|

市场调查报告书

商品编码

1844281

墨盒及笔材料市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Cartridge and Pen Materials Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

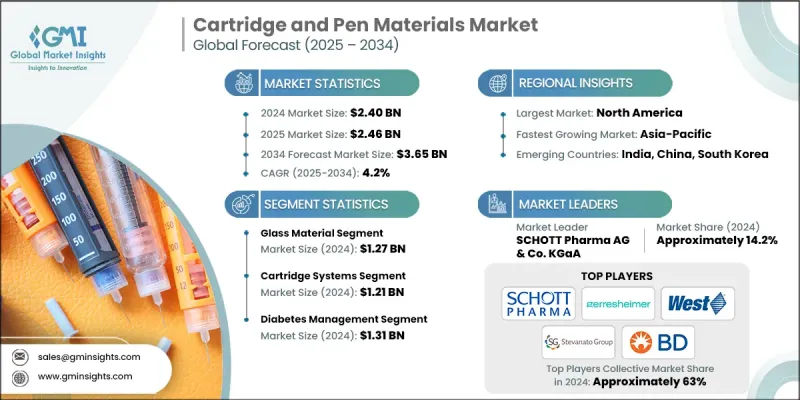

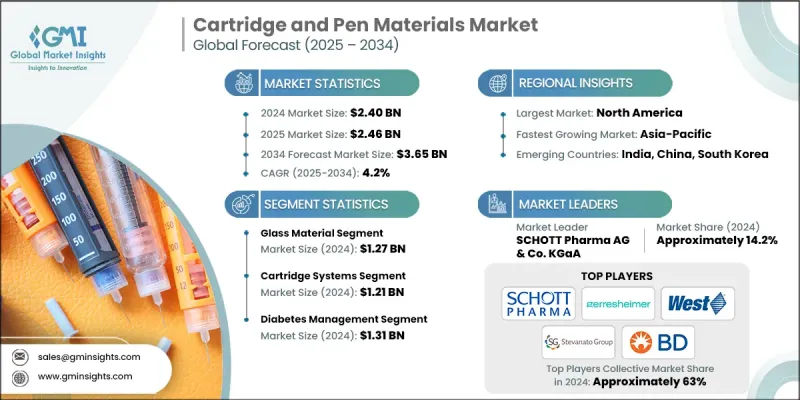

2024 年全球墨盒和笔材料市场价值为 24 亿美元,预计将以 4.2% 的复合年增长率成长,到 2034 年达到 36.5 亿美元。

这个不断发展的市场正经历着从高容量胰岛素输送系统转向更精密设计的转变,这些系统专注于提高患者的易用性。随着越来越多的疗法从医院给药转向家庭注射,材料创新已成为核心重点。人们越来越重视开发耐用、安全且符合法规的材料,以提升设备性能和病患体验。整个供应链上的製造商都在投资开发适用于复杂药物配方(尤其是生物製剂和联合疗法)的材料。随着对患者友善、自主给药系统的需求不断增长,材料必须具备卓越的兼容性、更低的反应性和更强的机械性能。 GLP-1 和多药疗法的日益普及,正推动市场发展为支持长期可用性和依从性的先进聚合物和混合材料。此外,人们对居家护理和数位监控的日益增长的偏好也推动了对智慧输送设备的需求,这给注射笔和药筒的组件製造和材料选择带来了新的复杂性。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 24亿美元 |

| 预测值 | 36.5亿美元 |

| 复合年增长率 | 4.2% |

2024年,玻璃材料市场占有52.4%的份额。玻璃在传统注射疗法和胰岛素笔芯中仍被广泛使用。由于玻璃易破损、重量较大、与敏感化合物的兼容性较低(尤其是在现代疗法中),市场正在逐渐放弃使用玻璃。製造商正在逐步采用先进的塑料,以提高安全性、降低污染风险,并提高组装灵活性。

2024年,注射笔组件市场占28.5%的市占率。人体工学、智慧且可重复使用的注射笔系统日益普及,推动了对高性能材料的需求,这些材料能够支援可重复使用性、连接性和使用者舒适度。随着人们越来越重视治疗依从性和便利性,尤其是在慢性病治疗中,对支持复杂给药机制的注射笔设计的需求也不断增长。 GLP-1应用、复方注射和自我给药方案的推广极大地影响了注射笔组件的设计和製造方式,使其重点转向精准性、触觉回馈和高耐用性。

