|

市场调查报告书

商品编码

1844327

机械呼吸器市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Mechanical Ventilators Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

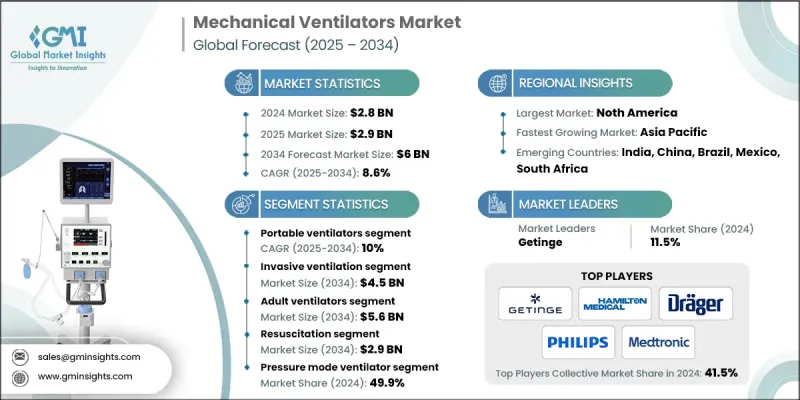

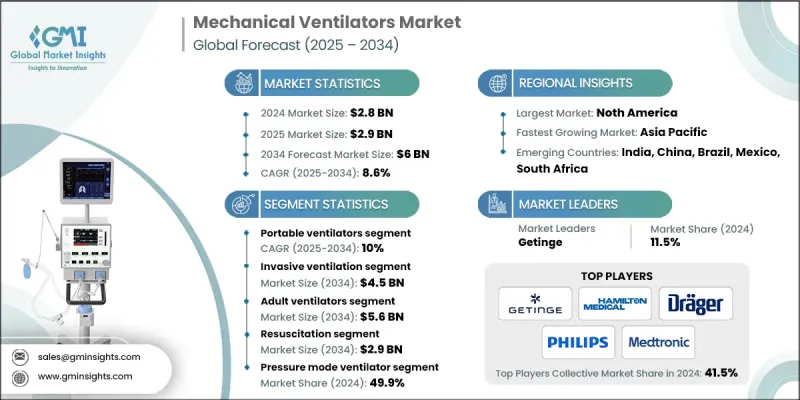

2024 年全球机械呼吸器市场价值为 28 亿美元,预计到 2034 年将以 8.6% 的复合年增长率增长至 60 亿美元。

推动成长的因素包括:ICU 入院人数的增加、呼吸系统疾病负担的加重、医疗技术的快速进步以及全球重症监护服务需求的增加。医疗保健提供者和生命科学公司正在转向机械通气系统,这些系统不仅提供关键的呼吸支持,还能帮助提高法规遵循、营运效率和患者整体预后。这些系统涵盖了各种各样的解决方案,从便携式重症监护病房到有创和非有创型号,并配备数位呼吸监测功能,以增强治疗效果和患者安全性。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 28亿美元 |

| 预测值 | 60亿美元 |

| 复合年增长率 | 8.6% |

睡眠呼吸中止症、气喘和慢性阻塞性肺病等长期呼吸系统疾病的发生率不断上升,这大大增加了呼吸器的需求。智慧监控、整合人工智慧和用户友好的呼吸机介面等先进技术也推动了市场成长,这些技术正在提升医疗标准。随着医院和家庭护理环境采用更具成本效益和以患者为中心的护理模式,向便携式和远端使用呼吸机的转变持续加速。医疗基础设施投资的不断增加,尤其是在发展中经济体,正在提高医疗服务的可近性,并扩大医院和外科护理领域的市场渗透率。

2024年,便携式呼吸器市场规模达4.724亿美元,预计到2034年将以10%的复合年增长率成长。随着越来越多的患者需要在家中或紧急情况下持续呼吸护理,便携式呼吸器的需求正在显着增长。慢性呼吸系统疾病促使人们使用行动解决方案,这些解决方案能够为患者和照护者提供长期支持,并提高行动性和易用性,这进一步增强了紧凑型便携式呼吸器在市场上的相关性。

