|

市场调查报告书

商品编码

1844331

气道清除设备市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Airway Clearance Devices Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

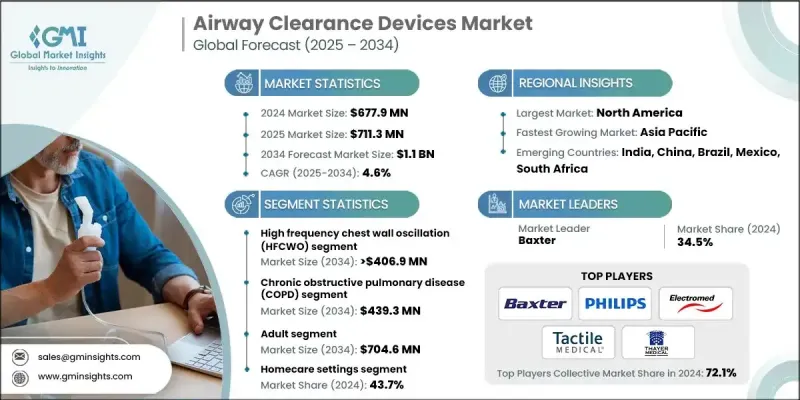

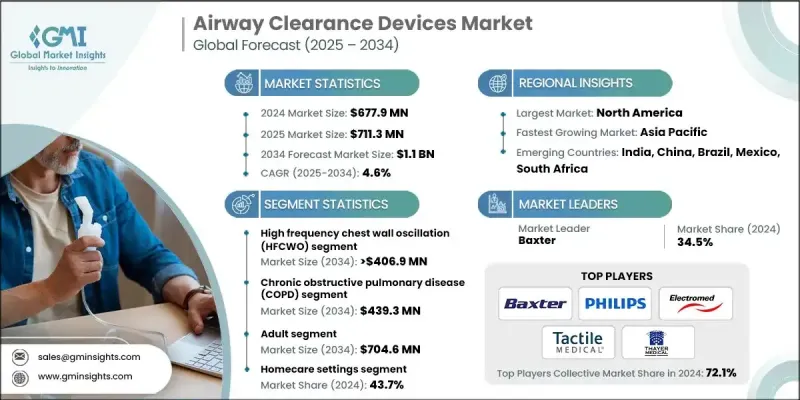

2024 年全球气道清理设备市场价值为 6.779 亿美元,预计将以 4.6% 的复合年增长率成长,到 2034 年达到 11 亿美元。

呼吸系统疾病盛行率的上升、科技的进步、人口老化以及人们对气道治疗的认识的提高,都是推动该市场成长的关键因素。医疗保健提供者、付款人和生命科学公司越来越多地采用气道清除解决方案,以改善治疗效果、简化护理流程并增强合规性。高频胸壁振盪 (HFCWO) 背心、振盪呼气正压 (OPEP) 系统以及互联数位健康解决方案的引入,正在重塑患者管理慢性肺部疾病的方式。这些创新技术能够实现个人化治疗调整和远端监控,使护理更加高效,更加以患者为中心。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 6.779亿美元 |

| 预测值 | 11亿美元 |

| 复合年增长率 | 4.6% |

病患教育计画和认知计画有助于促进早期诊断和呼吸系统疾病治疗的依从性。同时,全球医疗保健支出的不断增长、支持性报销框架以及针对慢性肺部疾病管理的公共卫生倡议,正在鼓励各地区更多地采用呼吸道清除疗法。随着门诊和家庭护理模式的推进,预计在预测期内,对紧凑、用户友好且非侵入性的呼吸设备的需求将持续增长。

2024年,扑动黏液清除设备市场规模达到1.52亿美元,预计2034年将以5.3%的复合年增长率成长。这类设备因其紧凑的设计、易用性和成本效益而日益普及。它们特别适合呼吸系统疾病较轻的患者,并且通常是自我照护的首选。其价格实惠的特性也使其在资源匮乏的地区和各种医疗保健系统中都能普及。随着人们的注意力转向预防和远端护理,这类设备为在非医院环境中维持呼吸健康提供了一种便捷的选择。

慢性阻塞性肺病 (COPD) 市场占 42%,预计到 2034 年将达到 4.393 亿美元。 COPD 仍然是全球最常见的呼吸系统疾病之一,环境和生活方式因素(例如污染、吸烟和职业危害)是其盛行率上升的主要原因。 COPD 患者经常出现黏液积聚和呼吸道阻塞的症状,因此迫切需要有效的呼吸道清除技术来改善呼吸、减少住院率并增强日常功能。

2024年,北美气道清除设备市场占38.7%的市占率。该地区受益于完善的医疗基础设施、耐用医疗设备的普及率以及有利的监管框架。在旨在促进独立护理和改善生活品质的倡议的推动下,振盪式和气动脉衝设备在住宅环境中的使用日益增多。该地区专注于个人化治疗,并将先进技术融入家庭护理,这正在加速气道清除解决方案的普及。

