|

市场调查报告书

商品编码

1844280

弹道飞弹市场机会、成长动力、产业趋势分析及2025-2034年预测Ballistic Missiles Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

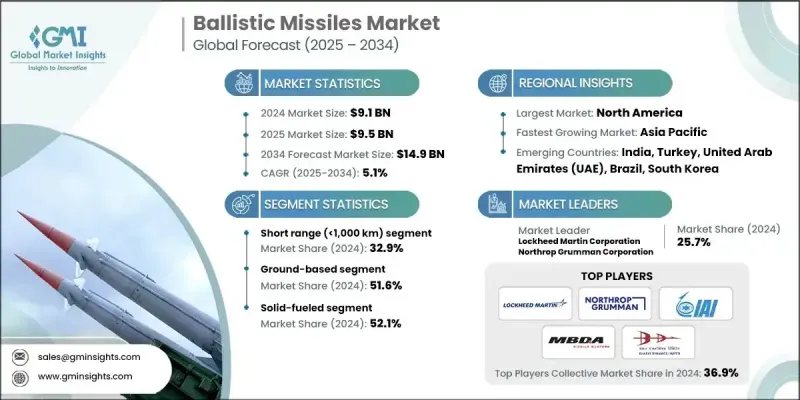

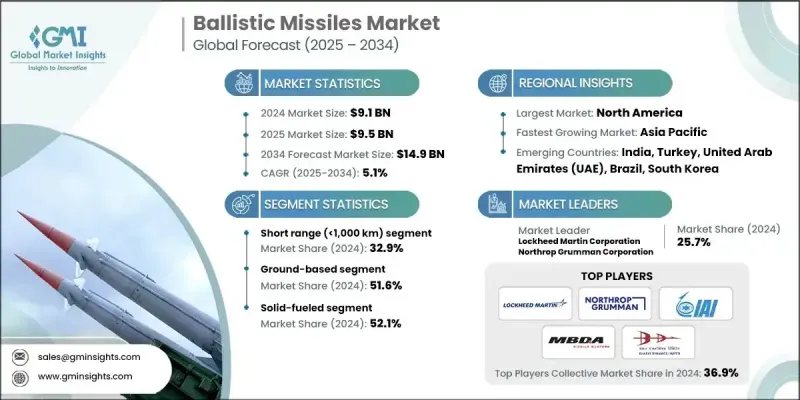

2024 年全球弹道飞弹市场价值为 91 亿美元,预计将以 5.1% 的复合年增长率成长,到 2034 年达到 149 亿美元。

推动这一成长的关键驱动因素包括全球国防开支的增加、过时飞弹库的现代化、推进和瞄准系统的技术进步以及日益加剧的地区和国际衝突。世界各国正大幅增加对飞弹能力的投资,旨在加强其战略威慑和快速反应框架。传统平台的升级正将重点转向更复杂的推进系统、增强的再入技术和精确导引系统。不断变化的威胁正在推动从常规飞弹类型向更先进类型的过渡,例如高超音速飞弹、机动再入飞行器(MaRV)和精确导引系统。这一发展既反映了国家安全的优先事项,也反映了现代战争日益复杂的情况。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 91亿美元 |

| 预测值 | 149亿美元 |

| 复合年增长率 | 5.1% |

短程弹道飞弹 (SRBM) 市场在 2024 年占 32.9% 的份额,这得益于其在地区衝突情境下的战术优势、快速部署能力和成本效益。预算有限且环境威胁较大的国家正在采用这些系统,以满足快速回应需求并增强威慑力。市场参与者应优先考虑紧凑型推进系统、可扩展弹头配置和增强型瞄准能力的创新,以满足新兴的地区需求和现代化要求。

2024年,陆基飞弹市场占了51.6%的份额。其吸引力在于更广泛的有效载荷选择、更远的打击范围以及相对于海基或空基系统更低的成本。它还支援战术和远程防御战略。为了保持竞争力,鼓励製造商开发下一代高超音速和固体推进系统,整合先进的精密技术,并加强与新兴市场中不断扩展的国防项目的合作。

受战略和战术飞弹能力持续投资的推动,美国弹道飞弹市场规模在2024年达到31亿美元。国防企业应专注于提升飞弹的准确性、可靠性和性能,同时与联邦机构密切合作,以配合当前的军事现代化战略。提供经济高效、可扩展的系统对于获得长期国防合约仍然至关重要。

