|

市场调查报告书

商品编码

1844299

企业法学硕士市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Enterprise LLM Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

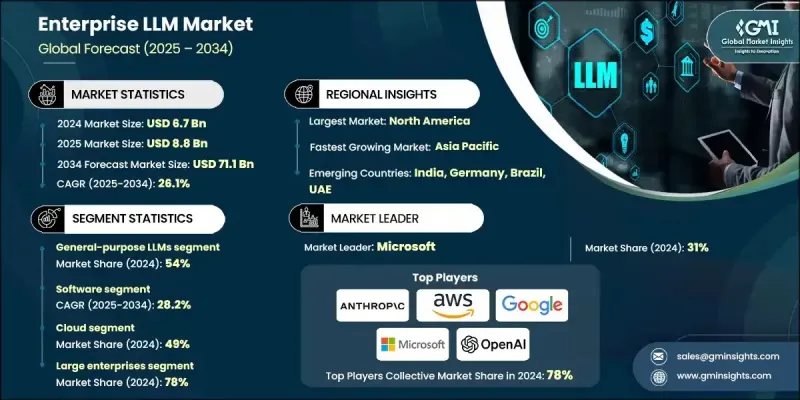

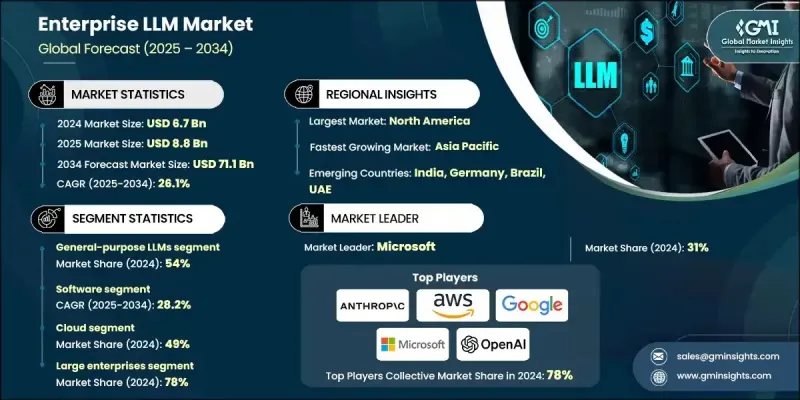

2024 年全球企业法学硕士市场价值为 67 亿美元,预计到 2034 年将以 26.1% 的复合年增长率增长至 711 亿美元。

企业级法学硕士 (LLM) 的采用率上升,主要得益于一系列策略性公共措施和私部门投资的不断增加。政府正努力透过更新监管框架和监督机制,促进人工智慧系统的安全、透明和公正部署,加速其应用。这种清晰的监管规定鼓励 LLM 供应商公平采购,同时增强了人们对企业人工智慧的信任。私部门的成长源自于对效率、成本节约和创新的追求,尤其是在资料密集型工作流程中。企业正在积极部署 LLM,以简化服务交付、提高自动化并大规模管理非结构化资料。行业特定的 LLM 也越来越受到关注,国防、医疗保健和科研等领域的组织正在整合领域训练模型来处理高度专业化的工作负载。这些企业部署正在重塑内部营运、知识管理和决策流程,从而提高回应速度和准确性。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 67亿美元 |

| 预测值 | 711亿美元 |

| 复合年增长率 | 26.1% |

2024年,通用LLM领域占据了54%的市场。企业选择通用模型是因为其适应性强、可扩展性强且客製化需求极低。这些模型可以部署在多个部门,并支援广泛的用例,例如虚拟协助、知识检索和文件处理。微软、Google和OpenAI等以企业为中心的主要供应商正在透过提供强大的基于云端的LLM整合来增强可访问性,从而减少在现有基础架构上实施的阻力。

预计2025年至2034年间,软体领域的复合年增长率将达到28.2%。包括模型API、训练平台、推理工具和分析仪表板在内的软体产品正在实现快速部署和无缝的模型互动。企业更青睐软体驱动的LLM解决方案,因为它们能够提供快速的模型更新、更低的维护要求和灵活的部署选项。 Cohere、Anthropic和Stability AI等供应商正在持续扩展其面向企业级工作流程的软体生态系统,进一步推动各行业的采用。