影响全球气道清除设备市场的关键参与者包括 ICU Medical、Monaghan Medical Corporation、VYAIRE MEDICAL、Baxter、Dymedso、ABM Respiratory Care、Mercury Medical、Pari Medical、Thayer Medical、Sentec、Dima Italia、Electromed、Tactile Medical、Philips、Phayer Medical、Sentec、Dima Italia、Electromed、Tactile Medical、PhilipRTs、Pne Medical Health Health 和 VORTliRT 和 VORT Technology。气道清除设备市场的领先公司正在追求产品创新、数位整合和策略合作,以加强其市场地位。透过整合智慧连接、远端监控和个人化治疗功能,他们让设备更加直观,更能满足患者的需求。企业还在全球扩展其分销网络,并进入新的地理市场,以挖掘未满足的需求。一些参与者正在投资临床研究,以验证设备的有效性并满足不断发展的监管标准。与呼吸照护提供者、医院和远距医疗平台的合併和合作使得住院和家庭护理环境中的采用率更高。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 呼吸系统疾病发生率上升

- 提高患者意识和产品发布

- 非侵入性治疗方案的采用率不断提高

- 政府大力推行控制呼吸道疾病的倡议

- 产业陷阱与挑战

- 设备成本高且监管要求严格

- 市场机会

- 数位健康与远端监控的整合

- 产品创新与客製化

- 成长动力

- 成长潜力分析

- 监管格局

- 技术格局

- 当前的技术趋势

- 便携式和家用气道清除设备的成长

- 支援远端监控的数位健康平台

- 患者友善的振盪 PEP 和 HFCWO 系统

- 新兴技术

- 人工智慧呼吸监测和预测分析

- 穿戴式连接气道清除设备

- 具有自适应治疗模式的智慧型设备

- 当前的技术趋势

- 差距分析

- 波特的分析

- PESTEL分析

- 未来市场趋势

- 人工智慧、数位健康和连网设备的融合

- 扩展慢性呼吸道照护的居家照护解决方案

- 基础建设改善的新兴市场实现成长

第四章:竞争格局

- 介绍

- 公司矩阵分析

- 公司市占率分析

- 全球的

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 多边环境协定

- 竞争定位矩阵

- 主要市场参与者的竞争分析

- 关键进展

- 併购

- 伙伴关係与合作

- 推出新服务类型

- 扩张计划

第五章:市场估计与预测:按设备类型,2021 - 2034 年

- 主要趋势

- 高频胸壁振盪(HFCWO)

- 扑动式黏液清除装置

- 肺内衝击通气(IPV)

- 机械性咳嗽辅助装置

- 呼气正压(PEP)

- 其他设备类型

第六章:市场估计与预测:按应用,2021 - 2034

- 主要趋势

- 慢性阻塞性肺病(COPD)

- 支气管扩张

- 囊肿纤维化

- 神经肌肉

- 其他应用

第七章:市场估计与预测:按年龄组,2021 - 2034 年

- 主要趋势

- 成人

- 儿科

第八章:市场估计与预测:依最终用途,2021 - 2034 年

- 主要趋势

- 居家照护环境

- 医院

- 门诊手术中心

- 其他最终用途

第九章:市场估计与预测:按地区,2021 - 2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十章:公司简介

- ABM Respiratory Care

- Baxter

- Dima Italia

- Dymedso

- Electromed

- ICU Medical

- Philips

- Mercury Medical

- Monaghan Medical Corporation

- Pari Medical

- Pneumo Care Health

- Sentec

- Tactile Medical

- Thayer Medical

- VORTRAN Medical Technology

- VYAIRE MEDICAL

The Global Airway Clearance Devices Market was valued at USD 677.9 million in 2024 and is estimated to grow at a CAGR of 4.6% to reach USD 1.1 billion by 2034.

The rising prevalence of respiratory illnesses, advancements in technology, an aging population, and greater awareness of airway therapy are all key contributors to this market's growth. Healthcare providers, payers, and life sciences companies are increasingly adopting airway clearance solutions to improve outcomes, streamline care delivery, and enhance regulatory compliance. The introduction of high-frequency chest wall oscillation (HFCWO) vests, oscillatory positive expiratory pressure (OPEP) systems, and connected digital health solutions is reshaping how patients manage chronic pulmonary conditions. These innovations enable personalized therapy adjustments and remote monitoring, making care more efficient and patient-centric.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $677.9 Million |

| Forecast Value | $1.1 Billion |

| CAGR | 4.6% |

Patient education initiatives and awareness programs are helping boost early diagnosis and adherence to respiratory treatments. At the same time, rising global healthcare expenditure, supportive reimbursement frameworks, and public health initiatives for managing chronic lung diseases are encouraging higher adoption of airway clearance therapies across regions. With the push toward outpatient and home care models, the demand for compact, user-friendly, and non-invasive respiratory devices is expected to rise consistently over the forecast period.

In 2024, the flutter mucus clearance device segment reached USD 152 million and is forecast to grow at a CAGR of 5.3% through 2034. These devices are becoming increasingly popular due to their compact design, ease of use, and cost-efficiency. They are particularly well-suited for individuals with less severe respiratory issues and are often preferred for self-administered care. Their affordability also makes them accessible in low-resource settings and across a wide range of healthcare systems. As the focus shifts toward prevention and remote care, these devices offer a convenient option for maintaining respiratory health in non-hospital environments.

