|

市场调查报告书

商品编码

1844367

癣治疗市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Ringworm Treatment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

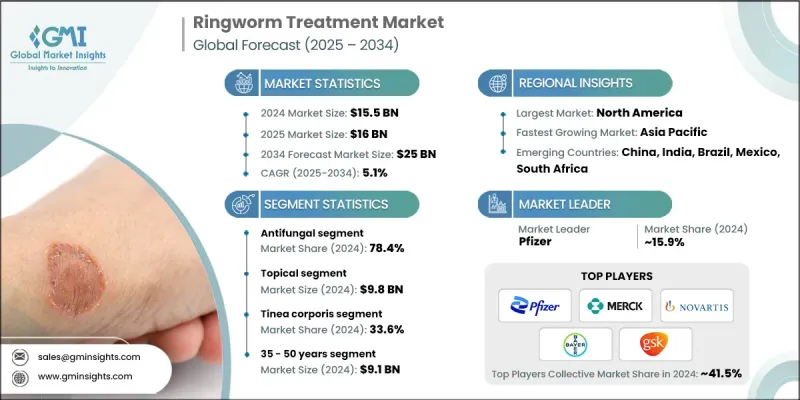

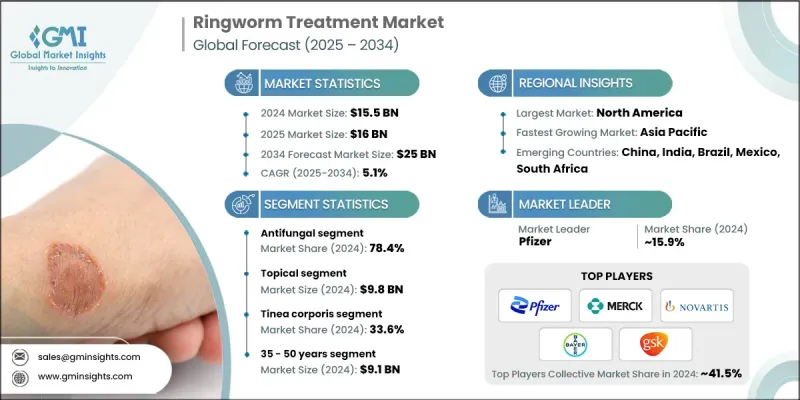

2024 年全球癣治疗市场价值为 155 亿美元,预计将以 5.1% 的复合年增长率成长,到 2034 年达到 250 亿美元。

在已开发国家和新兴国家,皮癣菌病等表浅真菌感染的发生率不断上升,这极大地推动了对有效治疗方案的需求。这一增长的关键因素是非处方药 (OTC) 的普及,这使得消费者更容易获得治疗。由于这些製剂在零售药局和数位平台上均有销售,它们通常用于日常自我护理,尤其适用于轻度至中度感染。城镇化和医疗保健可近性的提高也发挥了作用,促进了治疗方案的更快应用。正规零售药局和线上药局的不断扩张进一步推动了市场发展。消费者对便利性、隐私性和价格实惠的解决方案表现出强烈的偏好,促使製药公司加强在电商管道的布局。这种转变也促进了捆绑治疗套装和直接面向消费者的互动策略的推出。感染通常出现在手臂、腿部或头皮上,根据严重程度,需要局部用药或口服抗真菌药物。配方技术的进步和更广泛的分销网络使得癣治疗更加有效,并且适用于所有人群。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 155亿美元 |

| 预测值 | 250亿美元 |

| 复合年增长率 | 5.1% |

2024年,抗真菌药物市场占据78.4%的市场份额,反映出其作为各类皮癣菌病的一线治疗手段的广泛应用。含有咪康唑、克霉唑、特比萘芬和酮康唑等活性成分的产品因其已被证实能够抑制真菌生长并快速缓解症状而被广泛使用。这些药物价格实惠、疗效广谱且剂型多样,使其在治疗领域中占据主导地位。这些抗真菌药物常用于治疗体癣、足癣、头癣、股癣和甲癣等常见疾病,并常作为处方药或自行服用。

局部治疗领域占63%的市场份额,2024年市场规模达98亿美元。该领域的领先地位源于日益增长的自我治疗趋势,这使得非处方外用产品成为首选。这些产品可透过实体药局和线上药局轻鬆购买,尤其适用于治疗单纯性感染。製药公司越来越注重推出更容易使用的新型外用製剂,例如泡沫剂、喷雾剂、乳霜剂、粉末、凝胶剂和药用湿纸巾。这些创新产品,加上人们对早期介入意识的提升,正在显着推动全球对外用抗真菌药物的需求。

