|

市场调查报告书

商品编码

1844300

越野车煞车系统市场机会、成长动力、产业趋势分析及2025-2034年预测Off-road Vehicle Braking System Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

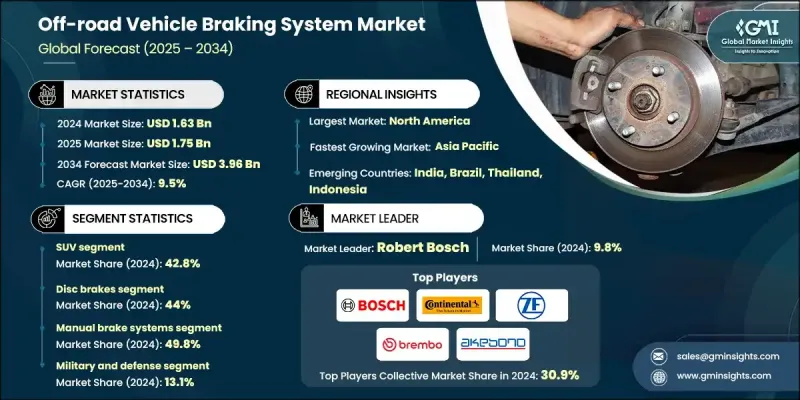

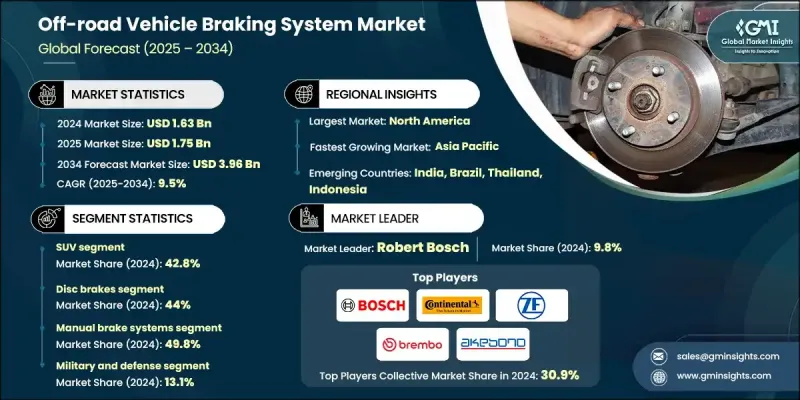

2024 年全球越野车煞车系统市场价值为 16.3 亿美元,预计到 2034 年将以 9.5% 的复合年增长率成长至 39.6 亿美元。

由于越野车会遇到各种地形,包括陡坡、鬆散的岩石、沙地和泥地,因此对越野车高性能煞车系统的需求持续成长。与传统煞车系统不同,越野煞车机制必须对不同的路面状况做出自适应反应,同时保持牵引力和控制。驾驶员依靠煞车系统进行精确调节,尤其是在崎岖地形或承载重物时。由于越野车经常搭载额外的设备或乘客,其煞车系统必须处理重量分布变化,同时有效散热和调节油液温度。这些系统还必须防止煞车衰退,确保在极端条件和长时间运行下的可靠性。煞车技术的进步继续致力于提高稳定性、控制力和响应能力,使车辆即使在满载或在恶劣、不可预测的环境中行驶时也能保持最佳制动力。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 16.3亿美元 |

| 预测值 | 39.6亿美元 |

| 复合年增长率 | 9.5% |

SUV细分市场在2024年占据42.8%的市场份额,预计到2034年将以10.3%的复合年增长率成长。如今,SUV越来越多地配备了能够适应路面变化的煞车系统,从而增强了在崎岖地形上的牵引力和车辆控制。这些技术通常与电子稳定和牵引力控制系统配合使用,以在各种驾驶条件下支援安全性和越野操控性。

2024年,碟式煞车市场占44%的市场份额,预计2025年至2034年的复合年增长率将达到9.9%。碟式煞车,尤其是碳-碳复合材料製成的碟式煞车,因其能够承受极端温度并减轻车辆总重量而日益受到欢迎。其卓越的强度重量比和耐热性使其成为性能和耐用性至关重要的越野应用的理想选择。

