|

市场调查报告书

商品编码

1844309

智慧门铃市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Smart Doorbell Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

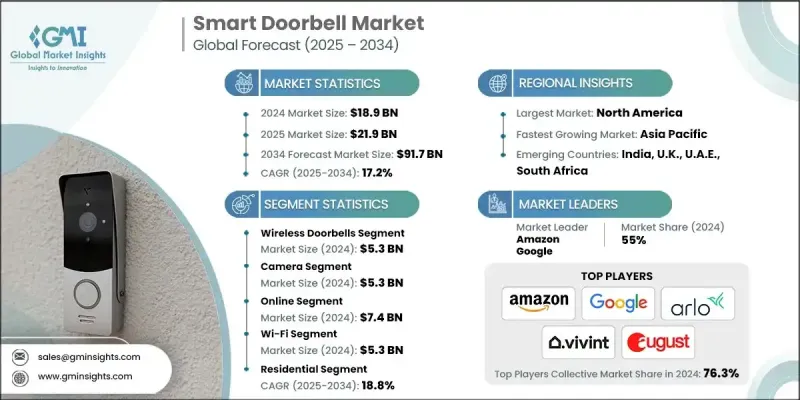

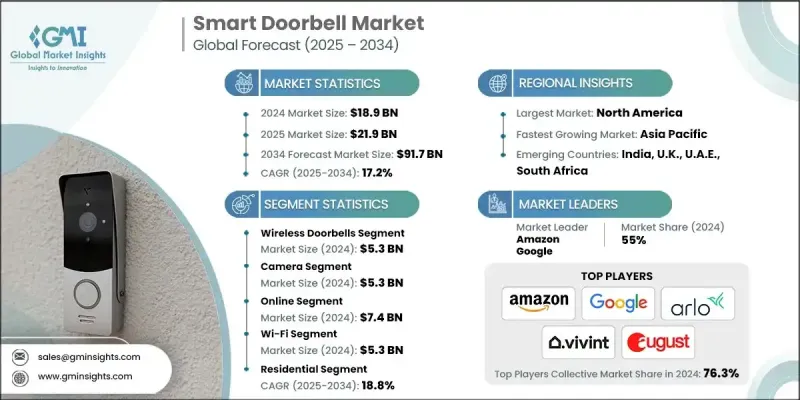

2024 年全球智慧门铃市场价值为 189 亿美元,预计到 2034 年将以 17.2% 的复合年增长率增长至 917 亿美元。

这一增长源于消费者对家居安全和防盗日益增长的担忧。许多家庭,尤其是在城市和郊区,开始使用智慧门铃,不仅是为了监控入口,也是为了获得内心的平静。这些设备可以对入侵者起到明显的威慑作用,加强人身安全和财产保护。随着智慧家庭生态系统的发展,跨平台整合变得至关重要。消费者现在期望他们的智慧门铃能够与灯光、锁和警报器等连网设备无缝协作。快速的城市化,尤其是在多单元住宅开发项目中,进一步推动了智慧门铃的普及,因为物业经理正在寻求可扩展的解决方案来处理访客进出和物品的配送。虽然人工智慧运动侦测和脸部辨识等功能很受欢迎,但基本款视觉门铃在价格敏感的地区仍然很受欢迎,这促使製造商提供多样化的产品线和价格点,以同时满足高端和价值驱动型细分市场的需求。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 189亿美元 |

| 预测值 | 917亿美元 |

| 复合年增长率 | 17.2% |

2024年,无线智慧门铃市场规模达53亿美元。其用户友好的设计和便捷的安装流程,使其对房主和租户都极具吸引力。无需重新布线或专业人员协助即可安装这些系统,这使其得到了广泛的应用,尤其是在房屋改造领域。无线型号相容于现有的Wi-Fi网络,通常可以与智慧型手机快速配对,这进一步推动了其在成熟经济体和新兴经济体的普及。随着包裹窃盗、访客验证和门禁监控意识的不断增强,消费者对无线型号的偏好持续增强,尤其是在人口密集的城市环境中,灵活性和安装速度至关重要。

2024年,摄影机组件市场规模达53亿美元。从高清到2K甚至4K分辨率,影像品质的提升提升了使用者的期望。夜视功能、广角视野、HDR清晰度以及盲点减少等功能正在影响使用者的购买决策。随着消费者越来越依赖透过行动应用程式进行远端监控,高效能摄影机已成为智慧门铃价值主张的核心。视觉验证在家庭安全中的作用日益增强,进一步巩固了摄影机作为智慧门铃系统最关键组成部分的地位。

