|

市场调查报告书

商品编码

1844354

快速诊断市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Rapid Diagnostics Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

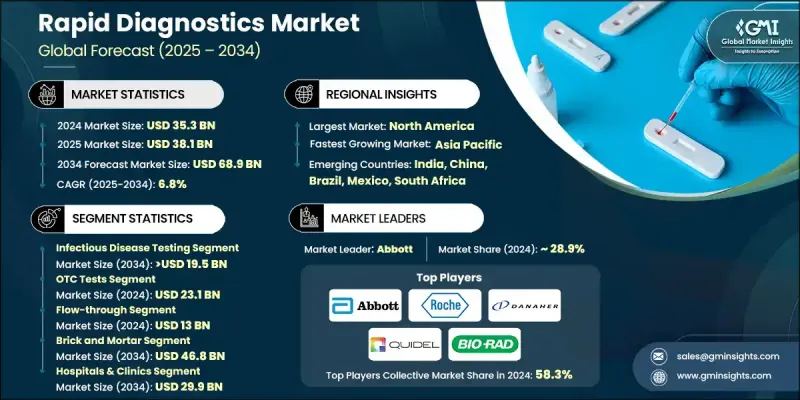

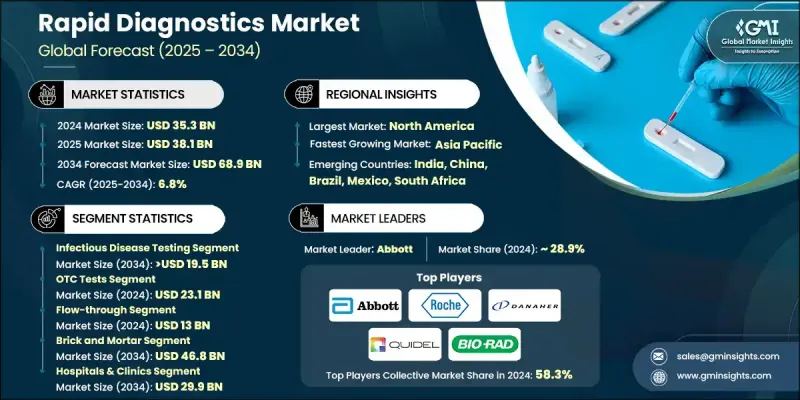

2024 年全球快速诊断市场价值为 353 亿美元,预计到 2034 年将以 6.8% 的复合年增长率增长至 689 亿美元。

市场不断扩大,原因有很多,包括传染病数量的增加、即时检测的日益普及、诊断技术的不断创新以及医疗基础设施升级投资的稳步增长。快速诊断测试旨在在几分钟到几小时内提供准确的结果,使其成为早期发现和及时医疗回应的关键工具。这些测试广泛应用于诊所、家庭和药房,以支援即时医疗决策。它们使用分子诊断、免疫测定和横向流动分析等各种平台来提供及时、可靠的结果。生物感测器、微流体技术和基于人工智慧的诊断工具的进步进一步提高了它们的速度、准确性和实用性。与数位医疗系统的更广泛整合也支持了市场的成长,这提高了诊断效率,并扩展了感染监测以外的应用。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 353亿美元 |

| 预测值 | 689亿美元 |

| 复合年增长率 | 6.8% |

2024年,传染病检测领域占了25.2%的市场。由于全球对肝炎、爱滋病毒、结核病、疟疾和流感等疾病的早期快速检测需求持续高涨,该领域继续保持领先地位。随着全球健康风险的增加和传播率的上升,早期诊断已成为当务之急。快速检测在快速识别这些疾病、加速治疗启动以及降低整体死亡率方面发挥关键作用。

2024年,非处方药 (OTC) 诊断市场规模达231亿美元,预计到2034年将以7.1%的复合年增长率成长。消费者越来越重视个人健康管理,这推动了对自测剂盒的需求。数位健康资源的便捷获取以及家用诊断产品的市场推广,显着提升了人们对使用OTC试剂盒的信心。人们正在利用这些工具进行血糖水平、怀孕和感染等健康状况的常规监测。

2024年,美国快速诊断市场规模达168亿美元。这一增长得益于北美地区强大的医疗基础设施、先进的实验室和广泛的医院网路。这些因素为尖端诊断技术的快速应用奠定了坚实的基础。高效的实验室系统也有助于快速部署和扩展诊断工具,从而促进该地区快速检测的普及。

