。持续的野火和气候事件加剧了对高性能现场红外线系统的需求,而远距医疗的扩张则促进了诊断和监测领域热成像应用的发展。

全球红外线感测器市场的知名企业包括洛克希德·马丁公司、迈来芯公司、FLIR系统公司、松下控股公司、滨松光子株式会社、欧姆龙公司、Leonardo DRS公司、新成像技术公司(NIT)、村田製作所、InfraTec GmbH、Opgal Optronic Industries Ltd.、Hcelitas Technologies Ltd.、Harcelitas TechnologiesL. Technologies公司、日本航空电子株式会社、德州仪器公司、雷神科技公司、霍尼韦尔国际公司。领先的红外线感测器公司正专注于材料、小型化和整合方面的创新,以提升竞争优势。许多公司正在开发具有更高灵敏度和更低杂讯的下一代量子或量子启发探测器。与半导体製造商、相机原始设备製造商和物联网平台的合作加速了这些技术的普及。

目录

第一章:方法论与范围

第 2 章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商概况

- 利润率

- 成本结构

- 每个阶段的增值

- 影响价值链的因素

- 中断

- 产业衝击力

- 成长动力

- 气候和环境监测任务

- 汽车 ADAS 和电动车安全采用

- 医疗保健数位化

- 国防和边境安全现代化

- 消费性电子化集成

- 产业陷阱与挑战

- 冷却红外线感知器成本高

- 出口管制条例

- 市场机会

- 工业安全和能源效率要求

- 人工智慧和边缘处理与红外线感测器的集成

- 小型化和低成本非製冷红外线感测器

- 汽车电气化和ADAS应用

- 成长动力

- 成长潜力分析

- 监管格局

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL分析

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 按产品

- 定价策略

- 新兴商业模式

- 合规性要求

- 永续性措施

- 消费者情绪分析

- 专利和智慧财产权分析

- 地缘政治与贸易动态

第四章:竞争格局

- 公司简介 市占率分析

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 市场集中度分析

- 关键参与者的竞争基准化分析

- 财务绩效比较

- 收入

- 利润率

- 研发

- 产品组合比较

- 产品范围广度

- 科技

- 创新

- 地理分布比较

- 全球足迹分析

- 服务网路覆盖

- 各地区市场渗透率

- 竞争定位矩阵

- 领导者

- 挑战者

- 追踪者

- 利基市场参与者

- 战略展望矩阵

- 财务绩效比较

- 2021-2024 年关键发展

- 併购

- 伙伴关係与合作

- 技术进步

- 扩张和投资策略

- 永续发展倡议

- 数位转型计划

- 新兴/新创企业竞争对手格局

第五章:市场估计与预测:按类型,2021 - 2034

- 近红外线(NIR)

- 红外线的

- 远红外线(FIR)

第六章:市场估计与预测:按工作机制,2021-2034 年

- 积极的

- 被动的

第七章:市场估计与预测:按技术,2021 - 2034 年

- 非冷冻红外线感测器

- 冷却红外线感测器

- 高光谱

- 人工智慧集成

- 微型化

- 其他的

第 8 章:市场估计与预测:按应用,2021-2034 年

- 温度测量

- 运动感应

- 气体和火灾侦测

- 安全与监控

- 其他的

第九章:市场估计与预测:依最终用途,2021-2034

- 製造业

- 汽车

- 消费性电器

- 航太与国防

- 卫生保健

- 石油和天然气

- 其他的

第 10 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 阿联酋

- 沙乌地阿拉伯

- 南非

第 11 章:公司简介

- FLIR Systems

- Hamamatsu Photonics KK

- Murata Manufacturing Co., Ltd.

- Omron Corporation

- Excelitas Technologies Corp.

- Honeywell International Inc.

- Texas Instruments Incorporated

- Panasonic Holdings Corporation

- InfraTec GmbH

- Kollmorgen (Danaher Corporation)

- Leonardo DRS, Inc.

- BAE Systems plc

- Raytheon Technologies Corporation

- Lockheed Martin Corporation

- L3Harris Technologies, Inc.