塑造该行业的主要参与者包括Roketsan公司、诺斯罗普·格鲁曼公司、英国宇航系统公司、拉斐尔先进防御系统有限公司、欧洲导弹集团、洛克希德·马丁公司、印度动力有限公司、布拉莫斯航太、以色列航太工业有限公司(IAI)和NPO Mashinostroyeniya。为了巩固其市场地位,领先公司正在投资尖端推进技术、先进导引系统和增强性能的轻质复合材料。他们也积极与国防机构合作,使产品开发与长期军事现代化目标保持一致。重点是扩大其产品组合,开发兼具威慑力和进攻能力的多程飞弹系统。

目录

第一章:方法论

- 市场范围和定义

- 研究设计

- 研究方法

- 资料收集方法

- 资料探勘来源

- 全球的

- 地区/国家

- 基础估算与计算

- 基准年计算

- 市场评估的主要趋势

- 初步研究和验证

- 主要来源

- 预测模型

- 研究假设和局限性

第 2 章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 利润率分析

- 成本结构

- 每个阶段的增值

- 影响价值链的因素

- 中断

- 产业衝击力

- 成长动力

- 全球国防预算扩张

- 地缘政治紧张局势和区域衝突加剧

- 老化飞弹系统的现代化与更换

- 飞弹导引与推进技术的进步

- 更加重视战略威慑与核能力

- 产业陷阱与挑战

- 弹道飞弹研发产量成本高

- 严格的军备管制条约和出口法规

- 市场机会

- 高超音速和机动再入飞行器(HGV/MaRV)的开发

- 合作防御计划和联合发展计划

- 新兴国防市场(亚太、中东)的成长

- 成长动力

- 成长潜力分析

- 监管格局

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL分析

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 新兴商业模式

- 合规性要求

- 国防预算分析

- 全球国防开支趋势

- 区域国防预算分配

- 北美洲

- 欧洲

- 亚太地区

- 中东和非洲

- 拉丁美洲

- 重点国防现代化项目

- 预算预测(2025-2034)

- 对产业成长的影响

- 各国国防预算

- 供应链弹性

- 地缘政治分析

- 劳动力分析

- 数位转型

- 合併、收购和策略伙伴关係格局

- 风险评估与管理

- 主要合约授予(2021-2024)

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 按地区

- 关键参与者的竞争基准

- 财务绩效比较

- 收入

- 利润率

- 研发

- 产品组合比较

- 产品范围广度

- 科技

- 创新

- 地理位置比较

- 全球足迹分析

- 服务网路覆盖

- 各地区市场渗透率

- 竞争定位矩阵

- 领导者

- 挑战者

- 追踪者

- 利基市场参与者

- 战略展望矩阵

- 财务绩效比较

- 2021-2024 年关键发展

- 併购

- 伙伴关係与合作

- 技术进步

- 扩张和投资策略

- 数位转型倡议

- 新兴/新创企业竞争对手格局

第五章:市场估计与预测:按范围,2021 - 2034

- 主要趋势

- 短距离(<1,000 公里)

- 中程(1,000-3,000公里)

- 中程(3,000-5,500公里)

- 洲际航程(>5,500 公里)

第六章:市场估计与预测:按发布平台,2021 - 2034 年

- 主要趋势

- 地面

- 空降

- 海军

- 太空赋能

第七章:市场估计与预测:按推进方式,2021 - 2034 年

- 主要趋势

- 液体燃料

- 固体燃料

- 杂交种

第八章:市场估计与预测:按指导系统,2021 - 2034 年

- 主要趋势

- 惯性导航系统(INS)

- 卫星辅助

- 进阶探索者

- 地形通讯/DSMAC

第九章:市场估计与预测:按速度,2021 - 2034 年

- 主要趋势

- 超音速

- 高超音速

第 10 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 多边环境协定

- 南非

- 沙乌地阿拉伯

- 阿联酋

第 11 章:公司简介

- 全球关键参与者

- BAE Systems plc

- MBDA

- Israel Aerospace Industries Ltd. (IAI)

- 区域关键参与者

- 北美洲

- Lockheed Martin Corporation

- Northrop Grumman Corporation

- 欧洲

- Avibras

- Elbit Systems

- 亚太地区

- Bharat Dynamics Limited

- BrahMos Aerospace

- China Aerospace Science and Technology Corporation (CASC)

- Hanwha Aerospace

- Roketsan

- 北美洲

- 利基市场参与者/颠覆者

- Makeyev Rocket Design Bureau (GRTs Makeyeva)

- NPO Mashinostroyeniya

- RAFAEL Advanced Defense Systems Ltd.