2024年,美国企业法学硕士市场产值达30亿美元。美国受益于其强大的政策框架,该框架专注于人工智慧基础设施建设、风险规避和创新加速。联邦层级的计划鼓励企业儘早采用和扩展人工智慧计划,推动云端建设、负责任的模型使用和安全的部署实践。国家机构正在製定对抗性机器学习风险指南,并塑造管理和减轻偏见的最佳实践,确保企业法学硕士在各机构和行业中以合乎道德且透明的方式部署。

企业法学硕士 (LLM) 市场的主要参与者包括 Meta、AWS、Mistral AI、OpenAI、AI21 Labs、微软、Stability AI、Cohere、Google和 Anthropic。为了在企业法学硕士 (LLM) 市场站稳脚跟,主要参与者正在大力投资模型微调、垂直行业解决方案以及可扩展的云端原生基础架构。 OpenAI、微软和谷歌等公司专注于实现无缝的企业集成,他们建立安全的 API、提供符合法规要求的部署选项,并与大型组织合作提供客製化实作。 Cohere 和 AI21 Labs 等参与者则透过检索增强生成 (RAG) 框架和低延迟推理引擎来脱颖而出。

目录

第一章:方法论

- 市场范围和定义

- 研究设计

- 研究方法

- 资料收集方法

- 资料探勘来源

- 全球的

- 地区/国家

- 基础估算与计算

- 基准年计算

- 市场评估的主要趋势

- 初步研究和验证

- 主要来源

- 预报

- 研究假设和局限性

第 2 章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 利润率分析

- 成本结构

- 每个阶段的增值

- 影响价值链的因素

- 中断

- 产业衝击力

- 成长动力

- 企业快速采用人工智慧和法学硕士

- 云端优先数位转型策略

- 产业特定人工智慧解决方案的成长

- 增加企业研发和人工智慧投资

- 混合和多云环境的扩展

- 产业陷阱与挑战

- 资料隐私和合规性问题

- AI/ML实施人才短缺

- 市场机会

- 生成式人工智慧在垂直领域的应用日益广泛

- 人工智慧即服务平台的成长

- 成长动力

- 成长潜力分析

- 监管格局

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- Pestel分析

- 技术成熟度评估框架

- 当前的技术趋势

- 新兴技术

- 成本结构分析

- 专利分析

- 永续性和 ESG 影响评估

- 环境影响分析和指标

- 社会影响考量与指标

- 治理与合规框架

- ESG 投资含义与财务影响

- 用例和应用

- 最佳情况

- 企业采用模式

- 早期采用者与主流企业

- 垂直特定采用趋势

- 部署模式偏好(云端、本地、混合)

- 组织准备和人工智慧成熟度

- 投资与融资分析

- 企业法学硕士的创投趋势

- 政府补助和补贴

- 按地区和行业分類的融资趋势

- 定价和授权模式

- 基于订阅的模型

- 基于使用情况和按查询付费的定价

- 企业授权和批量部署折扣

- 不同部署规模的成本效益分析

- 投资报酬率和价值实现指标

- 采用法学硕士 (LLM) 带来的生产力提升

- 节省成本、提高效率

- 收入提升和客户参与度影响

- 根据采用前 KPI基准化分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 多边环境协定

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 战略展望矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划和资金

第五章:市场估计与预测:依模型,2021 - 2034

- 主要趋势

- 通用法学硕士

- 特定领域的法学硕士

- 客製化/专有法学硕士

第六章:市场估计与预测:依组件,2021 - 2034

- 主要趋势

- 软体

- 硬体

- 服务

第七章:市场估计与预测:依部署模式,2021 - 2034

- 主要趋势

- 云

- 本地

- 杂交种

第八章:市场估计与预测:依企业规模,2021 - 2034 年

- 主要趋势

- 小型和中型

- 大型企业

第九章:市场估计与预测:依最终用途,2021 - 2034

- 主要趋势

- 金融服务业协会

- 卫生保健

- 零售与电子商务

- 法律与合规

- 教育

- 其他的

第 10 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 北欧人

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 东南亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 多边环境协定

