|

市场调查报告书

商品编码

1844317

幽门螺旋桿菌检测市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Helicobacter Pylori Testing Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

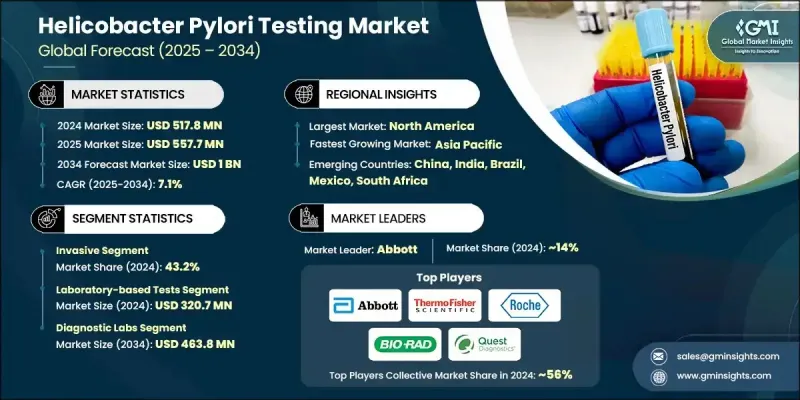

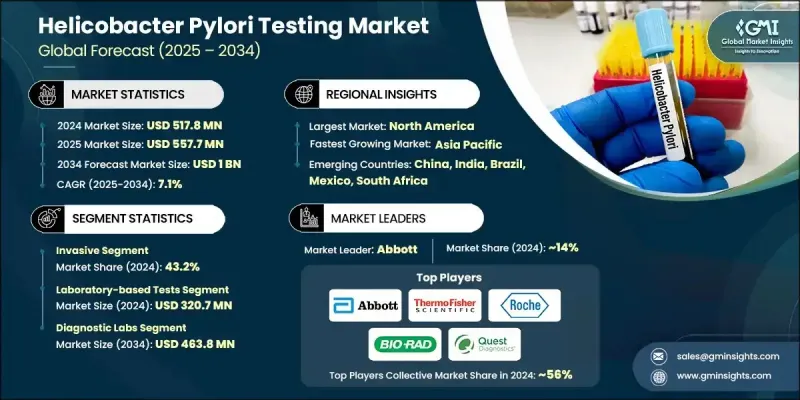

2024 年全球幽门螺旋桿菌检测市场价值为 5.178 亿美元,预计将以 7.1% 的复合年增长率成长,到 2034 年达到 10 亿美元。

胃病患病率的上升、老年人口的增加以及人们对非侵入性诊断方法日益增长的兴趣推动了这一行业的稳定增长。临床诊断领域正在发生重大转变,世界各地的医疗保健系统都致力于透过先进的检测工具进行早期疾病检测。随着胃肠道疾病的日益普遍,对精准且患者友善的检测的需求也日益增长。同时,人们对早期检测的认识和偏好不断提升,促使医院和诊断中心扩大其幽门螺旋桿菌检测能力。即时检测因其快速、便捷且在各种医疗环境中易于获取而受到广泛关注。这些设备使临床医生能够快速获得结果,从而改善患者的治疗效果并缩短治疗时间。此外,分子诊断和数位健康工具(包括基于人工智慧的结果解读和远端检测平台)的创新正在显着拓宽市场可及性并提高临床精准度。这些因素的共同作用,正在将幽门螺旋桿菌检测领域塑造成全球胃肠道医疗诊断的关键领域。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 5.178亿美元 |

| 预测值 | 10亿美元 |

| 复合年增长率 | 7.1% |

侵入性检测领域在2024年占据了43.2%的市场份额,这得益于其透过组织活检和显微镜分析实现的卓越诊断准确性。这些方法能够可靠地洞察细菌感染及其相关的胃部异常,尤其是在高风险或复杂病例中。当需要精确和详细的病理学检查时,临床医生仍然依赖侵入性操作,这进一步强化了其在全面诊断和癌症筛检中的关键作用。

2024年,实验室检测细分市场收入达3.207亿美元。该细分市场凭藉其提供的诊断资讯高度可靠且深度丰富而保持领先地位。组织学分析、培养和血清学检测等实验室检测对于鑑定细菌菌株、确定感染阶段和评估抗生素抗药性至关重要。幽门螺旋桿菌相关胃肠道疾病(例如溃疡和慢性胃炎)的发生率不断上升,持续推动医院和独立实验室对精准实验室诊断的需求。

2024年,北美幽门螺旋桿菌检测市场占据34.6%的市场份额,这得益于该地区完善的医疗基础设施和日益增长的胃肠道疾病负担。强大的诊断实验室、日益提升的临床意识以及早期筛检实践,促进了检测的广泛应用。此外,该地区还受益于对先进诊断技术的持续投资以及非侵入性解决方案的日益普及,从而支持了美国和加拿大市场的持续成长。