2024年,侵入性呼吸器市场占77.5%的市场份额,预计到2034年将达到45亿美元。这些系统对于治疗严重呼吸系统疾病和危及生命的併发症至关重要,尤其是在重症监护环境中。全球ICU设施的激增以及急性呼吸系统疾病的增多,推动了该领域的成长。有创呼吸机能够提供高水准的呼吸支持,这推动了医院和创伤护理部门的持续投资。

2024年,北美呼吸器市场占据36.7%的市场份额,这得益于其成熟的医疗体系、雄厚的医疗技术投入以及强大的重症监护基础设施。人口老化和日益加重的呼吸系统健康负担,增加了对医院和家用呼吸机系统的需求。研究投入、先进医疗服务的普及以及更高的诊断率,使得该地区呼吸机技术的应用迅速普及。

机械呼吸器市场的领先公司包括 ZOLL Medical、Medtronic、ResMed、Philips、Mindray、Noccarc Robotics、Bio-Med Devices、Baxter、Fisher & Paykel、Hamilton Medical、Getinge、Drager、ICU Medical、GE Healthcare、Niation Kohden、ACOMA Medical、Carl Retech、Aeonn Medical、ICU Medical、GE Healthcare S为了巩固其在机械呼吸器市场中的地位,製造商正专注于技术创新、产品多样化和战略合作伙伴关係。该公司正在开发整合 AI 和支援 IoT 的呼吸机,以提供即时患者监控和数据驱动的洞察。他们还在扩展产品范围,包括医院级和便携式设备,以满足整个护理环境中日益增长的需求。製造和售后服务中心的本地化有助于缩短交货时间并提高市场响应能力。此外,与医疗保健提供者的合併、收购和合作正在加强分销网络并促进研发能力。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 慢性呼吸系统疾病盛行率不断上升

- 医疗支出增加

- ICU病床/加护病床数量增加

- 技术进步

- 产业陷阱与挑战

- 使用呼吸器的相关风险

- 机械呼吸器成本高昂

- 市场机会

- 居家照护与非侵入性通气的成长

- 人工智慧与远端监控的融合

- 成长动力

- 成长潜力分析

- 监管格局

- 技术格局

- 当前的技术趋势

- 便携式和家用机械呼吸器的成长

- 支援远端监控的数位健康平台

- 先进的病人-呼吸器接口

- 新兴技术

- 人工智慧呼吸器和预测分析

- 穿戴式和连网呼吸器系统

- 整合物联网和云端功能的智慧呼吸机

- 当前的技术趋势

- 差距分析

- 波特的分析

- PESTEL分析

- 未来市场趋势

- 家庭护理和便携式呼吸机的扩展

- 远端监控和远距医疗的采用

- 小型化和穿戴式呼吸机

第四章:竞争格局

- 介绍

- 公司矩阵分析

- 公司市占率分析

- 全球的

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 多边环境协定

- 竞争定位矩阵

- 主要市场参与者的竞争分析

- 关键进展

- 併购

- 伙伴关係与合作

- 推出新服务类型

- 扩张计划

第五章:市场估计与预测:按产品,2021 - 2034 年

- 主要趋势

- 重症监护呼吸机

- 高阶

- 中端

- 基本端

- 随身呼吸机

第六章:市场估计与预测:按介面,2021 - 2034 年

- 主要趋势

- 侵入性通气

- 持续性气道正压通气

- 双水平气道正压通气

- 亚太

- 其他非侵入性通气

- 非侵入性通气

第七章:市场估计与预测:按呼吸器类型,2021 - 2034

- 主要趋势

- 成人呼吸器

- 新生儿呼吸机

第 8 章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 復苏

- 紧急/运输

- 麻醉学

- 临床应用

- 居家照护应用

- 睡眠呼吸中止症治疗

- 其他应用

第九章:市场估计与预测:按模式,2021 - 2034

- 主要趋势

- 压力模式呼吸机

- 控制模式呼吸机

- 复合模式呼吸机

第 10 章:市场估计与预测:依最终用途,2021 年至 2034 年

- 主要趋势

- 医院

- 门诊手术中心

- 居家护理

- 其他最终用途

第 11 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十二章:公司简介

- ACOMA Medical

- Aeonmed

- Air Liquide Medical Systems

- Allied Medical

- Baxter

- Bio-Med Devices

- Breas Medical

- Carl Reiner

- Drager

- Foremost Meditech

- Fisher & Paykel

- GE Healthcare

- Getinge

- Hamilton Medical

- ICU Medical

- Medtronic

- Mindray

- Nihon Kohden

- Noccarc Robotics

- Philips

- ResMed

- Skanray Technologies

- ZOLL Medical

The Global Mechanical Ventilators Market was valued at USD 2.8 billion in 2024 and is estimated to grow at a CAGR of 8.6% to reach USD 6 billion by 2034.

