|

市场调查报告书

商品编码

1844315

文件扫描器市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Document Scanner Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

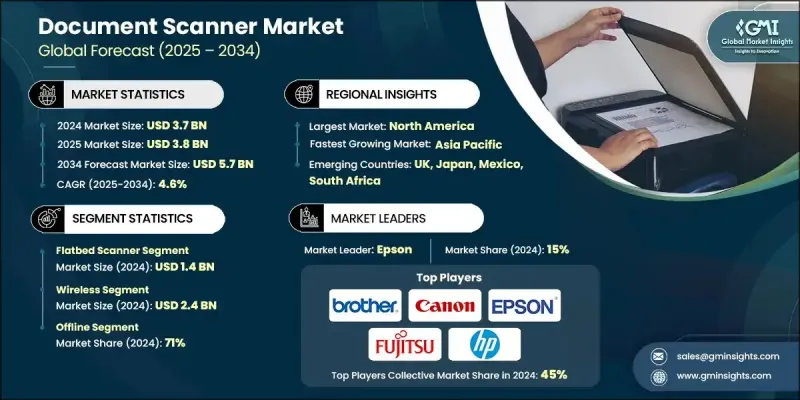

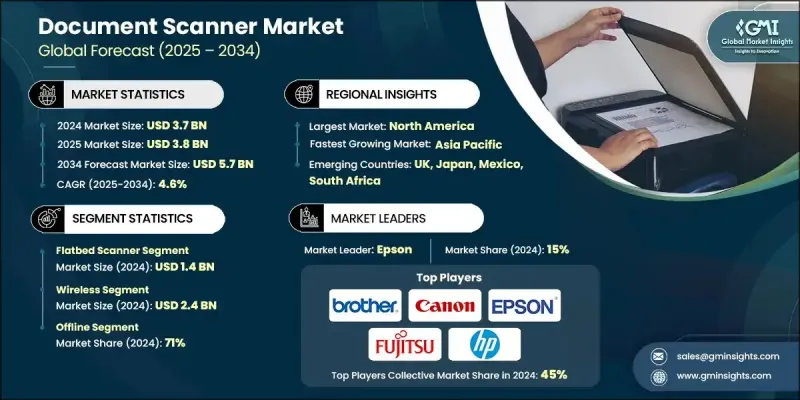

2024 年全球文件扫描器市值为 37 亿美元,预计到 2034 年将以 4.6% 的复合年增长率成长至 57 亿美元。

政府、银行、医疗保健和教育等产业持续向数位转型是推动这一成长的主要动力。随着企业向数位化工作流程转型,文件扫描器在将纸本记录转换为安全、可搜寻且易于存取的格式方面发挥关键作用。企业内容管理平台的日益普及和更严格的资料保护法规进一步加速了这一进程。此外,远端和混合工作模式的激增也增加了对具有灵活性、快速存取和远端协作功能的扫描器的需求。整合云端功能和DMS相容性的设备使用户能够在任何位置储存、共享和管理文件,从而显着提高团队生产力。随着企业持续投资智慧数位基础设施,预计未来几年对高速、可靠且用户友好的扫描解决方案的需求将会成长。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 37亿美元 |

| 预测值 | 57亿美元 |

| 复合年增长率 | 4.6% |

平板扫描器市场在2024年创造了14亿美元的收入,成为该领域最大的贡献者。这类扫描器具有卓越的灵活性,使用户能够扫描各种类型的文件,无论是易碎文件、厚书或照片,且不会造成损坏。它们能够处理各种尺寸和材质的文檔,在法律、教育和檔案服务领域尤其重要。

2024年,无线扫描器市场规模达24亿美元,这得益于市场对无缝连接和高效工作流程日益增长的需求。无线功能支援即时扫描至云端平台或行动设备,方便使用者即时将文件传输至电子邮件或云端储存等服务。此功能无需有线设定或依赖桌面设备,从而提升了工作效率,尤其是在行动或远端环境中。

美国文件扫描器市场占65.2%的市场份额,2024年市场规模达8亿美元,这得益于各行业数位化程度的提升、医疗保健、政府和教育机构的强劲需求,以及完善的技术生态系统。美国扫描器市场创新迅速,这得益于主要製造商的涌现以及有利于先进扫描技术早期采用的强大基础设施。

全球文件扫描器市场的主要参与者包括兄弟工业、富士通、柯达乐芮、佳能、精工爱普生、惠普、Visioneer、松下、理光公司、施乐控股、IRIS、Ambir Technology、Contex、虹光和精益科技。文件扫描器市场的公司正致力于透过开发具有人工智慧影像处理、云端相容性和行动整合功能的先进扫描技术来扩展其产品组合。与云端服务供应商和数位工作流程平台的策略合作使製造商能够提供满足企业级无缝文件管理和安全需求的解决方案。主要参与者也在投资小型化和用户友好介面,以满足小型企业和家庭办公室的需求。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 利润率