- 南非

- 沙乌地阿拉伯

- 阿联酋

第 11 章:公司简介

- 全球参与者

- OpenAI

- Anthropic

- Microsoft

- Meta

- AWS

- IBM

- Oracle

- NVIDIA

- Salesforce

- Cohere

- Regional Champions

- Baidu

- Alibaba Cloud

- DeepMind

- Mistral AI

- 新兴参与者/颠覆者

- xAI

- Hugging Face

- Cerebras Systems

- Stability AI

- AI21 Labs

- Inflection AI

- Jasper AI

- Runway

- Adept

- Peltarion

The Global Enterprise LLM Market was valued at USD 6.7 billion in 2024 and is estimated to grow at a CAGR of 26.1% to reach USD 71.1 billion by 2034.

The rise of enterprise-grade LLM adoption is primarily driven by a mix of strategic public initiatives and increasing private sector investment. Government efforts are accelerating adoption by promoting safe, transparent, and unbiased deployment of AI systems through updated regulatory frameworks and oversight mechanisms. This regulatory clarity encourages fair procurement processes for LLM vendors while enhancing trust in enterprise AI. Private sector growth is fueled by a push for efficiency, cost savings, and innovation, particularly in data-intensive workflows. Enterprises are actively deploying LLMs to streamline service delivery, increase automation, and manage unstructured data at scale. Industry-specific LLMs are also gaining traction, with organizations across sectors such as defense, healthcare, and scientific research integrating domain-trained models to handle highly specialized workloads. These enterprise deployments are reshaping internal operations, knowledge management, and decision-making processes with improved responsiveness and accuracy.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $6.7 Billion |

| Forecast Value | $71.1 Billion |

| CAGR | 26.1% |

In 2024, the general-purpose LLMs segment held a 54% share. Businesses are choosing general-purpose models for their adaptability, scalability, and minimal customization requirements. These models can be deployed across multiple departments and support a broad array of use cases such as virtual assistance, knowledge retrieval, and document processing. Major enterprise-focused providers like Microsoft, Google, and OpenAI are enhancing accessibility by offering robust, cloud-based LLM integrations that reduce friction for implementation across existing infrastructure.

The software segment is anticipated to grow at a CAGR of 28.2% between 2025 and 2034. Software offerings, including model APIs, training platforms, inference tools, and analytics dashboards, are enabling rapid deployment and seamless model interaction. Enterprises prefer software-driven LLM solutions due to their ability to deliver fast model updates, lower maintenance requirements, and flexible deployment options. Providers such as Cohere, Anthropic, and Stability AI continue to expand their software ecosystems for enterprise-level workflows, further boosting adoption across sectors.

United States Enterprise LLM Market generated USD 3 billion in 2024. The US landscape benefits from a strong policy framework focused on AI infrastructure, risk mitigation, and innovation acceleration. Federal-level plans encourage early adoption and scale-out of enterprise AI initiatives, promoting cloud build-outs, responsible model usage, and secure deployment practices. National institutions are laying out guidance on adversarial machine learning risks and shaping best practices for managing and mitigating bias, ensuring enterprise LLMs are deployed ethically and transparently across agencies and industries.

Key players in the Enterprise LLM Market include Meta, AWS, Mistral AI, OpenAI, AI21 Labs, Microsoft, Stability AI, Cohere, Google, and Anthropic. To secure their foothold in the enterprise LLM market, major players are heavily investing in model fine-tuning, vertical-specific solutions, and scalable cloud-native infrastructures. Companies like OpenAI, Microsoft, and Google are focusing on seamless enterprise integration by building secure APIs, offering compliance-ready deployment options, and partnering with large organizations for tailored implementations. Players such as Cohere and AI21 Labs are differentiating through retrieval-augmented generation (RAG) frameworks and low-latency inference engines.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Model

- 2.2.3 Component

- 2.2.4 Deployment Mode

- 2.2.5 Enterprise Size

- 2.2.6 End Use

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rapid adoption of AI and LLMs in enterprises