The Global Ballistic Missiles Market was valued at USD 9.1 billion in 2024 and is estimated to grow at a CAGR of 5.1% to reach USD 14.9 billion by 2034.

Key drivers contributing to this growth include rising global defense expenditures, the modernization of outdated missile arsenals, technological advancements in propulsion and targeting systems, and intensifying regional and international conflicts. Countries across the world are significantly increasing their investment in missile capabilities, aiming to strengthen both their strategic deterrence and rapid response frameworks. Upgrades to legacy platforms are shifting the focus toward more sophisticated propulsion systems, enhanced re-entry technologies, and precision targeting. The evolving threat is pushing the transition from conventional missile classes to more advanced types such as hypersonic, maneuverable reentry vehicles (MaRVs), and precision-guided systems. This development reflects both national security priorities and the growing complexity of modern warfare.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $9.1 billion |

| Forecast Value | $14.9 billion |

| CAGR | 5.1% |

The short-range ballistic missile (SRBM) segment held a 32.9% share in 2024 owing to its tactical advantages in regional conflict scenarios, rapid deployment capabilities, and cost-efficiency. Nations with limited budgets and high-threat environments are adopting these systems to meet fast-response needs and strengthen deterrent postures. Market players should prioritize innovation in compact propulsion, scalable warhead configurations, and enhanced targeting to align with emerging regional requirements and modernization mandates.

In 2024, the ground-based missile segment held a 51.6% share. Its appeal lies in broader payload options, extended strike range, and lower cost relative to sea or air-based systems. It also supports both tactical and long-range defense strategies. To remain competitive, manufacturers are encouraged to develop next-generation hypersonic and solid-propelled systems, integrate advanced precision technologies, and increase collaboration with expanding defense programs in newer markets.

U.S. Ballistic Missile Market reached USD 3.1 billion in 2024, driven by sustained investment in both strategic and tactical missile capabilities. Defense firms should focus on boosting the accuracy, reliability, and performance of missiles while working closely with federal agencies to align with current military modernization strategies. Providing cost-effective, scalable systems remains crucial in securing long-term defense contracts.

Major participants shaping the industry include Roketsan, Northrop Grumman Corporation, BAE Systems plc, RAFAEL Advanced Defense Systems Ltd., MBDA, Lockheed Martin Corporation, Bharat Dynamics Limited, BrahMos Aerospace, Israel Aerospace Industries Ltd. (IAI), and NPO Mashinostroyeniya. To secure their market position, leading companies are investing in cutting-edge propulsion technologies, advanced guidance systems, and lightweight composite materials that enhance performance. They're also actively partnering with national defense organizations to align product development with long-term military modernization goals. Emphasis is being placed on expanding portfolios with multi-range missile systems capable of both deterrence and offensive capability.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Range trends

- 2.2.2 Launch platform trends

- 2.2.3 Propulsion trends

- 2.2.4 Guidance system trends

- 2.2.5 Speed trends

- 2.2.6 Regional trends

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Expansion of defense budgets globally

- 3.2.1.2 Rising geopolitical tensions and regional conflicts

- 3.2.1.3 Modernization and replacement of aging missile systems

- 3.2.1.4 Advancements in missile guidance and propulsion technology

- 3.2.1.5 Increased focus on strategic deterrence and nuclear capabilities

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High R&D and production costs of ballistic missiles

- 3.2.2.2 Stringent arms control treaties and export regulations

- 3.2.3 Market opportunities

- 3.2.3.1 Development of hypersonic and maneuverable re-entry vehicles (HGV/MaRV)

- 3.2.3.2 Collaborative defense programs and joint development initiatives

- 3.2.3.3 Growth in emerging defense markets (Asia-Pacific, Middle East)

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter’s analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Emerging business models

