|

市场调查报告书

商品编码

1844353

超疏水涂层市场机会、成长动力、产业趋势分析及2025-2034年预测Superhydrophobic Coatings Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

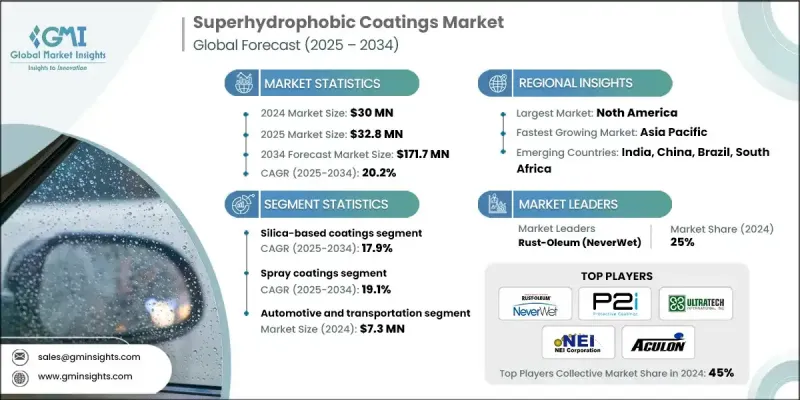

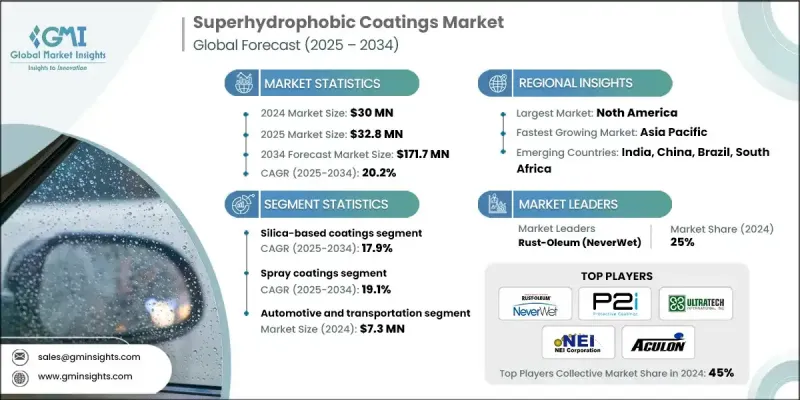

2024 年全球超疏水涂料市场价值为 3,000 万美元,预计到 2034 年将以 20.2% 的复合年增长率成长至 1.717 亿美元。

随着各行各业对防潮、防腐、防污染表面材料的需求日益增长,市场发展势头强劲。这一成长主要源自于防水电子产品的使用量不断增长、移动出行领域的防结冰应用以及向低维护太阳能电池板的转变。医疗保健行业也正在成为成长的推动力,越来越多的医疗设备整合了防液表面,以实现无菌性和长寿命。由于性能需求,防液表面最初仅限于航太和国防领域,但随着人们意识的提升和研发的不断创新,其应用范围正在再生能源、建筑和消费性电子产品领域不断扩大。人们对环境永续性的日益关注以及针对全氟烷基化合物(PFAS)的监管日益严格,正在推动无氟或生物基材料的创新,为更环保的产品配方铺平道路。在汽车、基础设施和智慧设备等高成长领域,多功能涂料具有自清洁、防污和防水等功能,这种趋势正在显着加速市场扩张。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 3000万美元 |

| 预测值 | 1.717亿美元 |

| 复合年增长率 | 20.2% |

受耐腐蚀和隐身增强涂层需求成长的推动,航太和国防领域在2024年将占据13.5%的市场份额。超疏水材料广泛应用于飞机系统、军用电子设备以及暴露于恶劣环境的设备。随着政府主导的现代化项目和日益严格的航空安全法规的实施,这些应用正在迅速增长,促使製造商采用高性能涂层技术。

预计到 2034 年,碳奈米管和石墨烯增强涂层领域的复合年增长率将达到 26.1%。这些基于奈米材料的配方具有出色的导电性、机械强度和耐腐蚀性,特别适用于性能可靠性至关重要的先进电子、航太航天和国防应用。

2024年至2034年,亚太地区超疏水涂料市场将以20.8%的复合年增长率成长,这得益于日本、韩国、印度和中国等主要经济体在电子、太阳能和基础设施领域不断增长的需求。政府对清洁能源应用和工业现代化的支持政策将进一步推动这一成长。中国在太阳能光电发电量方面的领先地位以及印度在公共基础设施中大力推广防水解决方案,都是推动产品渗透率提升和长期发展的区域因素。