2025年至2034年间,美国越野车煞车系统市场将以10.1%的复合年增长率成长。广泛的越野车道、专用公园、经销商和服务基础设施网路正在推动国内需求。电动越野车的兴起也提升了市场潜力。製造商正在推出电动越野车,这些车型在不影响车辆坚固耐用性能的情况下,能够提供更大的扭力、更安静的性能和更低的排放。美国消费者越来越青睐配备GPS、远端资讯处理、车载电脑和电子辅助转向等先进功能的越野车,这进一步提升了对精密煞车系统的需求。

主导越野车煞车系统市场的关键参与者包括采埃孚、克诺尔、万都、爱德克斯、罗伯特·博世、大陆、布雷博、曙光煞车工业和日信工业。为了巩固其地位,越野车煞车系统领域的公司正专注于创新和策略合作。许多公司正在投资轻质、高性能煞车材料,以提高耐热性和耐用性,特别是对于电动和混合动力越野平台。製造商也将电子煞车解决方案与先进的驾驶辅助技术相结合,以增强安全性和控制力。扩大与原始设备製造商的合作伙伴关係并根据特定地形需求客製化煞车系统,有助于公司提供更专业、更有价值的解决方案。同时,扩大製造能力和利用车辆远端资讯处理资料有助于製造商提供预测性维护和性能优化,从而确保长期客户忠诚度。

目录

第一章:方法论

- 市场范围和定义

- 研究设计

- 研究方法

- 资料收集方法

- 资料探勘来源

- 全球的

- 地区/国家

- 基础估算与计算

- 基准年计算

- 市场评估的主要趋势

- 初步研究和验证

- 主要来源

- 预报

- 研究假设和局限性

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 利润率分析

- 成本结构

- 每个阶段的增值

- 影响价值链的因素

- 中断

- 产业衝击力

- 成长动力

- 电气化和再生製动

- 安全法规和标准

- 恶劣的环境暴露

- 车辆载重和重量

- 地形多变

- 产业陷阱与挑战

- 开发和维护成本高

- 对新兴市场的认知有限

- 市场机会

- 电动越野车的成长

- 高级安全集成

- 农业和国防部门的需求

- 智慧型互联煞车系统

- 成长动力

- 成长潜力分析

- 监管格局

- 波特的分析

- PESTEL分析

- 技术与创新格局

- 当前的技术趋势

- 新兴技术

- 成本分解分析

- 专利分析

- 价格趋势

- 按地区

- 搭车

- 生产统计

- 生产中心

- 消费中心

- 汇出和汇入

- 成本结构与经济分析

- 製造成本明细(材料、人工、间接费用)

- 研发投资需求及摊销

- 规模经济分析

- 总拥有成本 (TCO) 模型

- 需求价格弹性分析

- 进出口贸易分析

- 全球贸易流程图(HS编码分析)

- 主要进出口国家

- 各地区贸易平衡分析

- 关税结构和贸易壁垒的影响

- 供应链脆弱性评估

- 永续性和环境方面

- 永续实践

- 减少废弃物的策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考虑

第四章:竞争格局

- 介绍

- 公司市占率分析

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 多边环境协定

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 战略展望矩阵

- 重要新闻和倡议

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划和资金

第五章:市场估计与预测:依车型,2021 - 2034

- 主要趋势

- SUV

- UTV

- 沙滩车

- 雪地摩托车

- 越野摩托车

第六章:市场估计与预测:按制动,2021 - 2034 年

- 主要趋势

- 碟式煞车

- 鼓式煞车

- 液压煞车

- 气动煞车

- 机电煞车

第七章:市场估计与预测:按煞车系统运营,2021 - 2034 年

- 主要趋势

- 手动煞车系统

- 自动煞车系统

- 防锁死煞车系统(ABS)

- 电子稳定控制系统(ESC)

- 牵引力控制系统(TCS)

第 8 章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 休閒娱乐

- 商业的

- 农业

- 军事和国防

- 采矿和开采

第九章:市场估计与预测:按地区,2021 - 2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 北欧人

- 荷兰

- 俄罗斯

- 亚太地区

- 澳洲

- 中国

- 印度

- 印尼

- 日本

- 新加坡

- 韩国

- 泰国

- 越南

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 多边环境协定

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十章:公司简介

- 全球顶尖玩家

- 布雷博

- 采埃孚

- 大陆航空

- 罗伯特·博世

- 曙光煞车工业

- 爱信

- 天纳克

- 万都

- 日清工业

- 区域参与者

- 毛虫

- 小松

- 克诺尔煞车系统公司

- 瀚德

- 日立阿斯泰莫

- 技术专家

- 爱德克斯

- 海耶斯绩效系统

- 威尔伍德工程公司

- 新兴企业和颠覆者

- 雅马哈

- Rivian 汽车

- OEM整合合作伙伴

- 约翰迪尔

- 沃尔沃建筑设备

- 利勃海尔

- 凯斯纽荷兰工业集团

The Global Off-road Vehicle Braking System Market was valued at USD 1.63 billion in 2024 and is estimated to grow at a CAGR of 9.5% to reach USD 3.96 billion by 2034.