- 每个阶段的增值

- 影响价值链的因素

- 产业衝击力

- 成长动力

- 数位转型

- 技术进步

- 远端工作和云端集成

- 产业陷阱与挑战

- 初期投资高

- 安全和隐私问题

- 机会

- 人工智慧与机器学习集成

- 基于行动和云端的扫描应用程式

- 成长动力

- 成长潜力分析

- 未来市场趋势

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 按扫描器类型

- 监管格局

- 标准和合规性要求

- 区域监理框架

- 认证标准

- 波特的分析

- PESTEL分析

- 消费者行为分析

- 购买模式

- 偏好分析

- 消费者行为的区域差异

- 电子商务对购买决策的影响

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:按扫描器类型,2021 - 2034

- 主要趋势

- 平板扫描仪

- 单张纸扫描仪

- 便携式扫描仪

- 顶置式/书籍扫描仪

- 其他(滚筒、条码)

第六章:市场估计与预测:按技术分类,2021 - 2034 年

- 主要趋势

- 光学字元辨识

- 双面扫描

- 彩色与单色

- 无线的

- 云端整合

第七章:市场估计与预测:按产能,2021 - 2034

- 主要趋势

- 最多 100 张

- 100-200张

- 200张以上

第八章:市场估计与预测:依颜色变化,2021 - 2034 年

- 主要趋势

- 不透明文件扫描仪

- 增强剂/彩色文件扫描仪

- 可见性彩色文件扫描仪

第九章:市场估计与预测:依连结性,2021 - 2034

- 主要趋势

- 有线

- 无线的

第 10 章:市场估计与预测:按影像质量,2021 年至 2034 年

- 主要趋势

- 小于 100 dpi

- 100-300 dpi

- 300-600 dpi

- 超过 600 dpi

第 11 章:市场估计与预测:按文件大小,2021 年至 2034 年

- 主要趋势

- 小于 A4

- A4

- A3

- A2

第 12 章:市场估计与预测:按价格,2021 年至 2034 年

- 主要趋势

- 低的

- 中等的

- 高的

第 13 章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 政府

- 银行与金融

- 卫生保健

- 教育

- 其他(IT、法律、零售等)

第 14 章:市场估计与预测:按配销通路,2021 年至 2034 年

- 主要趋势

- 离线

- 在线的

第 15 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第 16 章:公司简介

- Ambir Technology

- Avision

- Brother Industries

- Canon

- Contex

- Fujitsu

- HP

- IRIS

- Kodak Alaris

- Panasonic

- Plustek

- Ricoh Company

- Seiko Epson

- Visioneer

- Xerox Holdings

The Global Document Scanner Market was valued at USD 3.7 billion in 2024 and is estimated to grow at a CAGR of 4.6% to reach USD 5.7 billion by 2034.

The ongoing shift toward digital transformation across sectors such as government, banking, healthcare, and education is a major force behind this growth. As businesses transition to digital workflows, document scanners are playing a key role in converting paper-based records into secure, searchable, and easily accessible formats. This move is being further accelerated by the rising adoption of enterprise content management platforms and stricter data protection regulations. Additionally, the surge in remote and hybrid working models has increased demand for scanners that offer flexibility, fast access, and remote collaboration capabilities. Devices integrated with cloud functionality and DMS compatibility are enabling users to store, share, and manage files from any location, which significantly enhances team productivity. With organizations continuing to invest in intelligent digital infrastructure, the demand for high-speed, reliable, and user-friendly scanning solutions is projected to rise in the years ahead.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.7 Billion |

| Forecast Value | $5.7 Billion |

| CAGR | 4.6% |

The flatbed scanners segment generated USD 1.4 billion in 2024, making it the top contributor by type. These scanners provide superior flexibility, allowing users to scan a wide range of items, whether they are fragile documents, thick books, or photographs, without risking damage. Their ability to handle varied document sizes and materials makes them particularly valuable in legal, educational, and archival services.

The wireless scanners segment accounted for USD 2.4 billion in 2024, driven by growing demand for seamless connectivity and efficient workflow. Wireless capability supports real-time scanning to cloud platforms or mobile devices, offering users the convenience of instantly transferring files to services like email or cloud storage. This feature promotes productivity, especially in mobile or remote environments, by eliminating the need for wired setups or desktop dependency.

United States Document Scanner Market held a 65.2% share and generated USD 800 million in 2024, attributed to high levels of digital adoption across sectors, robust demand from healthcare, government, and educational institutions, and a well-established technology ecosystem. Innovation is rapid in the U.S. scanner market, supported by the presence of major manufacturers and a strong infrastructure that favors early adoption of advanced scanning technologies.

