|

市场调查报告书

商品编码

1844292

腐植酸和黄腐酸市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Humic and Fulvic Acids Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

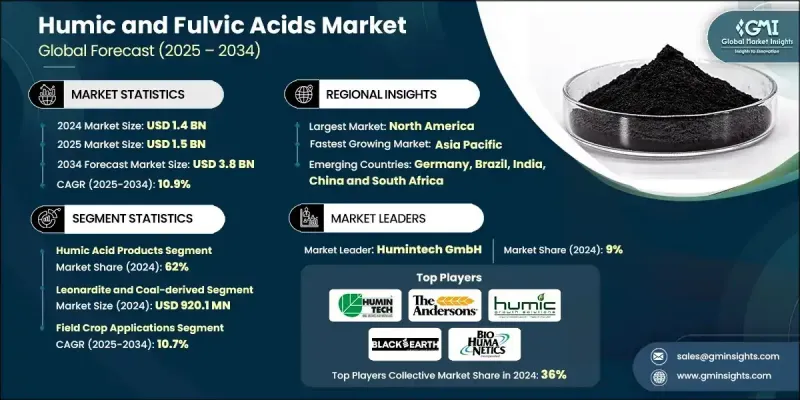

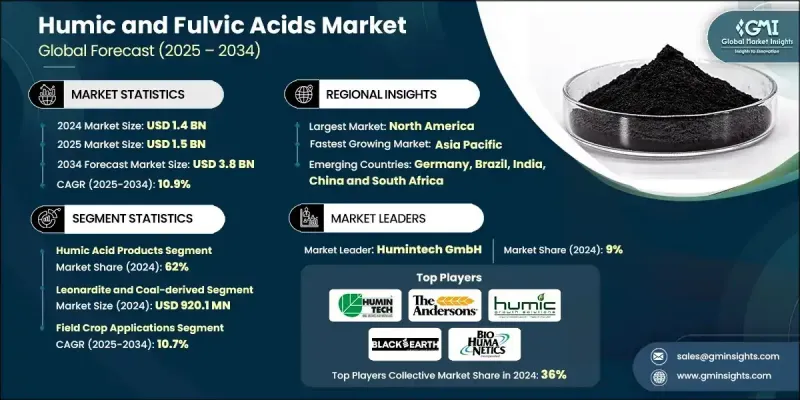

2024 年全球腐植酸和黄腐酸市场价值为 14 亿美元,预计到 2034 年将以 10.9% 的复合年增长率增长至 38 亿美元。

这一增长的动力源于农业领域普遍转向更永续的土壤改良方法,并减少对合成肥料的依赖。腐植酸和黄腐酸在改善土壤品质、提高养分吸收和植物生产力方面发挥着至关重要的作用,在日益增长的环境问题中,这一点尤其重要。随着对再生农业的重视程度不断提高,这些物质正日益成为环保作物投入策略的核心组成部分。监管支持、人们对生物基土壤添加剂日益增长的兴趣以及气候智慧型农业的广泛应用,持续推动需求。将腐植酸和黄腐酸融入精准施肥系统的先进农业技术进一步推动了其应用。透过水肥一体化、叶面施肥和数位监测等方法,使用者可以对施用方法进行微调,以实现作物效率的最大化。北美仍然是最大的市场,由于其完善的农业基础设施和对永续技术的持续投资,腐殖酸和黄腐酸在传统和有机农业体系中的应用都保持了强劲增长势头。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 14亿美元 |

| 预测值 | 38亿美元 |

| 复合年增长率 | 10.9% |

腐植酸产品细分市场在2024年占据62%的市场份额,预计到2034年将以10.7%的复合年增长率成长。腐植酸产品因其在改善土壤质地、维持养分和促进植物生长方面的显着效果而广泛应用。这些产品有液体、粉末和颗粒形式,支持多种农业环境的多样化使用。黄腐酸产品虽然仍占市场份额的一小部分,但由于其增强的养分螯合能力,尤其是在灌溉施肥系统和叶面施肥中,其应用正在加速成长。这种吸收率的提高有助于提高植物的復原力和养分效率。

2024年,风化褐煤和煤基资源市场规模达9.201亿美元,复合年增长率将达10.7%。由于其腐殖化程度高且品质稳定,是萃取浓缩腐植质的理想选择。北美和欧洲等地区的风化褐煤矿床广泛应用于农业和环境领域,其高碳含量和优异的性能推动了生物刺激剂级和土壤改良剂产品的扩张。

2024年,北美腐植酸和黄腐酸市场占有38.2%的份额。再生农业、有机种植和生态标籤农业投入品的兴起,持续提升了对天然土壤改良剂的需求。在环境友善农业文化的熏陶下,农民和农业企业越来越多地转向使用腐植酸和黄腐酸产品来提高作物产量和土壤活力。消费者对采用清洁、可持续投入种植的食品的偏好进一步强化了这一趋势。