- 3.9 Compliance requirements

- 3.10 Defense budget analysis

- 3.11 Global defense spending trends

- 3.12 Regional defense budget allocation

- 3.12.1 North America

- 3.12.2 Europe

- 3.12.3 Asia Pacific

- 3.12.4 Middle East and Africa

- 3.12.5 Latin America

- 3.13 Key defense modernization programs

- 3.14 Budget forecast (2025-2034)

- 3.14.1 Impact on industry growth

- 3.14.2 Defense budgets by country

- 3.15 Supply chain resilience

- 3.16 Geopolitical analysis

- 3.17 Workforce analysis

- 3.18 Digital transformation

- 3.19 Mergers, acquisitions, and strategic partnerships landscape

- 3.20 Risk assessment and management

- 3.21 Major contract awards (2021-2024)

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.1 By region

- 4.3 Competitive benchmarking of key players

- 4.3.1 Financial performance comparison

- 4.3.1.1 Revenue

- 4.3.1.2 Profit margin

- 4.3.1.3 R&D

- 4.3.2 Product portfolio comparison

- 4.3.2.1 Product range breadth

- 4.3.2.2 Technology

- 4.3.2.3 Innovation

- 4.3.3 Geographic presence comparison

- 4.3.3.1 Global footprint analysis

- 4.3.3.2 Service network coverage

- 4.3.3.3 Market penetration by region

- 4.3.4 Competitive positioning matrix

- 4.3.4.1 Leaders

- 4.3.4.2 Challengers

- 4.3.4.3 Followers

- 4.3.4.4 Niche players

- 4.3.5 Strategic outlook matrix

- 4.3.1 Financial performance comparison

- 4.4 Key developments, 2021-2024

- 4.4.1 Mergers and acquisitions

- 4.4.2 Partnerships and collaborations

- 4.4.3 Technological advancements

- 4.4.4 Expansion and investment strategies

- 4.4.5 Digital transformation initiatives

- 4.5 Emerging/ startup competitors landscape

Chapter 5 Market Estimates and Forecast, By Range, 2021 - 2034 (USD Million)

- 5.1 Key trends

- 5.2 Short range (<1,000 km)

- 5.3 Medium range (1,000-3,000 km)

- 5.4 Intermediate range (3,000-5,500 km)

- 5.5 Intercontinental range (>5,500 km)

Chapter 6 Market Estimates and Forecast, By Launch Platform, 2021 - 2034 (USD Million)

- 6.1 Key trends

- 6.2 Ground-based

- 6.3 Airborne

- 6.4 Naval

- 6.5 Space-enabled

Chapter 7 Market Estimates and Forecast, By Propulsion, 2021 - 2034 (USD Million)

- 7.1 Key trends

- 7.2 Liquid-fueled

- 7.3 Solid-fueled

- 7.4 Hybrid

Chapter 8 Market Estimates and Forecast, By Guidance System, 2021 - 2034 (USD Million)

- 8.1 Key trends

- 8.2 Inertial navigation systems (INS)

- 8.3 Satellite-aided

- 8.4 Advanced seekers

- 8.5 TERCOM / DSMAC

Chapter 9 Market Estimates and Forecast, By Speed, 2021 - 2034 (USD Million)

- 9.1 Key trends

- 9.2 Supersonic

- 9.3 Hypersonic

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 (USD Million)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Global Key Players

- 11.1.1 BAE Systems plc

- 11.1.2 MBDA

- 11.1.3 Israel Aerospace Industries Ltd. (IAI)

- 11.2 Regional Key Players

- 11.2.1 North America

- 11.2.1.1 Lockheed Martin Corporation

- 11.2.1.2 Northrop Grumman Corporation

- 11.2.2 Europe

- 11.2.2.1 Avibras

- 11.2.2.2 Elbit Systems

- 11.2.3 Asia Pacific

- 11.2.3.1 Bharat Dynamics Limited

- 11.2.3.2 BrahMos Aerospace

- 11.2.3.3 China Aerospace Science and Technology Corporation (CASC)

- 11.2.3.4 Hanwha Aerospace

- 11.2.3.5 Roketsan

- 11.2.1 North America

- 11.3 Niche Players / Disruptors

- 11.3.1 Makeyev Rocket Design Bureau (GRTs Makeyeva)

- 11.3.2 NPO Mashinostroyeniya

- 11.3.3 RAFAEL Advanced Defense Systems Ltd.