Key players in the Global Document Scanner Market include Brother Industries, Fujitsu, Kodak Alaris, Canon, Seiko Epson, HP, Visioneer, Panasonic, Ricoh Company, Xerox Holdings, IRIS, Ambir Technology, Contex, Avision, and Plustek. Companies operating in the document scanner market are focusing on expanding their product portfolios through the development of advanced scanning technologies with AI-powered image processing, cloud compatibility, and mobile integration. Strategic collaborations with cloud service providers and digital workflow platforms allow manufacturers to offer solutions that meet enterprise-level demands for seamless file management and security. Major players are also investing in miniaturization and user-friendly interfaces to cater to small businesses and home offices.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Scanner type

- 2.2.3 Technology

- 2.2.4 Capacity

- 2.2.5 Connectivity

- 2.2.6 Image quality

- 2.2.7 Document size

- 2.2.8 Price

- 2.2.9 Application

- 2.2.10 Distribution channel

- 2.3 CXO perspectives: strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Digital transformation

- 3.2.1.2 Technological advancements

- 3.2.1.3 Remote work and cloud integration

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High initial investment

- 3.2.2.2 Security & privacy concerns

- 3.2.3 Opportunities

- 3.2.3.1 AI & machine learning integration

- 3.2.3.2 Mobile & cloud based scanning apps

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By scanner type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

- 3.10 Consumer behavior analysis

- 3.10.1 Purchasing patterns

- 3.10.2 Preference analysis

- 3.10.3 Regional variations in consumer behavior

- 3.10.4 Impact of e-commerce on buying decisions

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Scanner Type, 2021 - 2034 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Flatbed scanners

- 5.3 Sheetfed scanners

- 5.4 Portable scanners

- 5.5 Overhead/book scanners

- 5.6 Others (drum, barcode)

Chapter 6 Market Estimates and Forecast, By Technology, 2021 - 2034 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Optical character recognition

- 6.3 Duplex scanning

- 6.4 Color vs. monochrome

- 6.5 Wireless

- 6.6 Cloud integration

Chapter 7 Market Estimates and Forecast, By Capacity, 2021 - 2034 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Upto 100 sheets

- 7.3 100-200 sheets

- 7.4 Above 200 sheets

Chapter 8 Market Estimates and Forecast, By Color variation, 2021 - 2034 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Opaque document scanner

- 8.3 Enhancers/tinted document scanner

- 8.4 Visibility tinted document scanner

Chapter 9 Market Estimates and Forecast, By Connectivity, 2021 - 2034 (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 Wired

- 9.3 Wireless

Chapter 10 Market Estimates and Forecast, By Image Quality, 2021 - 2034 (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 Less than 100 dpi

- 10.3 100-300 dpi

- 10.4 300-600 dpi

- 10.5 More than 600 dpi

Chapter 11 Market Estimates and Forecast, By Document Size, 2021 - 2034 (USD Billion) (Thousand Units)

- 11.1 Key trends

- 11.2 Less than A4

- 11.3 A4

- 11.4 A3

- 11.5 A2

Chapter 12 Market Estimates and Forecast, By Price, 2021 - 2034 (USD Billion) (Thousand Units)

- 12.1 Key trends

- 12.2 Low

- 12.3 Medium

- 12.4 High

Chapter 13 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Billion) (Thousand Units)

- 13.1 Key trends

- 13.2 Government

- 13.3 Banking & finance

- 13.4 Healthcare

- 13.5 Education

- 13.6 Others (IT, legal, retail, etc.)

Chapter 14 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 (USD Billion) (Thousand Units)

- 14.1 Key trends

- 14.2 Offline

- 14.3 Online

Chapter 15 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion) (Thousand Units)

- 15.1 Key trends

- 15.2 North America

- 15.2.1 U.S.

- 15.2.2 Canada

- 15.3 Europe

- 15.3.1 Germany

- 15.3.2 UK

- 15.3.3 France

- 15.3.4 Italy

- 15.3.5 Spain

- 15.4 Asia Pacific

- 15.4.1 China

- 15.4.2 Japan

- 15.4.3 India

- 15.4.4 Australia

- 15.4.5 South Korea

- 15.5 Latin America

- 15.5.1 Brazil

- 15.5.2 Mexico

- 15.5.3 Argentina

- 15.6 Middle East and Africa

- 15.6.1 South Africa

- 15.6.2 Saudi Arabia

- 15.6.3 UAE

Chapter 16 Company Profiles

- 16.1 Ambir Technology

- 16.2 Avision

- 16.3 Brother Industries

- 16.4 Canon

- 16.5 Contex

- 16.6 Fujitsu

- 16.7 HP

- 16.8 IRIS

- 16.9 Kodak Alaris

- 16.10 Panasonic

- 16.11 Plustek

- 16.12 Ricoh Company

- 16.13 Seiko Epson

- 16.14 Visioneer

- 16.15 Xerox Holdings