|

市场调查报告书

商品编码

1844333

家用冰箱及冰柜市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Household Refrigerators and Freezers Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

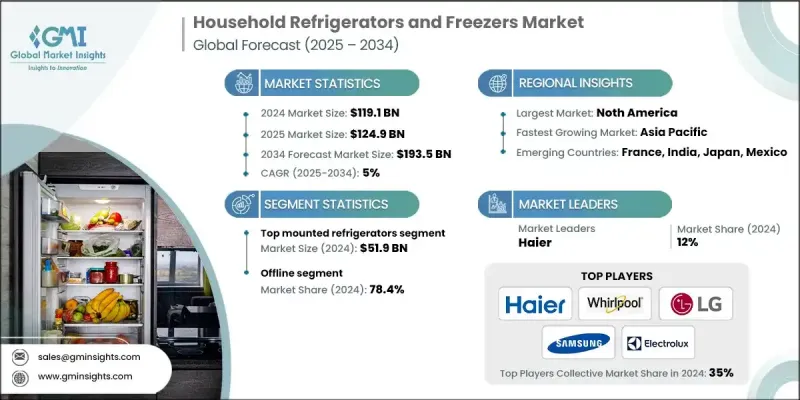

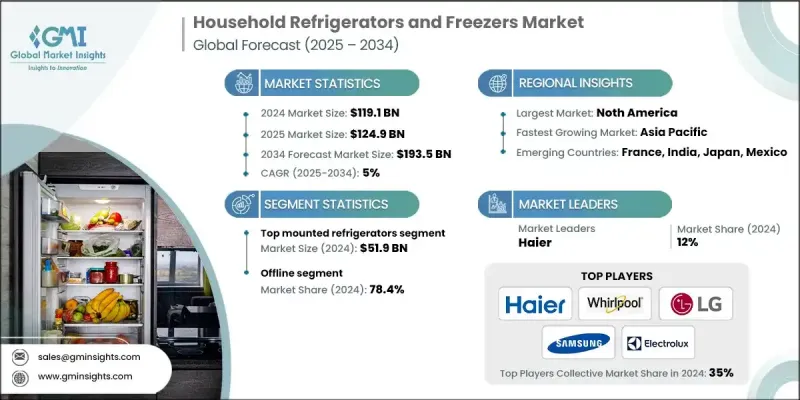

2024 年全球家用冰箱和冷冻柜市场价值为 1,191 亿美元,预计将以 5% 的复合年增长率成长,到 2034 年达到 1,935 亿美元。

消费者对环境永续性的意识不断增强,加上电费上涨,推动了对节能家电的需求。消费者现在更青睐那些在性能上不打折、拥有先进节能功能的家电。政府越来越多地推出推广环保产品的措施和监管政策,进一步强化了这一趋势。同时,家庭也开始采用智慧技术,提供更强大的控制力和便利性。现代冰箱配备了触控萤幕、虚拟助理相容性和无线连接等功能,使用户能够远端管理储存、监控库存和存取整合服务。智慧家庭与连网家电的融合正在不断重塑市场格局,反映出人们对舒适度、效率和即时回应能力的偏好不断变化。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 1191亿美元 |

| 预测值 | 1935亿美元 |

| 复合年增长率 | 5% |

2024年,顶置式冰箱市场规模达519亿美元,持续维持市场领先地位。这类冰箱将冷冻室置于冷藏室上方,因其经济实惠和节省空间的设计而广受欢迎。其较低的价格使其成为已开发地区和新兴地区注重价值的消费者的理想选择。紧凑、易用和稳定的性能继续支撑其强大的市场地位。

2024年,线下配销通路占了78.4%的市占率。在店内购物,买家可以亲眼检查家电,评估产品功能,并在训练有素的销售人员的指导下做出明智的决定。消费者非常重视个人化服务、即时产品演示以及送货、安装和维护等便利服务的体验,而实体店可以更好地满足这些需求。这种沉浸式、服务驱动的零售体验,对于维持家电领域线下领先地位至关重要。

