|

市场调查报告书

商品编码

1844345

心室辅助装置市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Ventricular Assist Devices Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

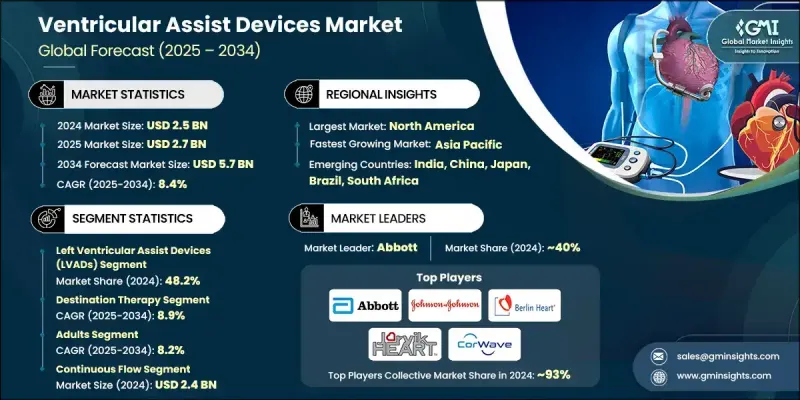

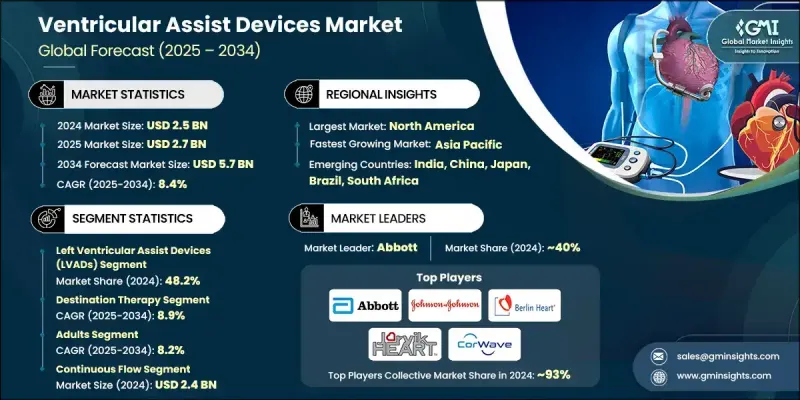

2024 年全球心室辅助装置市场价值为 25 亿美元,预计到 2034 年将以 8.4% 的复合年增长率增长至 57 亿美元。

市场成长的驱动力在于心血管疾病和心臟衰竭盛行率的不断上升,加上患者意识的不断增强以及心臟捐赠者的持续短缺。由于心臟移植数量仍然有限,心室辅助装置 (VAD) 已成为长期支持和移植前过渡病例的重要替代方案。技术的快速发展提高了临床性能和用户安全性,从而提高了患者存活率并使其在全球范围内得到更广泛的应用。植入式技术、材料科学和数位健康整合方面的进步,正在支持其在重症监护和门诊环境中的广泛应用。微型化和生物相容性的组件,结合无线监控和远端诊断等智慧功能,正在帮助心室辅助装置从侵入性机械支援转变为智慧心臟护理系统。随着新兴市场和已开发市场都在不断提升其心臟护理能力,心室辅助装置在心臟衰竭综合治疗中发挥越来越重要的作用,尤其是在单靠药物治疗无法奏效的情况下。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 25亿美元 |

| 预测值 | 57亿美元 |

| 复合年增长率 | 8.4% |

到2034年,右心室辅助装置 (RVAD) 市场将以9.4%的复合年增长率成长。其需求的增长与右心併发症患者数量的增加以及先进心臟治疗中对专业心室支持的需求密切相关。随着紧凑型设备架构和降低排斥风险的材料的不断改进,RVAD 在需要针对性干预的复杂心臟手术中越来越受欢迎。这些设备现在更适用于移植桥接手术和短期復健应用,从而增强了它们在多种护理途径中的相关性。

2024年,医院市场占据43.1%的份额,预计到2034年将达到24亿美元。医院仍然是心臟辅助装置(VAD)患者手术植入、即时监测和术后护理的中心。严重心臟衰竭病例日益增多,需要高阶干预,这推动了医院环境中设备安装的需求。此外,专业的心臟科室和训练有素的人员提高了设备部署的效率和安全性,巩固了医院的市场主导地位。现代化基础设施的配备和创新工具的日益普及,使医院系统成为VAD计画长期成功的关键因素。