- 3.2.1.2 Cloud-first digital transformation strategies

- 3.2.1.3 Growth in industry-specific AI solutions

- 3.2.1.4 Increasing enterprise R&D and AI investments

- 3.2.1.5 Expansion of hybrid and multi-cloud environments

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Data privacy and compliance concerns

- 3.2.2.2 Talent shortage for AI/ML implementation

- 3.2.3 Market opportunities

- 3.2.3.1 Increasing adoption of generative AI in verticals

- 3.2.3.2 Growth of AI-as-a-Service platforms

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter’s analysis

- 3.6 Pestel analysis

- 3.7 Technology maturity assessment framework

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Cost structure analysis

- 3.9 Patent analysis

- 3.10 Sustainability and ESG impact assessment

- 3.10.1 Environmental impact analysis and metrics

- 3.10.2 Social impact considerations and metrics

- 3.10.3 Governance and compliance framework

- 3.10.4 ESG investment implications and financial impact

- 3.11 Use cases and applications

- 3.12 Best-case scenario

- 3.13 Enterprise Adoption Patterns

- 3.13.1 Early adopters vs. mainstream enterprises

- 3.13.2 Vertical-specific adoption trends

- 3.13.3 Deployment models preference (cloud, on-premises, hybrid)

- 3.13.4 Organizational readiness and AI maturity

- 3.14 Investment and Funding Analysis

- 3.14.1 Venture capital trends in enterprise LLMs

- 3.14.2 Government grants and subsidies

- 3.14.3 Funding trends by region and vertical

- 3.15 Pricing and Licensing Models

- 3.15.1 Subscription-based models

- 3.15.2 Usage-based and pay-per-query pricing

- 3.15.3 Enterprise licensing and bulk deployment discounts

- 3.15.4 Cost-benefit analysis for different deployment scales

- 3.16 ROI and Value Realization Metrics

- 3.16.1 Productivity gains from LLM adoption

- 3.16.2 Cost savings and efficiency improvements

- 3.16.3 Revenue uplift and customer engagement impact

- 3.16.4 Benchmarking against pre-adoption KPIs

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Model, 2021 - 2034 ($Mn)

- 5.1 Key trends

- 5.2 General-purpose LLMs

- 5.3 Domain-specific LLMs

- 5.4 Custom/proprietary LLMs

Chapter 6 Market Estimates & Forecast, By Component, 2021 - 2034 ($Mn)

- 6.1 Key trends

- 6.2 Software

- 6.3 Hardware

- 6.4 Services

Chapter 7 Market Estimates & Forecast, By Deployment Mode, 2021 - 2034 ($Mn)

- 7.1 Key trends

- 7.2 Cloud

- 7.3 On-premises

- 7.4 Hybrid

Chapter 8 Market Estimates & Forecast, By Enterprise Size, 2021 - 2034 ($Mn)

- 8.1 Key trends

- 8.2 Small & medium size

- 8.3 Large enterprises

Chapter 9 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Mn)

- 9.1 Key trends

- 9.2 BFSI

- 9.3 Healthcare

- 9.4 Retail and e-commerce

- 9.5 Legal and compliance

- 9.6 Education

- 9.7 Others

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 US

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Nordics

- 10.3.7 Russia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Southeast Asia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Global Players

- 11.1.1 OpenAI

- 11.1.2 Anthropic

- 11.1.3 Microsoft

- 11.1.4 Google

- 11.1.5 Meta

- 11.1.6 AWS

- 11.1.7 IBM

- 11.1.8 Oracle

- 11.1.9 NVIDIA

- 11.1.10 Salesforce

- 11.1.11 Cohere

- 11.2 Regional Champions

- 11.2.1 Baidu

- 11.2.2 Alibaba Cloud

- 11.2.3 DeepMind

- 11.2.4 Mistral AI

- 11.3 Emerging Players / Disruptors

- 11.3.1 xAI

- 11.3.2 Hugging Face

- 11.3.3 Cerebras Systems

- 11.3.4 Stability AI

- 11.3.5 AI21 Labs

- 11.3.6 Inflection AI

- 11.3.7 Jasper AI

- 11.3.8 Runway

- 11.3.9 Adept

- 11.3.10 Peltarion