|

市场调查报告书

商品编码

1844277

高阶炊具市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Premium Cookware Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

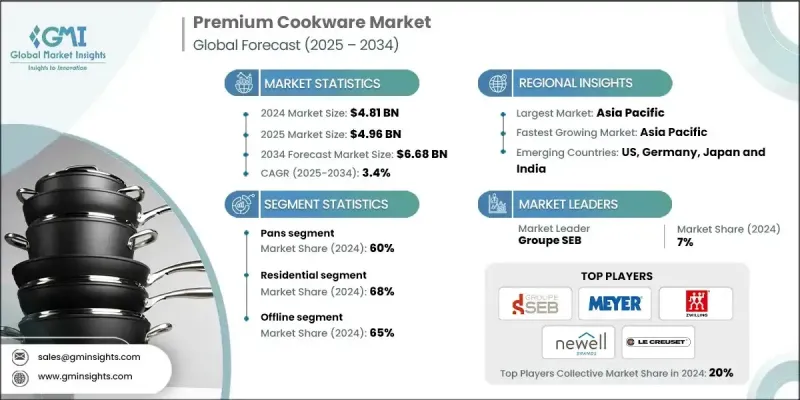

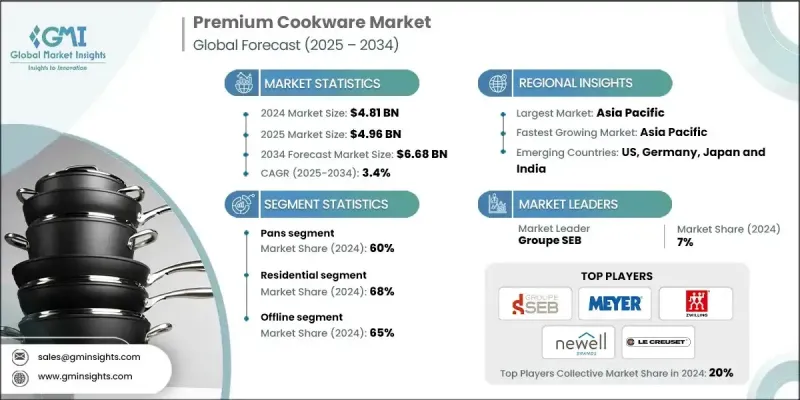

2024 年全球高端炊具市场价值为 48.1 亿美元,预计到 2034 年将以 3.4% 的复合年增长率增长至 66.8 亿美元。

消费者对更安全、无毒炊具的需求大幅成长,这在很大程度上推动了市场成长。消费者正逐渐放弃含有PFOA和PFAS化学物质的传统不沾锅具,转而选择采用陶瓷、溶胶-凝胶涂层或铸铁、碳钢等材料製成的炊具,这些材料被认为更注重健康。此外,炊具越来越被认为是厨房的美学点缀,各大品牌也更注重美观的设计和造型。美国食品药物管理局(FDA)制定的法规确保炊具产品符合严格的食品接触物质(FCS)标准,确保所使用材料可用于安全烹调。消费者对烹饪工具安全性的担忧以及对更健康生活方式的日益追求,推动了「无化学」炊具的兴起。随着消费者在厨房投资中更加重视品质、安全和设计,高端炊具市场预计将继续保持上升趋势。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 48.1亿美元 |

| 预测值 | 66.8亿美元 |

| 复合年增长率 | 3.4% |

2024年,平底锅市场占据了60%的市场份额,预计到2034年将以3.5%的复合年增长率增长,这得益于其多功能性以及在日常烹饪中不可或缺的作用,可用于煎、煸、煎和烤等各种烹饪方式。不銹钢和陶瓷等高品质多层炊具因其性能卓越、使用方便且经久耐用,其需求持续增长。

2024年,家用炊具市场占据了68%的市场份额,预计到2034年将以3.5%的复合年增长率增长,这得益于消费者对高端炊具日益增长的需求,这些炊具能够与其多样化的厨房设计相得益彰,并提升烹饪体验。家用炊具消费者对炊具创新过程的参与度更高,这促使製造商开发兼顾美观和功能的产品。消费者行为的这种转变将持续推动炊具产业的创新。

至2034年,亚太地区高端炊具市场的复合年增长率将达到3.7%。都市化、可支配收入的提升、西式烹饪的日益普及,以及亚洲人传统的饮食习惯,显着提升了对高端炊具的需求。随着中国、印度和澳洲等国消费者转向更高品质的烹饪工具,该地区消费者的炊具偏好也正在快速转变。

全球高端炊具市场的主要参与者包括 Groupe SEB、Meyer Corporation、Zwilling JA Henckels、Newell Brands、Le Creuset、Demeyere、Made In Cookware、Fissler GmbH、Mauviel、The Cookware Company、Tramontina、TTK Prestige、Conairchen Corp.、BERNDES KuDES 和 Steel。为了巩固市场地位,高端炊具市场的公司正专注于产品创新、永续材料和扩大品牌影响力。许多製造商正在开发具有先进无毒涂层和多层结构的炊具,以吸引註重健康的消费者。与知名厨师和有影响力人士的合作,以及提高线上和线下零售空间的知名度,帮助这些品牌扩大了影响力。一些公司也正在投资环保生产方法,并推出由再生材料製成的产品,以满足有环保意识的消费者的需求。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 利润率