由于其完善的心臟照护生态系统,美国心室辅助装置市场在2024年的估值达到13亿美元。先进的医疗设施、大量训练有素的心血管外科医生以及获得最新外科创新技术的管道,是推动心室辅助装置(VAD)应用的主要因素。美国在手术量、创新应用和植入后护理方面继续保持领先地位。凭藉健全的报销框架和高度的病患意识,美国为拓展VAD解决方案的公司提供了有利的环境。

全球心室辅助装置市场的知名企业包括 CorWave、Berlin Heart、雅培、BrioHealth、Jarvik HEART、EVAHEART 和强生。心室辅助装置市场的领先公司正致力于创新驱动型成长,开发注重小型化、无线连接和生物相容性的下一代技术。许多公司正在透过智慧材料和流动演算法来延长设备使用寿命并降低併发症风险。为了涵盖更广泛的患者群体,各公司正在投资微创植入技术和完全植入式系统。与医院和研究中心建立策略合作伙伴关係有助于推动临床试验并加快监管审批。此外,企业也透过分销联盟和外科团队培训计画进入新兴医疗市场,实现地理扩张。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 心臟衰竭和心血管疾病患者数量增加

- 技术进步

- 提高对心臟衰竭治疗的认识

- 心臟捐赠者短缺

- 产业陷阱与挑战

- 设备成本高

- 手术风险和併发症

- 市场机会

- 新兴市场的采用

- 对患者友善解决方案的需求不断增长

- 成长动力

- 成长潜力分析

- 监管格局

- 北美洲

- 欧洲

- 亚太地区

- 技术格局

- 现有技术

- 新兴技术

- 未来市场趋势

- 报销场景

- 全球心臟移植状况

- 流行病学概况

- 管道分析

- 投资前景

- 2024年定价分析

- 波特的分析

- PESTEL分析

- 差距分析

第四章:竞争格局

- 介绍

- 公司矩阵分析

- 公司市占率分析

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲和中东地区

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:按产品,2021 - 2034 年

- 主要趋势

- 左心室辅助装置(LVAD)

- 右心室辅助装置(RVAD)

- 双心室辅助装置(BIVAD)

- 经皮心室辅助装置

第六章:市场估计与预测:按应用,2021 - 2034

- 主要趋势

- 目的地疗法

- 桥接候选(BTC)治疗

- 移植前桥接(BTT)治疗

- 桥接復健(BTR)疗法

- 其他应用

第七章:市场估计与预测:按患者,2021 - 2034

- 主要趋势

- 成年人

- 儿科

第八章:市场估计与预测:按流量,2021 - 2034 年

- 主要趋势

- 脉动流

- 连续流

- 轴向连续流

- 离心连续流

第九章:市场估计与预测:依设计,2021 - 2034

- 主要趋势

- 经皮

- 可植入

第 10 章:市场估计与预测:依最终用途,2021 年至 2034 年

- 主要趋势

- 医院

- 心导管实验室

- 门诊手术中心

- 其他最终用途

第 11 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十二章:公司简介

- Abbott

- Berlin Heart

- BrioHealth

- CorWave

- EVAHEART

- Jarvik HEART

- Johnson & Johnson

The Global Ventricular Assist Devices Market was valued at USD 2.5 billion in 2024 and is estimated to grow at a CAGR of 8.4% to reach USD 5.7 billion by 2034.

Market growth is driven by the increasing prevalence of cardiovascular disorders and heart failure, coupled with growing patient awareness and the persistent shortage of heart donors. With heart transplants remaining limited, VADs have become an essential alternative for long-term support and bridge-to-transplant cases. Rapid technological evolution has enhanced both clinical performance and user safety, leading to better patient survival rates and wider global adoption. Advancements in implantable technologies, material science, and digital health integration are supporting expanded use in both critical care and outpatient settings. Miniaturized and biocompatible components, combined with smart functionalities such as wireless monitoring and remote diagnostics, are helping shift VADs from invasive mechanical supports to intelligent cardiac care systems. As both emerging and developed markets expand their cardiac care capabilities, VADs are playing an increasingly important role in comprehensive heart failure treatment, especially in cases where medical therapy alone falls short.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.5 Billion |

| Forecast Value | $5.7 Billion |

| CAGR | 8.4% |

The right ventricular assist devices (RVADs) segment will grow at a CAGR of 9.4% through 2034. Their rising demand is closely tied to the growing number of patients with right-sided heart complications and the need for specialized ventricular support in advanced cardiac therapies. With continuous enhancements in compact device architecture and materials that reduce rejection risks, RVADs are increasingly favored in complex cardiac procedures requiring targeted intervention. These devices are now more suitable for bridge-to-transplant procedures and short-term recovery applications, strengthening their relevance across multiple care pathways.

