|

市场调查报告书

商品编码

1844343

基于 LTE 和 5G NR 的 CBRS 网路市场机会、成长动力、产业趋势分析和 2025 - 2034 年预测LTE and 5G NR-based CBRS Networks Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

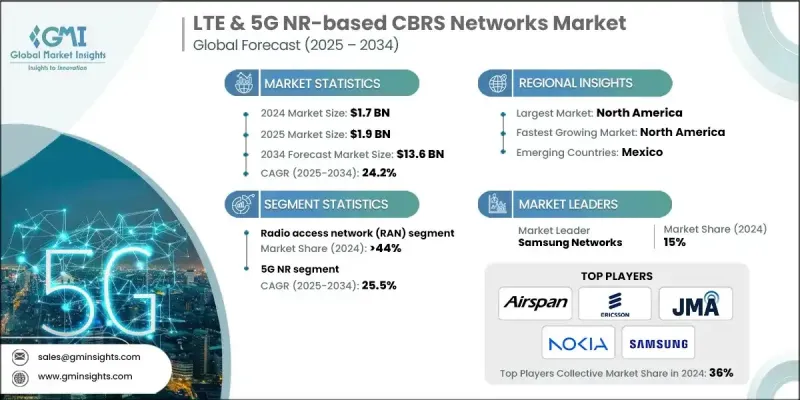

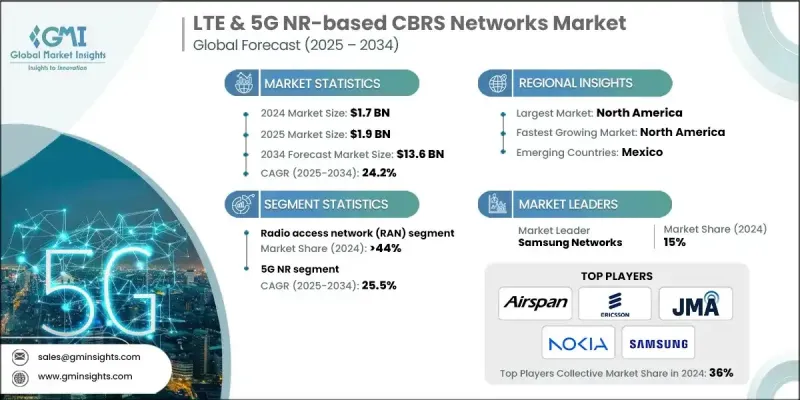

2024 年全球基于 LTE 和 5G NR 的 CBRS 网路市场价值为 17 亿美元,预计到 2034 年将以 24.2% 的复合年增长率增长至 136 亿美元。

製造业、物流业、港口和大型园区等企业正越来越多地转向私有LTE和5G NR网络,以满足日益增长的高速、低延迟和安全通讯需求。 CBRS提供3.5 GHz(3550至3700 MHz)中频频谱接入,为企业提供了一种经济实惠的替代方案,以取代昂贵的授权频谱。随着数位转型的加速,基于CBRS的私有蜂窝网路的使用持续成长。企业看到了部署客製化无线网路以实现园区行动化、工业自动化和固定无线存取的显着优势。各行各业正在进行试验和即时部署,以验证用例并证明CBRS网路的成本效益。中立主机解决方案、室内覆盖应用以及由SAS提供者管理的共享频谱存取的不断发展,进一步增强了市场发展势头。儘管面临联邦协调、干扰风险和成本方面的挑战,但市场前景仍然强劲。产业和监管机构正在努力解决这些障碍,而科技的进步也正在加快部署速度并扩大企业应用范围。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 17亿美元 |

| 预测值 | 136亿美元 |

| 复合年增长率 | 24.2% |

2024年,无线接取网路 (RAN) 市场占有 44% 的份额。 RAN 元件(包括小型和大型基地台)对于将使用者装置连接到核心网络,同时提供一致的室内外覆盖至关重要。三星、诺基亚和爱立信等供应商的硬体支援波束成形和动态频谱分配等功能,可提升网路效能并降低延迟。企业利用 RAN 系统建立可扩展且安全的网络,以处理密集流量和低延迟应用。

预计到2034年,5G NR细分市场的复合年增长率将达到25.5%。该细分市场的强劲表现得益于其能够提供超低延迟、更高容量以及支援网路切片。在自主系统、扩增实境、机器人技术和智慧自动化等新兴技术领域,企业越来越青睐5G NR而非LTE。 5G NR还支援高效的频谱利用,并透过集中管理实现跨站点的无缝扩展。这使得它对于寻求性能驱动且面向未来的架构的网路的行业尤其具有吸引力。