全球超疏水涂料市场的领导者包括 BASF SE、Surfactis Technologies、Lotus Nano、DryWired、3M Company、NEI Corporation、UltraTech International, Inc.、The Sherwin-Williams Company、Nanex Company、United Protective Technologies (UPT)、Lotus Leaf Coatings, Inc.、Pearex Company、United Protective Technologies (UPT)、Lotus Leaf Coatings, Inc.、Pearp. (NeverWet)、Advanced NanoTech Lab、Hydrobead、P2i Ltd、NanoTech Solutions 和 Cytonix, LLC。为了加强竞争地位,超疏水涂料市场的公司正在优先考虑旨在开发不含 PFAS 的环保替代品的先进研发工作。与航太、电子和太阳能製造商的策略合作有助于确保直接整合到下一代产品线。企业正在透过当地生产单位和通路合作伙伴关係扩大其全球影响力,尤其是在亚太地区,以挖掘新兴需求。

目录

第一章:方法论

- 市场范围和定义

- 研究设计

- 研究方法

- 资料收集方法

- 资料探勘来源

- 全球的

- 地区/国家

- 基础估算与计算

- 基准年计算

- 市场评估的主要趋势

- 初步研究和验证

- 主要来源

- 预测模型

- 研究假设和局限性

第 2 章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商概况

- 利润率

- 每个阶段的增值

- 影响价值链的因素

- 中断

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 市场机会

- 成长潜力分析

- 监管格局

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL分析

- 价格趋势

- 按地区

- 按产品

- 未来市场趋势

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 专利态势

- 贸易统计资料(HS 编码)(註:仅提供重点国家的贸易统计资料)

- 主要进口国

- 主要出口国

- 永续性和环境方面

- 永续实践

- 减少废弃物的策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考量

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 多边环境协定

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:依技术分类,2021-2034 年

- 主要趋势

- 二氧化硅基超疏水涂层

- 含氟聚合物基涂料

- PDMS 和硅基涂层

- 二氧化钛基涂料

- 碳奈米管和石墨烯基涂层

- 仿生和植物性涂料

第六章:市场估计与预测:依製造工艺,2021-2034 年

- 主要趋势

- 喷涂方法

- 浸涂工艺

- 溶胶-凝胶工艺

- 电沉积方法

- 化学气相沉积(CVD)

第七章:市场估计与预测:按应用,2021-2034

- 主要趋势

- 汽车和运输

- 航太和国防

- 船舶和近海工程

- 建筑与建筑

- 纺织品和服装

- 电子和电信

- 医疗保健

- 太阳能和再生能源应用

第八章:市场估计与预测:按地区,2021-2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

第九章:公司简介

- 3M Company

- Aculon, Inc.

- Advanced NanoTech Lab

- BASF SE

- Cytonix, LLC

- DryWired

- Hydrobead

- Lotus Leaf Coatings, Inc.

- Lotus Nano

- Nanex Company

- NanoTech Solutions

- NEI Corporation

- NTT Advanced Technology Corp.

- P2i Ltd

- Pearl Nano LLC

- Rust-Oleum (NeverWet)

- Surfactis Technologies

- The Sherwin-Williams Company

- UltraTech International, Inc.

- United Protective Technologies (UPT)

The Global Superhydrophobic Coatings Market was valued at USD 30 million in 2024 and is estimated to grow at a CAGR of 20.2% to reach USD 171.7 million by 2034.

Market momentum is building as demand intensifies across industries for surfaces that resist moisture, corrosion, and contamination. This surge is largely due to rising usage in electronics requiring water resistance, anti-icing applications in mobility sectors, and the shift toward low-maintenance solar panels. Healthcare is also emerging as a growth contributor, with medical devices increasingly integrating liquid-repelling surfaces for sterility and longevity. Initially restricted to aerospace and defense due to performance needs, adoption is now scaling across renewable energy, construction, and consumer electronics as awareness improves and R&D opens new possibilities. Heightened attention toward environmental sustainability and stricter regulations around PFAS are pushing innovation toward fluorine-free or bio-based materials, paving the way for more eco-conscious product formulations. This rising trend of multifunctional coatings offering self-cleaning, anti-fouling, and water-repellency across high-growth sectors like automotive, infrastructure, and smart devices is significantly accelerating market expansion.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $30 Million |

| Forecast Value | $171.7 Million |

| CAGR | 20.2% |

The aerospace and defense segment held 13.5% share in 2024, driven by increasing demand for corrosion-resistant and stealth-enhancing coatings. Superhydrophobic materials are utilized in aircraft systems, military-grade electronics, and equipment exposed to harsh environments. These applications are growing rapidly in line with government-led modernization programs and tightening aviation safety mandates, pushing manufacturers to adopt high-performance coating technologies.