2024年,美国墨水匣和笔材市场产值达6.7亿美元。医疗和消费领域对可再填充和一次性笔产品的需求不断增长,推动了美国市场的发展。中性笔和原子笔等书写工具的需求保持稳定,消费者更重视流畅的使用体验和持久耐用性。製造商正在将先进的塑胶聚合物与轻质合金相结合,以满足消费者在舒适度、设计和功能方面不断变化的偏好。此外,促销笔的需求持续旺盛,尤其是在品牌推广和行销活动中。随着电商通路的蓬勃发展,个人化和特种材料越来越受到消费者的青睐,推动了该领域材料需求的稳定成长。

全球墨水匣和笔材料市场的主要参与者包括 Gerresheimer AG、SCHOTT Pharma AG、West Pharmaceutical Services, Inc.、Becton, Dickinson and Company (BD) 和 Stevanato Group SpA。墨盒和笔材料市场的领先公司正在透过开发具有耐化学性、低反应性并符合不断发展的全球标准的先进聚合物来扩展其材料组合。 SCHOTT Pharma AG 和 Gerresheimer AG 正在大力投资製造能力以支持混合材料开发,将传统玻璃和高级聚合物相结合,用于下一代墨盒和笔。 BD 和 Stevanato Group 等公司正在将智慧技术相容性整合到他们的笔平台中,以实现数位连接。为了提高供应链弹性和区域影响力,许多公司正在本地化生产设施。与药物开发商合作设计客製化的输送装置的做法也在增加。强调永续性,提供可回收和环保的材料选择,是另一个确保产品线面向未来并获得竞争优势的关键策略。

目录

第一章:方法论

- 市场范围和定义

- 研究设计

- 研究方法

- 资料收集方法

- 资料探勘来源

- 全球的

- 地区/国家

- 基础估算与计算

- 基准年计算

- 市场评估的主要趋势

- 初步研究和验证

- 主要来源

- 预测模型

- 研究假设和局限性

第 2 章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商概况

- 利润率

- 每个阶段的增值

- 影响价值链的因素

- 中断

- 产业衝击力

- 成长动力

- 生物製剂和生物相似药的兴起

- 自我管理和家庭护理

- 加强注射器安全监管

- 产业陷阱与挑战

- 玻璃脱层和破损

- 严格的监管测试

- 供应链复杂性

- 市场机会

- 高分子材料创新

- 智慧型/连网注射器系统

- 亚太新兴市场的需求

- 成长动力

- 成长潜力分析

- 监管格局

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL分析

- 价格趋势

- 按地区

- 按产品

- 未来市场趋势

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 专利态势

- 贸易统计资料(HS 编码)(註:仅提供重点国家的贸易统计资料)

- 主要进口国

- 主要出口国

- 永续性和环境方面

- 永续实践

- 减少废弃物的策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考量

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 多边环境协定

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:按材料类型,2025 - 2034 年

- 主要趋势

- 玻璃材质

- 硼硅酸盐玻璃

- 钠钙玻璃

- 镀膜玻璃解决方案

- 高分子材料

- 环烯烃共聚物(COC)

- 环状烯烃聚合物(COP)

- 其他聚合物(聚丙烯、聚乙烯)

- 特种聚合物

- 金属部件

- 不銹钢

- 铝合金

- 涂层/镀层金属

- 弹性体组件

- 橡胶密封件

- 有机硅弹性体

- 热塑性弹性体(TPE)

第六章:市场估计与预测:依产品类型,2025 - 2034

- 主要趋势

- 墨水匣系统

- 胰岛素笔芯

- 生物製剂药筒

- 特种药筒

- 笔组件

- 笔身

- 注射机制

- 针头组件

- 封闭密封系统

- 柱塞塞

- 针头护罩

- 盖子和锁定係统。

第七章:市场估计与预测:按应用类型,2025 - 2034

- 主要趋势

- 糖尿病管理

- 胰岛素笔

- GLP-1激动剂

- 组合喷油器

- 生物製剂和生物相似药

- 单株抗体

- 生长激素

- 疫苗注射器

- 专科治疗

- 自体免疫疾病治疗

- 肿瘤治疗

- 罕见疾病药物输送

第八章:市场估计与预测:按地区,2025 - 2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 亚太其他地区

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

- 中东和非洲其他地区

第九章:公司简介

- SCHOTT Pharma AG & Co. KGaA

- Gerresheimer AG

- Stevanato Group SpA

- West Pharmaceutical Services, Inc.