2024年,美国基于LTE和5G NR的CBRS网路市场规模达7.255亿美元。美国联邦通讯委员会(FCC)的结构化频谱共享框架允许联邦用户和商业用户在三个存取层级下共存:现有用户、优先接取授权(PAL)和通用授权接取(GAA)。此模式使企业能够更灵活地使用频谱,同时确保关键用户的保护,从而促进创新。各大业者持续投资扩展以CBRS为基础的基础设施,以改善网路覆盖范围,增强服务弹性,并在共享频谱资源充足的高需求区域分担行动流量。

塑造基于 LTE 和 5G NR 的 CBRS 网路市场的关键公司包括康普、诺基亚、Airspan、康卡斯特、JMA Wireless、亚马逊网路服务、思科、Radisys、三星和爱立信。这些参与者正在采取有针对性的策略来巩固其市场地位,例如推出交钥匙专用网路解决方案、整合边缘运算和人工智慧功能以及扩大生态系统合作伙伴关係。他们正在投资软体定义平台,这些平台提供集中管理并与企业 IT 系统无缝互通。一些公司也参与监管合作,以影响频谱政策并改善 SAS 协调,旨在最大限度地减少干扰并简化部署。他们的重点仍然是开发强大、可扩展且与应用程式无关的 CBRS 解决方案,以满足不断变化的企业连接需求。

目录

第一章:方法论

- 市场范围和定义

- 研究设计

- 研究方法

- 资料收集方法

- 资料探勘来源

- 全球的

- 地区/国家

- 基础估算与计算

- 基准年计算

- 市场评估的主要趋势

- 初步研究和验证

- 主要来源

- 预报

- 研究假设和局限性

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 利润率分析

- 成本结构

- 每个阶段的增值

- 影响价值链的因素

- 中断

- 产业衝击力

- 成长动力

- 私有 LTE 和 5G NR 网路的采用率不断上升

- 有线电视营运商增加 CBRS 小型基地台部署

- 投资便携式私有5G解决方案

- SAS 和 CBRS 2.0 的进步

- 企业对私人无线网路的兴趣日益浓厚

- 产业陷阱与挑战

- 干扰联邦现任官员

- 协调复杂性和营运成本

- 市场机会

- 不断发展的工业物联网和企业园区网络

- MVNO 卸载和二次载波聚合

- 与私有 5G 解决方案集成

- 成长动力

- 成长潜力分析

- 监管格局

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL分析

- 技术成熟度评估框架

- 当前的技术趋势

- 新兴技术

- 成本结构分析

- 专利分析

- 各地区专利申请情形(2021-2025 年)

- CBRS 特定的 SEP 类别

- 重要新闻和倡议

- 永续性和 ESG 影响评估

- 环境影响分析和指标

- 社会影响考量和指标

- 治理与合规框架

- ESG 投资含义与财务影响

- 用例和应用

- 最佳情况

- 投资和融资格局

- CBRS/私人5G领域的创投与私募股权投资

- 政府补助、奖励和补贴

- 资金对部署速度和创新的影响

- 市场进入和商业策略

- 服务捆绑策略(FWA、IoT、企业套餐)

- 行销和客户获取策略

第四章:竞争格局

- 介绍

- 公司市占率分析

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 多边环境协定

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 战略展望矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划和资金

第五章:市场估计与预测:依基础设施子市场,2021 - 2034 年

- 主要趋势

- 无线接取网路(RAN)

- 移动核心

- 交通网络

- 小型蜂巢 RU(无线电单元)

- 分散式和集中式基频单元(DU/CU)

第六章:市场估计与预测:按空中介面技术,2021 - 2034 年

- 主要趋势

- LTE

- 5G NR

第七章:市场估计与预测:按细胞,2021 - 2034

- 主要趋势

- 室内小型基地台

- 室外小型基地台

第 8 章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 行动网路密集化

- 固定无线接入(FWA)

- 有线电视营运商和新进入者

- 中立主机

- 私人蜂窝网络

- 教育

- 政府和市政当局

- 卫生保健

- 製造业

- 军队

- 矿业

- 石油和天然气

- 零售和酒店

- 其他的

第九章:市场估计与预测:按频段,2021 - 2034

- 主要趋势

- 低于 2.3 GHz

- 2.3-2.6 GHz

- 3.3-3.6 GHz

- 3.55-3.7 GHz

- 3.7-3.8 GHz

- 3.8-4.2 GHz

- 4.6-4.9 GHz

- 20 GHz以上

第 10 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 北欧人

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 东南亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 多边环境协定