Growth is driven by increasing ICU admissions, a rising burden of respiratory disorders, rapid medical advancements, and a higher demand for intensive care services worldwide. Healthcare providers and life sciences firms are turning to mechanical ventilation systems that offer not only critical respiratory support but also help improve regulatory compliance, operational efficiency, and overall patient outcomes. These systems include a wide variety of solutions, ranging from portable and critical care units to invasive and non-invasive models, equipped with digital respiratory monitoring for enhanced treatment delivery and patient safety.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.8 Billion |

| Forecast Value | $6 Billion |

| CAGR | 8.6% |

The growing incidence of long-term respiratory conditions such as sleep apnea, asthma, and chronic obstructive pulmonary disease is contributing heavily to the demand for ventilators. Market growth is also being fueled by advanced technologies like smart monitoring, integrated AI, and user-friendly ventilator interfaces that are elevating care standards. As hospitals and home care environments adopt more cost-effective and patient-centered care models, the shift toward portable and remote-use ventilators continues to accelerate. Rising healthcare infrastructure investments especially in developing economies are increasing accessibility and broadening market penetration across both hospital and surgical care segments.

In 2024, the portable ventilators segment generated USD 472.4 million and is expected to grow at a 10% CAGR through 2034. Demand is rising significantly as more patients require ongoing respiratory care in home-based or emergency scenarios. Chronic respiratory illnesses are prompting the use of mobile solutions that offer long-term support with increased mobility and ease of use for both patients and caregivers, reinforcing the relevance of compact, transportable units in the market.

The invasive ventilators segment held a 77.5% share in 2024 and is estimated to reach USD 4.5 billion by 2034. These systems are essential for managing severe respiratory conditions and life-threatening complications, particularly in intensive care settings. Growth in this segment is backed by a surge in ICU facilities worldwide and the rise in acute respiratory conditions. The ability of invasive ventilators to offer high levels of respiratory support is driving continued investment from hospitals and trauma care units.

North America Mechanical Ventilators Market held 36.7% share in 2024, supported by a mature healthcare system, significant spending on medical technologies, and a strong infrastructure for critical care. The aging population and growing respiratory health burden have elevated demand for both hospital-based and home-based ventilatory systems. Investments in research, access to advanced healthcare, and higher diagnosis rates have enabled rapid technology adoption across the region.

Leading companies in the Mechanical Ventilators Market include ZOLL Medical, Medtronic, ResMed, Philips, Mindray, Noccarc Robotics, Bio-Med Devices, Baxter, Fisher & Paykel, Hamilton Medical, Getinge, Drager, ICU Medical, GE Healthcare, Nihon Kohden, ACOMA Medical, Carl Reiner, Aeonmed, Breas Medical, Air Liquide Medical Systems, Allied Medical, Foremost Meditech, and Skanray Technologies. To strengthen their position in the Mechanical Ventilators Market, manufacturers are focusing on technological innovation, product diversification, and strategic partnerships. Companies are developing AI-integrated and IoT-enabled ventilators to deliver real-time patient monitoring and data-driven insights. They are also expanding their offerings to include both hospital-grade and portable devices to meet growing demand across care settings. Localization of manufacturing and after-sales service centers is helping reduce lead times and improve market responsiveness. Additionally, mergers, acquisitions, and collaborations with healthcare providers are enhancing distribution networks and fostering R&D capabilities.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Product trends

- 2.2.3 Interface trends

- 2.2.4 Ventilator type trends

- 2.2.5 Application trends

- 2.2.6 Mode trends

- 2.2.7 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of chronic respiratory diseases