塑造全球快速诊断市场竞争格局的知名公司包括 Trinity Biotech、雅培、Quidel、赛默飞世尔科技、罗氏、Sight Diagnostics、ACON、BIOMERIEUX、Alfa Scientific、Meridian Bioscience、Becton、Dickinson and Company (BD)、QIAGEN、雅昌、Hologic、Becton、Dickinson and Company (BD)、QIAGEN、雅昌、Hologic、BIO-Ho层。为了获得更强大的市场地位,快速诊断产业的公司正在积极推行以技术创新和全球影响力为重点的策略。许多公司正在投入大量资金进行研发,以打造高度准确、快速且用户友好的检测试剂盒。与医疗保健提供者和分销合作伙伴的策略合作使这些公司能够拓展新兴市场。此外,公司正在采用数位整合和人工智慧驱动的平台来增强检测解读和结果管理。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 传染病的盛行率不断上升

- 技术进步

- 快速诊断测试日益普及

- 提高人们对早期诊断的认识

- 政府加强对传染病诊断的力度

- 产业陷阱与挑战

- 结果准确度低

- 替代产品的可用性

- 严格的监管框架

- 市场机会

- 向新兴市场和分散护理点扩张

- 与远距医疗和数位报告的整合

- 成长动力

- 成长潜力分析

- 报销场景

- 监管格局

- 北美洲

- 欧洲

- 亚太地区

- 技术格局

- 当前的技术趋势

- 新兴技术

- 差距分析

- 波特的分析

- PESTEL分析

- 价值链分析

- 未来市场趋势

第四章:竞争格局

- 介绍

- 公司矩阵分析

- 公司市占率分析

- 全球的

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲和中东地区

- 竞争定位矩阵

- 主要市场参与者的竞争分析

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:按产品,2021 - 2034 年

- 主要趋势

- 传染病检测

- 呼吸道感染检测产品

- 流感

- 肝炎

- 爱滋病

- 其他传染病检测

- 妊娠和生育能力测试

- 血液学检测产品

- 血糖监测

- 药物滥用(DoA)检测产品

- 心臟代谢测试

- 凝血检测产品

- 胆固醇检测产品

- 尿液分析检测产品

- 肿瘤/癌症标记检测产品

- 粪便隐血检测产品

- 其他产品

第六章:市场估计与预测:按购买量,2021 - 2034 年

- 主要趋势

- OTC 测试

- 基于处方的测试

第七章:市场估计与预测:按技术/平台,2021 - 2034 年

- 主要趋势

- 流通式

- 固相

- 横向流动

- 凝集试验

- 其他技术/平台

第 8 章:市场估计与预测:按配销通路,2021 年至 2034 年

- 主要趋势

- 实体店面

- 电子商务

第九章:市场估计与预测:依最终用途,2021 - 2034

- 主要趋势

- 医院和诊所

- 诊断中心

- 居家照护环境

- 其他最终用途

第 10 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第 11 章:公司简介

- Abbott

- ACON

- Alfa Scientific

- Artron

- Becton, Dickinson and Company (BD)

- BIOMERIEUX

- BIO-RAD

- Danaher

- HOLOGIC

- Meridian Bioscience

- QIAGEN

- Quidel

- Roche

- Sight Diagnostics

- Thermo Fisher Scientific

- Trinity Biotech

The Global Rapid Diagnostics Market was valued at USD 35.3 billion in 2024 and is estimated to grow at a CAGR of 6.8% to reach USD 68.9 billion by 2034.

The market is expanding due to several factors, including the rising number of infectious diseases, the increasing popularity of point-of-care testing, continuous innovation in diagnostic technologies, and the steady rise in investments aimed at upgrading healthcare infrastructure. Rapid diagnostic tests are designed to deliver accurate results within minutes to a few hours, making them a crucial tool for early detection and prompt medical response. These tests are widely used in clinics, homes, and pharmacies to support real-time healthcare decisions. They use a variety of platforms such as molecular diagnostics, immunoassays, and lateral flow assays to provide timely, dependable results. Advancements in biosensors, microfluidic technology, and AI-based diagnostic tools have further enhanced their speed, accuracy, and utility. Market growth is also supported by broader integration with digital health systems, improving diagnostic efficiency and expanding applications beyond just infection monitoring.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $35.3 Billion |

| Forecast Value | $68.9 Billion |

| CAGR | 6.8% |

The infectious disease testing segment held a 25.2% share in 2024. The segment continues to lead as the demand for early and rapid detection of illnesses like hepatitis, HIV, tuberculosis, malaria, and influenza remains high worldwide. With growing global health risks and higher transmission rates, early diagnosis has become a top priority. Rapid tests play a key role in identifying these diseases quickly, enabling faster treatment initiation and helping reduce the overall mortality rate.