2024年,北美癣治疗市场占据40.3%的市场份额,这得益于其完善的医疗基础设施和领先的製药公司。处方药和非处方药的广泛可及性,加上日益增长的认知度和自我照护趋势,巩固了该地区的主导地位。该市场的消费者越来越多地选择居家治疗方案,以方便获得可靠的治疗方案。零售药局和电商平台继续对该地区的产品供应和消费者行为产生重大影响。

全球癣治疗市场的主要公司包括强生、Mankind Pharma、Sun Pharmaceuticals、艾伯维、辉瑞、赛诺菲、诺华、Glenmark Pharmaceuticals、Cipla、Biofield Pharma、吉利德科学、梯瓦製药工业、拜耳、默克、百利戈公司、葛兰素史克和礼来公司。为了保持竞争优势,癣治疗领域的公司正专注于多通路分销,包括电子商务和有组织的零售药局,以提高产品的可及性。许多公司正在投资开发新型外用製剂,以提高用户的依从性和有效性。与数位健康平台和连锁药局的策略合作伙伴关係可以扩大覆盖范围,而行销活动则针对真菌感染和早期干预的宣传活动。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 每个阶段的增值

- 影响价值链的因素

- 产业衝击力

- 成长动力

- 癣感染的盛行率不断上升

- 非处方抗真菌药物容易取得

- 提高对癣感染及其症状的认识

- 产业陷阱与挑战

- 常见抗真菌药物的抗药性不断增强

- 患者缺乏治疗依从性

- 市场机会

- 新型药物製剂的开发

- 联合用药的采用率不断上升

- 成长动力

- 成长潜力分析

- 监管格局

- 癣感染的流行病学分析

- 管道分析

- 未来市场趋势

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 北美洲

- 欧洲

- 亚太地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:按药物类别,2021 - 2034 年

- 主要趋势

- 抗真菌

- 联合用药

第六章:市场估计与预测:按管理路线,2021 - 2034 年

- 主要趋势

- 外用

- 口服

- 肠外

第七章:市场估计与预测:按感染类型,2021 - 2034 年

- 主要趋势

- 体癣

- 足癣

- 股癣

- 头癣

- 手癣

- 其他类型

第八章:市场估计与预测:按年龄组,2021 - 2034 年

- 主要趋势

- 18岁以下

- 18 - 35岁

- 35 - 50岁

- 50岁以上

第九章:市场估计与预测:按药物类型,2021 - 2034

- 主要趋势

- 处方

- 场外交易

第 10 章:市场估计与预测:按配销通路,2021 年至 2034 年

- 主要趋势

- 医院药房

- 零售药局

- 网路药局

第 11 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 日本

- 中国

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第 12 章:公司简介

- AbbVie

- Biofield Pharma

- Bayer

- Cipla

- Eli Lilly and Company

- Gilead Sciences

- GlaxoSmithKline

- Glenmark Pharmaceuticals

- Johnson and Johnson

- Mankind Pharma

- Merck

- Novartis

- Perrigo Company

- Pfizer

- Sanofi

- Sun Pharmaceuticals

- Teva Pharmaceutical Industries

The Global Ringworm Treatment Market was valued at USD 15.5 billion in 2024 and is estimated to grow at a CAGR of 5.1% to reach USD 25 billion by 2034.

The increasing prevalence of superficial fungal infections like dermatophytosis across both developed and emerging nations is significantly driving the demand for effective treatment options. A key contributor to this growth is the rising adoption of over-the-counter (OTC) medications, making treatments more accessible for consumers. These formulations are commonly used in self-care routines, especially for mild to moderate infections, thanks to their availability across retail pharmacies and digital platforms. Urbanization and better healthcare access have also played a role, encouraging faster treatment adoption. The growing expansion of organized retail and online pharmacies is further fueling market momentum. Consumers are showing a strong preference for convenience, privacy, and affordable solutions, prompting pharmaceutical companies to enhance their presence in e-commerce channels. This shift also supports the introduction of bundled treatment kits and direct-to-consumer engagement strategies. Infections typically appear on the arms, legs, or scalp, and depending on severity, require either topical application or oral antifungal therapies. Advancements in formulation technology and broader distribution networks have made ringworm treatments more effective and accessible across all demographics.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $15.5 Billion |

| Forecast Value | $25 Billion |

| CAGR | 5.1% |

In 2024, the antifungal drugs segment accounted for 78.4% share, reflecting their widespread usage as the frontline treatment for various types of dermatophytosis. Products containing active ingredients like miconazole, clotrimazole, terbinafine, and ketoconazole are widely utilized due to their proven ability to stop fungal growth and relieve symptoms quickly. Their affordability, broad-spectrum efficacy, and availability in multiple formats contribute to their dominance in the treatment landscape. These antifungals are frequently prescribed or self-administered for common conditions like tinea corporis, tinea pedis, tinea capitis, tinea cruris, and tinea unguium.