塑造全球腐植酸和黄腐酸市场竞争格局的关键参与者包括Humatech, Inc.、加拿大Humalite International Inc.、山东创新腐殖酸科技有限公司、Humintech GmbH、Grow More, Inc.、Horizon Ag-Products, LLC、Omnia Specialities Australia Pty Ltd.、The Andersons, Inc., Nvi Technologiesxx离子科技公司Inc.、Jiloca Industrial, SA、Black Earth Humic LP、Bio Huma Netics, Inc.和Humatech, Inc.。为了巩固更强大的市场地位,腐植酸和黄腐酸行业的公司正在投资先进的配方技术,以提高产品功效和易用性。许多公司正在扩展颗粒、液体和可溶性产品线,以满足不同的应用方式。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 利润率

- 每个阶段的增值

- 影响价值链的因素

- 中断

- 产业衝击力

- 成长动力

- 更重视土壤健康与再生农业

- 环境永续性和气候变迁缓解

- 有机农业的成长与消费者需求

- 作物增产、品质改善

- 产业陷阱与挑战

- 消费者和农民的意识和教育有限

- 与传统肥料和改良剂相比成本较高

- 市场机会

- 新兴市场农业发展与投资

- 精准农业与技术整合

- 碳信用与环境服务市场

- 政府激励措施和永续发展计划

- 成长动力

- 成长潜力分析

- 监管格局

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL分析

- 价格趋势

- 按地区

- 依产品类型

- 未来市场趋势

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 专利态势

- 贸易统计(HS编码)

(註:仅提供重点国家的贸易统计)

- 主要进口国

- 主要出口国

- 永续性和环境方面

- 永续实践

- 减少废弃物的策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考虑

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 多边环境协定

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:依产品类型,2021-2034

- 主要趋势

- 腐植酸产品

- 液体腐植酸配方

- 固体腐植酸产品

- 黄腐酸产品

- 液体黄腐酸溶液

- 固体黄腐酸产品

- 腐植酸和黄腐酸混合产品

- 均衡配方

- 增强型和强化型产品

- 特殊和功能性产品

- 植物生长刺激剂

- 抗压力配方

第六章:市场估计与预测:依来源资料,2021-2034

- 主要趋势

- 风化褐煤和煤衍生

- 风化褐煤矿产资源

- 煤炭开采

- 堆肥有机物

- 堆肥粪肥来源

- 植物基堆肥

- 泥炭和有机土壤来源

- 泥炭沼泽提取

- 有机土壤和腐植质

第七章:市场估计与预测:按应用,2021-2034

- 主要趋势

- 农田作物应用

- 谷物和谷类作物

- 油籽和豆类作物

- 水果和蔬菜生产

- 树果和果园

- 蔬菜和行栽作物

- 特色高价值作物

- 酿酒葡萄和葡萄园

- 咖啡和多年生作物

- 草坪和装饰应用

- 高尔夫球场和运动场草坪

- 住宅和商业景观美化

第八章:市场估计与预测:按地区,2021-2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 亚太其他地区

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

- 中东和非洲其他地区

第九章:公司简介

- Bio Huma Netics, Inc.

- Black Earth Humic LP

- Canadian Humalite International Inc.

- Grow More, Inc.

- Horizon Ag-Products, LLC

- Humatech, Inc.

- Humic Growth Solutions, Inc.

- Humintech GmbH

- Inner Mongolia Yili Humic Acid Ecological Technology Co., Ltd.

- Jiloca Industrial, SA

- Novihum Technologies GmbH

- Omnia Specialities Australia Pty Ltd.

- Shandong Chuangxin Humic Acid Technology Co., Ltd.

- The Andersons, Inc.

The Global Humic and Fulvic Acids Market was valued at USD 1.4 billion in 2024 and is estimated to grow at a CAGR of 10.9% to reach USD 3.8 billion by 2034.

This growth is fueled by a widespread shift in agriculture toward more sustainable soil enhancement methods and reduced dependency on synthetic fertilizers. Humic and fulvic acids play a vital role in improving soil quality, nutrient absorption, and plant productivity, which is increasingly important amid rising environmental concerns. As the emphasis on regenerative farming intensifies, these substances are gaining traction as core components of eco-friendly crop input strategies. Regulatory support, growing interest in bio-based soil additives, and a broader movement toward climate-smart agriculture continue to drive demand. Adoption is further supported by advanced farming techniques integrating humic and fulvic acids into precision application systems. Through methods such as fertigation, foliar feeding, and digital monitoring, users can fine-tune application for maximum crop efficiency. North America remains the largest market, benefiting from a well-established agriculture infrastructure and increased investment in sustainable technologies, giving humic and fulvic acids strong momentum in both conventional and organic farming systems.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.4 billion |

| Forecast Value | $3.8 billion |

| CAGR | 10.9% |

The humic acid products segment held 62% share in 2024 and is expected to grow at a CAGR of 10.7% through 2034. Their widespread use stems from strong results in enhancing soil texture, retaining nutrients, and fostering plant development. Available in liquid, powder, and granular formats, these products support diverse usage across multiple agricultural settings. Fulvic acid products, while still a smaller segment, are witnessing accelerated adoption due to their enhanced nutrient chelation abilities, particularly in fertigation systems and foliar applications. This increased uptake is helping improve plant resilience and nutrient efficiency.

