|

市场调查报告书

商品编码

1844341

注塑机市场机会、成长动力、产业趋势分析及2025-2034年预测Injection Molding Machine Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

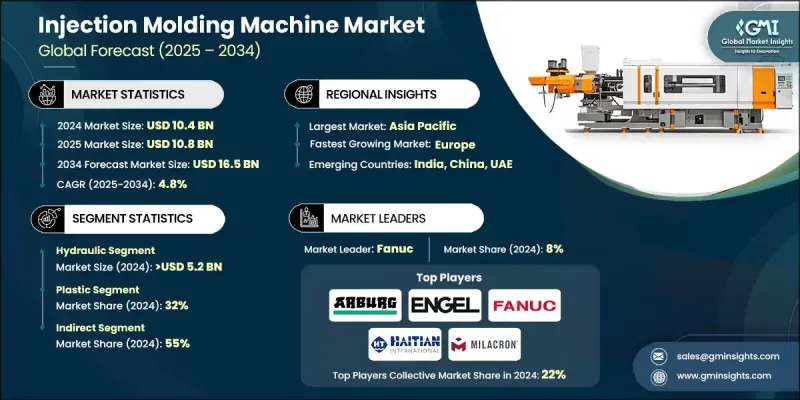

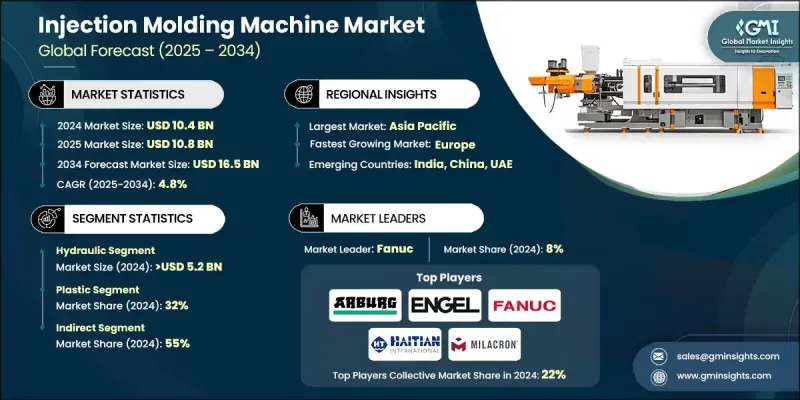

2024 年全球注塑机市场价值为 104 亿美元,预计到 2034 年将以 4.8% 的复合年增长率增长至 165 亿美元。

市场成长的动力来自于各主要製造业对轻量化和高性能塑胶零件日益增长的需求。各行各业正在转向能够提高效率和降低营运成本的材料。例如,在运输和航太,更轻的零件意味着更好的燃油经济性并减少排放。注塑机在这里发挥着至关重要的作用,它在生产既耐用又轻便的复杂零件时提供精确度和可重复性。随着最终用途应用的设计密集度越来越高,製造商正在转向提供更高精度、更快循环时间以及与新型聚合物相容的机器。对完美产出和快速交付的日益重视使得新一代机器成为必不可少的升级。该公司现在正在投资能够处理复杂模具和各种材料的先进技术,确保可靠的性能和最大限度地减少缺陷。使用复杂轻质材料的趋势继续塑造对尖端注塑机的需求,使其成为现代製造策略的基本组成部分。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 104亿美元 |

| 预测值 | 165亿美元 |

| 复合年增长率 | 4.8% |

2024年,液压注塑机市场规模达到52亿美元,预计2034年将以4.8%的复合年增长率成长。由于可靠性高且初始成本较低,这类机器仍受到生产更大、更重部件的青睐。儘管成长速度适中,但由于应用广泛,它们仍占据着强劲地位。然而,电动注塑机正日益受到青睐,其优势包括更高的能源效率、更高的精度、更低的噪音水平和更低的维护要求,这些优势吸引了注重永续性和营运效率的製造商。

2024年,塑胶材料市场占据32%的市场份额,预计2025年至2034年的复合年增长率为4.4%。塑胶持续占据主导地位,得益于其多功能性、易成型性以及在消费品、包装和汽车零件等应用领域日益增长的需求。塑胶的轻量化和成本效益使其成为产品设计和量产对获利能力至关重要的行业的首选。

美国注塑机市场占76%的市场份额,2024年市场规模达21.5亿美元。该地区的成长与医疗保健、汽车和包装等行业密切相关,这些行业正转向轻量化、精密的塑胶零件。越来越多的企业正在用现代化的机器替换老旧设备,以提高生产力和产品品质。电动和混合动力机器的普及率激增,反映了自动化和效率在该地区製造业中日益重要的角色。