The topical treatments segment held a 63% share and generated USD 9.8 billion in 2024. Their leadership position stems from the growing trend of self-treatment, which has made OTC topical products a preferred option. These are easily accessible via both physical and online pharmacies, especially for uncomplicated infections. Pharmaceutical companies are increasingly focused on launching new and more user-friendly topical formulations like foams, sprays, creams, powders, gels, and medicated wipes. This innovation, coupled with increased awareness around early intervention, is significantly driving global demand for topical antifungals.

North America Ringworm Treatment Market held 40.3% share in 2024, due to its well-established healthcare infrastructure and the presence of leading pharmaceutical companies. Widespread access to both prescription and OTC medications, coupled with growing awareness and self-care trends, supports the region's dominance. Consumers in this market increasingly opt for at-home solutions, leveraging convenient access to trusted treatment options. Retail drugstores and e-commerce platforms continue to make a strong impact on product availability and consumer behavior in this region.

Key companies operating in the Global Ringworm Treatment Market include Johnson and Johnson, Mankind Pharma, Sun Pharmaceuticals, AbbVie, Pfizer, Sanofi, Novartis, Glenmark Pharmaceuticals, Cipla, Biofield Pharma, Gilead Sciences, Teva Pharmaceutical Industries, Bayer, Merck, Perrigo Company, GlaxoSmithKline, and Eli Lilly and Company. To maintain a competitive edge, companies in the ringworm treatment space are focusing on multi-channel distribution, including e-commerce and organized retail pharmacies, to increase product accessibility. Many are investing in the development of novel topical formulations that enhance user compliance and effectiveness. Strategic partnerships with digital health platforms and pharmacy chains allow for broader outreach, while marketing initiatives target awareness campaigns around fungal infections and early intervention.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Drug class trends

- 2.2.3 Route of administration trends

- 2.2.4 Infection type trends

- 2.2.5 Age group trends

- 2.2.6 Medication type trends

- 2.2.7 Distribution channel trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of ringworm infections

- 3.2.1.2 Easy availability of over-the-counter antifungal medications

- 3.2.1.3 Increased awareness about ringworm infections and their symptoms

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Increasing drug resistance to common antifungal medications

- 3.2.2.2 Lack of patient compliance with treatment

- 3.2.3 Market opportunities

- 3.2.3.1 Development of novel drug formulations

- 3.2.3.2 Rising adoption of combination drugs

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East and Africa

- 3.5 Epidemiology analysis of ringworm infection

- 3.6 Pipeline analysis

- 3.7 Future market trends

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Drug Class, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Antifungal

- 5.3 Combination drugs

Chapter 6 Market Estimates and Forecast, By Route of Administration, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Topical

- 6.3 Oral

- 6.4 Parenteral

Chapter 7 Market Estimates and Forecast, By Infection Type, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Tinea corporis

- 7.3 Tinea pedis

- 7.4 Tinea cruris

- 7.5 Tinea capitis

- 7.6 Tinea manuum

- 7.7 Other types

Chapter 8 Market Estimates and Forecast, By Age Group, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Below 18 years

- 8.3 18 - 35 years

- 8.4 35 - 50 years

- 8.5 50 years and above

Chapter 9 Market Estimates and Forecast, By Medication Type, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Prescription

- 9.3 OTC

Chapter 10 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 ($ Mn)

- 10.1 Key trends

- 10.2 Hospital pharmacies

- 10.3 Retail pharmacies

- 10.4 Online pharmacies

Chapter 11 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Spain

- 11.3.5 Italy

- 11.3.6 Netherlands

- 11.4 Asia Pacific

- 11.4.1 Japan

- 11.4.2 China

- 11.4.3 India

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 Middle East and Africa

- 11.6.1 South Africa

- 11.6.2 Saudi Arabia

- 11.6.3 UAE

Chapter 12 Company Profiles

- 12.1 AbbVie

- 12.2 Biofield Pharma

- 12.3 Bayer

- 12.4 Cipla

- 12.5 Eli Lilly and Company

- 12.6 Gilead Sciences

- 12.7 GlaxoSmithKline

- 12.8 Glenmark Pharmaceuticals

- 12.9 Johnson and Johnson

- 12.10 Mankind Pharma

- 12.11 Merck

- 12.12 Novartis

- 12.13 Perrigo Company

- 12.14 Pfizer

- 12.15 Sanofi

- 12.16 Sun Pharmaceuticals

- 12.17 Teva Pharmaceutical Industries