2024年,美国家用冰箱和冰柜市场占74.9%的市场。强劲的消费者购买力以及对高端高性能家电日益增长的偏好,正在推动冰箱的普及。智慧家庭生态系统的整合正在加速对具有应用程式控制、能源监控和数位介面等智慧功能的冰箱的需求。美国消费者对符合永续发展目标的创新也反应迅速,从而支持了节能机型的成长。

活跃于全球家用冰箱和冷冻库市场的主要公司包括东芝、三星、惠而浦、格力、松下、LG、美的、海尔、Arcelik、利勃海尔、海信、博西家电、夏普、日立和伊莱克斯。家用冰箱和冰柜市场的公司专注于产品创新、可持续性和数位集成,以巩固其竞争地位。许多品牌正在透过嵌入物联网功能、基于人工智慧的库存追踪和行动连接来扩展其智慧家电产品组合。为了满足监管标准和消费者对环保解决方案的需求,製造商正在透过变频技术和环保冷媒来提高能源效率。地理扩张,尤其是向新兴市场的扩张,是另一个核心策略,并得到在地化生产和零售合作伙伴关係的支持。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 利润率

- 每个阶段的增值

- 影响价值链的因素

- 产业衝击力

- 成长动力

- 节能电器需求不断成长

- 技术进步和智慧功能

- 都市化和可支配所得不断增加

- 产业陷阱与挑战

- 延长更换週期

- 消费者的价格敏感度

- 机会

- 新兴市场扩张

- 智慧家庭生态系统的成长

- 成长动力

- 成长潜力分析

- 未来市场趋势

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 按产品

- 监管格局

- 标准和合规性要求

- 区域监理框架

- 认证标准

- 贸易统计(HS 代码 - 8418)

- 主要进口国

- 主要出口国

- 波特的分析

- PESTEL分析

- 消费者购买行为分析

- 购买模式

- 偏好分析

- 消费者行为的区域差异

- 电子商务对购买决策的影响

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:依产品,2021-2034

- 主要趋势

- 顶置式冰箱

- 底部安装冰箱

- 并排冰箱

- 法式对开门冰箱

第六章:市场估计与预测:依产能,2021-2034

- 主要趋势

- 小于 15 立方英尺。

- 16 立方英尺至 30 立方英尺

- 超过 30 立方英尺。

第七章:市场估计与预测:依结构,2021-2034

- 主要趋势

- 内建

- 独立式

- 反深度

- 紧凑型/迷你型

- 并排

- 其他(法式门、顶部冷冻室、底部冷冻室等)

第 8 章:市场估计与预测:按冷却技术,2021-2034 年

- 主要趋势

- 直接冷却

- 无霜

- 变频压缩机

- 双蒸发器

- 热电

第九章:市场估计与预测:依智慧功能,2021-2034

- 主要趋势

- 已启用 Wi-Fi

- 应用程式控制

- 语音助理集成

- 其他(触控萤幕、内建相机等)

第 10 章:市场估计与预测:按完成情况,2021-2034 年

- 不銹钢

- 雾面黑色

- 玻璃门

- 其他(復古、订製等)

第 11 章:市场估计与预测:依价格区间,2021-2034 年

- 主要趋势

- 低的

- 中等的

- 高的

第 12 章:市场估计与预测:按最终用途,2021-2034 年

- 主要趋势

- 住宅

- 商业的

第 13 章:市场估计与预测:按配销通路,2021-2034 年

- 主要趋势

- 在线的

- 电子商务

- 公司网站

- 离线

- 百货公司

- 大卖场/超市

- 专业零售商

- 其他的

第 14 章:市场估计与预测:按地区,2021-2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第 15 章:公司简介

- Arcelik

- BSH

- Electrolux

- Gree

- Haier

- Hisense

- Hitachi

- LG

- Liebherr

- Midea

- Panasonic

- Samsung

- Sharp

- Toshiba

- Whirlpool

The Global Household Refrigerators and Freezers Market was valued at USD 119.1 billion in 2024 and is estimated to grow at a CAGR of 5% to reach USD 193.5 billion by 2034.