2024年,北美智慧门铃市场占28.2%的市场份额,复合年增长率高达17.5%。该地区受益于智慧家居技术的早期应用以及消费者对连网设备的高度认可。随着消费者对窃盗的担忧日益加剧,家门口的安全成为首要考虑因素,相容平台的普及和强大的电商基础设施推动了市场成长。高可支配收入和对物联网技术的认知度进一步支持了该地区市场的扩张,使北美成为全球智慧门铃应用表现最佳的地区之一。

影响全球智慧门铃产业的关键参与者包括 Eufy Security(Anker Innovations)、Vivint Smart Home, Inc.、松下公司、SkyBell Technologies, Inc.、罗技(Logi Circle)、Robin Telecom Development、Netatmo(Legrand 旗下)、Honeywell 国际公司、August Home(ASSA ABLOY. Inc.、Ecobee、Zmodo、VTech Communications, Inc.、Arlo Technologies, Inc.、Google(Nest)、dbell Inc.、博世安防系统、Owlet Home LLC 和亚马逊(Ring)。智慧门铃产业的领先公司正专注于生态系统整合,确保与主要智慧家庭平台的无缝相容性。许多公司正在投资先进的人工智慧功能,包括脸部辨识和行为分析,使其产品脱颖而出。其他公司则透过经济实惠的型号扩展到新兴市场,这些型号在保持核心功能的同时降低了成本。我们正在与电子商务平台、电信供应商和家庭安全服务建立策略合作伙伴关係,以扩大覆盖范围和分销范围。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商概况

- 利润率

- 成本结构

- 每个阶段的增值

- 影响价值链的因素

- 中断

- 产业衝击力

- 成长动力

- 无线和电池供电的智慧门铃迅速普及

- 与语音助理和智慧家居生态系统(Alexa、Google、Apple HomeKit、Matter)集成

- 电子商务成长与送货上门安全需求

- 城市安全问题与防盗

- 智慧城市专案和多住户单位的物业管理应用

- 产业陷阱与挑战

- 隐私和监管障碍

- 连线限制

- 市场机会

- 采用 Matter 和 Thread 标准

- 人工智慧驱动的边缘分析

- 扩展到多住宅单元和商业设施

- 与更广泛的智慧安全解决方案捆绑

- 成长动力

- 成长潜力分析

- 监管格局

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL分析

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 按产品

- 定价策略

- 新兴商业模式

- 合规性要求

- 永续性措施

- 消费者情绪分析

- 专利和智慧财产权分析

- 地缘政治与贸易动态

第四章:竞争格局

- 公司简介 市占率分析

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 多边环境协定

- 市场集中度分析

- 关键参与者的竞争基准化分析

- 财务绩效比较

- 收入

- 利润率

- 研发

- 产品组合比较

- 产品范围广度

- 科技

- 创新

- 地理分布比较

- 全球足迹分析

- 服务网路覆盖

- 各地区市场渗透率

- 竞争定位矩阵

- 领导者

- 挑战者

- 追踪者

- 利基市场参与者

- 战略展望矩阵

- 财务绩效比较

- 2021-2024 年关键发展

- 併购

- 伙伴关係与合作

- 技术进步

- 扩张和投资策略

- 永续发展倡议

- 数位转型计划

- 新兴/新创企业竞争对手格局

第五章:市场估计与预测:依产品类型,2021 - 2034 年

- 有线智慧门铃

- 无线门铃

- 混合门铃

- 太阳能门铃

- 其他的

第六章:市场估计与预测:按配销通路,2021-2034 年

- 在线的

- 离线

第七章:市场估计与预测:按组件,2021 - 2034

- 相机

- 运动感应器

- 麦克风和扬声器

- 钟声/铃声模组

- 其他的

第八章:市场估计与预测:按连结性,2021 - 2034 年

- 无线上网

- 线索/事项

- Zigbee

- 蜂巢

- 其他的

第九章:市场估计与预测:依最终用途,2021 - 2034

- 住宅

- 商业的

- 多住户单元(MDU)

- 工业的

- 公共/政府设施

- 其他的

第 10 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 荷兰

- 鱼子

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 亚太区

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 罗拉塔姆

- 中东和非洲

- 阿联酋

- 沙乌地阿拉伯

- 南非

- 罗马

第 11 章:公司简介

- Amazon (Ring)

- Arlo Technologies, Inc.

- August Home

- Bosch Security Systems

- dbell Inc.

- Ecobee

- Eufy Security

- Google (Nest)

- Honeywell International Inc.

- Logitech

- Netatmo

- Owlet Home LLC

- Panasonic Corporation

- Remo+ (Olive & Dove)

- Reolink

- Robin Telecom Development

- SkyBell Technologies, Inc.