- 每个阶段的增值

- 影响价值链的因素

- 中断

- 产业衝击力

- 成长动力

- 城市中产阶级对厨具的高端化

- 永续性驱动的产品创新

- 采用智慧和多功能炊具

- 产业陷阱与挑战

- 对安全声明的监管审查

- 新兴市场的价格弹性

- 机会

- 透过电子商务生态系统实现直接面向消费者 (DTC) 的扩张

- 针对新兴市场的在地化高端 SKU

- 成长动力

- 成长潜力分析

- 未来市场趋势

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 按产品

- 监理框架

- 标准和认证

- 环境法规

- 进出口法规

- 贸易统计

- 主要进口国

- 主要出口国

- 波特五力分析

- PESTEL分析

- 消费者行为分析

- 购买模式

- 偏好分析

- 消费者行为的区域差异

- 电子商务对购买决策的影响

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:依产品,2021 - 2034

- 主要趋势

- 平底锅

- 煎锅

- 炒锅

- 平底锅

- 烤盘

- 其他(烹饪架、烹饪工具、烤盘、压力锅)

- 锅

- 火盆

- 酱汁锅

- 炸锅

- 荷兰烤锅/炖锅

- 其他的

- 烘焙用具

- 麵包和麵包盘

- 烤盘

- 蛋糕盘

- 鬆饼盘

- 其他的

- 其他的

第六章:市场估计与预测:依资料,2021 - 2034 年

- 主要趋势

- 不銹钢

- 铸铁和搪瓷铸铁

- 铝和阳极氧化铝

- 碳钢

- 不黏

- 其他的

第七章:市场估计与预测:依涂层类型,2021 - 2034

- 主要趋势

- 不黏(聚四氟乙烯)

- 陶瓷涂层

- 硬质阳极氧化铝

- 无涂层/自然饰面

第 8 章:市场估计与预测:按最终用途,2021 - 2034 年

- 主要趋势

- 住宅

- 商业的

- HoReCa

- 麵包店

- 餐饮服务

- 其他的

第九章:市场估计与预测:按配销通路,2021 - 2034

- 主要趋势

- 在线的

- 电子商务网站

- 公司网站

- 离线

- 专卖店

- 大型零售商店

- 其他的

第 10 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 多边环境协定

- 南非

- 沙乌地阿拉伯

- 阿联酋

第 11 章:公司简介

- Groupe SEB

- Meyer Corporation

- Zwilling JA Henckels

- Newell Brands

- Le Creuset

- Demeyere

- Made In Cookware

- Fissler GmbH

- Mauviel

- The Cookware Company

- Tramontina

- TTK Prestige

- Conair Corp.

- BERNDES Kuchen

- Heritage Steel

- Zwilling

The Global Premium Cookware Market was valued at USD 4.81 billion in 2024 and is estimated to grow at a CAGR of 3.4% to reach USD 6.68 billion by 2034.

A significant shift toward safer, non-toxic cookware largely drives market growth. Consumers are moving away from traditional non-stick cookware that contains PFOA and PFAS chemicals, and instead, they are opting for cookware made with ceramic, sol-gel coatings, or materials like cast iron and carbon steel, which are considered more health-conscious. Additionally, cookware is being increasingly recognized as an aesthetic addition to the kitchen, with brands prioritizing appealing designs and attractive forms. Regulations set by the FDA ensure that cookware products meet strict guidelines for Food Contact Substances (FCS), guaranteeing that materials used are safe for food preparation. The rise of "chemical-free" cookware is being propelled by consumers' concerns over the safety of their cooking tools and the growing preference for healthier lifestyles. The market for premium cookware is expected to continue its upward trajectory as consumers prioritize quality, safety, and design in their kitchen investments.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.81 Billion |

| Forecast Value | $6.68 Billion |

| CAGR | 3.4% |

In 2024, the pan segment held a 60% share and is anticipated to grow at a CAGR of 3.5% through 2034, owing to its versatility and essential role in daily cooking, allowing for various techniques such as frying, sauteing, searing, and browning. The demand for high-quality, multi-layered cookware, like stainless steel and ceramic, continues to grow because of their combination of performance, ease of use, and durability.

The residential segment held a 68% share in 2024 and is expected to grow at a 3.5% CAGR through 2034, driven by consumers' increasing desire for premium cookware that aligns with their diverse kitchen designs and enhances their cooking experiences. The residential demographic is more engaged with the cookware innovation process, pushing manufacturers to develop products that cater to both aesthetic appeal and functionality. This shift in consumer behavior continues to drive innovation within the cookware industry.