- Heimann Sensor GmbH

- New Imaging Technologies (NIT, France)

- Nippon Avionics Co., Ltd. (NEC Group)

- Melexis NV

- Opgal Optronic Industries Ltd.

The Global Infrared Sensors Market was valued at USD 1.1 billion in 2024 and is estimated to grow at a CAGR of 7.2% to reach USD 2.2 billion by 2034.

Rising deployment of IR sensing across climate monitoring, environmental observation, industry, and consumer electronics is fueling this growth. Infrared sensors provide critical insights into temperature gradients, atmospheric phenomena, and heat signatures data vital for weather forecasting, environmental protection, and disaster resilience. Innovations such as high-resolution thermal imaging, compact detectors, and smart algorithms are driving adoption across sectors. Governments and private entities are integrating IR technology into remote sensing infrastructure, early warning systems, and urban planning frameworks to strengthen climate resilience. As global attention intensifies on sustainability, pollution control, and ecosystem management, the need for precise thermal data is expanding, thus broadening the addressable market for infrared sensors.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.1 billion |

| Forecast Value | $2.2 billion |

| CAGR | 7.2% |

In 2024, the near infrared (NIR) segment generated USD 455.6 million. NIR sensors dominate due to their widespread use in consumer devices facial recognition, gesture sensing, biometric applications as well as in industrial quality control and medical diagnostics. Their cost efficiency, compactness, and ease of integration underpin their popularity.

The uncooled infrared sensor segment was valued at USD 270.8 million in 2024. Uncooled IR detectors strike an effective balance between affordability, compactness, and robustness, making them well suited for consumer electronics, handheld thermal cameras, medical thermography, and industrial safety systems.

U.S. Infrared Sensor Market generated USD 247.5 million in 2024 and will grow at a CAGR of 7.7% through 2034. The American market is powered by investments in defense, remote sensing, autonomous vehicles, and medical imaging. Ongoing wildfires and climate events have heightened demand for high-performance field IR systems, while telehealth expansion is encouraging thermal applications in diagnostics and monitoring.

Prominent players in the Global Infrared Sensor Market include Lockheed Martin Corporation, Melexis N.V., FLIR Systems, Panasonic Holdings Corporation, Hamamatsu Photonics K.K., Omron Corporation, Leonardo DRS, Inc., New Imaging Technologies (NIT), Murata Manufacturing Co., Ltd., InfraTec GmbH, Opgal Optronic Industries Ltd., Excelitas Technologies Corp., Heimann Sensor GmbH, BAE Systems plc, L3Harris Technologies, Inc., Nippon Avionics Co., Ltd., Texas Instruments Incorporated, Raytheon Technologies Corporation, and Honeywell International Inc. Leading infrared sensor firms are focusing on innovation in materials, miniaturization, and integration to boost competitive edge. Many are developing next generation quantum or quantum inspired detectors with higher sensitivity and lower noise. Partnerships with semiconductor manufacturers, camera OEMs, and IoT platforms accelerate adoption.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1. Material Type

- 2.2.2 Product Type

- 2.2.3 Form

- 2.2.4 End use Industry

- 2.2.5 North America

- 2.2.6 Europe

- 2.2.7 Asia Pacific

- 2.2.8 Latin America

- 2.2.9 Middle East & Africa

- 2.3 TAM Analysis, 2025-2034 (USD Million)

- 2.4 CXO perspective: Strategic imperatives

- 2.5 Executive decision points

- 2.6 Critical Success Factors

- 2.7 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Climate & environmental monitoring missions

- 3.2.1.2 Automotive ADAS & EV safety adoption

- 3.2.1.3 Healthcare digitization

- 3.2.1.4 Defense & border security modernization

- 3.2.1.5 Consumer electronics integration

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of cooled IR sensors

- 3.2.2.2 Export control regulations

- 3.2.3 Market Opportunities

- 3.2.3.1 Industrial Safety & Energy Efficiency Mandates

- 3.2.3.2 Integration of AI & Edge Processing with IR Sensors

- 3.2.3.3 Miniaturization & Low-Cost Uncooled IR Sensors

- 3.2.3.4 Automotive Electrification & ADAS Adoption

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter’s analysis

- 3.6 PESTEL analysis

- 3.7 Technological and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price Trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Pricing strategies