In 2024, the over-the-counter (OTC) diagnostics segment generated USD 23.1 billion, and it is expected to grow at a CAGR of 7.1% through 2034. Consumers are increasingly prioritizing personal health management, which fuels demand for self-testing kits. The ease of access to digital health resources and marketing efforts promoting home-use diagnostics has significantly increased confidence in using OTC kits. People are embracing these tools for routine monitoring of health conditions like glucose levels, pregnancy, and infections.

U.S. Rapid Diagnostics Market generated USD 16.8 billion in 2024. This growth is supported by the presence of a robust healthcare infrastructure, advanced laboratories, and wide hospital networks across North America. These factors have created a solid foundation for the rapid adoption of cutting-edge diagnostic technologies. Efficient lab systems also allow for quick rollout and scaling of diagnostic tools, contributing to the strong uptake of rapid testing in the region.

Notable companies shaping the competitive landscape of the Global Rapid Diagnostics Market include Trinity Biotech, Abbott, Quidel, Thermo Fisher Scientific, Roche, Sight Diagnostics, ACON, BIOMERIEUX, Alfa Scientific, Meridian Bioscience, Becton, Dickinson and Company (BD), QIAGEN, Artron, Hologic, BIO-RAD, and Danaher. To gain a stronger position, companies within the rapid diagnostics industry are pursuing aggressive strategies focused on technological innovation and global reach. Many are channeling significant investment into research and development to create highly accurate, faster, and user-friendly test kits. Strategic collaborations with healthcare providers and distribution partners allow these firms to expand into emerging markets. Additionally, firms are adopting digital integration and AI-driven platforms to enhance test interpretation and result management.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Product trends

- 2.2.3 Purchase trends

- 2.2.4 Technology/platform trends

- 2.2.5 Distribution channel trends

- 2.2.6 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of infectious disease

- 3.2.1.2 Technological advancements

- 3.2.1.3 Growing popularity of rapid diagnostic tests

- 3.2.1.4 Rising awareness regarding early diagnosis among people

- 3.2.1.5 Increasing government initiatives for the diagnosis of infectious diseases

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Low accuracy of results

- 3.2.2.2 Availability of substitute products

- 3.2.2.3 Stringent regulatory framework

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion into emerging markets and decentralized care sites

- 3.2.3.2 Integration with telemedicine and digital reporting

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Reimbursement scenario

- 3.5 Regulatory landscape

- 3.5.1 North America

- 3.5.2 Europe

- 3.5.3 Asia Pacific

- 3.6 Technology landscape

- 3.6.1 Current technological trends

- 3.6.2 Emerging technologies

- 3.7 Gap analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

- 3.10 Value chain analysis

- 3.11 Future market trends

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.3.1 Global

- 4.3.2 North America

- 4.3.3 Europe

- 4.3.4 Asia Pacific

- 4.3.5 LAMEA

- 4.4 Competitive positioning matrix

- 4.5 Competitive analysis of major market players

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Infectious disease testing

- 5.2.1 Respiratory infection testing products

- 5.2.2 Influenza

- 5.2.3 Hepatitis

- 5.2.4 HIV

- 5.2.5 Other infectious disease testings

- 5.3 Pregnancy and fertility testing

- 5.4 Hematology testing products

- 5.5 Glucose monitoring

- 5.6 Drug-of-abuse (DoA) testing products

- 5.7 Cardiometabolic testing

- 5.8 Coagulation testing products

- 5.9 Cholesterol testing products

- 5.10 Urinalysis testing products

- 5.11 Tumor/cancer marker testing products

- 5.12 Fecal occult testing products

- 5.13 Other products

Chapter 6 Market Estimates and Forecast, By Purchase, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 OTC tests

- 6.3 Prescription-based tests

Chapter 7 Market Estimates and Forecast, By Technology/Platform, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Flow-through

- 7.3 Solid phase

- 7.4 Lateral flow

- 7.5 Agglutination assays

- 7.6 Other technology/platforms

Chapter 8 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Brick and mortar

- 8.3 E-commerce

Chapter 9 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Hospitals & clinics

- 9.3 Diagnostic centers

- 9.4 Homecare settings

- 9.5 Other end use

Chapter 10 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Abbott

- 11.2 ACON

- 11.3 Alfa Scientific

- 11.4 Artron

- 11.5 Becton, Dickinson and Company (BD)

- 11.6 BIOMERIEUX

- 11.7 BIO-RAD

- 11.8 Danaher

- 11.9 HOLOGIC

- 11.10 Meridian Bioscience

- 11.11 QIAGEN

- 11.12 Quidel

- 11.13 Roche

- 11.14 Sight Diagnostics

- 11.15 Thermo Fisher Scientific

- 11.16 Trinity Biotech