- 南非

- 沙乌地阿拉伯

- 阿联酋

第 11 章:公司简介

- 全球参与者

- Airspan

- Amazon Web Services

- AT&T

- Charter Communications

- Cisco Systems

- Comcast

- CommScope

- Ericsson

- HPE

- Huawei

- Intel

- JMA Wireless

- Microsoft Azure

- NEC

- Nokia

- Qualcomm

- Samsung

- Sony

- T-Mobile

- Verizon Communications

- 区域参与者

- ZTE

- Baicells

- Fujitsu

- 新兴参与者/颠覆者

- Altiostar

- Federated Wireless

- Mavenir

- Radisys

The Global LTE & 5G NR-based CBRS Networks Market was valued at USD 1.7 billion in 2024 and is estimated to grow at a CAGR of 24.2% to reach USD 13.6 billion by 2034.

Enterprises across manufacturing, logistics, ports, and large campuses are increasingly turning to private LTE and 5G NR networks to meet the growing need for high-speed, low-latency, secure communication. CBRS offers access to mid-band spectrum in the 3.5 GHz range (3550 to 3700 MHz), giving organizations an affordable alternative to costly licensed spectrum. As digital transformation accelerates, the use of private cellular networks over CBRS continues to expand. Businesses see clear benefits in deploying tailored wireless networks for campus mobility, industrial automation, and fixed wireless access. Trials and live deployments are underway across industries, validating use cases and proving the cost-efficiency of CBRS networks. Market momentum is further supported by the evolution of neutral-host solutions, indoor coverage applications, and shared spectrum access managed by SAS providers. Despite challenges around federal coordination, interference risks, and cost, the market outlook remains strong. Industry and regulatory efforts continue to address these barriers, while advancements in technology are enabling faster rollouts and broader enterprise adoption.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.7 Billion |

| Forecast Value | $13.6 Billion |

| CAGR | 24.2% |

In 2024, the radio access network (RAN) segment held a 44% share. RAN components, including small and macro cell radios, are essential for connecting user devices to the core network while delivering consistent indoor and outdoor coverage. With support for features like beamforming and dynamic spectrum allocation, hardware from vendors such as Samsung, Nokia, and Ericsson enhances network performance while reducing latency. Enterprises utilize RAN systems to build scalable and secure networks capable of handling intensive traffic and low-latency applications.

The 5G NR segment is forecast to grow at a CAGR of 25.5% through 2034. The segment's strong performance is attributed to its ability to deliver ultra-low latency, higher capacity, and support for network slicing. Enterprises increasingly favor 5G NR over LTE for emerging technologies such as autonomous systems, augmented reality, robotics, and smart automation. 5G NR also supports efficient spectrum use and seamless scaling across multiple sites with centralized management. This makes it particularly attractive to industries seeking performance-driven networks with future-ready architecture.

United States LTE & 5G NR-based CBRS Networks Market generated USD 725.5 million in 2024. The FCC's structured spectrum-sharing framework has allowed the coexistence of federal and commercial users under three access tiers: Incumbent, Priority Access License (PAL), and General Authorized Access (GAA). This model fosters innovation by enabling enterprises to use spectrum more flexibly while maintaining protection for critical users. Major operators continue to invest in expanding CBRS-based infrastructure to improve network coverage, enhance service flexibility, and offload mobile traffic in high-demand areas where shared spectrum is readily available.

Key companies shaping the LTE & 5G NR-based CBRS Networks Market include Commscope, Nokia, Airspan, Comcast, JMA Wireless, Amazon Web Services, Cisco, Radisys, Samsung, and Ericsson. These players are using targeted strategies to strengthen their market position, such as launching turnkey private network solutions, integrating edge computing and AI capabilities, and expanding ecosystem partnerships. They are investing in software-defined platforms that offer centralized management and seamless interoperability with enterprise IT systems. Some companies are also engaging in regulatory collaborations to influence spectrum policy and improve SAS coordination, aiming to minimize interference and streamline deployments. Their focus remains on developing robust, scalable, and application-agnostic CBRS solutions that can meet the evolving demands of enterprise connectivity.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Infrastructure submarkets

- 2.2.3 Air interface technology

- 2.2.4 Cells

- 2.2.5 Application

- 2.2.6 Frequency band

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising adoption of private LTE and 5G NR networks