- 3.10 Emerging business models

- 3.11 Compliance requirements

- 3.12 Sustainability measures

- 3.13 Consumer sentiment analysis

- 3.14 Patent and IP analysis

- 3.15 Geopolitical and trade dynamics

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction Company market share analysis

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1. North America

- 4.2.2. Europe

- 4.2.3. Asia Pacific

- 4.2.2 Market concentration analysis

- 4.3 Competitive Benchmarking of key Players

- 4.3.1 Financial Performance Comparison

- 4.3.1.1. Revenue

- 4.3.1.2. Profit Margin

- 4.3.1.3. R&D

- 4.3.2 Product Portfolio Comparison

- 4.3.2.1. Product Range Breadth

- 4.3.2.2. Technology

- 4.3.2.3. Innovation

- 4.3.3 Geographic Presence Comparison

- 4.3.3.1. Global Footprint Analysis

- 4.3.3.2. Service Network Coverage

- 4.3.3.3. Market Penetration by Region

- 4.3.4 Competitive Positioning Matrix

- 4.3.4.1. Leaders

- 4.3.4.2. Challengers

- 4.3.4.3. Followers

- 4.3.4.4. Niche Players

- 4.3.5 Strategic outlook matrix

- 4.3.1 Financial Performance Comparison

- 4.4 Key developments, 2021-2024

- 4.4.1 Mergers and Acquisitions

- 4.4.2 Partnerships and Collaborations

- 4.4.3 Technological Advancements

- 4.4.4 Expansion and Investment Strategies

- 4.4.5 Sustainability Initiatives

- 4.4.6 Digital Transformation Initiatives

- 4.5 Emerging/ Startup Competitors Landscape

Chapter 5 Market Estimates & Forecast, By Type, 2021 - 2034 (USD Million)

- 5.1 Near Infrared (NIR)

- 5.2 Infrared

- 5.3 Far Infrared (FIR)

Chapter 6 Market estimates & forecast, By Working Mechanism, 2021 - 2034 (USD Million)

- 6.1 Active

- 6.2 Passive

Chapter 7 Market estimates & forecast, By Technology, 2021 - 2034 (USD Million)

- 7.1 Uncooled IR Sensors

- 7.2 Cooled IR Sensors

- 7.3 Hyperspectral

- 7.4 AI-Integrated

- 7.5 Miniaturized

- 7.6 Others

Chapter 8 Market estimates & forecast, By Application, 2021-2034 (USD Million)

- 8.1 Temperature Measurement

- 8.2 Motion sensing

- 8.3 Gas and Fire Detection

- 8.4 Security and Surveillance

- 8.5 Others

Chapter 9 Market estimates & forecast, By End use, 2021-2034 (USD Million)

- 8.6 Manufacturing

- 8.7 Automotive

- 8.8 Consumer Appliances

- 8.9 Aerospace & Defense

- 8.10 Healthcare

- 8.11 Oil and Gas

- 8.12 Others

Chapter 10 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Million)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 U.K.

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East & Africa

- 10.6.1 UAE

- 10.6.2 Saudi Arabia

- 10.6.3 South Africa

Chapter 11 Company Profile

- 11.1 FLIR Systems

- 11.2 Hamamatsu Photonics K.K.

- 11.3 Murata Manufacturing Co., Ltd.

- 11.4 Omron Corporation

- 11.5 Excelitas Technologies Corp.

- 11.6 Honeywell International Inc.

- 11.7 Texas Instruments Incorporated

- 11.8 Panasonic Holdings Corporation

- 11.9 InfraTec GmbH

- 11.10 Kollmorgen (Danaher Corporation)

- 11.11 Leonardo DRS, Inc.

- 11.12 BAE Systems plc

- 11.13 Raytheon Technologies Corporation

- 11.14 Lockheed Martin Corporation

- 11.15 L3Harris Technologies, Inc.

- 11.16 Heimann Sensor GmbH

- 11.17 New Imaging Technologies (NIT, France)

- 11.18 Nippon Avionics Co., Ltd. (NEC Group)

- 11.19 Melexis N.V.

- 11.20 Opgal Optronic Industries Ltd.