|

市场调查报告书

商品编码

1844357

宠物牙齿保健市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Pet Dental Health Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

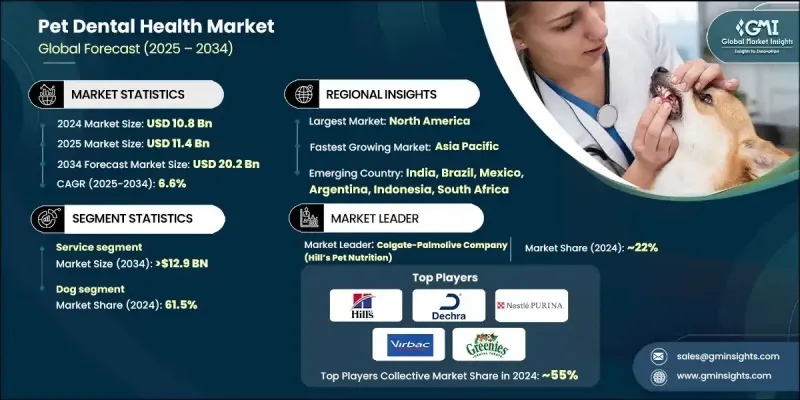

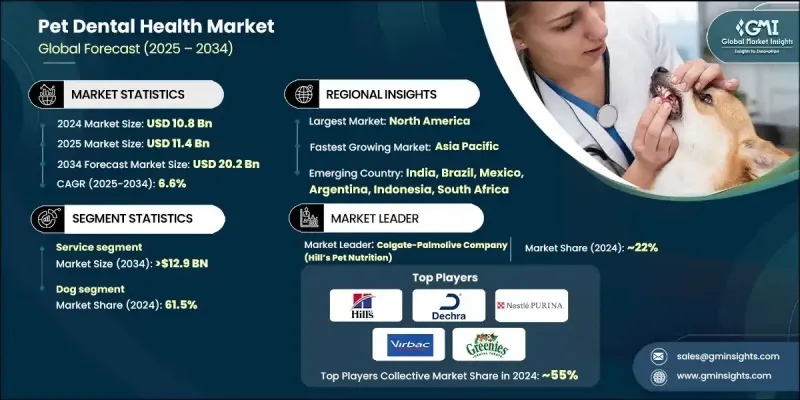

2024 年全球宠物牙齿保健市场价值为 108 亿美元,预计到 2034 年将以 6.6% 的复合年增长率增长至 202 亿美元。

市场成长的驱动力包括宠物拥有量的增加、动物口腔健康意识的增强以及兽医护理支出的增加。牙齿健康是宠物整体健康的重要组成部分,口腔疾病是伴侣动物(尤其是犬猫)最常见的健康问题之一。人们日益认识到口腔卫生与全身健康之间的联繫,这刺激了对预防性和治疗性牙科护理解决方案的需求,使宠物口腔健康行业成为全球兽医市场的重要组成部分。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 108亿美元 |

| 预测值 | 202亿美元 |

| 复合年增长率 | 6.6% |

宠物人性化趋势进一步推动了市场的成长,宠物主人越来越将动物视为家庭成员,并投资于先进的医疗保健解决方案。随着宠物主人寻求延长宠物的寿命和生活质量,包括常规体检、专业清洁和牙齿护理在内的预防性护理日益受到重视。此外,兽医协会和宠物医疗保健组织正在积极进行宣传活动,强调口腔护理在预防疼痛、牙齿脱落以及心臟病和肾臟病等继发性疾病方面的重要性。这加速了已开发市场和新兴市场对宠物牙科产品和服务的采用。

2024年,服务业收入达67亿美元,涵盖兽医诊所和医院提供的专业牙齿清洁、洁治、抛光、拔牙以及预防性口腔检查。宠物主人意识到定期进行牙科检查对于预防口腔疾病及相关併发症的重要性。由于宠物牙周病的发生率不断上升,兽医牙科服务的需求也日益增长,近70%至80%的三岁以上犬猫都患有牙周病。

就动物类型而言,2024年犬类消费比61.5%。与其他伴侣动物相比,犬类更容易出现牙齿问题,这增加了对专业口腔护理产品和兽医牙科服务的需求。犬类健康领域对预防性口腔护理的日益重视,以及各种咀嚼物、漱口水、牙刷和专业清洁服务的普及,持续推动着这个细分市场的发展。宠物主人越来越积极主动地关注爱犬的牙齿健康需求,这与高端兽医服务支出不断增长的整体趋势一致。