The carbon nanotube and graphene-enhanced coatings segment is projected to grow at a CAGR of 26.1% through 2034. These nanomaterial-based formulations deliver excellent conductivity, mechanical strength, and corrosion resistance, making them particularly suitable for advanced electronics, aerospace, and defense applications where performance reliability is critical.

Asia-Pacific Superhydrophobic Coatings Market will grow at a CAGR of 20.8% from 2024 to 2034, underpinned by rising demand across electronics, solar, and infrastructure sectors in major economies like Japan, South Korea, India, and China. Supportive government policies for clean energy adoption and industrial modernization are further bolstering this expansion. China's lead in solar PV output and India's push to adopt water-repellent solutions for public infrastructure are among the regional factors contributing to increased product penetration and long-term development.

Leading players in the Global Superhydrophobic Coatings Market include BASF SE, Surfactis Technologies, Lotus Nano, DryWired, 3M Company, NEI Corporation, UltraTech International, Inc., The Sherwin-Williams Company, Nanex Company, United Protective Technologies (UPT), Lotus Leaf Coatings, Inc., Pearl Nano LLC, Aculon, Inc., NTT Advanced Technology Corp., Rust-Oleum (NeverWet), Advanced NanoTech Lab, Hydrobead, P2i Ltd, NanoTech Solutions, and Cytonix, LLC. To strengthen their competitive position, companies in the superhydrophobic coatings market are prioritizing advanced R&D efforts aimed at developing PFAS-free and environmentally friendly alternatives. Strategic collaborations with aerospace, electronics, and solar manufacturers help to ensure direct integration into next-gen product pipelines. Firms are expanding their global reach through local production units and channel partnerships, especially in Asia-Pacific, to tap into emerging demand.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Technology

- 2.2.3 Manufacturing Process

- 2.2.4 Application

- 2.3 TAM Analysis, 2021-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter’s analysis

- 3.6 PESTEL analysis

- 3.6.1 Technology and Innovation landscape

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and Environmental Aspects

- 3.12.1 Sustainable Practices

- 3.12.2 Waste Reduction Strategies

- 3.12.3 Energy Efficiency in Production

- 3.12.4 Eco-friendly Initiatives

- 3.13 Carbon Footprint Considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates & Forecast, By Technology, 2021-2034 (USD Million) (Units)

- 5.1 Key trends

- 5.2 Silica-based superhydrophobic coatings

- 5.3 Fluoropolymer-based coatings

- 5.4 PDMS and silicone-based coatings

- 5.5 Titanium dioxide-based coatings

- 5.6 Carbon nanotube and graphene-based coatings

- 5.7 Bio-inspired and plant-based coatings

Chapter 6 Market Estimates & Forecast, By Manufacturing Process, 2021-2034 (USD Million) (Units)

- 6.1 Key trends

- 6.2 Spray coating methods

- 6.3 Dip coating processes

- 6.4 Sol-gel processing

- 6.5 Electrodeposition methods

- 6.6 Chemical Vapor Deposition (CVD)

Chapter 7 Market Estimates & Forecast, By Application, 2021-2034 (USD Million) (Units)

- 7.1 Key trends

- 7.2 Automotive and transportation

- 7.3 Aerospace and defense

- 7.4 Marine and offshore

- 7.5 Construction and architecture

- 7.6 Textiles and apparel

- 7.7 Electronics and telecommunications

- 7.8 Medical and healthcare

- 7.9 Solar energy and renewable applications

Chapter 8 Market Estimates & Forecast, By Region, 2021-2034 (USD Million) (Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East & Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 3M Company

- 9.2 Aculon, Inc.

- 9.3 Advanced NanoTech Lab

- 9.4 BASF SE

- 9.5 Cytonix, LLC

- 9.6 DryWired

- 9.7 Hydrobead

- 9.8 Lotus Leaf Coatings, Inc.

- 9.9 Lotus Nano

- 9.10 Nanex Company

- 9.11 NanoTech Solutions

- 9.12 NEI Corporation

- 9.13 NTT Advanced Technology Corp.

- 9.14 P2i Ltd

- 9.15 Pearl Nano LLC

- 9.16 Rust-Oleum (NeverWet)

- 9.17 Surfactis Technologies

- 9.18 The Sherwin-Williams Company

- 9.19 UltraTech International, Inc.

- 9.20 United Protective Technologies (UPT)