The demand for high-performance braking systems in off-road vehicles continues to grow due to the diverse terrains these vehicles encounter, including steep inclines, loose rocks, sand, and mud. Unlike conventional braking systems, off-road braking mechanisms must deliver adaptive responsiveness to varying surface conditions while maintaining traction and control. Drivers depend on braking systems to offer precise modulation, particularly when navigating rugged terrain or managing heavy payloads. As off-road vehicles frequently carry added equipment or passengers, their braking systems must handle weight distribution shifts while effectively dissipating heat and regulating fluid temperature. These systems must also resist brake fade, ensuring reliability under extreme conditions and during prolonged operation. Advancements in braking technology continue to focus on improving stability, control, and responsiveness, making it possible to maintain optimal stopping power even when vehicles are fully loaded or maneuvering through harsh, unpredictable environments.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.63 Billion |

| Forecast Value | $3.96 Billion |

| CAGR | 9.5% |

The SUV segment held 42.8% in 2024 and is forecasted to grow at a CAGR of 10.3% through 2034. SUVs today are increasingly equipped with braking systems that adapt to changing surfaces, enhancing traction and vehicle control across uneven terrains. These technologies are often paired with electronic stability and traction control systems to support safety and off-road maneuverability in a wide range of driving conditions.

In 2024, the disc brake segment held a 44% share and will grow at a CAGR of 9.9% from 2025 to 2034. Disc brakes, particularly those constructed from carbon-carbon composites, are gaining popularity due to their ability to withstand extreme temperatures while reducing overall vehicle weight. Their superior strength-to-weight ratio and heat resistance make them ideal for off-road applications where both performance and durability are critical.

U.S. Off-road Vehicle Braking System Market will grow at a CAGR of 10.1% between 2025 and 2034. An extensive network of off-road trails, dedicated parks, dealerships, and service infrastructure is driving domestic demand. The rise of electric off-road vehicles is also boosting market potential. Manufacturers are rolling out electric variants that deliver greater torque, quieter performance, and lower emissions all without compromising the vehicle's rugged capabilities. U.S. consumers are increasingly favoring off-road vehicles equipped with advanced features like GPS, telematics, onboard computers, and electronic power steering, further elevating the demand for precision-engineered braking systems.

Key players dominating the Off-road Vehicle Braking System Market include ZF Friedrichshafen, Knorr-Bremse, Mando, Advics, Robert Bosch, Continental, Brembo, Akebono Brake Industry, and Nissin Kogyo. To strengthen their position, companies in the off-road vehicle braking system sector are focusing on innovation and strategic collaboration. Many are investing in lightweight, high-performance brake materials that enhance thermal resistance and durability, particularly for electric and hybrid off-road platforms. Manufacturers are also integrating electronic braking solutions with advanced driver-assist technologies to enhance safety and control. Expanding partnerships with OEMs and customizing braking systems for terrain-specific needs are helping companies offer more specialized, value-driven solutions. In parallel, expanding manufacturing capabilities and leveraging data from vehicle telematics are helping manufacturers provide predictive maintenance and performance optimization, securing long-term customer loyalty.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Vehicle

- 2.2.3 Brake

- 2.2.4 Brake system operations

- 2.2.5 Application

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook

- 2.6 Strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Electrification & regenerative braking

- 3.2.1.2 Safety regulations & standards

- 3.2.1.3 Harsh environmental exposure

- 3.2.1.4 Vehicle load & weight

- 3.2.1.5 Terrain variability

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High development & maintenance costs

- 3.2.2.2 Limited awareness in emerging markets

- 3.2.3 Market opportunities

- 3.2.3.1 Growth of electric off-road vehicles

- 3.2.3.2 Advanced safety integration

- 3.2.3.3 Demand in agriculture & defense sectors

- 3.2.3.4 Smart & connected braking systems

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Porter’s analysis

- 3.6 PESTEL analysis

- 3.7 Technology & innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Cost breakdown analysis