推动全球注塑机产业进步的关键参与者包括米拉克龙、海天国际、恩格尔、JSW、克劳斯玛菲、伊之密、发那科、日精树脂工业、住友、芝浦机械、东洋机械金属、威猛巴顿菲尔、阿博格、赫斯基注塑系统和震雄控股。这些公司始终专注于创新、自动化和系统整合。注塑机市场的顶尖公司专注于采用智慧製造技术和自动化来提高生产效率。对节能和全电动车型的投资大幅增长,满足了对永续解决方案日益增长的需求。企业正在不断扩展其产品线以支援复杂的应用,特别是在医疗设备和电子产品等高精度领域。策略伙伴关係和协作有助于企业针对特定区域需求开发在地化解决方案。关键参与者还在升级数位介面、整合物联网并提供远端监控功能,以提供更好的机器诊断并减少停机时间。

目录

第一章:方法论与范围

第 2 章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商概况

- 利润率

- 每个阶段的增值

- 影响价值链的因素

- 产业衝击力

- 成长动力

- 对轻量复杂塑胶零件的需求

- 对更快生产和效率的需求日益增长

- 产业陷阱与挑战

- 初期投资和营运成本高

- 熟练劳动力短缺

- 机会

- 采用工业4.0和智慧製造

- 电动和混合动力注塑机的成长

- 成长动力

- 成长潜力分析

- 未来市场趋势

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 按机器类型

- 监管格局

- 标准和合规性要求

- 区域监理框架

- 认证标准

- 贸易统计

- 主要进口国

- 主要出口国

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:依机器类型,2021 - 2034 年

- 主要趋势

- 油压

- 电的

- 杂交种

第六章:市场估计与预测:按材料类型,2021 - 2034 年

- 主要趋势

- 塑胶

- 橡皮

- 金属

- 陶瓷製品

第七章:市场估计与预测:按运营,2021 - 2034

- 主要趋势

- 自动的

- 半自动

- 手动的

第八章:市场估计与预测:按註射压力,2021 - 2034 年

- 主要趋势

- 低于 1000 巴

- 1000-2500巴之间

- 2500巴以上

第九章:市场估计与预测:依产能,2021 - 2034

- 主要趋势

- 500吨以下

- 500-1000吨之间

- 1000吨以上

第 10 章:市场估计与预测:依最终用途,2021 年至 2034 年

- 主要趋势

- 汽车与运输

- 建造

- 消费品

- 包装

- 电气和电子产品

第 11 章:市场估计与预测:按配销通路,2021 年至 2034 年

- 主要趋势

- 直销

- 间接销售

第 12 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十三章:公司简介

- Arburg

- Chen Hsong Holdings

- ENGEL

- Fanuc

- Haitian International

- Husky Injection Molding Systems

- JSW

- KraussMaffei

- Milacron

- Nissei Plastic Industrial

- Shibaura Machine

- Sumitomo

- Toyo Machinery & Metal

- Wittmann Battenfeld

- Yizumi

The Global Injection Molding Machine Market was valued at USD 10.4 billion in 2024 and is estimated to grow at a CAGR of 4.8% to reach USD 16.5 billion by 2034.

Market growth is propelled by the increasing demand for lightweight and high-performance plastic components across key manufacturing sectors. Industries are shifting toward materials that enhance efficiency and cut down on operational costs. In transportation and aerospace, for instance, lighter parts translate into better fuel economy and reduced emissions. Injection molding machines play a critical role here, offering precision and repeatability in producing complex parts that are both durable and lightweight. As end-use applications become more design-intensive, manufacturers are turning to machines that offer higher precision, faster cycle times, and compatibility with newer polymers. The growing emphasis on flawless output and rapid delivery has made newer-generation machines an essential upgrade. Companies are now investing in advanced technologies that can handle intricate molds and varied materials, ensuring reliable performance and minimized defects. The trend toward using complex, lightweight materials continues to shape the demand for cutting-edge injection molding machinery, making it a fundamental part of modern manufacturing strategies.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $10.4 Billion |

| Forecast Value | $16.5 Billion |

| CAGR | 4.8% |

The hydraulic injection molding machines segment reached USD 5.2 billion in 2024 and is expected to grow at a CAGR of 4.8% through 2034. These machines remain favored for producing larger and heavier components due to their reliability and lower initial cost. Although their growth is moderate, they still hold a strong position due to widespread usage. However, electric injection molding machines are gaining traction, offering benefits like improved energy efficiency, higher accuracy, reduced noise levels, and lower maintenance requirements, which appeal to manufacturers focused on sustainability and operational efficiency.

The plastic materials segment held a 32% share in 2024 and is forecast to grow at a CAGR of 4.4% from 2025 to 2034. The continued dominance of plastic is tied to its versatility, ease of molding, and rising demand across applications like consumer goods, packaging, and automotive components. Its lightweight nature and cost-effectiveness make it the go-to choice in industries where product design and mass production play a critical role in profitability.