2024年,北美宠物口腔保健市场占据44.9%的市场份额,这得益于较高的宠物拥有率、先进的兽医基础设施以及消费者对预防性口腔护理的强烈认知。美国尤其占据了该地区宠物口腔保健市场的大部分需求,宠物保险的普及率和高端宠物护理支出推动了市场的成长。

全球宠物口腔保健市场的主要参与者包括玛氏宠物护理、维克、雀巢普瑞纳宠物护理、希尔思宠物营养、德克萨製药、PetIQ、TropiClean 和 Vetoquinol。这些公司在推动创新和扩大全球影响力方面处于领先地位,透过推出新产品、收购以及与兽医服务提供者的合作。宠物口腔保健市场的竞争格局由对产品创新的大力投资、与兽医诊所的合作以及有针对性的行销策略决定。各公司正致力于扩展其产品组合,包括功能性咀嚼物、酵素口腔护理解决方案和先进的牙齿清洁服务。

目录

第一章:方法论与范围

第 2 章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 每个阶段的增值

- 影响价值链的因素

- 产业衝击力

- 成长动力

- 宠物收养率上升

- 宠物牙齿问题日益增多

- 宠物口腔健康意识不断增强

- 动物保健支出增加

- 产业陷阱与挑战

- 先进的牙科手术费用高昂

- 专业兽医牙医短缺

- 市场机会

- 扩大宠物牙科的技术进步

- 天然和有机产品需求

- 预防性牙科日益受到重视

- 成长动力

- 成长潜力分析

- 技术格局

- 当前的技术趋势

- 新兴技术

- 监管格局

- 2024年宠物数量统计

- 定价分析

- 报销场景

- 动物保健产业的创投场景

- 未来市场趋势

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与协作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:按类型,2021 - 2034

- 主要趋势

- 服务

- 按服务类型

- 治疗

- 诊断

- 按最终用途

- 兽医诊所

- 兽医院

- 按服务类型

- 产品

- 依产品类型

- 牙齿咀嚼物和零食

- 口腔护理解决方案

- 牙膏和牙刷

- 牙齿喷雾

- 其他产品类型

- 按配销通路

- 零售药局

- 网路药局

- 宠物店

- 其他分销管道

- 依产品类型

第六章:市场估计与预测:依动物类型,2021 - 2034 年

- 主要趋势

- 狗

- 猫

- 其他动物类型

第七章:市场估计与预测:按地区,2021 - 2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 中东和非洲

- 南非

- 沙乌地阿拉伯

第八章:公司简介

- Animalcare Group

- BarkBox

- Bo International

- Boehringer Ingelheim

- Ceva Sante Animale

- Colgate-Palmolive Company (Hill's Pet Nutrition)

- H. von Gimborn

- imRex

- Ingenious Probiotics

- Mars (GREENIES)

- PetDine

- Petsona

- Petzlife Products

- Purina PetCare (Nestle)

- TropiClean Pet Products

- Vetoquinol

- Virbac

The Global Pet Dental Health Market was valued at USD 10.8 billion in 2024 and is estimated to grow at a CAGR of 6.6% to reach USD 20.2 billion by 2034.

Market growth is driven by rising pet ownership, increasing awareness of animal oral health, and higher spending on veterinary care. Dental health is a critical component of overall pet wellness, with oral diseases among the most common health issues in companion animals, particularly dogs and cats. Growing recognition of the link between oral hygiene and systemic health has spurred demand for preventive and therapeutic dental care solutions, positioning the pet dental health industry as a vital segment of the global veterinary market.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $10.8 Billion |

| Forecast Value | $20.2 Billion |

| CAGR | 6.6% |

The market's growth is further supported by the humanization of pets, where owners increasingly view animals as family members and invest in advanced healthcare solutions. Preventive care, including routine checkups, professional cleanings, and dental diets, has gained traction as pet parents seek to extend the longevity and quality of life of their animals. Additionally, veterinary associations and pet healthcare organizations are actively running awareness campaigns that highlight the importance of oral care in preventing pain, tooth loss, and secondary conditions such as heart and kidney disease. This has accelerated the adoption of pet dental products and services across developed and emerging markets alike.

The services segment generated USD 6.7 billion in 2024, encompassing professional dental cleanings, scaling, polishing, tooth extractions, and preventive oral checkups offered by veterinary clinics and hospitals. Pet owners recognized the importance of routine dental visits to prevent oral diseases and associated health complications. Veterinary dental services are increasingly in demand due to the rising prevalence of periodontal disease in pets, which affects nearly 70-80% of dogs and cats over the age of three.