Asia-Pacific Premium Cookware Market will grow at a CAGR of 3.7% through 2034. Urbanization, rising disposable incomes, and the growing popularity of Western cooking, combined with traditional Asian food habits, have significantly increased demand for premium cookware. As consumers in countries like China, India, and Australia shift toward higher-quality cooking tools, this region is seeing a rapid transformation in its cookware preferences.

Key players in the Global Premium Cookware Market include Groupe SEB, Meyer Corporation, Zwilling J.A. Henckels, Newell Brands, Le Creuset, Demeyere, Made In Cookware, Fissler GmbH, Mauviel, The Cookware Company, Tramontina, TTK Prestige, Conair Corp., BERNDES Kuchen, and Heritage Steel. To strengthen their market position, companies in the premium cookware market are focusing on product innovation, sustainable materials, and expanding their brand presence. Many manufacturers are developing cookware with advanced non-toxic coatings and multi-layer constructions to appeal to health-conscious consumers. Partnerships with well-known chefs and influencers, along with increasing visibility in online and offline retail spaces, have helped these brands enhance their reach. Several companies are also investing in eco-friendly production methods and introducing products made from recycled materials to cater to environmentally conscious consumers.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 Material

- 2.2.4 Coating type

- 2.2.5 End Use

- 2.2.6 Distribution channel

- 2.3 CXO perspectives: strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Premiumization of kitchenware in urban middle-class segments

- 3.2.1.2 Sustainability-driven product innovation

- 3.2.1.3 Smart & multifunctional cookware adoption

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Regulatory scrutiny on safety claims

- 3.2.2.2 Price elasticity in emerging markets

- 3.2.3 Opportunities

- 3.2.3.1 Direct-to-consumer (DTC) expansion via e-commerce ecosystems

- 3.2.3.2 Localized premium SKUs for emerging markets

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By product

- 3.7 Regulatory framework

- 3.7.1 Standards and certifications

- 3.7.2 Environmental regulations

- 3.7.3 Import export regulations

- 3.8 Trade statistics

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Porter's five forces analysis

- 3.10 PESTEL analysis

- 3.11 Consumer behaviour analysis

- 3.11.1 Purchasing patterns

- 3.11.2 Preference analysis

- 3.11.3 Regional variations in consumer behaviour

- 3.11.4 Impact of e-commerce on buying decisions

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Product, 2021 - 2034, (USD Million) (Million Units)

- 5.1 Key trends

- 5.2 Pan

- 5.2.2 Fry pan

- 5.2.3 Saute pan

- 5.2.4 Saucepan

- 5.2.5 Roasting pan

- 5.2.6 Others (cooking racks, cooking tools, bakeware, pressure cookers)

- 5.3 Pots

- 5.3.1 Brazier

- 5.3.2 Sauce pot

- 5.3.3 Fryer pot

- 5.3.4 Dutch oven/ cocotte pots

- 5.3.5 Others

- 5.4 Bakeware

- 5.4.1 Bread and loaf pan

- 5.4.2 Sheet pan

- 5.4.3 Cake pans

- 5.4.4 Muffin pans

- 5.4.5 Others

- 5.5 Others

Chapter 6 Market Estimates & Forecast, By Material, 2021 - 2034, (USD Million) (Million Units)

- 6.1 Key trends

- 6.2 Stainless steel

- 6.3 Cast & enameled cast iron

- 6.4 Aluminum & anodized aluminum

- 6.5 Carbon steel

- 6.6 Non-stick

- 6.7 Others

Chapter 7 Market Estimates & Forecast, By Coating Type, 2021 - 2034, (USD Million) (Million Units)

- 7.1 Key trends

- 7.2 Nonstick (PTFE)

- 7.3 Ceramic coated

- 7.4 Hard-anodized aluminum

- 7.5 Uncoated / natural finish

Chapter 8 Market Estimates & Forecast, By End Use, 2021 - 2034, (USD Million) (Million Units)

- 8.1 Key trends

- 8.2 Residential

- 8.3 Commercial

- 8.3.1 HoReCa

- 8.3.2 Bakery

- 8.3.3 Catering services

- 8.3.4 Others

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034, (USD Billion) (Million Units)

- 9.1 Key trends

- 9.2 Online

- 9.2.1 E-commerce sites

- 9.2.2 Company websites

- 9.3 Offline

- 9.3.1 Specialty stores

- 9.3.2 Mega retail stores

- 9.3.3 Others

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034, (USD Million) (Million Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Groupe SEB

- 11.2 Meyer Corporation

- 11.3 Zwilling J.A. Henckels

- 11.4 Newell Brands

- 11.5 Le Creuset

- 11.6 Demeyere

- 11.7 Made In Cookware

- 11.8 Fissler GmbH

- 11.9 Mauviel

- 11.10 The Cookware Company

- 11.11 Tramontina

- 11.12 TTK Prestige

- 11.13 Conair Corp.

- 11.14 BERNDES Kuchen

- 11.15 Heritage Steel

- 11.16 Zwilling