全球幽门螺旋桿菌检测市场的主要参与者包括雅培、生物梅里埃、赛默飞世尔科技、Bio-Rad Laboratories、Meridian Biosciences、Quidel Corporation、Gulf Coast Scientific、CERTEST、Coris BioConcept、Quest Diagnostics、罗氏、Cardinal Health 和 BIOHIT。幽门螺旋桿菌检测市场的公司正在采取多方面的策略来巩固其市场地位。领先的製造商正在优先进行研发投资,以开发具有更短週转时间和更广泛临床应用的高灵敏度诊断试剂盒。许多公司正在扩展其非侵入性检测产品组合,以满足对患者友善诊断日益增长的需求。与医院、诊断连锁店和研究机构的策略合作伙伴关係使公司能够扩大分销网络并将检测解决方案整合到主流临床工作流程中。

目录

第一章:方法论与范围

第 2 章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 每个阶段的增值

- 影响价值链的因素

- 产业衝击力

- 成长动力

- 胃溃疡盛行率上升

- 老年人口风险不断增加

- 对即时检测设备的需求不断增长

- 非侵入性幽门螺旋桿菌检测的采用率不断上升

- 产业陷阱与挑战

- 缺乏熟练的侵入性检测专业人员

- 缺乏对幽门螺旋桿菌感染的认识

- 市场机会

- 分子检测的技术创新

- 家庭和自我检测试剂盒

- 成长动力

- 成长潜力分析

- 监管格局

- 技术格局

- 当前的技术趋势

- 采用非侵入性检测(尿素呼气、粪便抗原、血清学)

- 自动化和高通量诊断系统

- 与实验室资讯系统(LIS)集成

- 提高检测的敏感度和特异性

- 新兴技术

- 便携式幽门螺旋桿菌检测试剂盒

- 基于分子和PCR的精确检测

- 用于活检和组织学分析的人工智慧和机器学习

- 同时检测病原体的多重检测平台

- 当前的技术趋势

- 未来市场趋势

- 非侵入式家用幽门螺旋桿菌检测试剂盒的采用率不断提高

- 扩展人工智慧驱动的诊断工具,实现更快、更准确的检测

- 数位健康平台与远距医疗在测试监控方面的整合日益加强

- 市场进入策略

- 定价分析

- 差距分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 全球的

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲和中东

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与协作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:按测试类型,2021 - 2034 年

- 主要趋势

- 侵入性

- 快速尿素酶试验

- 组织学

- 惠普文化

- 非侵入性

- 血清学检测

- 尿素呼气试验

- 粪便抗原检测

第六章:市场估计与预测:依方法,2021 - 2034 年

- 主要趋势

- 实验室测试

- 即时检验 (POC)

第七章:市场估计与预测:依最终用途,2021 - 2034

- 主要趋势

- 诊断实验室

- 医院

- 诊所

- 其他最终用途

第八章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第九章:公司简介

- Abbott

- BIOHIT

- bioMerieux

- Bio-Rad Laboratories

- Cardinal Health

- CERTEST

- Coris BioConcept

- Gulf Coast Scientific

- Meridian Biosciences

- Quest Diagnostics

- Quidel Corporation

- Roche

- Thermo Fisher Scientific

The Global Helicobacter Pylori Testing Market was valued at USD 517.8 million in 2024 and is estimated to grow at a CAGR of 7.1% to reach USD 1 billion by 2034.

The steady growth is driven by the increasing prevalence of gastric disorders, a rise in the elderly population, and growing interest in non-invasive diagnostic approaches. A major shift is underway in clinical diagnostics, with healthcare systems across the world focusing on early disease detection through advanced testing tools. As gastrointestinal diseases become more common, the demand for accurate and patient-friendly tests is climbing. Simultaneously, rising awareness and preference for early detection are influencing hospitals and diagnostic centers to expand their H. pylori testing capabilities. Point-of-care testing is also gaining widespread traction due to its speed, convenience, and accessibility in a variety of healthcare settings. These devices enable clinicians to deliver rapid results, which enhances patient outcomes and treatment timelines. Additionally, innovations in molecular diagnostics and digital health tools including AI-based result interpretation and remote testing platforms are significantly broadening market accessibility and improving clinical precision. Combined, these elements are shaping the helicobacter pylori testing space into a key sector of gastrointestinal healthcare diagnostics worldwide.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $517.8 Million |

| Forecast Value | $1 Billion |

| CAGR | 7.1% |

The invasive testing segment captured 43.2% share in 2024, due to its superior diagnostic accuracy achieved through tissue biopsies and microscopic analysis. These methods offer reliable insights into bacterial infection and associated gastric abnormalities, particularly in high-risk or complicated cases. Clinicians continue to rely on invasive procedures when precision and detailed pathology are required, reinforcing their critical role in comprehensive diagnosis and cancer screening.