In terms of animal type, the dogs segment held a 61.5% share in 2024. Dogs are more prone to dental issues compared to other companion animals, which has heightened demand for specialized oral care products and veterinary dental services. The growing emphasis on preventive oral care in canine health, supported by the availability of a wide range of chews, rinses, toothbrushes, and professional cleaning services, continues to drive this segment forward. Pet owners are increasingly proactive in addressing their dogs' dental health needs, aligning with the broader trend of rising expenditure on premium veterinary services.

North America Pet Dental Health Market held a 44.9% share in 2024, supported by high pet ownership rates, advanced veterinary infrastructure, and strong consumer awareness regarding preventive oral care. The United States, in particular, accounts for the bulk of regional demand, with pet insurance penetration and premium pet care spending fueling market growth.

Key players in the Global Pet Dental Health Market include Mars Petcare, Virbac, Nestle Purina PetCare, Hill's Pet Nutrition, Dechra Pharmaceuticals, PetIQ, TropiClean, and Vetoquinol. These companies are at the forefront of driving innovation and expanding their global footprint through new product launches, acquisitions, and partnerships with veterinary service providers. The competitive landscape of the pet dental health market is defined by strong investments in product innovation, partnerships with veterinary clinics, and targeted marketing strategies. Companies are focusing on expanding their product portfolios to include functional chews, enzymatic oral care solutions, and advanced dental cleaning services.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Type

- 2.2.3 Animal type

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factors affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising pet adoption

- 3.2.1.2 Increasing cases of pet dental problems

- 3.2.1.3 Growing awareness of pet oral health

- 3.2.1.4 Increasing animal healthcare expenditure

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of advanced dental procedures

- 3.2.2.2 Shortage of specialized veterinary dentists

- 3.2.3 Market opportunities

- 3.2.3.1 Expanding technological advancements in pet dentistry

- 3.2.3.2 Natural and organic product demand

- 3.2.3.3 Growing focus on preventive dental

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Technology landscape

- 3.4.1 Current technological trends

- 3.4.2 Emerging technologies

- 3.5 Regulatory landscape

- 3.6 Pet population statistics 2024

- 3.7 Pricing analysis

- 3.8 Reimbursement scenario

- 3.9 Venture capitalist scenario in animal health industry

- 3.10 Future market trends

- 3.11 Porter’s analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Key developments

- 4.5.1 Merger and acquisition

- 4.5.2 Partnership and collaboration

- 4.5.3 New product launches

- 4.5.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Service

- 5.2.1 By service type

- 5.2.1.1 Treatment

- 5.2.1.2 Diagnosis

- 5.2.2 By end use

- 5.2.2.1 Veterinary clinics

- 5.2.2.2 Veterinary hospitals

- 5.2.1 By service type

- 5.3 Product

- 5.3.1 By product type

- 5.3.1.1 Dental chews and treats

- 5.3.1.2 Oral care solutions

- 5.3.1.3 Toothpastes and brushes

- 5.3.1.4 Dental spray

- 5.3.1.5 Other product types

- 5.3.2 By distribution channel

- 5.3.2.1 Retail pharmacies

- 5.3.2.2 Online pharmacies

- 5.3.2.3 Pet stores

- 5.3.2.4 Other distribution channels

- 5.3.1 By product type

Chapter 6 Market Estimates and Forecast, By Animal Type, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Dogs

- 6.3 Cats

- 6.4 Other animal types

Chapter 7 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Spain

- 7.3.5 Italy

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Japan

- 7.4.3 India

- 7.4.4 Australia

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.6 Middle East and Africa

- 7.6.1 South Africa

- 7.6.2 Saudi Arabia

Chapter 8 Company Profiles

- 8.1 Animalcare Group

- 8.2 BarkBox

- 8.3 Bo International

- 8.4 Boehringer Ingelheim

- 8.5 Ceva Sante Animale

- 8.6 Colgate-Palmolive Company (Hill’s Pet Nutrition)

- 8.7 H. von Gimborn

- 8.8 imRex

- 8.9 Ingenious Probiotics

- 8.10 Mars (GREENIES)

- 8.11 PetDine

- 8.12 Petsona

- 8.13 Petzlife Products

- 8.14 Purina PetCare (Nestle)

- 8.15 TropiClean Pet Products

- 8.16 Vetoquinol

- 8.17 Virbac