- VTech Communications, Inc.

- Vivint Smart Home, Inc.

- Wyze Labs, Inc.

- Zmodo

- Zumimall

The Global Smart Doorbell Market was valued at USD 18.9 billion in 2024 and is estimated to grow at a CAGR of 17.2% to reach USD 91.7 billion by 2034.

This growth is fueled by increasing consumer concerns around home security and theft prevention. Many households, especially in urban and suburban regions, are turning to smart doorbells not only for monitoring entry points but also for gaining peace of mind. These devices serve as visible deterrents to intruders, reinforcing both personal safety and property protection. As smart home ecosystems evolve, integration across platforms becomes essential. Consumers now expect their smart doorbells to function effortlessly with connected devices like lights, locks, and alarms. Rapid urbanization, particularly in multi-unit residential developments, is further boosting adoption as property managers seek scalable solutions to handle visitor access and deliveries. While features like AI motion detection and facial recognition are in demand, basic video doorbells remain popular in price-sensitive regions, prompting manufacturers to diversify product tiers and price points to cater to both premium and value-driven segments.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $18.9 Billion |

| Forecast Value | $91.7 Billion |

| CAGR | 17.2% |

In 2024, the wireless smart doorbells segment generated USD 5.3 billion. Their user-friendly design and easy installation process make them appealing to both homeowners and renters. The ability to set up these systems without rewiring or professional help contributes to their widespread use, especially in retrofit applications. Wireless models are compatible with existing Wi-Fi networks and typically offer quick pairing with smartphones, further boosting adoption in both established and emerging economies. Growing awareness about package theft, visitor verification, and front-door surveillance continues to drive consumer preference toward wireless models, particularly in dense urban settings where flexibility and speed of installation are essential.

The camera component segment reached USD 5.3 billion in 2024. Advancements in image quality, from HD to 2K and even 4K resolution, have raised user expectations. Features such as improved night vision, wide-angle views, HDR clarity, and reduced blind spots are shaping purchase decisions. As consumers increasingly rely on remote monitoring through mobile apps, high-performance cameras have become central to the value proposition of smart doorbells. The growing role of visual verification in home security continues to cement the camera as the most crucial part of smart doorbell systems.

North America Smart Doorbell Market held 28.2% share in 2024, growing at a robust CAGR of 17.5%. This region benefits from early adoption of smart home technologies and a high level of consumer readiness for connected devices. The availability of compatible platforms and strong e-commerce infrastructure fuels growth as consumers prioritize doorstep security amid rising concerns over theft. High disposable income and awareness of IoT technologies further support market expansion in this region, making North America one of the top-performing regions globally for smart doorbell adoption.

Key players shaping the Global Smart Doorbell Industry include Eufy Security (Anker Innovations), Vivint Smart Home, Inc., Panasonic Corporation, SkyBell Technologies, Inc., Logitech (Logi Circle), Robin Telecom Development, Netatmo (part of Legrand), Honeywell International Inc., August Home (part of ASSA ABLOY), Reolink, Remo+ (Olive & Dove), Zumimall, Wyze Labs, Inc., Ecobee, Zmodo, VTech Communications, Inc., Arlo Technologies, Inc., Google (Nest), dbell Inc., Bosch Security Systems, Owlet Home LLC, and Amazon (Ring). Leading companies in the smart doorbell industry are focusing on ecosystem integration by ensuring seamless compatibility with major smart home platforms. Many are investing in advanced AI capabilities, including facial recognition and behavioral analytics, to differentiate their offerings. Others are expanding into emerging markets with budget-friendly models that maintain core functionality while reducing costs. Strategic partnerships with e-commerce platforms, telecom providers, and home security services are being formed to expand reach and distribution.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1. Material Type

- 2.2.2 Product Type

- 2.2.3 Form

- 2.2.4 End use Industry

- 2.2.5 Region

- 2.3 TAM Analysis, 2025-2034 (USD Million)

- 2.4 CXO perspectives: Strategic imperatives

- 2.5 Executive decision points

- 2.6 Critical Success Factors

- 2.7 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rapid adoption of wireless and battery-powered smart doorbells

- 3.2.1.2 Integration with voice assistants and smart home ecosystems (Alexa, Google, Apple HomeKit, Matter)

- 3.2.1.3 E-commerce growth and doorstep delivery security needs

- 3.2.1.4 Urban safety concerns and burglary prevention

- 3.2.1.5 Smart city projects and property management adoption in MDUs

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Privacy and regulatory barriers