- Becton, Dickinson and Company (BD)

- Ypsomed AG

- Owen Mumford Ltd.

- SHL Medical AG

- Haselmeier GmbH

- Phillips-Medisize (a Molex company)

- Nemera

- Credence MedSystems, Inc.

- Terumo Corporation

- Kraton Corporation

- Datwyler Holding Inc.

The Global Cartridge and Pen Materials Market was valued at USD 2.40 billion in 2024 and is estimated to grow at a CAGR of 4.2% to reach USD 3.65 billion by 2034.

This evolving market is undergoing a shift from high-volume insulin delivery systems to more sophisticated designs focused on improved usability for patients. As more therapies move from hospital-based administration to home-based injectable formats, material innovation has become a core priority. The focus is increasingly on developing durable, safe, and regulatory-compliant materials that enhance device performance and patient experience. Manufacturers across the supply chain are investing in materials tailored for complex drug formulations, particularly in biologics and combination therapies. As demand for patient-friendly, self-administered systems rises, materials must offer superior compatibility, reduced reactivity, and enhanced mechanical properties. The growing popularity of GLP-1s and multi-drug regimens is pushing the market toward advanced polymers and hybrid materials that support long-term usability and compliance. Additionally, the growing preference for at-home care and digital monitoring is driving demand for smart delivery devices, adding another layer of complexity to component manufacturing and material selection in pens and cartridges.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.40 Billion |

| Forecast Value | $3.65 Billion |

| CAGR | 4.2% |

In 2024, the glass materials segment held a 52.4% share. Glasses continue to be widely used in legacy injectable therapies and traditional insulin cartridges. The market is moving away from glass because of its susceptibility to breakage, higher weight, and lower compatibility with sensitive compounds, especially in modern therapies. Manufacturers are progressively adopting advanced plastics that provide improved safety, reduced contamination risk, and greater flexibility during assembly.

The pen components segment held a 28.5% share in 2024. The rising use of ergonomic, smart, and reusable pen systems is driving the need for high-performance materials that support reusability, connectivity, and user comfort. With the increasing focus on therapy adherence and convenience, particularly in chronic treatments, demand is rising for pen designs that support complex delivery mechanisms. The expansion of GLP-1 use, combination injectables, and self-administration protocols has significantly influenced the way pen components are designed and manufactured, shifting emphasis toward precision, tactile feedback, and high durability.

United States Cartridge and Pen Materials Market generated USD 670 million in 2024. The US market is shaped by growing demand for both refillable and disposable pen products across medical and consumer use cases. Demand for writing instruments like gel and ballpoint pens remains steady, with consumers valuing smooth performance and long-lasting durability. Manufacturers are blending advanced plastic polymers and lightweight alloys to meet evolving preferences in comfort, design, and function. Additionally, promotional pens continue to see high demand, especially for branding and marketing activities. As e-commerce channels gain strength, personalization and specialty materials are gaining more traction among buyers, supporting steady growth in material demand across this segment.

Major players in the Global Cartridge and Pen Materials Market include Gerresheimer AG, SCHOTT Pharma AG, West Pharmaceutical Services, Inc., Becton, Dickinson and Company (BD), and Stevanato Group S.p.A. Leading companies in Cartridge and Pen Materials Market are expanding their material portfolios by developing advanced polymers that offer chemical resistance, low reactivity, and regulatory alignment with evolving global standards. SCHOTT Pharma AG and Gerresheimer AG are heavily investing in manufacturing capabilities to support hybrid material development, combining traditional glass and high-grade polymers for next-gen cartridges and pens. Firms like BD and Stevanato Group are integrating smart technology compatibility into their pen platforms, enabling digital connectivity. To improve supply chain resilience and regional presence, many companies are localizing production facilities. Collaborations with drug developers to co-design customized delivery devices are also on the rise. Emphasis on sustainability, with recyclable and eco-friendly material options, is another key tactic adopted to future-proof product lines and gain a competitive advantage.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Material Type