U.S. Injection Molding Machine Market held a 76% share and generated USD 2.15 billion in 2024. The growth in this region is closely linked to industries such as healthcare, automotive, and packaging that are shifting toward lightweight, precision plastic parts. Companies are increasingly replacing older equipment with modern machines that improve productivity and output quality. The surge in adoption of electric and hybrid machines reflects the expanding role of automation and efficiency in manufacturing across the region.

Key players driving advancements in the Global Injection Molding Machine Industry include Milacron, Haitian International, ENGEL, JSW, KraussMaffei, Yizumi, Fanuc, Nissei Plastic Industrial, Sumitomo, Shibaura Machine, Toyo Machinery & Metal, Wittmann Battenfeld, Arburg, Husky Injection Molding Systems, and Chen Hsong Holdings. These companies are consistently focused on innovation, automation, and system integration. Top companies in the injection molding machine market are focused on adopting smart manufacturing technologies and automation to improve production efficiency. Investment in energy-efficient and all-electric models has grown significantly, meeting increasing demand for sustainable solutions. Firms are continuously expanding their product lines to support complex applications, especially in high-precision sectors like medical devices and electronics. Strategic partnerships and collaborations help companies develop localized solutions for specific regional demands. Key players are also upgrading digital interfaces, integrating IoT, and offering remote monitoring capabilities to provide better machine diagnostics and reduce downtime.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Machine type

- 2.2.3 Material type

- 2.2.4 Operation

- 2.2.5 Injection pressure

- 2.2.6 Capacity

- 2.2.7 End use

- 2.2.8 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Demand for lightweight and complex plastic parts

- 3.2.1.2 Growing need for faster production and efficiency

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High initial investment and operational costs

- 3.2.2.2 Skilled labor shortage

- 3.2.3 Opportunities

- 3.2.3.1 Adoption of industry 4.0 and smart manufacturing

- 3.2.3.2 Growth in electric and hybrid injection molding machines

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and Innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By machine type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Trade Statistics

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Porter’s analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates & Forecast, By Machine Type, 2021 - 2034 ($Billion, Thousand Units)

- 5.1 Key trends

- 5.2 Hydraulic

- 5.3 Electric

- 5.4 Hybrid

Chapter 6 Market Estimates & Forecast, By Material Type, 2021 - 2034 ($Billion, Thousand Units)

- 6.1 Key trends

- 6.2 Plastic

- 6.3 Rubber

- 6.4 Metal

- 6.5 Ceramic

Chapter 7 Market Estimates & Forecast, By Operation, 2021 - 2034 ($Billion, Thousand Units)

- 7.1 Key trends

- 7.2 Automatic

- 7.3 Semi-automatic

- 7.4 Manual

Chapter 8 Market Estimates & Forecast, By Injection Pressure, 2021 - 2034 ($Billion, Thousand Units)

- 8.1 Key trends

- 8.2 Below 1000 Bar

- 8.3 Between 1000-2500 Bar

- 8.4 Above 2500 Bar

Chapter 9 Market Estimates & Forecast, By Capacity, 2021 - 2034 ($Billion, Thousand Units)

- 9.1 Key trends

- 9.2 Below 500 tons

- 9.3 Between 500-1,000 tons

- 9.4 Above 1,000 tons

Chapter 10 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Billion, Thousand Units)

- 10.1 Key trends

- 10.2 Automotive & Transportation

- 10.3 Construction

- 10.4 Consumer Goods

- 10.5 Packaging

- 10.6 Electrical & electronics

Chapter 11 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 ($Billion, Thousand Units)

- 11.1 Key trends

- 11.2 Direct sales

- 11.3 Indirect sales

Chapter 12 Market Estimates & Forecast, By Region, 2021 - 2034 ($Billion, Thousand Units)

- 12.1 Key trends

- 12.2 North America

- 12.2.1 U.S.

- 12.2.2 Canada

- 12.3 Europe

- 12.3.1 Germany

- 12.3.2 UK

- 12.3.3 France

- 12.3.4 Spain

- 12.3.5 Italy

- 12.3.6 Netherlands

- 12.4 Asia Pacific

- 12.4.1 China

- 12.4.2 Japan

- 12.4.3 India

- 12.4.4 Australia

- 12.4.5 South Korea

- 12.5 Latin America

- 12.5.1 Brazil

- 12.5.2 Mexico

- 12.5.3 Argentina

- 12.6 Middle East and Africa

- 12.6.1 South Africa

- 12.6.2 Saudi Arabia

- 12.6.3 UAE

Chapter 13 Company Profiles

- 13.1 Arburg

- 13.2 Chen Hsong Holdings

- 13.3 ENGEL

- 13.4 Fanuc

- 13.5 Haitian International

- 13.6 Husky Injection Molding Systems

- 13.7 JSW

- 13.8 KraussMaffei

- 13.9 Milacron

- 13.10 Nissei Plastic Industrial

- 13.11 Shibaura Machine

- 13.12 Sumitomo

- 13.13 Toyo Machinery & Metal

- 13.14 Wittmann Battenfeld

- 13.15 Yizumi