- 3.2.2.2 Connectivity limitations

- 3.2.3 Market Opportunities

- 3.2.3.1 Adoption of Matter and Thread standards

- 3.2.3.2 AI-powered edge analytics

- 3.2.3.3 Expansion into Multi-Dwelling Units and commercial facilities

- 3.2.3.4 Bundling with broader smart security solutions

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter’s analysis

- 3.6 PESTEL analysis

- 3.7 Technological and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price Trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Pricing strategies

- 3.10 Emerging business models

- 3.11 Compliance requirements

- 3.12 Sustainability measures

- 3.13 Consumer sentiment analysis

- 3.14 Patent and IP analysis

- 3.15 Geopolitical and trade dynamics

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction Company market share analysis

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1. North America

- 4.2.2. Europe

- 4.2.3. Asia Pacific

- 4.2.4. Latin America

- 4.2.5. MEA

- 4.2.2 Market concentration analysis

- 4.3 Competitive Benchmarking of key Players

- 4.3.1 Financial Performance Comparison

- 4.3.1.1. Revenue

- 4.3.1.2. Profit Margin

- 4.3.1.3. R&D

- 4.3.2 Product Portfolio Comparison

- 4.3.2.1. Product Range Breadth

- 4.3.2.2. Technology

- 4.3.2.3. Innovation

- 4.3.3 Geographic Presence Comparison

- 4.3.3.1. Global Footprint Analysis

- 4.3.3.2. Service Network Coverage

- 4.3.3.3. Market Penetration by Region

- 4.3.4 Competitive Positioning Matrix

- 4.3.4.1. Leaders

- 4.3.4.2. Challengers

- 4.3.4.3. Followers

- 4.3.4.4. Niche Players

- 4.3.5 Strategic outlook matrix

- 4.3.1 Financial Performance Comparison

- 4.4 Key developments, 2021-2024

- 4.4.1 Mergers and Acquisitions

- 4.4.2 Partnerships and Collaborations

- 4.4.3 Technological Advancements

- 4.4.4 Expansion and Investment Strategies

- 4.4.5 Sustainability Initiatives

- 4.4.6 Digital Transformation Initiatives

- 4.5 Emerging/ Startup Competitors Landscape

Chapter 5 Market Estimates & Forecast, By Product Type, 2021 - 2034

- 5.1 Wired Smart Doorbells

- 5.2 Wireless Doorbells

- 5.3 Hybrid Doorbells

- 5.4 Solar-Powered Doorbells

- 5.5 Others

Chapter 6 Market estimates & forecast, By Distribution Channel, 2021 - 2034

- 6.1 Online

- 6.2 Offline

Chapter 7 Market estimates & forecast, By Component, 2021 - 2034

- 7.1 Camera

- 7.2 Motion Sensor

- 7.3 Microphone & Speaker

- 7.4 Chime / Bell Module

- 7.5 Others

Chapter 8 Market estimates & forecast, By Connectivity, 2021 - 2034

- 8.1 Wi-Fi

- 8.2 Thread / Matter

- 8.3 Zigbee

- 8.4 Cellular

- 8.5 Others

Chapter 9 Market estimates & forecast, By End use, 2021 - 2034

- 8.6 Residential

- 8.7 Commercial

- 8.8 Multi-Dwelling Units (MDUs)

- 8.9 Industrial

- 8.10 Public / Government Facilities

- 8.11 Others

Chapter 10 Market Estimates and Forecast, By Region, 2021 - 2034

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 U.K.

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Netherlands

- 10.3.7 ROE

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.4.6 RoAPAC

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.5.4 RoLATAM

- 10.6 Middle East & Africa

- 10.6.1 UAE

- 10.6.2 Saudi Arabia

- 10.6.3 South Africa

- 10.6.4 RoMEA

Chapter 11 Company Profile

- 11.1 Amazon (Ring)

- 11.2 Arlo Technologies, Inc.

- 11.3 August Home

- 11.4 Bosch Security Systems

- 11.5 dbell Inc.

- 11.6 Ecobee

- 11.7 Eufy Security

- 11.8 Google (Nest)

- 11.9 Honeywell International Inc.

- 11.10 Logitech

- 11.11 Netatmo

- 11.12 Owlet Home LLC

- 11.13 Panasonic Corporation

- 11.14 Remo+ (Olive & Dove)

- 11.15 Reolink

- 11.16 Robin Telecom Development

- 11.17 SkyBell Technologies, Inc.

- 11.18 VTech Communications, Inc.

- 11.19 Vivint Smart Home, Inc.

- 11.20 Wyze Labs, Inc.

- 11.21 Zmodo

- 11.22 Zumimall