- 2.2.3 Product Type

- 2.2.4 Application

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rise in biologics and biosimilars

- 3.2.1.2 Self-administration & home care

- 3.2.1.3 Regulatory push for syringe safety

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Glass delamination & breakage

- 3.2.2.2 Stringent regulatory testing

- 3.2.2.3 Supply chain complexity

- 3.2.3 Market opportunities

- 3.2.3.1 Polymer material innovation

- 3.2.3.2 Smart/connected syringe systems

- 3.2.3.3 Demand in APAC emerging markets

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter’s analysis

- 3.6 PESTEL analysis

- 3.6.1 Technology and Innovation landscape

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and Environmental Aspects

- 3.12.1 Sustainable Practices

- 3.12.2 Waste Reduction Strategies

- 3.12.3 Energy Efficiency in Production

- 3.12.4 Eco-friendly Initiatives

- 3.13 Carbon Footprint Considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Material Type, 2025 - 2034 (USD Million, Units)

- 5.1 Key trends

- 5.2 Glass materials

- 5.2.1 Borosilicate glass

- 5.2.2 Soda-lime glass

- 5.2.3 Coated glass solutions

- 5.3 Polymer materials

- 5.3.1 Cyclic olefin copolymer (COC)

- 5.3.2 Cyclic olefin polymer (COP)

- 5.3.3 Other polymers (polypropylene, polyethylene)

- 5.3.4 Specialty polymers

- 5.4 Metal components

- 5.4.1 Stainless steel

- 5.4.2 Aluminum alloys

- 5.4.3 Coated/plated metals

- 5.5 Elastomer components

- 5.5.1 Rubber seals

- 5.5.2 Silicone elastomers

- 5.5.3 Thermoplastic elastomers (TPEs)

Chapter 6 Market Estimates and Forecast, By Product Type, 2025 - 2034 (USD Million, Units)

- 6.1 Key trends

- 6.2 Cartridge systems

- 6.2.1 Insulin cartridges

- 6.2.2 Biologics cartridges

- 6.2.3 Specialty drug cartridges

- 6.3 Pen components

- 6.3.1 Pen bodies

- 6.3.2 Injection mechanisms

- 6.3.3 Needle assemblies

- 6.4 Closure & sealing systems

- 6.4.1 Plunger stoppers

- 6.4.2 Needle shields

- 6.4.3 Cap and locking systems.

Chapter 7 Market Estimates and Forecast, By Application type, 2025 - 2034 (USD Million, Units)

- 7.1 Key trends

- 7.2 Diabetes management

- 7.2.1 Insulin pens

- 7.2.2 GLP-1 agonists

- 7.2.3 Combination injectors

- 7.3 Biologics and biosimilars

- 7.3.1 Monoclonal antibodies

- 7.3.2 Growth hormones

- 7.3.3 Vaccine injectors

- 7.4 Specialty therapeutics

- 7.4.1 Autoimmune disease therapies

- 7.4.2 Oncology treatments

- 7.4.3 Rare disease drug delivery

Chapter 8 Market Estimates and Forecast, By Region, 2025 - 2034 (USD Million, Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East & Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of Middle East & Africa

Chapter 9 Company Profiles

- 9.1 SCHOTT Pharma AG & Co. KGaA

- 9.2 Gerresheimer AG

- 9.3 Stevanato Group S.p.A.

- 9.4 West Pharmaceutical Services, Inc.

- 9.5 Becton, Dickinson and Company (BD)

- 9.6 Ypsomed AG

- 9.7 Owen Mumford Ltd.

- 9.8 SHL Medical AG

- 9.9 Haselmeier GmbH

- 9.10 Phillips-Medisize (a Molex company)

- 9.11 Nemera

- 9.12 Credence MedSystems, Inc.

- 9.13 Terumo Corporation

- 9.14 Kraton Corporation

- 9.15 Datwyler Holding Inc.