- 3.2.1.2 Increasing CBRS small cell deployments by cable operators

- 3.2.1.3 Investment in portable private 5G solutions

- 3.2.1.4 Advancements in SAS and CBRS 2.0

- 3.2.1.5 Growing enterprise interest in private wireless networks

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Interference near federal incumbents

- 3.2.2.2 Coordination complexity and operational costs

- 3.2.3 Market opportunities

- 3.2.3.1 Growing industrial IoT and enterprise campus networks

- 3.2.3.2 MVNO offload and secondary carrier aggregation

- 3.2.3.3 Integration with private 5G solutions

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter’s analysis

- 3.6 PESTEL analysis

- 3.7 Technology maturity assessment framework

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Cost structure analysis

- 3.9 Patent analysis

- 3.9.1 Patent applications by region (2021-2025)

- 3.9.2 CBRS-Specific SEP categories

- 3.10 Key News and Initiatives

- 3.11 Sustainability and ESG impact assessment

- 3.11.1 Environmental impact analysis and metrics

- 3.11.2 Social impact considerations and metrics

- 3.11.3 Governance and compliance framework

- 3.11.4 ESG investment implications and financial impact

- 3.12 Use cases and applications

- 3.13 Best-case scenario

- 3.14 Investment and funding landscape

- 3.14.1. Venture capital and private equity investments in CBRS/Private 5 G

- 3.14.2 Government grants, incentives, and subsidies

- 3.14.3 Impact of funding on deployment speed and innovation

- 3.15 Go-to-market and commercial strategies

- 3.15.1 Service bundling strategies (FWA, IoT, Enterprise Packages)

- 3.15.2 Marketing & customer acquisition strategies

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Infrastructure Submarkets, 2021 - 2034 ($Mn)

- 5.1 Key trends

- 5.2 Radio Access Network (RAN)

- 5.3 Mobile core

- 5.4 Transport network

- 5.5 Small Cell RUs (Radio Units)

- 5.6 Distributed & Centralized Baseband Units (DUs/CUs)

Chapter 6 Market Estimates & Forecast, By Air Interface Technology, 2021 - 2034 ($Mn)

- 6.1 Key trends

- 6.2 LTE

- 6.3 5G NR

Chapter 7 Market Estimates & Forecast, By Cells, 2021 - 2034 ($Mn)

- 7.1 Key trends

- 7.2 Indoor small cells

- 7.3 Outdoor small cells

Chapter 8 Market Estimates & Forecast, By Application, 2021 - 2034 ($Mn)

- 8.1 Key trends

- 8.2 Mobile network densification

- 8.3 Fixed Wireless Access (FWA)

- 8.4 Cable operators & new entrants

- 8.5 Neutral hosts

- 8.6 Private cellular networks

- 8.6.1 Education

- 8.6.2 Governments & municipalities

- 8.6.3 Healthcare

- 8.6.4 Manufacturing

- 8.6.5 Military

- 8.6.6 Mining

- 8.6.7 Oil & gas

- 8.6.8 Retail & hospitality

- 8.6.9 Others

Chapter 9 Market Estimates & Forecast, By Frequency Band, 2021 - 2034 ($Mn)

- 9.1 Key trends

- 9.2 Below 2.3 GHz

- 9.3 2.3-2.6 GHz

- 9.4 3.3-3.6 GHz

- 9.5 3.55-3.7 GHz

- 9.6 3.7-3.8 GHz

- 9.7 3.8-4.2 GHz

- 9.8 4.6-4.9 GHz

- 9.9 Above 20 GHz

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 US

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Nordics

- 10.3.7 Russia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Southeast Asia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Global Players

- 11.1.1 Airspan

- 11.1.2 Amazon Web Services

- 11.1.3 AT&T

- 11.1.4 Charter Communications

- 11.1.5 Cisco Systems

- 11.1.6 Comcast

- 11.1.7 CommScope

- 11.1.8 Ericsson

- 11.1.9 Google

- 11.1.10 HPE

- 11.1.11 Huawei

- 11.1.12 Intel

- 11.1.13 JMA Wireless

- 11.1.14 Microsoft Azure

- 11.1.15 NEC

- 11.1.16 Nokia

- 11.1.17 Qualcomm

- 11.1.18 Samsung

- 11.1.19 Sony

- 11.1.20 T-Mobile

- 11.1.21 Verizon Communications

- 11.2 Regional Players

- 11.2.1 ZTE

- 11.2.2 Baicells

- 11.2.3 Fujitsu

- 11.3 Emerging Players / Disruptors

- 11.3.1 Altiostar

- 11.3.2 Federated Wireless

- 11.3.3 Mavenir

- 11.3.4 Radisys