- 3.9 Patent analysis

- 3.10 Price trends

- 3.10.1 By region

- 3.10.2 By Vehicle

- 3.11 Production statistics

- 3.11.1 Production hubs

- 3.11.2 Consumption hubs

- 3.11.3 Export and import

- 3.12 Cost Structure & Economics Analysis

- 3.12.1 Manufacturing Cost Breakdown (Materials, Labor, Overhead)

- 3.12.2 R&D Investment Requirements & Amortization

- 3.12.3 Economies of Scale Analysis

- 3.12.4 Total Cost of Ownership (TCO) Models

- 3.12.5 Price Elasticity of Demand Analysis

- 3.13 Import-Export Trade Analysis

- 3.13.1 Global Trade Flow Mapping (HS Code Analysis)

- 3.13.2 Top Importing & Exporting Countries

- 3.13.3 Trade Balance Analysis by Region

- 3.13.4 Tariff Structure & Trade Barriers Impact

- 3.13.5 Supply Chain Vulnerability Assessment

- 3.14 Sustainability and environmental aspects

- 3.14.1 Sustainable practices

- 3.14.2 Waste reduction strategies

- 3.14.3 Energy efficiency in production

- 3.14.4 Eco-friendly initiatives

- 3.14.5 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key news and initiatives

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Mn, Units)

- 5.1 Key trends

- 5.1.1 SUV

- 5.1.2 UTV

- 5.1.3 ATV

- 5.1.4 Snowmobile

- 5.1.5 Off-road Motorcycle

Chapter 6 Market Estimates & Forecast, By Brake, 2021 - 2034 ($Mn, Units)

- 6.1 Key trends

- 6.2 Disc Brakes

- 6.3 Drum Brakes

- 6.4 Hydraulic Brakes

- 6.5 Pneumatic Brakes

- 6.6 Electromechanical Brakes

Chapter 7 Market Estimates & Forecast, By Brake System Operations, 2021 - 2034 ($Mn, Units)

- 7.1 Key trends

- 7.1.1 Manual Brake Systems

- 7.1.2 Automatic Brake Systems

- 7.1.3 Anti-lock Braking Systems (ABS)

- 7.1.4 Electronic Stability Control (ESC)

- 7.1.5 Traction Control Systems (TCS)

Chapter 8 Market Estimates & Forecast, By Application, 2021 - 2034 ($Mn, Units)

- 8.1 Key trends

- 8.2 Recreational

- 8.3 Commercial

- 8.4 Agricultural

- 8.5 Military and Defense

- 8.6 Mining and Extraction

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn, Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 US

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Nordics

- 9.3.7 Netherlands

- 9.3.8 Russia

- 9.4 Asia Pacific

- 9.4.1 Australia

- 9.4.2 China

- 9.4.3 India

- 9.4.4 Indonesia

- 9.4.5 Japan

- 9.4.6 Singapore

- 9.4.7 South Korea

- 9.4.8 Thailand

- 9.4.9 Vietnam

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1.1.1 Top Global Players

- 10.1.1.1.1 Brembo

- 10.1.1.1.2 ZF Friedrichshafen

- 10.1.1.1.3 Continental

- 10.1.1.1.4 Robert Bosch

- 10.1.1.1.5 Akebono Brake Industry

- 10.1.1.1.6 AISIN

- 10.1.1.1.7 Tenneco

- 10.1.1.1.8 Mando

- 10.1.1.1.9 Nissin Kogyo

- 10.1.1.2 Regional Players

- 10.1.1.2.1 Caterpillar

- 10.1.1.2.2 Komatsu

- 10.1.1.2.3 KNORR-BREMSE

- 10.1.1.2.4 Haldex

- 10.1.1.2.5 Hitachi Astemo

- 10.1.1.2.6 Technology Specialists

- 10.1.1.2.7 ADVICS

- 10.1.1.2.8 Hayes Performance Systems

- 10.1.1.2.9 Wilwood Engineering

- 10.1.1.3 Emerging Players & Disruptors

- 10.1.1.3.1 Yamaha

- 10.1.1.3.2 Rivian Automotive

- 10.1.1.3.3 OEM Integration Partners

- 10.1.1.3.4 John Deere

- 10.1.1.3.5 Volvo Construction Equipment

- 10.1.1.3.6 Liebherr

- 10.1.1.3.7 CNH Industrial