Increasing consumer awareness about environmental sustainability and rising electricity costs are fueling the demand for energy-efficient home appliances. Consumers are now prioritizing appliances that offer advanced energy-saving capabilities without compromising on performance. This trend is further strengthened by growing government initiatives and regulatory policies promoting eco-friendly products. Simultaneously, households are adopting smart technologies that provide greater control and convenience. Modern refrigerators now come equipped with features like touchscreen panels, virtual assistant compatibility, and wireless connectivity, which allow users to manage storage, monitor inventory, and access integrated services remotely. The merging of smart homes with connected appliances continues to reshape the market landscape, reflecting shifting preferences for comfort, efficiency, and real-time responsiveness.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $119.1 Billion |

| Forecast Value | $193.5 Billion |

| CAGR | 5% |

The top-mounted refrigerators segment generated USD 51.9 billion in 2024, maintaining its leading position in the market. These models, which place the freezer compartment above the main refrigerator section, remain popular for their affordability and space-saving design. Their lower price point makes them an ideal option for value-driven consumers across developed and emerging regions. Compactness, ease of use, and consistent performance continue to support their strong market presence.

The offline distribution channel segment held 78.4% share in 2024. In-store shopping allows buyers to physically inspect appliances, assess features, and make informed decisions with the guidance of trained sales staff. Consumers place significant value on personal assistance, immediate product demonstrations, and the added convenience of services such as delivery, installation, and maintenance, all of which are better facilitated through brick-and-mortar stores. This immersive, service-driven retail experience plays a major role in maintaining offline leadership in the appliance segment.

U.S. Household Refrigerators and Freezers Market held 74.9% share in 2024. Strong consumer purchasing power and a rising preference for premium, high-performance home appliances are driving adoption. The integration of intelligent home ecosystems is accelerating demand for refrigerators with smart features such as app control, energy monitoring, and digital interfaces. U.S. consumers are also highly responsive to innovations that align with sustainability goals, supporting the growth of energy-efficient models.

Major companies active in the Global Household Refrigerators and Freezers Market include Toshiba, Samsung, Whirlpool, Gree, Panasonic, LG, Midea, Haier, Arcelik, Liebherr, Hisense, BSH, Sharp, Hitachi, and Electrolux. Companies in the household refrigerators and freezers market are focusing on product innovation, sustainability, and digital integration to solidify their competitive position. Many brands are expanding their smart appliance portfolios by embedding IoT capabilities, AI-based inventory tracking, and mobile connectivity. To meet regulatory standards and consumer demand for eco-friendly solutions, manufacturers are enhancing energy efficiency through inverter technology and environmentally friendly refrigerants. Geographic expansion, particularly into emerging markets, is another core strategy, supported by localized production and retail partnerships.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 Capacity

- 2.2.4 Structure

- 2.2.5 Cooling technology

- 2.2.6 Smart features

- 2.2.7 Finish

- 2.2.8 Price range

- 2.2.9 End use

- 2.2.10 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for energy-efficient appliances

- 3.2.1.2 Technological advancements and smart features

- 3.2.1.3 Increasing urbanization and disposable income

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Extended replacement cycles

- 3.2.2.2 Price sensitivity among consumers

- 3.2.3 Opportunities

- 3.2.3.1 Expansion in emerging market

- 3.2.3.2 Growth of smart home ecosystems

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By Product

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Trade statistics (HS code- 8418)

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Porter’s analysis

- 3.10 PESTEL analysis

- 3.11 Consumer buying behavior analysis

- 3.11.1 Purchasing patterns

- 3.11.2 Preference analysis

- 3.11.3 Regional variations in consumer behavior

- 3.11.4 Impact of e-commerce on buying decisions

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Product, 2021-2034 (USD Billion) (Million Units)

- 5.1 Key trends

- 5.2 Top mounted refrigerators

- 5.3 Bottom mounted refrigerators

- 5.4 Side-by-side refrigerators

- 5.5 French door refrigerators

Chapter 6 Market Estimates & Forecast, By Capacity, 2021-2034 (USD Billion) (Million Units)

- 6.1 Key trends

- 6.2 Less than 15 cu. Ft.