- 3.2.1.2 Rise in healthcare expenditure

- 3.2.1.3 Increase in number of ICU beds/critical care beds

- 3.2.1.4 Technological advancements

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Risks associated with the use of ventilators

- 3.2.2.2 High cost of mechanical ventilators

- 3.2.3 Market opportunities

- 3.2.3.1 Growth of homecare and non-invasive ventilation

- 3.2.3.2 Integration of AI and remote monitoring

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 MEA

- 3.5 Technology landscape

- 3.5.1 Current technological trends

- 3.5.1.1 Growth of portable and home-based mechanical ventilators

- 3.5.1.2 Digital health platforms enabling remote monitoring

- 3.5.1.3 Advanced patient-ventilator interfaces

- 3.5.2 Emerging technologies

- 3.5.2.1 AI-powered ventilators and predictive analytics

- 3.5.2.2 Wearable and connected ventilator systems

- 3.5.2.3 Smart ventilators with integrated IoT and cloud capabilities

- 3.5.1 Current technological trends

- 3.6 Gap analysis

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

- 3.9 Future market trends

- 3.9.1 Expansion of homecare and portable ventilators

- 3.9.2 Remote monitoring and telehealth adoption

- 3.9.3 Miniaturization and wearable ventilators

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.3.1 Global

- 4.3.2 North America

- 4.3.3 Europe

- 4.3.4 Asia Pacific

- 4.3.5 Latin America

- 4.3.6 MEA

- 4.4 Competitive positioning matrix

- 4.5 Competitive analysis of major market players

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New service type launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn, Units)

- 5.1 Key trends

- 5.2 Intensive care ventilators

- 5.2.1 High-end

- 5.2.2 Mid-end

- 5.2.3 Basic-end

- 5.3 Portable ventilators

Chapter 6 Market Estimates and Forecast, By Interface, 2021 - 2034 ($ Mn, Units)

- 6.1 Key trends

- 6.2 Invasive ventilation

- 6.2.1 CPAP

- 6.2.2 BiPAP

- 6.2.3 APAP

- 6.2.4 Other non-invasive ventilation

- 6.3 Non-invasive ventilation

Chapter 7 Market Estimates and Forecast, By Ventilator Type, 2021 - 2034 ($ Mn, Units)

- 7.1 Key trends

- 7.2 Adult ventilators

- 7.3 Neonatal ventilators

Chapter 8 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn, Units)

- 8.1 Key trends

- 8.2 Resuscitation

- 8.3 Emergency/Transport

- 8.4 Anesthesiology

- 8.5 Clinical applications

- 8.6 Homecare applications

- 8.7 Sleep apnea therapy

- 8.8 Other applications

Chapter 9 Market Estimates and Forecast, By Mode, 2021 - 2034 ($ Mn, Units)

- 9.1 Key trends

- 9.2 Pressure mode ventilator

- 9.3 Control mode ventilator

- 9.4 Combined mode ventilator

Chapter 10 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn, Units)

- 10.1 Key trends

- 10.2 Hospitals

- 10.3 Ambulatory surgical centers

- 10.4 Homecare

- 10.5 Other end use

Chapter 11 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn, Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Spain

- 11.3.5 Italy

- 11.3.6 Netherlands

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 Japan

- 11.4.3 India

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 Middle East and Africa

- 11.6.1 South Africa

- 11.6.2 Saudi Arabia

- 11.6.3 UAE

Chapter 12 Company Profiles

- 12.1 ACOMA Medical

- 12.2 Aeonmed

- 12.3 Air Liquide Medical Systems

- 12.4 Allied Medical

- 12.5 Baxter

- 12.6 Bio-Med Devices

- 12.7 Breas Medical

- 12.8 Carl Reiner

- 12.9 Drager

- 12.10 Foremost Meditech

- 12.11 Fisher & Paykel

- 12.12 GE Healthcare

- 12.13 Getinge

- 12.14 Hamilton Medical

- 12.15 ICU Medical

- 12.16 Medtronic

- 12.17 Mindray

- 12.18 Nihon Kohden

- 12.19 Noccarc Robotics

- 12.20 Philips

- 12.21 ResMed

- 12.22 Skanray Technologies

- 12.23 ZOLL Medical