The chronic obstructive pulmonary disease (COPD) segment held a 42% share and is expected to reach USD 439.3 million by 2034. COPD remains one of the most widespread respiratory conditions globally, with environmental and lifestyle factors such as pollution, smoking, and occupational hazards driving its prevalence. Patients with COPD frequently suffer from mucus build-up and obstructed airways, creating a strong need for effective airway clearance to improve breathing, reduce hospitalizations, and enhance daily function.

North America Airway Clearance Devices Market held a 38.7% share in 2024. The region benefits from well-established healthcare infrastructure, high adoption of durable medical equipment, and favorable regulatory frameworks. There's growing use of oscillatory and air-pulse devices in residential settings, driven by initiatives aimed at promoting independent care and improving quality of life. The region's focus on personalized treatment and integration of advanced technologies into home care is accelerating the uptake of airway clearance solutions.

Key players shaping the Global Airway Clearance Devices Market include ICU Medical, Monaghan Medical Corporation, VYAIRE MEDICAL, Baxter, Dymedso, ABM Respiratory Care, Mercury Medical, Pari Medical, Thayer Medical, Sentec, Dima Italia, Electromed, Tactile Medical, Philips, Pneumo Care Health, and VORTRAN Medical Technology. Leading companies in the airway clearance devices market are pursuing product innovation, digital integration, and strategic collaborations to reinforce their market presence. By incorporating smart connectivity, remote monitoring, and personalized therapy features, they're making devices more intuitive and responsive to patient needs. Firms are also expanding their distribution networks globally and entering new geographic markets to tap into unmet demand. Several players are investing in clinical research to validate device efficacy and meet evolving regulatory standards. Mergers and partnerships with respiratory care providers, hospitals, and telehealth platforms allow for greater adoption in both inpatient and home care environments.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Device type trends

- 2.2.3 Application trends

- 2.2.4 Age group trends

- 2.2.5 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rise in incidence of respiratory conditions

- 3.2.1.2 Growing patient awareness and product launches

- 3.2.1.3 Increasing adoption of non-invasive treatment options

- 3.2.1.4 Surge in government initiatives towards controlling respiratory disorders

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High device cost and stringent regulatory requirements

- 3.2.3 Market opportunities

- 3.2.3.1 Integration of digital health and remote monitoring

- 3.2.3.2 Product innovation and customization

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 MEA

- 3.5 Technology landscape

- 3.5.1 Current technological trends

- 3.5.1.1 Growth of portable and home-based airway clearance devices

- 3.5.1.2 Digital health platforms enabling remote monitoring

- 3.5.1.3 Patient-friendly oscillatory PEP and HFCWO systems

- 3.5.2 Emerging technologies

- 3.5.2.1 AI-powered respiratory monitoring and predictive analytics

- 3.5.2.2 Wearable connected airway clearance devices

- 3.5.2.3 Smart devices with adaptive therapy modes

- 3.5.1 Current technological trends

- 3.6 Gap analysis

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

- 3.9 Future market trends

- 3.9.1 Convergence of AI, digital health, and connected devices

- 3.9.2 Expansion of homecare solutions for chronic respiratory care

- 3.9.3 Growth in emerging markets with improved infrastructure

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.3.1 Global

- 4.3.2 North America

- 4.3.3 Europe

- 4.3.4 Asia Pacific

- 4.3.5 Latin America

- 4.3.6 MEA

- 4.4 Competitive positioning matrix

- 4.5 Competitive analysis of major market players

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New service type launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Device Type, 2021 - 2034 ($ Mn, Units)

- 5.1 Key trends

- 5.2 High frequency chest wall oscillation (HFCWO)

- 5.3 Flutter mucus clearance device

- 5.4 Intrapulmonary percussive ventilation (IPV)

- 5.5 Mechanical cough assist devices

- 5.6 Positive expiratory pressure (PEP)

- 5.7 Other device types

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Chronic obstructive pulmonary disease (COPD)

- 6.3 Bronchiectasis

- 6.4 Cystic fibrosis

- 6.5 Neuromuscular

- 6.6 Other applications

Chapter 7 Market Estimates and Forecast, By Age Group, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Adult

- 7.3 Pediatric

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Homecare settings

- 8.3 Hospital

- 8.4 Ambulatory surgical centers

- 8.5 Other end use

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 ABM Respiratory Care

- 10.2 Baxter

- 10.3 Dima Italia

- 10.4 Dymedso

- 10.5 Electromed

- 10.6 ICU Medical

- 10.7 Philips

- 10.8 Mercury Medical

- 10.9 Monaghan Medical Corporation

- 10.10 Pari Medical

- 10.11 Pneumo Care Health

- 10.12 Sentec

- 10.13 Tactile Medical

- 10.14 Thayer Medical

- 10.15 VORTRAN Medical Technology

- 10.16 VYAIRE MEDICAL