- 6.3 16 cu. Ft to 30 cu. Ft.

- 6.4 More than 30 cu. Ft.

Chapter 7 Market Estimates & Forecast, By Structure, 2021-2034 (USD Billion) (Million Units)

- 7.1 Key trends

- 7.2 Built-in

- 7.3 Freestanding

- 7.4 Counter-depth

- 7.5 Compact/Mini

- 7.6 Side-by-side

- 7.7 Others (French door, top freezer, bottom freezer etc.)

Chapter 8 Market Estimates & Forecast, By Cooling technology, 2021-2034 (USD Billion) (Million Units)

- 8.1 Key trends

- 8.2 Direct cool

- 8.3 Frost-free

- 8.4 Inverter compressor

- 8.5 Dual evaporator

- 8.6 Thermoelectric

Chapter 9 Market Estimates & Forecast, By Smart features, 2021-2034 (USD Billion) (Million Units)

- 9.1 Key trends

- 9.2 Wi-Fi enabled

- 9.3 App-controlled

- 9.4 Voice assistant integration

- 9.5 Others (touchscreen display, internal camera etc.)

Chapter 10 Market Estimates & Forecast, By Finish, 2021-2034 (USD Billion) (Million Units)

- 10.1 Stainless steel

- 10.2 Matte black

- 10.3 Glass door

- 10.4 Others (retro, custom etc.)

Chapter 11 Market Estimates & Forecast, By Price Range, 2021-2034 (USD Billion) (Million Units)

- 11.1 Key trends

- 11.2 Low

- 11.3 Medium

- 11.4 High

Chapter 12 Market Estimates & Forecast, By End use, 2021-2034 (USD Billion) (Million Units)

- 12.1 Key trends

- 12.2 Residential

- 12.3 Commercial

Chapter 13 Market Estimates & Forecast, By Distribution Channel, 2021-2034 (USD Billion) (Million Units)

- 13.1 Key trends

- 13.2 Online

- 13.2.1 E-commerce

- 13.2.2 Company websites

- 13.3 Offline

- 13.3.1 Departmental stores

- 13.3.2 Hypermarkets/supermarkets

- 13.3.3 Specialty retailers

- 13.3.4 Others

Chapter 14 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Million Units)

- 14.1 Key trends

- 14.2 North America

- 14.2.1 U.S.

- 14.2.2 Canada

- 14.3 Europe

- 14.3.1 Germany

- 14.3.2 UK

- 14.3.3 France

- 14.3.4 Spain

- 14.3.5 Italy

- 14.4 Asia Pacific

- 14.4.1 China

- 14.4.2 Japan

- 14.4.3 India

- 14.4.4 Australia

- 14.4.5 South Korea

- 14.5 Latin America

- 14.5.1 Brazil

- 14.5.2 Mexico

- 14.5.3 Argentina

- 14.6 Middle East and Africa

- 14.6.1 South Africa

- 14.6.2 Saudi Arabia

- 14.6.3 UAE

Chapter 15 Company Profiles

- 15.1 Arcelik

- 15.2 BSH

- 15.3 Electrolux

- 15.4 Gree

- 15.5 Haier

- 15.6 Hisense

- 15.7 Hitachi

- 15.8 LG

- 15.9 Liebherr

- 15.10 Midea

- 15.11 Panasonic

- 15.12 Samsung

- 15.13 Sharp

- 15.14 Toshiba

- 15.15 Whirlpool