In 2024, the hospitals segment held a 43.1% share and is projected to reach USD 2.4 billion by 2034. Hospitals remain the epicenter of surgical implantation, real-time monitoring, and postoperative care for VAD patients. The increasing burden of severe heart failure cases requiring advanced intervention is fueling demand for device installation in hospital environments. Additionally, specialized cardiac units and trained personnel enhance the efficiency and safety of device deployment, reinforcing hospitals' dominant market position. The presence of modern infrastructure and growing access to innovative tools are positioning hospital systems as critical contributors to the long-term success of VAD programs.

United States Ventricular Assist Devices Market was valued at USD 1.3 billion in 2024, owing to its well-established cardiac care ecosystem. Advanced medical facilities, a large base of trained cardiovascular surgeons, and access to the latest surgical innovations are major enablers for VAD adoption. The nation continues to lead in surgical volumes, innovation uptake, and post-implantation care. With its robust reimbursement frameworks and strong patient awareness, the U.S. offers a favorable environment for companies expanding VAD solutions.

Prominent players in the Global Ventricular Assist Devices Market include CorWave, Berlin Heart, Abbott, BrioHealth, Jarvik HEART, EVAHEART, and Johnson & Johnson. Leading companies in the ventricular assist devices market are focusing heavily on innovation-driven growth by developing next-gen technologies that emphasize miniaturization, wireless connectivity, and biocompatibility. Many are enhancing device lifespans and lowering complication risks through smart materials and flow algorithms. To reach wider patient populations, firms are investing in less-invasive implantation techniques and fully implantable systems. Strategic partnerships with hospitals and research centers help drive clinical trials and accelerate regulatory approvals. Additionally, players are expanding geographically by entering emerging healthcare markets through distribution alliances and training programs for surgical teams.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Product trends

- 2.2.3 Application trends

- 2.2.4 Patient trends

- 2.2.5 Flow trends

- 2.2.6 Design trends

- 2.2.7 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increase in the number of heart failures and cardiovascular diseases

- 3.2.1.2 Technological advancements

- 3.2.1.3 Rise in awareness regarding heart failure treatment

- 3.2.1.4 Shortage of heart donors

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of devices

- 3.2.2.2 Surgical risks and complications

- 3.2.3 Market opportunities

- 3.2.3.1 Adoption in emerging markets

- 3.2.3.2 Growing demand for patient-friendly solutions

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.5 Technological landscape

- 3.5.1 Current technologies

- 3.5.2 Emerging technologies

- 3.6 Future market trends

- 3.7 Reimbursement scenario

- 3.8 Global heart transplantation scenario

- 3.9 Epidemiology landscape

- 3.10 Pipeline analysis

- 3.11 Investment landscape

- 3.12 Pricing analysis, 2024

- 3.13 Porter's analysis

- 3.14 PESTEL analysis

- 3.15 Gap analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.3.1 North America

- 4.3.2 Europe

- 4.3.3 Asia Pacific

- 4.3.4 LAMEA

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn, Units)

- 5.1 Key trends

- 5.2 Left ventricular assist devices (LVADs)

- 5.3 Right ventricular assist devices (RVADs)

- 5.4 Biventricular assist devices (BIVADs)

- 5.5 Percutaneous ventricular assist devices

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Destination therapy

- 6.3 Bridge-to-candidacy (BTC) therapy

- 6.4 Bridge-to-transplant (BTT) therapy

- 6.5 Bridge-to-recovery (BTR) therapy

- 6.6 Other applications

Chapter 7 Market Estimates and Forecast, By Patient, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Adults

- 7.3 Pediatrics

Chapter 8 Market Estimates and Forecast, By Flow, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Pulsatile flow

- 8.3 Continuous flow

- 8.3.1 Axial continuous flow

- 8.3.2 Centrifugal continuous flow

Chapter 9 Market Estimates and Forecast, By Design, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Transcutaneous

- 9.3 Implantable

Chapter 10 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 10.1 Key trends

- 10.2 Hospitals

- 10.3 Cardiac catheterization labs

- 10.4 Ambulatory surgical centers

- 10.5 Other end use

Chapter 11 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Spain

- 11.3.5 Italy

- 11.3.6 Netherlands

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 Japan

- 11.4.3 India

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 Middle East and Africa

- 11.6.1 South Africa

- 11.6.2 Saudi Arabia

- 11.6.3 UAE

Chapter 12 Company Profiles

- 12.1 Abbott

- 12.2 Berlin Heart

- 12.3 BrioHealth

- 12.4 CorWave

- 12.5 EVAHEART

- 12.6 Jarvik HEART

- 12.7 Johnson & Johnson