The laboratory-based tests segment generated USD 320.7 million in 2024. This segment holds its lead due to the high reliability and depth of diagnostic information provided. Laboratory tests like histological analysis, cultures, and serological assays are essential for identifying bacterial strains, determining infection stages, and assessing antibiotic resistance. Rising rates of H. pylori-associated gastrointestinal conditions such as ulcers and chronic gastritis continue to fuel the demand for precise lab-based diagnostics in both hospital and independent lab environments.

North American Helicobacter Pylori Testing Market held 34.6% share in 2024, driven by the region's well-established healthcare infrastructure and increasing gastrointestinal disease burden. Strong presence of diagnostic laboratories, growing clinical awareness, and early screening practices contribute to widespread test adoption. The region also benefits from ongoing investments in advanced diagnostics and rising uptake of non-invasive solutions, supporting sustained market growth across the US and Canada.

Key players actively competing in the Global Helicobacter Pylori Testing Market include Abbott, bioMerieux, Thermo Fisher Scientific, Bio-Rad Laboratories, Meridian Biosciences, Quidel Corporation, Gulf Coast Scientific, CERTEST, Coris BioConcept, Quest Diagnostics, Roche, Cardinal Health, and BIOHIT. Companies in the helicobacter pylori testing market are adopting multifaceted strategies to reinforce their market presence. Leading manufacturers are prioritizing R&D investments to develop high-sensitivity diagnostic kits with shorter turnaround times and broader clinical utility. Many firms are expanding their non-invasive testing portfolios to align with rising demand for patient-friendly diagnostics. Strategic partnerships with hospitals, diagnostic chains, and research institutions allow companies to widen distribution networks and integrate testing solutions into mainstream clinical workflows.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Test type trends

- 2.2.3 Method trends

- 2.2.4 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factors affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rise in prevalence of gastric ulcer

- 3.2.1.2 Increasing geriatric population at risk

- 3.2.1.3 Growing demand for point-of-care testing devices

- 3.2.1.4 Rising adoption of non-invasive H. pylori testing

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Lack of skilled professionals for invasive testing

- 3.2.2.2 Lack of awareness regarding H. pylori infection

- 3.2.3 Market opportunities

- 3.2.3.1 Technological innovations in molecular testing

- 3.2.3.2 Home-based and self-testing kits

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East and Africa

- 3.5 Technology landscape

- 3.5.1 Current technological trends

- 3.5.1.1 Non-invasive testing adoption (urea breath, stool antigen, serology)

- 3.5.1.2 Automation and high-throughput diagnostic systems

- 3.5.1.3 Integration with laboratory information systems (LIS)

- 3.5.1.4 Improved sensitivity and specificity of assays

- 3.5.2 Emerging technologies

- 3.5.2.1 Point-of-Care (POC) portable H. pylori detection kits

- 3.5.2.2 Molecular and PCR-based assays for precise detection

- 3.5.2.3 AI and machine learning for biopsy and histology analysis

- 3.5.2.4 Multiplex testing platforms for simultaneous pathogen detection

- 3.5.1 Current technological trends

- 3.6 Future market trends

- 3.6.1 Increased adoption of non-invasive home-based H. pylori testing kits

- 3.6.2 Expansion of AI-driven diagnostic tools for faster and more accurate detection

- 3.6.3 Growing integration of digital health platforms and telemedicine for test monitoring

- 3.7 Go-to-market strategies

- 3.8 Pricing analysis

- 3.9 GAP analysis

- 3.10 Porter’s analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 Global

- 4.2.2 North America

- 4.2.3 Europe

- 4.2.4 Asia Pacific

- 4.2.5 LAMEA

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Merger and acquisition

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Test Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Invasive

- 5.2.1 Rapid urease test

- 5.2.2 Histology

- 5.2.3 HP culture

- 5.3 Non-invasive

- 5.3.1 Serologic test

- 5.3.2 Urea breath test

- 5.3.3 Stool/fecal antigen test

Chapter 6 Market Estimates and Forecast, By Method, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Laboratory based tests

- 6.3 Point of care (POC) tests

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Diagnostic labs

- 7.3 Hospitals

- 7.4 Clinics

- 7.5 Other end use

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Abbott

- 9.2 BIOHIT

- 9.3 bioMerieux

- 9.4 Bio-Rad Laboratories

- 9.5 Cardinal Health

- 9.6 CERTEST

- 9.7 Coris BioConcept

- 9.8 Gulf Coast Scientific

- 9.9 Meridian Biosciences

- 9.10 Quest Diagnostics

- 9.11 Quidel Corporation

- 9.12 Roche

- 9.13 Thermo Fisher Scientific