In 2024, the leonardite and coal-derived sources segment reached USD 920.1 million and will grow at a CAGR of 10.7% due to their rich humification levels and consistent quality, making them ideal for extracting concentrated humic substances. Deposits from regions like North America and Europe are widely used in agricultural and environmental applications, with their high carbon content and performance capabilities fueling the expansion of biostimulant-grade and soil amendment products.

North America Humic and Fulvic Acids Market held 38.2% share in 2024. The rise in regenerative farming, organic cultivation, and eco-labeled agricultural inputs continues to elevate demand for natural soil conditioners. With a strong culture around environmentally responsible farming, farmers and agribusinesses are increasingly turning to humic and fulvic acid products to enhance crop yield and soil vitality. The trend is further reinforced by consumer preference for food grown with clean, sustainable inputs.

Key players shaping the competitive landscape of the Global Humic And Fulvic Acids Market include Humatech, Inc., Canadian Humalite International Inc., Shandong Chuangxin Humic Acid Technology Co., Ltd., Humintech GmbH, Grow More, Inc., Horizon Ag-Products, LLC, Omnia Specialities Australia Pty Ltd., The Andersons, Inc., Novihum Technologies GmbH, Inner Mongolia Yili Humic Acid Ecological Technology Co., Ltd., Humic Growth Solutions, Inc., Jiloca Industrial, S.A., Black Earth Humic LP, Bio Huma Netics, Inc., and Humatech, Inc. To secure stronger market positioning, companies in the humic and fulvic acids sector are investing in advanced formulation technologies to enhance product efficacy and ease of use. Many are expanding product lines across granular, liquid, and soluble forms to cater to varied application methods.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 Source material

- 2.2.4 Application

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing focus on soil health and regenerative agriculture

- 3.2.1.2 Environmental sustainability and climate change mitigation

- 3.2.1.3 Organic agriculture growth and consumer demand

- 3.2.1.4 Crop yield enhancement and quality improvement

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Limited consumer and farmer awareness and education

- 3.2.2.2 Higher cost vs traditional fertilizers and amendments

- 3.2.3 Market opportunities

- 3.2.3.1 Emerging market agricultural development and investment

- 3.2.3.2 Precision agriculture and technology integration

- 3.2.3.3 Carbon credit and environmental service markets

- 3.2.3.4 Government incentives and sustainability programs

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter’s analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product type

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code)

( Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021-2034 (USD Million & Tons)

- 5.1 Key trends

- 5.2 Humic acid products

- 5.2.1 Liquid humic acid formulations

- 5.2.2 Solid humic acid products

- 5.3 Fulvic acid products

- 5.3.1 Liquid fulvic acid solutions

- 5.3.2 Solid fulvic acid products

- 5.4 Combined humic and fulvic products

- 5.4.1 Balanced formulations

- 5.4.2 Enhanced and fortified products

- 5.5 Specialty and functional products

- 5.5.1 Plant growth stimulants

- 5.5.2 Stress resistance formulations

Chapter 6 Market Estimates and Forecast, By Source Material, 2021-2034 (USD Million & Tons)

- 6.1 Key trends

- 6.2 Leonardite and coal-derived

- 6.2.1 Leonardite mining sources

- 6.2.2 Coal-based extraction

- 6.3 Composted organic matter

- 6.3.1 Composted manure sources

- 6.3.2 Plant-based compost

- 6.4 Peat and organic soil sources

- 6.4.1 Peat bog extraction

- 6.4.2 Organic soil and muck

Chapter 7 Market Estimates and Forecast, By Application, 2021-2034 (USD Million & Tons)

- 7.1 Key trends

- 7.2 Field crop applications

- 7.2.1 Cereal and grain crops

- 7.2.2 Oilseed and legume crops

- 7.3 Fruit and vegetable production

- 7.3.1 Tree fruit and orchards

- 7.3.2 Vegetable and row crops

- 7.4 Specialty and high-value crops

- 7.4.1 Wine grape and vineyard

- 7.4.2 Coffee and perennial crops

- 7.5 Turf and ornamental applications

- 7.5.1 Golf course and sports turf

- 7.5.2 Residential and commercial landscaping

Chapter 8 Market Estimates and Forecast, By Region, 2021-2034 (USD Million & Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of Middle East and Africa

Chapter 9 Company Profiles

- 9.1 Bio Huma Netics, Inc.

- 9.2 Black Earth Humic LP

- 9.3 Canadian Humalite International Inc.

- 9.4 Grow More, Inc.

- 9.5 Horizon Ag-Products, LLC

- 9.6 Humatech, Inc.

- 9.7 Humic Growth Solutions, Inc.

- 9.8 Humintech GmbH

- 9.9 Inner Mongolia Yili Humic Acid Ecological Technology Co., Ltd.

- 9.10 Jiloca Industrial, S.A.

- 9.11 Novihum Technologies GmbH

- 9.12 Omnia Specialities Australia Pty Ltd.

- 9.13 Shandong Chuangxin Humic Acid Technology Co., Ltd.

- 9.14 The Andersons, Inc.